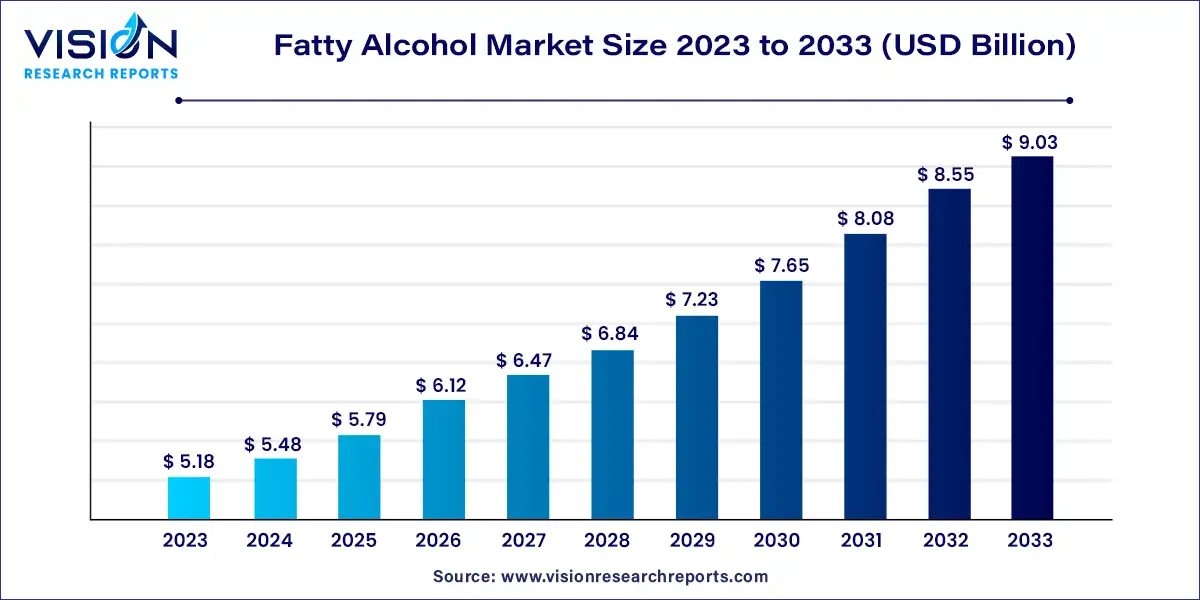

The global fatty alcohol market size was estimated at around USD 5.18 billion in 2023 and it is projected to hit around USD 9.03 billion by 2033, growing at a CAGR of 5.72% from 2024 to 2033. The fatty alcohol market plays a critical role in the global chemical industry, serving as a foundational raw material for a variety of products. Derived from natural fats and oils or synthesized through petrochemical processes, fatty alcohols are primarily used in the production of surfactants, detergents, personal care products, and pharmaceuticals.

The growth of the fatty alcohol market is primarily driven by an increasing demand for sustainable and biodegradable products in various industries. As consumers become more environmentally conscious, there is a rising preference for natural ingredients, particularly in personal care, cosmetics, and household cleaning products. This shift has encouraged manufacturers to use fatty alcohols derived from renewable resources like palm and coconut oils. Additionally, the expansion of the global personal care and home care sectors, especially in developing economies, further boosts the demand for fatty alcohols. The ongoing trend toward replacing petrochemical-based products with eco-friendly alternatives is also contributing to market growth.

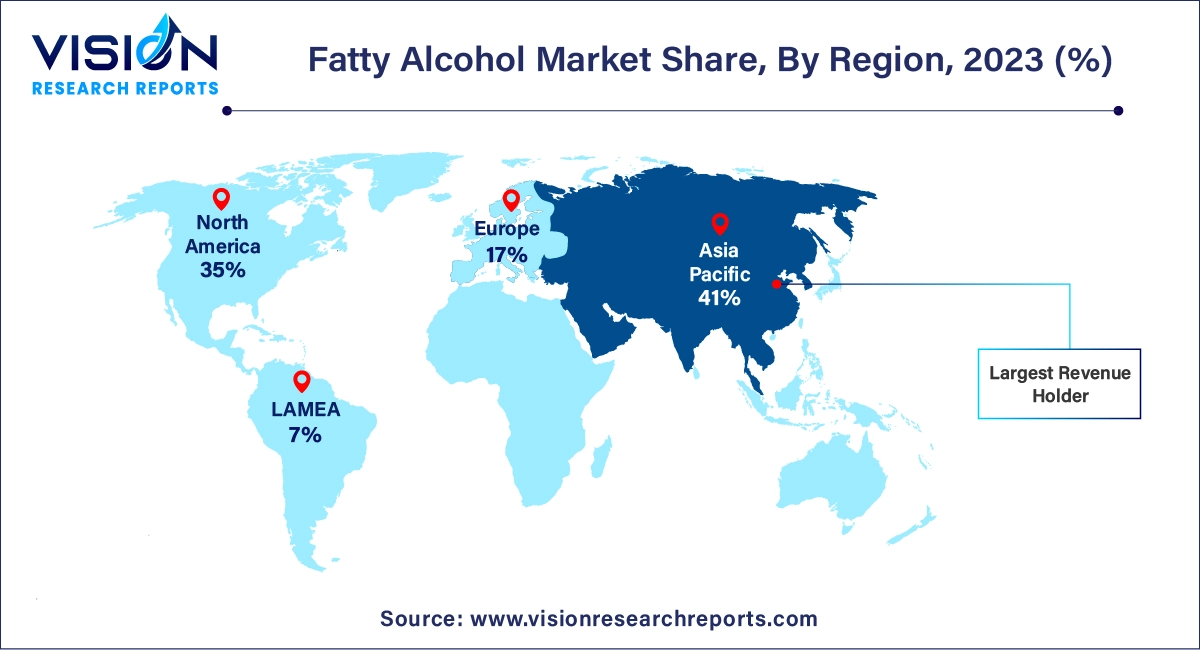

The Asia Pacific region led the global fatty alcohol market in 2023, commanding a revenue share of 41%. This growth is expected to continue throughout the forecast period, driven by robust demand from industries such as surfactants, personal care, cosmetics, and pharmaceuticals, particularly in China, India, and Japan. The surge in population and the corresponding rise in demand for cleaning products in developing economies within the region will likely contribute to exponential market growth.

| Attribute | Asia Pacific |

| Market Value | USD 2.12 Billion |

| Growth Rate | 5.73% CAGR |

| Projected Value | USD 3.70 Billion |

The North American fatty alcohol market is projected to witness significant growth, driven by rising demand for personal care and cleaning products. Consumers are increasingly favoring eco-friendly, sustainable ingredients, pushing major manufacturers to adopt bio-based fatty alcohols to cater to this demand. Additionally, regulations restricting the use of petrochemical-derived ingredients are accelerating the shift towards plant-based, renewable fatty alcohols.

| Attribute | North America |

| Market Value | USD 1.81 Billion |

| Growth Rate | 5.73% CAGR |

| Projected Value | USD 3.16 Billion |

The European fatty alcohol market is set for rapid growth during the forecast period, spurred by the increasing demand for eco-friendly products and stringent regulations governing petrochemical-derived ingredients. With a well-established oleochemicals industry, Europe is seeing a rise in the adoption of bio-based fatty alcohols. Growing consumer awareness regarding environmental impact is encouraging manufacturers to transition towards plant-based, renewable alternatives, further fueling market growth.

In 2023, long-chain fatty alcohols captured the largest market share, contributing 39% to overall revenue. These alcohols, consisting of 14-22 carbon atoms, are highly sought after for their multifunctional use as surfactants, emulsifiers, and emollients in personal care items and industrial cleaning products. The rising demand for natural, eco-friendly ingredients has driven the adoption of long-chain fatty alcohols, particularly those derived from renewable resources like vegetable oils and animal fats, due to their sustainability benefits.

The pure and mid-cut segment is anticipated to experience the fastest growth, with a projected CAGR of 6.43% during the forecast period. This growth is largely attributed to its wide application in producing Sodium Laureth Sulfate (SLS) and Sodium Lauryl Ether Sulfate (SLES), which are commonly found in personal care products such as shampoos, soaps, and toothpaste. Increased consumer demand for these items is expected to further drive segment expansion.

In 2023, the soaps and detergents segment held the largest share of market revenue. This is due to improving living standards in developing economies and heightened focus on personal hygiene. Additionally, the increasing need for both household and industrial cleaning products to maintain cleanliness is projected to boost this sector.

The personal care segment is forecasted to grow at the fastest CAGR during the predicted period. Rising consumer purchasing power is propelling the demand for personal care products such as shampoos, lotions, and essential oils, where fatty alcohols are integral. These alcohols play a key role in producing surfactants, known for their cleaning, emulsifying, and foaming properties, making them ideal for use in a variety of personal care and hygiene products like soaps, hand sanitizers, and detergents.

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fatty Alcohol Market

5.1. COVID-19 Landscape: Fatty Alcohol Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fatty Alcohol Market, By Type

8.1. Fatty Alcohol Market, by Type, 2024-2033

8.1.1. Short-Chain

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Pure & Mid cut

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Long Chain

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Higher Chain

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Fatty Alcohol Market, By Application

9.1. Fatty Alcohol Market, by Application, 2024-2033

9.1.1. Soaps & Detergents

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Personal Care

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Lubricants

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Plasticizers

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Amines

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Pharmaceutical Formulation

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Other Applications

9.1.7.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Fatty Alcohol Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Univar Solutions LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. BASF SE

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. KLK OLEO

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Wilmar International Ltd

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. VVF L.L.C.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ecogreen Oleochemicals

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Emery Oleochemicals

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Arkema Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Royal Dutch Shell Plc .com

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Oleon NV

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others