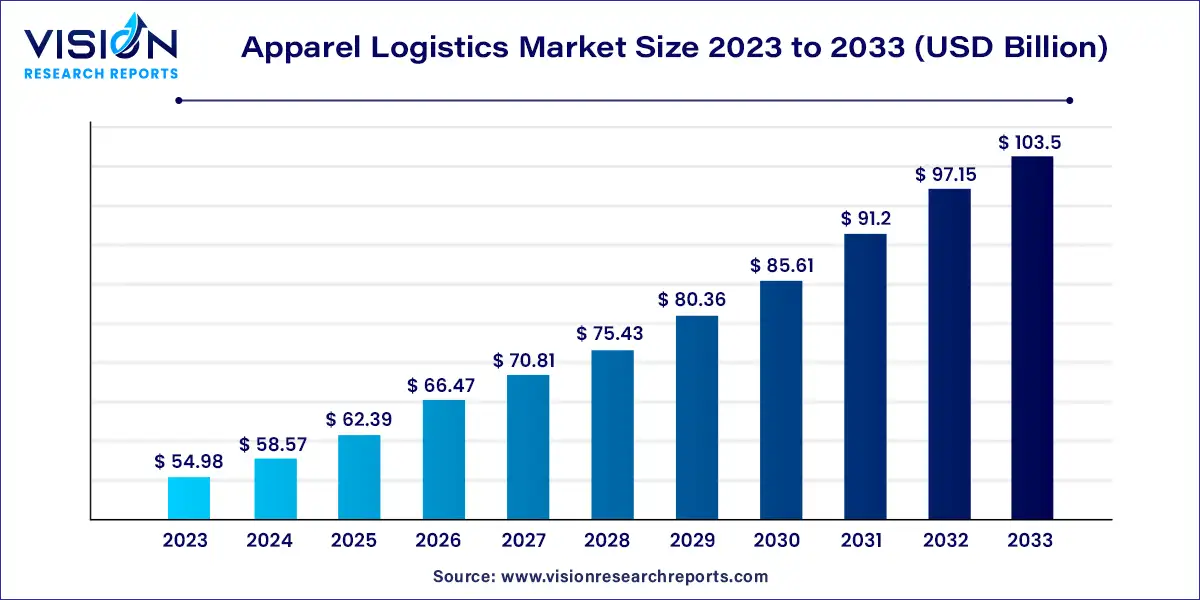

The global apparel logistics market size was surpassed at USD 54.98 billion in 2023 and is expected to hit around USD 103.5 billion by 2033, growing at a CAGR of 6.53% from 2024 to 2033. The apparel logistics market plays a crucial role in the global fashion and garment industry, encompassing the management, transportation, and distribution of clothing and accessories. As the fashion industry continues to grow and evolve, driven by changing consumer preferences and increasing e-commerce activities, the logistics sector is adapting to meet new demands and challenges.

The apparel logistics market is experiencing robust growth driven by the surge in e-commerce has significantly altered consumer purchasing behaviors, leading to a higher demand for efficient logistics solutions that can ensure timely and accurate delivery of apparel items. As online shopping continues to rise, retailers are increasingly relying on advanced logistics technologies to enhance their supply chain operations. Additionally, the globalization of fashion brands has expanded their sourcing and distribution networks, necessitating sophisticated logistics strategies to manage complex supply chains effectively. Technological advancements, such as real-time tracking, automated warehousing, and data analytics, are further propelling market growth by improving operational efficiency and accuracy. Furthermore, the growing emphasis on sustainability is prompting logistics providers to adopt eco-friendly practices and technologies, aligning with the industry’s push towards greener operations.

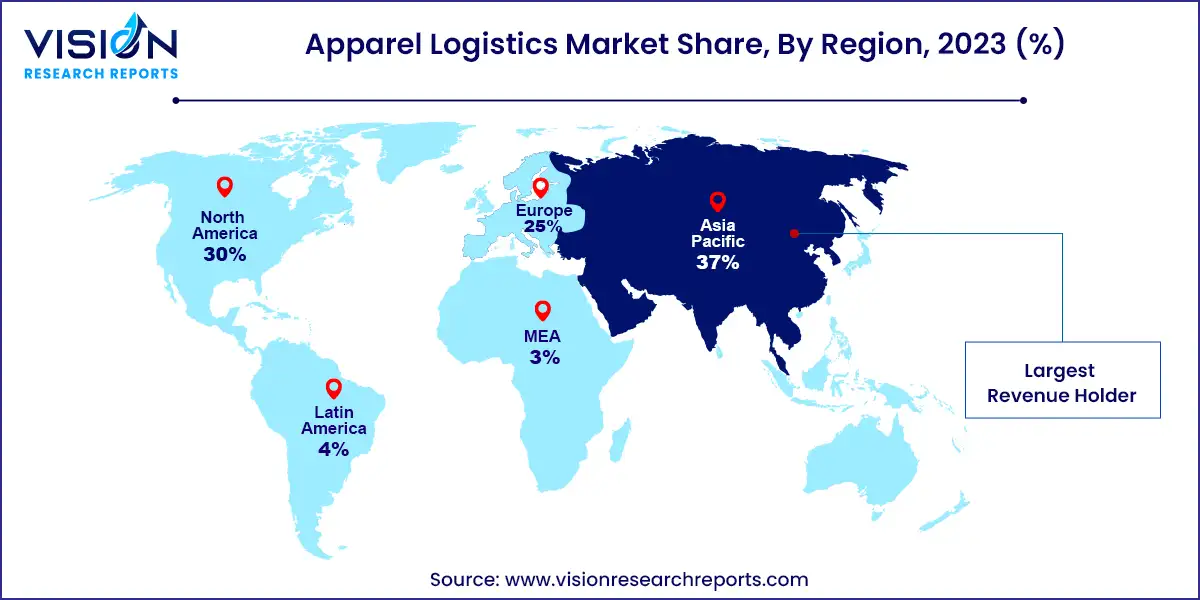

In 2023, the Asia Pacific region held the largest revenue share of 37% in the apparel logistics market. This dominance is primarily driven by rapid e-commerce growth. With a burgeoning middle class and increased internet penetration, countries like China and India are experiencing a surge in online apparel shopping. This trend is compelling retailers and brands to establish efficient logistics networks to handle high volumes of orders and deliveries across diverse geographic areas. The region's significant role as a major apparel manufacturing hub also requires advanced logistics solutions to connect production centers with global markets.

| Attribute | Asia Pacific |

| Market Value | USD 20.34 Billion |

| Growth Rate | 6.54% CAGR |

| Projected Value | USD 38.29 Billion |

The North American apparel logistics market is growing due to the expansion of e-commerce, which has increased the demand for effective supply chain management and last-mile delivery services. Consumer expectations for quicker shipping and smooth returns are prompting companies to optimize their logistics networks. The adoption of advanced technologies such as AI, IoT, and blockchain in inventory management and tracking has improved operational efficiency. Sustainability concerns are also influencing the market, with companies adopting eco-friendly practices in transportation and packaging. Additionally, the need for greater supply chain resilience, highlighted by recent global disruptions, is driving businesses to diversify sourcing and strengthen their logistics capabilities.

The U.S. apparel logistics market is projected to grow at a CAGR of 6.93% from 2024 to 2033. Growth is driven by the increasing complexity of global supply chains, necessitating more sophisticated logistics solutions. The rise of direct-to-consumer (D2C) brands is creating new demands for specialized fulfillment services. Additionally, the focus on sustainability in fashion is prompting logistics providers to develop eco-friendly transportation and packaging solutions, appealing to both environmentally conscious consumers and brands.

The apparel logistics market in Europe is expected to grow at a notable CAGR of 6.24% from 2024 to 2033. This growth is driven by several factors, including the adoption of omnichannel retail strategies that boost demand for integrated inventory and distribution systems. Sustainability initiatives are prompting logistics providers to implement eco-friendly transportation and packaging solutions. The fast fashion trend requires agile supply chains for rapid design-to-delivery cycles. Additionally, the rise in cross-border e-commerce within the EU is increasing the need for efficient international logistics networks.

In 2023, the warehousing and distribution segment led the market with a substantial revenue share of 35%, and it is projected to sustain this leadership from 2024 to 2033. The expansion of e-commerce has intensified the need for effective warehousing and distribution systems to manage inventory, process orders, and ensure swift shipping. Investments in automation and artificial intelligence (AI) are key drivers of growth in this segment, enhancing operational efficiency and reducing costs. Multi-channel distribution strategies demand advanced warehousing solutions to effectively serve both online and physical retail channels. Furthermore, the shift towards localized distribution hubs is aiding faster delivery times and contributing to the segment’s ongoing growth and market share.

The inventory management segment is anticipated to experience the highest compound annual growth rate (CAGR) of 7.23% from 2024 to 2033. This growth is fueled by the increasing complexity of multi-channel retail operations. The integration of advanced technologies such as AI and the Internet of Things (IoT) is improving demand forecasting and real-time inventory tracking. Retailers are focusing on optimizing inventory to cut carrying costs and prevent stockouts, while remaining agile to shifting consumer preferences. Effective inventory management is becoming increasingly crucial for maintaining competitiveness in the dynamic apparel market.

In 2023, road freight dominated the market with a revenue share of 57%, and this trend is expected to continue from 2024 to 2033. The growth of this segment is attributed to its flexibility and extensive use in domestic and regional supply chains. Road transport is cost-effective for short and medium-haul routes, making it a preferred option for the apparel industry, which requires frequent and timely deliveries to meet rapidly changing consumer demands. Its ability to reach remote locations, adjust routes for faster deliveries, and offer door-to-door services enhances its appeal.

Looking ahead, the road freight segment is set to remain dominant due to ongoing improvements in transportation infrastructure and advancements such as real-time tracking and route optimization. The rise of e-commerce, which often relies on road transport for last-mile delivery, will continue to drive demand for road freight services.

The air freight segment is projected to grow at the fastest CAGR of 7.24% from 2024 to 2033, driven by the demand for rapid delivery and the need to support fast fashion trends. Air transport provides the quickest shipping times, which is essential for high-value, time-sensitive apparel products, especially for international shipments. As consumer expectations for fast delivery increase, particularly for online orders, retailers are increasingly turning to air freight. Additionally, air freight is crucial for global supply chains, allowing brands to quickly respond to market changes, seasonal trends, and inventory shortages.

In 2023, online retailers (e-commerce) captured the largest revenue share of 47%, reflecting the growing preference for online shopping and a shift towards digital purchasing channels. This segment is expected to continue its dominance from 2024 to 2033, driven by the expansion of e-commerce platforms and enhancements in delivery infrastructure. Advances in last-mile delivery, inventory management, and integrated distribution networks will further strengthen e-commerce's position in the apparel logistics sector, meeting the rising consumer expectations for fast and reliable service.

The retailers segment accounted for the largest revenue share of 59% in 2023 and is expected to maintain this lead from 2024 to 2033. This segment’s growth is driven by the need for efficient supply chain solutions to support physical stores and omnichannel operations. Retailers depend on streamlined logistics to manage inventory, ensure timely restocking, and handle seasonal demand fluctuations. Continued dominance is anticipated as retailers enhance their logistics capabilities to improve customer experiences, optimize costs, and stay competitive in both physical and digital marketplaces. The rise of omnichannel retail, combining in-store and online shopping, further underscores the importance of robust logistics support.

By Service

By Mode of Transport

By Sales Channel

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Apparel Logistics Market

5.1. COVID-19 Landscape: Apparel Logistics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Apparel Logistics Market, By Service

8.1. Apparel Logistics Market, by Service, 2024-2033

8.1.1. Warehousing & Distribution

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Inventory Management

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Freight Forwarding

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Returns Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Other

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Apparel Logistics Market, By Mode of Transport

9.1. Apparel Logistics Market, by Mode of Transport, 2024-2033

9.1.1. Rail Freight

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Road Freight

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Air Freight

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Ocean Freight

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Apparel Logistics Market, By Sales Channel

10.1. Apparel Logistics Market, by Sales Channel, 2024-2033

10.1.1. Online Retailers (E-commerce)

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Brick-and-Mortar Stores

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Multi-channel Retailing

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Direct to Consumer (D2C)

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Apparel Logistics Market, By End Use

11.1. Apparel Logistics Market, by End Use, 2024-2033

11.1.1. Manufacturer

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Retailers

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Apparel Logistics Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.1.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.2.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.3.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.4.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End Use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Service (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End Use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Service (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Mode of Transport (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Sales Channel (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 13. Company Profiles

13.1. Ceva Logistics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. DB Schenker

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. DHL Group

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. DSV

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Hellmann Worldwide Logistics

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Kuehne + Nagel

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Delhivery

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Logwin

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. DTDC Express Limited

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Apparel Logistics Group Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others