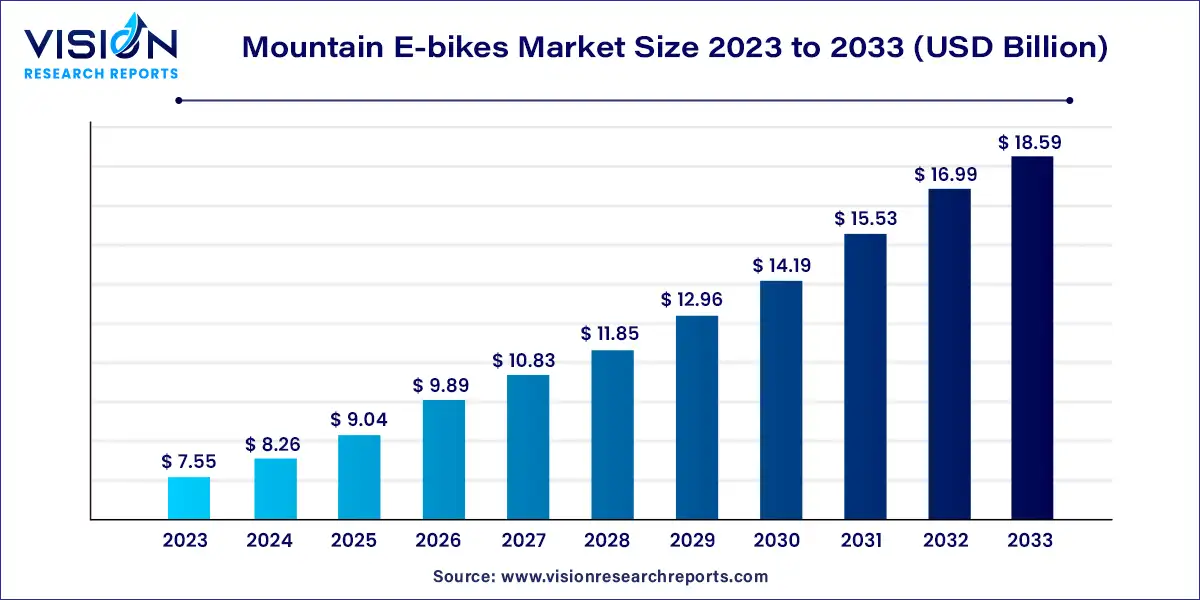

The global mountain e-bikes market size was estimated at around USD 7.55 billion in 2023 and it is projected to hit around USD 18.59 billion by 2033, growing at a CAGR of 9.43% from 2024 to 2033. The mountain e-bikes market is experiencing significant growth, driven by a combination of rising environmental awareness, advancements in e-bike technology, and an increasing focus on fitness and outdoor activities. Mountain e-bikes, equipped with electric motors to assist pedaling, are specifically designed for off-road terrains, providing enhanced control, stability, and power, making them a popular choice among adventurers and recreational cyclists.

The growth of the mountain e-bikes market is largely driven by an increasing adoption of eco-friendly transportation options, coupled with rising consumer interest in fitness and outdoor recreational activities. These bikes offer an appealing combination of physical exercise and electric assistance, making off-road cycling more accessible to a broader range of users. Advancements in battery technology, including longer life and faster charging, are also enhancing the appeal of e-bikes. Furthermore, government incentives promoting the use of electric vehicles and the expanding availability of dedicated bike trails are encouraging more consumers to invest in mountain e-bikes.

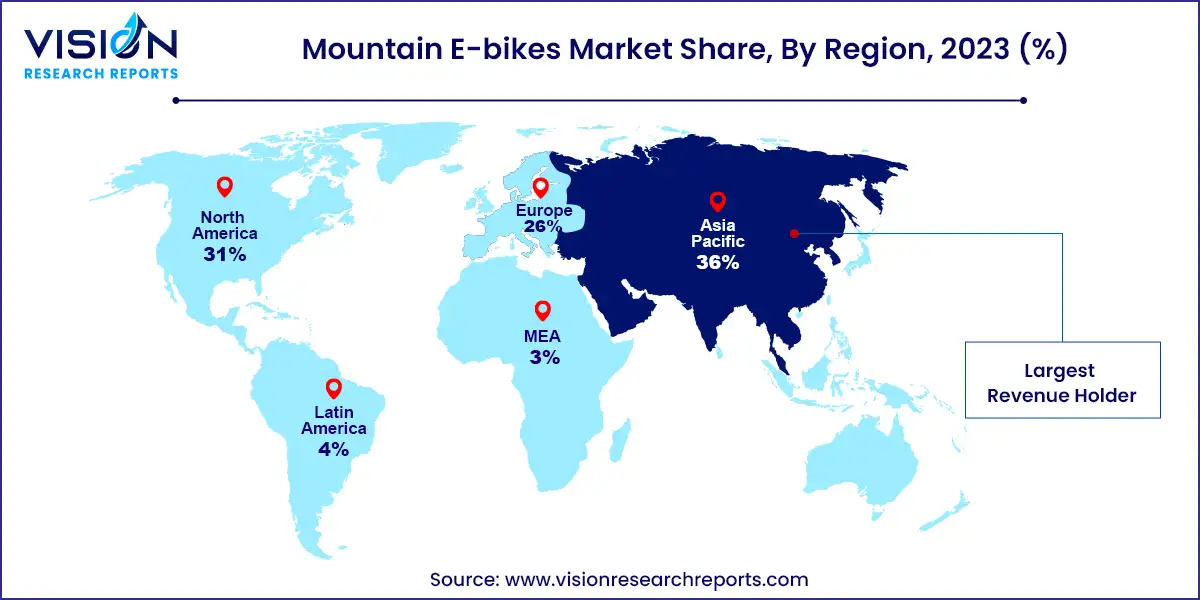

In 2023, the Asia Pacific region led the global mountain e-bikes market, accounting for 36% of the total share. Key economies like China, Japan, and South Korea are seeing increased adoption of mountain e-bikes, thanks to government policies that encourage green transportation and reduce dependence on fossil fuels. The growing popularity of outdoor activities, along with the development of dedicated cycling paths, is also driving market growth. Advances in battery technology and lightweight materials are making mountain e-bikes more accessible and attractive to a wider range of consumers. As the region continues to prioritize sustainable transportation options, the market is expected to expand rapidly, driven by innovation and favorable economic conditions.

| Attribute | Asia Pacific |

| Market Value | USD 2.71 Billion |

| Growth Rate | 9.44% CAGR |

| Projected Value | USD 6.69 Billion |

In North America, the mountain e-bikes market is set for significant growth from 2024 to 2033. Increasing consumer interest in sustainable transportation and outdoor recreation is driving demand, particularly in the U.S. and Canada. These countries are at the forefront of technological advancements in e-bikes and infrastructure, with a focus on expanding dedicated bike trails and implementing e-bike-friendly policies. Growing awareness of the environmental benefits of e-bikes, combined with government initiatives promoting eco-friendly transportation, is further fueling the market. Enhanced battery technology and more efficient motor systems are making mountain e-bikes more appealing to a broader consumer base, supporting market expansion.

The European Mountain e-bikes market is poised for substantial growth from 2024 to 2033. Europe’s strong focus on sustainability and the growing trend of eco-friendly transportation are key factors driving market expansion. Countries like Germany, France, and the Netherlands are actively promoting cycling as a green alternative to traditional vehicles, with mountain e-bikes gaining traction for both pedal-assisted commuting and recreational use. The region’s commitment to reducing carbon emissions and fostering green technologies is encouraging innovation in e-bike design and performance. Improvements in battery life, motor efficiency, and supportive regulations are contributing to the growing popularity of mountain e-bikes across Europe.

In 2023, the chain drive segment led the mountain e-bikes market, capturing 92% of global revenue. This dominance is due to chain drives’ well-established reputation for durability, strength, and cost-effectiveness. Riders appreciate chain drives for their ability to withstand the intense demands of off-road cycling, such as steep inclines, rocky terrain, and muddy conditions. Their compatibility with most bike components and widespread availability make chain drives a popular choice for a wide range of users, from beginners to experienced mountain bikers. Additionally, the straightforward design of chain drives allows for easy maintenance and repairs, which further boosts their popularity. Consequently, chain drives continue to be the preferred drivetrain for mountain e-bikes, maintaining their leadership in the market.

Looking forward, the belt drive segment is expected to see significant growth from 2024 to 2033. This growth is driven by the unique advantages belt drives offer, particularly for riders seeking a quieter, low-maintenance alternative. Unlike traditional chain drives, belt drives do not require lubrication, offering a cleaner, more convenient option. They are also highly durable and resistant to rust and wear, making them ideal for wet or muddy conditions often encountered in mountain biking. The smooth, quiet operation of belt drives enhances the overall riding experience, attracting a growing number of e-bike enthusiasts looking for advanced drivetrain solutions. As these benefits become more widely known, the belt drive segment is set to grow, positioning itself as a modern and efficient alternative to chain drives.

In 2023, lithium-ion batteries held the largest revenue share in the mountain e-bikes market. Their dominance can be attributed to superior performance features, including higher energy density, longer lifespan, and lighter weight compared to other battery types. Riders prefer lithium-ion batteries for their longer range and quicker charging times, which are essential for extended mountain biking adventures. These batteries also cater to the increasing demand for high-performance e-bikes capable of navigating challenging terrains and long distances without frequent recharging. Moreover, advancements in lithium-ion technology have introduced enhanced safety features, such as thermal management systems, making them a more reliable option for both manufacturers and consumers.

The lead-acid battery segment is anticipated to experience notable growth from 2024 to 2033. Recent technological improvements have made lead-acid batteries more energy-efficient and reduced their weight, increasing their viability for e-bikes. Known for their reliability and ability to perform well in extreme weather, these batteries appeal to riders in regions with harsh climates. Furthermore, lead-acid batteries are easier to recycle, aligning with growing consumer demand for sustainable and eco-friendly solutions. As the market reaches more budget-conscious consumers and expands into regions with diverse climate conditions, the lead-acid battery segment is gaining momentum as a durable and affordable alternative.

The pedal-assisted segment was the largest revenue contributor in 2023. This growth stems from the segment’s ability to offer a more natural biking experience while providing the benefits of electric assistance. Pedal-assisted e-bikes are popular among riders who want to enjoy the physical benefits of traditional mountain biking but appreciate extra support on steep inclines and rugged trails. The appeal of this segment spans fitness enthusiasts and casual riders alike, as it encourages active pedaling while reducing physical strain on difficult terrains. The increasing popularity of pedal-assisted mountain e-bikes is further driven by favorable regulations that classify them similarly to traditional bicycles, allowing broader trail access.

The throttle-assisted segment is projected to grow significantly between 2024 and 2033, driven by its convenience and appeal to riders seeking a less physically demanding option. Throttle-assisted e-bikes enable riders to activate the electric motor independently of pedaling, making them ideal for those who want to enjoy the outdoors without the exertion of constant pedaling. This feature is particularly attractive to older riders, individuals with physical limitations, and those seeking an easier ride over rough or steep terrain. Additionally, throttle-assisted e-bikes provide a more accessible entry point for beginners and casual users unfamiliar with advanced mountain biking techniques.

By Drive

By Battery

By Propulsion

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Drive Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Mountain E-bikes Market

5.1. COVID-19 Landscape: Mountain E-bikes Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Mountain E-bikes Market, By Drive

8.1. Mountain E-bikes Market, by Drive, 2024-2033

8.1.1 Belt Drive

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Chain Drive

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Mountain E-bikes Market, By Battery

9.1. Mountain E-bikes Market, by Battery, 2024-2033

9.1.1. Lead-acid Battery

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Lithium-ion Battery

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Mountain E-bikes Market, By Propulsion

10.1. Mountain E-bikes Market, by Propulsion, 2024-2033

10.1.1. Pedal-assisted

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Throttle-assisted

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Mountain E-bikes Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Drive (2021-2033)

11.1.2. Market Revenue and Forecast, by Battery (2021-2033)

11.1.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Drive (2021-2033)

11.2.2. Market Revenue and Forecast, by Battery (2021-2033)

11.2.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Drive (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Battery (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Drive (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Battery (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Drive (2021-2033)

11.3.2. Market Revenue and Forecast, by Battery (2021-2033)

11.3.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Drive (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Battery (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Drive (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Battery (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Drive (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Battery (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Drive (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Battery (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Drive (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Battery (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Propulsion (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Drive (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Battery (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Propulsion (2021-2033)

Chapter 12. Company Profiles

12.1. Bulls Bikes USA.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Accell Group.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Cycling Sports Group, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Heybike Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Husqvarna E-Bicycles.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Magnum Electric Bikes

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. RANDRIDE.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Heybike Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Pedego.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Polygon Bikes

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others