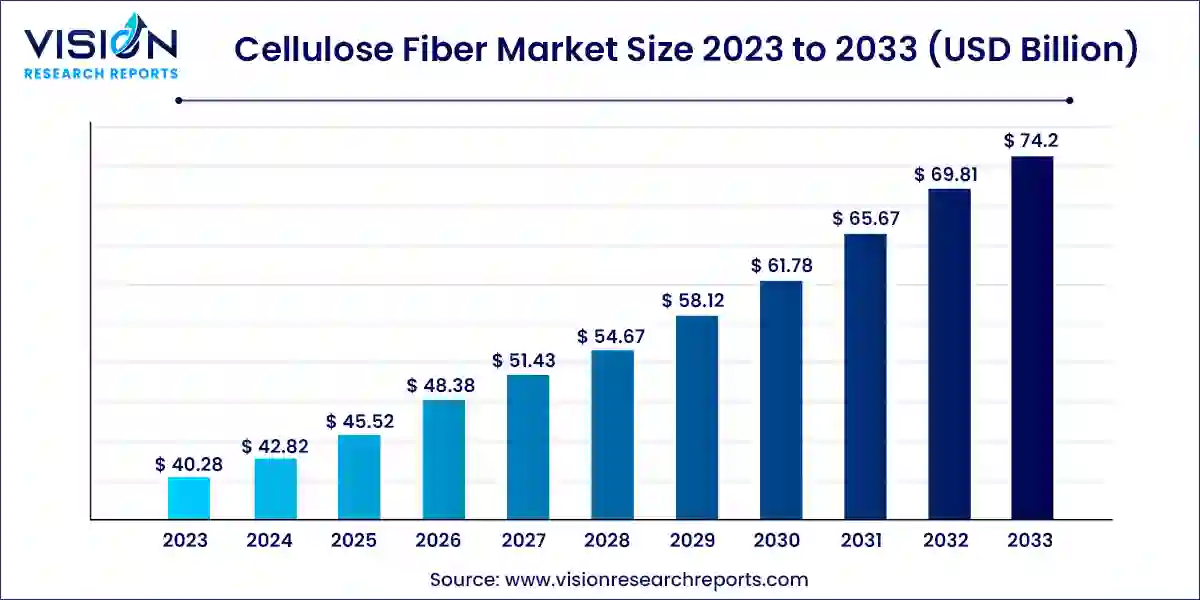

The global cellulose fiber market size was estimated at around USD 40.28 billion in 2023 and it is projected to hit around USD 74.2 billion by 2033, growing at a CAGR of 6.3% from 2024 to 2033. Cellulose fibers are derived from the cell walls of plants and are known for their biodegradable nature, sustainability, and versatility. They play a crucial role in various industries, including textiles, paper, and construction. The increasing demand for eco-friendly materials has fueled the growth of the cellulose fiber market.

The growth of the cellulose fiber market is primarily driven by the rising demand for sustainable and eco-friendly materials across various industries. As consumers become increasingly conscious of environmental issues, there is a notable shift towards natural fibers, which are biodegradable and renewable. Additionally, advancements in technology have led to improved production processes, making the manufacturing of cellulose fibers more efficient and less resource-intensive. The textile industry, in particular, is witnessing a surge in the adoption of cellulose fibers due to their versatility, comfort, and moisture-wicking properties, which enhance the overall quality of garments. Furthermore, the growing applications of cellulose fibers in non-textile sectors, such as composites and medical products, are expanding market opportunities. As industries strive to reduce their carbon footprint and promote sustainability, the cellulose fiber market is expected to experience significant growth in the coming years.

Asia Pacific led the cellulose fiber market with a revenue share of 39% in 2023. The region's well-established industrial and textile sectors are primary consumers of cellulose fibers, driving significant expansion in production capacity. Additionally, the abundance of timber resources in Asia Pacific serves as a critical input for cellulose fiber production. This ready access to raw materials, combined with affordable labor and strong government support, fosters an environment conducive to the growth of the cellulose fiber industry.

In 2023, China accounted for the largest share of the regional cellulose fiber market. Prominent industry players, such as Sateri, Tangshan Sanyou Xingda Chemical Fiber CO., Ltd., and Jiangsu Aoyang Technology Co., Ltd., ensure cost-competitive production of cellulose fibers. Furthermore, growing domestic demand, along with strong logistics and export networks catering to neighboring economies like India and Bangladesh, has positioned China as a leading supplier of cellulose fibers.

In 2023, North America held a substantial share of the cellulose fiber market. The region's extensive forestlands provide a robust and sustainable supply of wood pulp, the primary raw material for cellulose fiber production. Companies in North America have made significant investments in research and development to explore alternative uses for cellulose fibers. Furthermore, there has been notable demand for fashion apparel made from biodegradable fibers, driven by a younger, environmentally conscious population in the region.

The U.S. cellulose fiber market constituted a significant portion of the regional market in 2023. The country has established a mature and technologically advanced pulp and paper industry over the decades, providing a strong foundation for cellulose fiber manufacturing. Additionally, a growing domestic market for cellulose-based products, particularly in hygiene, textiles, and construction, has driven innovation and production levels.

In 2023, the European cellulose fiber market held a considerable share, influenced by the European Union's increasing emphasis on sustainability across industries. For instance, the European Commission prioritized enhancing sustainability in sectors such as textiles and promptly introduced the "EU Strategy for Sustainable and Circular Textiles." The announcement of comprehensive plans for a "Directive on Green Claims" in 2023 further underscores this commitment.

Germany's cellulose fiber market stands out as a leading regional player focusing on sustainable alternatives to wood-derived cellulose fibers. The country hosts several prominent companies in this sector, including CFF GmbH & Co. KG, JELU-WERK, and Kelheim Fibres GmbH, which contribute to cellulose fiber production. Cologne, Germany, is set to host the Cellulose Fibers Conference in 2025, focusing on innovative applications of cellulose fibers in textiles, packaging, and hygiene products, as well as exploring biosynthetics for a sustainable circular economy. Such initiatives are anticipated to raise awareness of cellulose fibers in Germany, driving market demand.

In 2023, synthetic products dominated the cellulose fiber market, capturing a significant revenue share of 63%. This dominance can be attributed to the cost-effectiveness, scalability, and superior performance characteristics of man-made fibers. Compared to natural fibers, synthetic fibers offer numerous advantages, including durability, low absorbency, elasticity, and resistance to environmental factors. These properties make synthetic fibers particularly suitable for diverse applications, such as industry-specific apparel and construction materials. Additionally, the production of synthetic fibers is less dependent on climatic conditions and geographic factors than that of natural fibers, ensuring a more stable and predictable supply chain.

Conversely, the natural products segment is anticipated to experience substantial growth at a notable CAGR during the forecast period. The increasing focus on environmentally friendly and sustainable practices has driven a surge in demand for natural fibers, aligning with consumer preferences for eco-conscious products. Natural cellulose fibers exhibit versatility and find utility across various industries, including textiles, paper, and biocomposites, thereby broadening their market reach. Industries in developing economies are expected to see a significant increase in the utilization of these fibers, driven by the rising preference for naturally sourced products among middle-income consumers.

Regarding applications, the textile industry accounted for the largest market share in 2023. This sector is a major consumer of cellulose fibers, employing them as a primary raw material in producing a wide range of products, including apparel, home furnishings, and industrial textiles. The consistent demand from the textile sector has been a key driver of industry growth. Cellulose fibers are used in various textile products, from casual wear to high-performance technical fabrics, enhancing their application scope.

Simultaneously, the industrial segment is projected to grow at a notable CAGR over the forecast period. The robust demand for cellulose fibers as essential components in various manufacturing processes has significantly contributed to this segment’s expansion. The unique physical properties of cellulose fibers, such as high strength, absorbency, and biodegradability, make them invaluable in applications ranging from construction and insulation to filtration and paper production. Additionally, advancements in cellulose fiber technology have broadened their application in the industrial sector, with innovations in fiber modification and processing enhancing performance characteristics and solidifying their position as a preferred choice.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Cellulose Fiber Market

5.1. COVID-19 Landscape: Cellulose Fiber Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Cellulose Fiber Market, By Product

8.1. Cellulose Fiber Market, by Product, 2024-2033

8.1.1. Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Cellulose Fiber Market, By Application

9.1. Cellulose Fiber Market, by Application, 2024-2033

9.1.1. Textile

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hygiene

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Cellulose Fiber Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. LENZING AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Grasim Industries Limited (Aditya Birla Group)

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Sateri

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Södra

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Eastman Chemical Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Kelheim Fibres GmbH

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Tangshan Sanyou Xingda Chemical Fiber CO.,Ltd

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. China Hi-Tech Group Corporation (CHTC)

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. ENKA GmbH & Co. KG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. CFF GmbH & Co. KG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others