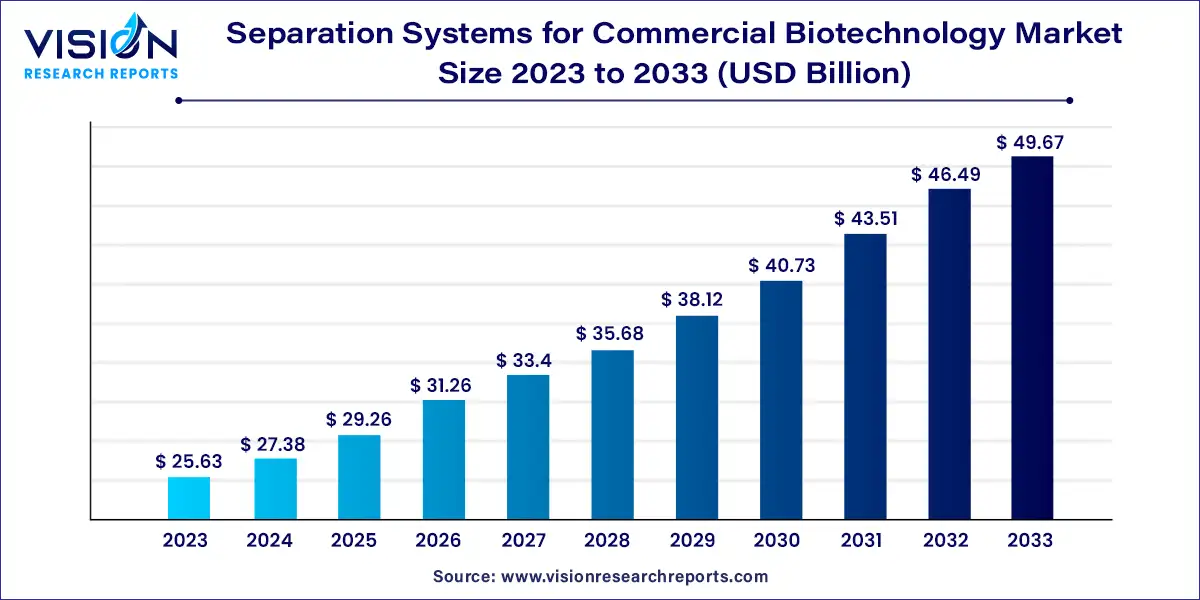

The global separation systems for commercial biotechnology market size was estimated at around USD 25.63 billion in 2023 and it is projected to hit around USD 49.67 billion by 2033, growing at a CAGR of 6.84% from 2024 to 2033. Separation systems are critical components in commercial biotechnology, serving to purify and isolate biological materials like proteins, nucleic acids, and cells from complex mixtures. As biotechnology continues to advance, these systems are becoming increasingly important for pharmaceutical development, bioprocessing, and diagnostic applications. The global separation systems market is witnessing significant growth due to expanding biotechnological research, rising demand for biopharmaceuticals, and innovations in separation technologies.

The growth of the separation systems market for commercial biotechnology is driven by an increasing demand for biopharmaceuticals, such as vaccines, monoclonal antibodies, and cell-based therapies, which require precise and efficient separation processes during production. Additionally, advancements in bioprocessing technologies, including downstream processing, have led to the development of more innovative and efficient separation systems. The rise in biotechnology research, along with expanding applications in diagnostics, therapeutics, and drug development, is further propelling market growth. Lastly, the focus on sustainable biomanufacturing and regulatory requirements for product purity and safety are also contributing to the increasing adoption of advanced separation technologies in the biotech industry.

In 2023, North America led the separation systems market for commercial biotechnology, thanks to its well-established pharmaceutical and biotechnology sectors. Significant investments in R&D, combined with a robust regulatory framework, have driven the high demand for advanced separation technologies in the region. The focus on innovation and technological advancements, coupled with the presence of major biopharmaceutical companies and leading research institutions, further contributed to market growth.

| Attribute | North America |

| Market Value | USD 9.73 Billion |

| Growth Rate | 6.85% CAGR |

| Projected Value | USD 18.87 Billion |

The European market also saw significant growth in 2023, driven by strong investments in biopharmaceutical R&D and stringent regulatory standards for drug purity and quality. The region's emphasis on personalized medicine and biotechnological innovations has further boosted the adoption of advanced separation technologies. According to the Wallonia Export and Investment Agency, Belgium is at the forefront of biopharmaceutical R&D investment in Europe, spending nearly 70% more than Denmark and Slovenia. In 2021, Belgium approved 578 clinical trials, a 20% increase from the previous year, making it a leader in clinical trials per capita. The country also ranks second in biopharmaceutical patent applications per capita and third in the share of biopharmaceutical patents overall.

The Asia Pacific region is poised for substantial growth in the separation systems market, driven by expanding biopharmaceutical manufacturing capabilities in countries like China and India. Rising healthcare expenditures, along with significant investments in biotechnology infrastructure, are key factors fueling market growth. Additionally, the region's growing focus on developing innovative biotechnological solutions and the large patient population are accelerating the adoption of advanced separation technologies.

In 2023, conventional methods held a dominant market share of 70%, largely due to their proven reliability and cost-effectiveness. Techniques such as centrifugation and filtration have long been trusted for their efficacy and regulatory compliance, ensuring their continued use. Moreover, recent technological advancements have improved the efficiency and scalability of these traditional systems, making them a popular choice for large-scale biotech applications.

Modern methods are projected to experience the fastest growth, with a CAGR of 7.03% during the forecast period, as they offer greater precision and efficiency in separating complex biomolecules. Innovations in chromatography and membrane technologies have enhanced the purification process, driving demand for high-purity biopharmaceuticals. Additionally, increased investment in R&D for novel biotech applications is encouraging the adoption of advanced separation techniques. For example, in February 2024, Thermo Fisher Scientific Inc. introduced the Dionex Inuvion Ion Chromatography (IC) system, designed for flexible analyses of ions and small polar molecules, simplifying ion analysis for researchers at all levels.

The pharmaceutical segment led the market in 2023, accounting for 40% of the total market share. This dominance is attributed to the industry's growing focus on timely drug production, the rise of biopharmaceuticals, personalized medicine, and stringent purity standards. These factors are driving the demand for advanced separation techniques in pharmaceutical manufacturing.

The food and cosmetics segment is expected to grow at a CAGR of 7.03% over the forecast period, driven by increasing consumer awareness around natural and clean-label products. Improved extraction and purification technologies are resulting in safer, higher-quality products in both the food and cosmetics industries. Consumers' demand for organic, healthy products, along with stricter regulatory requirements, is prompting manufacturers to adopt advanced separation methods. For instance, in October 2023, Organic Harvest launched a toxin-free and cruelty-free makeup line, aligning with the growing demand for eco-friendly and safe beauty products that prioritize both skin health and environmental responsibility.

By Method

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Separation Systems for Commercial Biotechnology Market

5.1. COVID-19 Landscape: Separation Systems for Commercial Biotechnology Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Separation Systems for Commercial Biotechnology Market, By Method

8.1. Separation Systems for Commercial Biotechnology Market, by Method, 2024-2033

8.1.1. Conventional Methods

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Modern Methods

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Separation Systems for Commercial Biotechnology Market, By Application

9.1. Separation Systems for Commercial Biotechnology Market, by Application, 2024-2033

9.1.1. Pharmaceutical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food & Cosmetics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Agriculture

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Separation Systems for Commercial Biotechnology Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Method (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Method (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Method (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Method (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Method (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Method (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Method (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Method (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Method (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Method (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Method (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. QIAGEN

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Horizon Discovery Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. OriGene Technologies, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Oxford Biomedica PLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. SignaGen Laboratories

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Flash Therapeutics

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Takara Bio Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Bio-Rad Laboratories, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. System Biosciences, LLC.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others