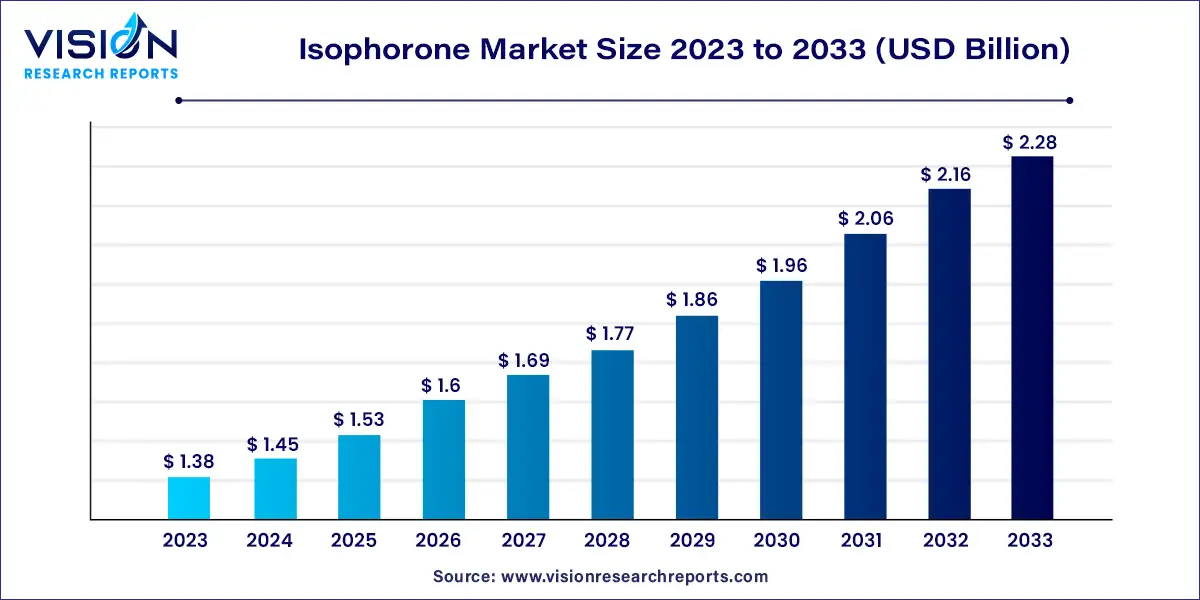

The global isophorone market size was estimated at around USD 1.38 billion in 2023 and it is projected to hit around USD 2.28 billion by 2033, growing at a CAGR of 5.13% from 2024 to 2033. Isophorone, a cyclic ketone, is an essential chemical compound used widely in industrial applications. It serves as a solvent in coatings, adhesives, and paints due to its excellent solvency properties and low vapor pressure. The global isophorone market has shown steady growth, driven by its versatile applications and increasing demand in various end-use industries.

The growth of the isophorone market is significantly driven by its expanding applications across various industrial sectors. As industries such as automotive, aerospace, and construction continue to demand high-performance coatings and adhesives, isophorone's role as a versatile solvent becomes increasingly crucial. Its properties, including excellent solvency and low vapor pressure, enhance the durability and effectiveness of end products, fueling its adoption. Additionally, advancements in production technologies that improve efficiency and reduce costs are further propelling market growth. The rising emphasis on high-quality and durable coatings is expected to sustain demand for isophorone, making it a key component in the evolution of industrial applications.

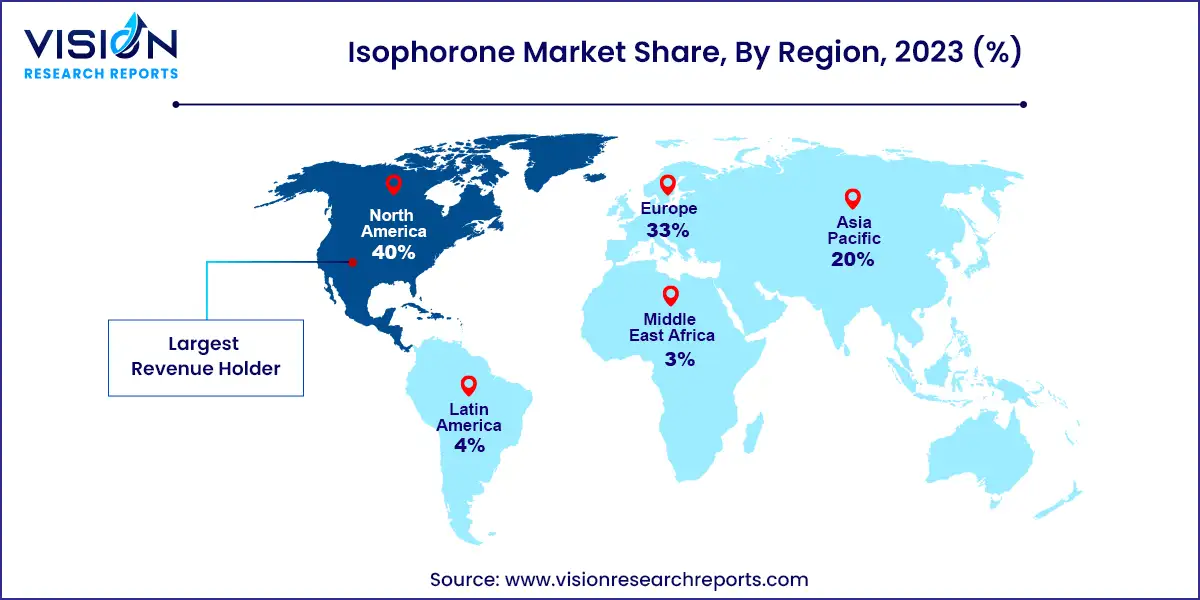

In 2023, North America led the isophorone market with a revenue share of 40%, largely due to the burgeoning demand in industries such as paints and coatings and adhesives. The region's expanding construction sector is a significant driver, boosting demand for architectural and decorative paints and coatings.

The North American construction industry is projected to grow substantially, driven by high demand for non-residential projects. This growth is expected to elevate the need for paints and coatings throughout the forecast period. Policies favoring housing sector recovery and reconstruction activities in the U.S., combined with infrastructure development in Canada and Mexico, are anticipated to create significant market opportunities.

| Attribute | North America |

| Market Value | USD 0.55 Billion |

| Growth Rate | 5.15% CAGR |

| Projected Value | USD 0.91 Billion |

Asia Pacific Isophorone Market Trends

In 2023, the Asia Pacific isophorone market held the second-largest share, valued at USD 424.7 million. This growth is attributed to strong adoption in adhesive and paint & coating sectors in China and India. For instance, the Asia Pacific paint and coatings market was valued at USD 88 billion in 2023, with decorative paints and coatings accounting for 38.7% of this market, according to Coatings World. India has surpassed Japan as the second-largest market for paints and coatings in Asia and is recognized as the fastest-growing major market globally. Both decorative and industrial coatings sectors in India are expanding rapidly.

Europe Isophorone Market Trends

The isophorone market in Europe is poised for notable growth, driven by the region's expanding automotive industry. The demand for paints and adhesives in automotive applications is fueling this growth. According to Autobei Consulting Group, Germany leads Europe's automotive sector with 41 engine production plants in 2023, accounting for one-third of the region’s total automobile production, which in turn supports the isophorone market.

In 2023, the adhesives segment led the market with a revenue share of 36%, driven by its extensive use in adhesive formulations. Isophorone enhances the wetting and adhesion properties of adhesives, creating robust bonds between adhesives and substrates. It demonstrates excellent solvency for various resins, including vinyl, polyurethanes, epoxy, and acrylics, which improves the dissolution and dispersion of these resins, resulting in better adhesive performance.

In some adhesive formulations, isophorone functions as a plasticizer, increasing the flexibility and durability of the adhesive film. This is particularly beneficial in applications requiring resistance to mechanical stress or environmental changes. Additionally, adhesives containing isophorone exhibit commendable thermal stability.

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Isophorone Market

5.1. COVID-19 Landscape: Isophorone Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Isophorone Market, By Application

8.1. Isophorone Market, by Application Type, 2024-2033

8.1.1. Paints and Coatings

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Printing Inks

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Artificial Leather

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Adhesives

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Agrochemicals

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Composites

8.1.6.1. Market Revenue and Forecast (2021-2033)

8.1.7. Others

8.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Isophorone Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10. Company Profiles

10.1. Arkema Group

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. CHAIN FONG

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Evonik Industries

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Jiangsu Huanxin High Tech Materials Co. Ltd

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Prasol Chemicals Pvt Ltd

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. SI Group Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. BASF SE

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Covestro AG

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Krasiklal

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. DHALOP CHEMICALS

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others