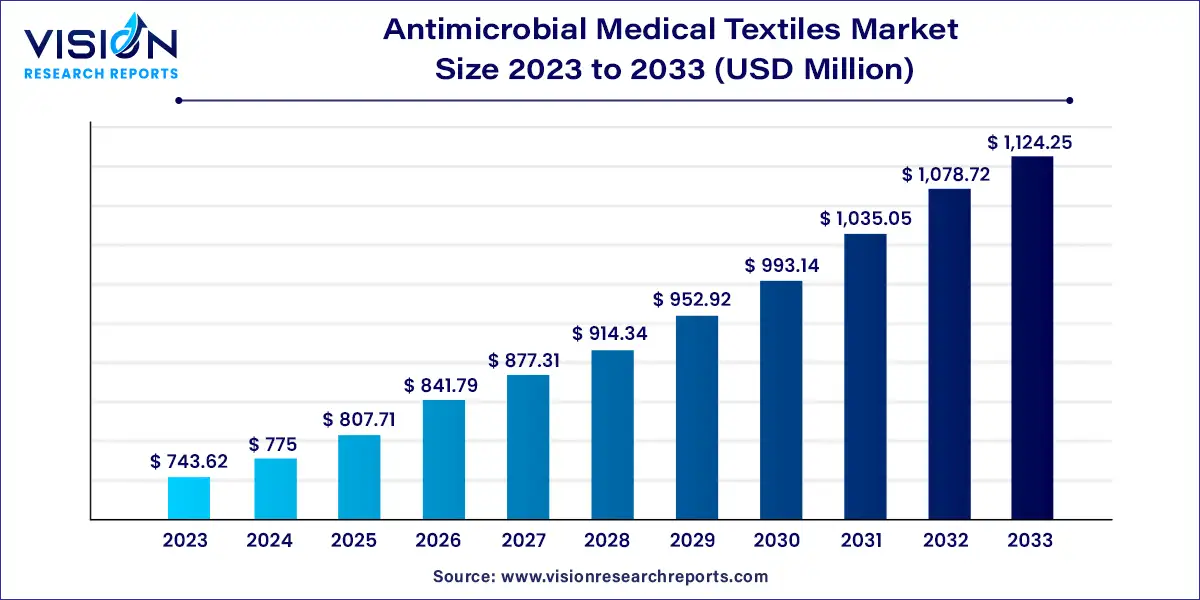

The global antimicrobial medical textiles market size was estimated at around USD 743.62 million in 2023 and it is projected to hit around USD 1,124.25 million by 2033, growing at a CAGR of 4.22% from 2024 to 2033. The antimicrobial medical textiles market has witnessed significant growth due to the increasing demand for textiles that provide enhanced protection against infections and contaminants. These specialized fabrics are engineered to inhibit the growth of microorganisms, thereby reducing the risk of infections and improving patient outcomes.

The growth of the antimicrobial medical textiles market is primarily driven by the rising prevalence of healthcare-associated infections (HAIs) underscores the need for textiles that can offer enhanced protection and reduce infection rates. As hospitals and healthcare facilities strive to improve patient safety, antimicrobial textiles have become a crucial component in their infection control strategies. Additionally, advancements in textile technology, such as the use of silver, copper, and other antimicrobial agents, have significantly improved the effectiveness and range of these products. The growing awareness and emphasis on hygiene, fueled by public health initiatives and an increasing focus on preventive care, also contribute to market expansion. Furthermore, the aging population, which is more vulnerable to infections, drives demand for medical textiles that offer superior protection. These factors collectively contribute to the robust growth of the antimicrobial medical textiles market, positioning it as a vital segment within the broader healthcare industry.

North America led the antimicrobial medical textiles market in 2023, holding a 41% market share. This dominance is attributed to the high number of medical procedures and the presence of major healthcare institutions in the U.S. and Canada, which implement rigorous hygiene standards. Growing awareness of hospital-associated infections has also spurred the demand for antimicrobial medical textiles in this region.

Europe emerged as a prominent market, with a 29% share in 2023. This growth is linked to the expansion of the healthcare sector and the presence of major textile industries in the region. Increased awareness about antimicrobial textiles and their role in infection prevention has driven market growth. Additionally, heightened cleanliness measures in hospitals to control hospital-acquired infections (HAIs) have supported the industry's expansion.

The Asia Pacific market for antimicrobial medical textiles is projected to grow at a CAGR of 13.82% during the forecast period. This growth is driven by high demand in countries such as China, Japan, and India, coupled with a rising population and increased adoption of antimicrobial products. The region's growing healthcare needs and the prevalence of diseases in developing areas further contribute to the market's expansion.

In 2023, the metallic salts segment led the market with a dominant share of 59%, driven by their versatility, effectiveness, and broad applicability across various industries. Metallic salts are renowned for their strong antimicrobial properties, which effectively inhibit the growth of microorganisms, bacteria, and molds, making them highly suitable for medical textile manufacturing. Their ease of application further enhances their appeal in textile production, contributing to the robust growth of this segment.

The quaternary ammonium salts segment is anticipated to experience significant growth, thanks to their superior antimicrobial protection against fungi, viruses, and bacteria, as well as their effectiveness in odor control. The growing demand for these salts is fueled by their ease of application in various textiles, including apparel and medical fabrics. Additionally, quaternary ammonium salts are more cost-effective compared to metallic salts, driving their increasing market adoption.

In 2023, the non-implantable goods segment captured the largest market share of 43%, owing to the heightened demand for wound care and increased awareness about healthcare and hygiene. Medical institutions are increasingly adopting advanced methods to prevent infections and bacterial spread, leading to a higher demand for non-implantable items such as braces, wound dressings, and pressure garments. The expansion of the healthcare sector has significantly boosted the market for these products.

The healthcare and hygiene products segment is expected to see substantial growth, driven by the expanding healthcare industry. Rising awareness of disease transmission in hospitals and enhanced healthcare practices have heightened the demand for antimicrobial textiles. Additionally, changing lifestyles and increased hygiene consciousness are further fueling the market growth in this segment.

By Finishing Agents

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antimicrobial Medical Textiles Market

5.1. COVID-19 Landscape: Antimicrobial Medical Textiles Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antimicrobial Medical Textiles Market, By Finishing Agents

8.1. Antimicrobial Medical Textiles Market, by Finishing Agents, 2024-2033

8.1.1. Quaternary Ammonium

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Triclosan

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Metallic Salts

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Antimicrobial Medical Textiles Market, By Application

9.1. Antimicrobial Medical Textiles Market, by Application, 2024-2033

9.1.1. Implantable Goods

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Non-Implantable Goods

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Healthcare & Hygiene Products

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Antimicrobial Medical Textiles Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Finishing Agents (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Indorama Ventures Fibers Germany

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Microban International

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Dow

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. BioCote Limited

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Annovotek LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Herculite

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PurThread Technologies

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sciessent LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Quick-Med Technologies Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sinanen Zeomic Co. Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others