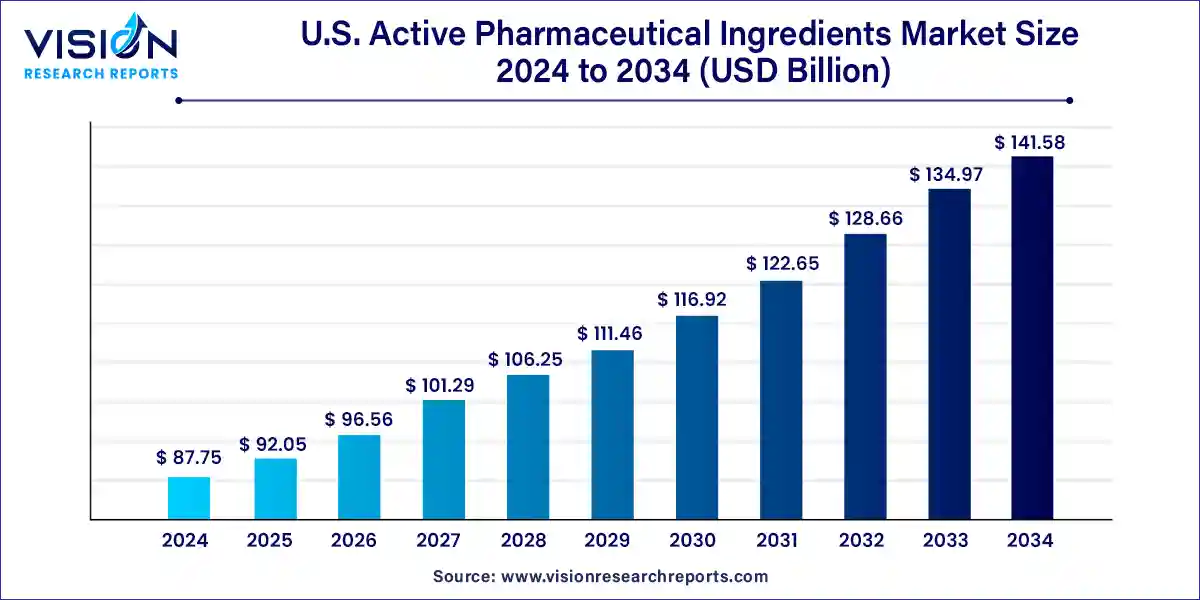

The U.S. active pharmaceutical ingredients market size was valued at USD 87.75 billion in 2024 and is projected to surpass around USD 141.58 billion by 2033, registering a CAGR of 4.9% over the forecast period of 2025 to 2034.

This growth is attributed to the increasing demand for innovative medicines, advancements in biotechnology, and the shift towards microbial-based fermentation approaches. In addition, the rising need for environmentally friendly production methods and the rising consciousness of the ecological risks associated with traditional chemical routes have led to a significant rise in the demand for APIs. Furthermore, there is substantial development of innovators and CDMOs seen in the country, which is anticipated to drive the growth of the market in the country.

The U.S. Active Pharmaceutical Ingredients Marketaccounted for a share of 35.1% of the global active pharmaceuticals ingredients market revenue. The demand for active pharmaceutical ingredients (APIs) is rising due to the growing prevalence of chronic diseases, infectious diseases, and genetic disorders.

This surge in demand is driven by the need for efficient and harmless drugs to treat these conditions. For instance, the Centers for Disease Control and Prevention (CDC) reports that almost 58.5 million American adults have arthritis, and this number is projected to reach 35 million by 2040. This rising diabetic population drives the focus on developing advanced and safe drugs, which requires an essential amount of API, thus boosting market growth.

Furthermore, the increasing growth and medical trials of biosimilar and biologics drugs and the increasing acceptance of new therapeutic classes are expected to increase their adoption by physicians and patients, further boosting the demand for APIs and driving market development.

| Report Attribute | Details |

| Market Size in 2025 | USD 92.05 Billion |

| Market Size by 2034 | USD 141.58 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 4.9% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Types of synthesis, types of manufacturers, types, and application |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | AbbVie Inc.; Viatris Inc.; Fresenius Kabi AG.; Curia.; Pfizer Inc. (Pfizer Center One); Bristol-Myers Squibb Company; Catalent, Inc.; Ampac Fine Chemicals (AFC); Amgen Inc.; Johnson & Johnson |

The cardiovascular diseases segment accounted for the largest market share of 23.5% in 2024. This growth is attributed to the growing prevalence of chronic diseases, such as diabetes, hypertension, and dyslipidemia. In addition, the increasing awareness of cardiovascular risk factors and the need for effective treatments are also contributing to the growth. Furthermore, the increasing development and clinical trials of biosimilar and biologics drugs are expected to increase their adoption, further driving the demand for APIs.

The endocrinology segment registered a substantial revenue share in 2024 owing to the increasing prevalence of chronic diseases such as diabetes and thyroid disorders. In addition, advancements in API manufacturing and the development of new treatments for endocrine-related conditions contribute to the growth. Furthermore, favorable government policies and changes in geopolitical situations also drive market growth.

The synthetic API dominated the market and accounted for the largest market share of 73.56% in 2024. This growth is attributed to the increasing prevalence of chronic diseases such as diabetes, cancer, and cardiovascular disorders, which fuels the demand for effective medications that rely heavily on synthetic APIs. Furthermore, the increasing adoption of biologics and biosimilars, as well as advancements in oncology drug research, contribute to the growth of the synthetic API segment in the market.

The biotech API segment also registered significant growth in 2024 owing to advancements in the biopharmaceutical and biotechnology sectors, as well as the rising adoption of biologics and biosimilars. Furthermore, the growing support from regulatory agencies for new drug approvals and the growing focus on personalized medicine and precision therapeutics are also driving the growth of the segment.

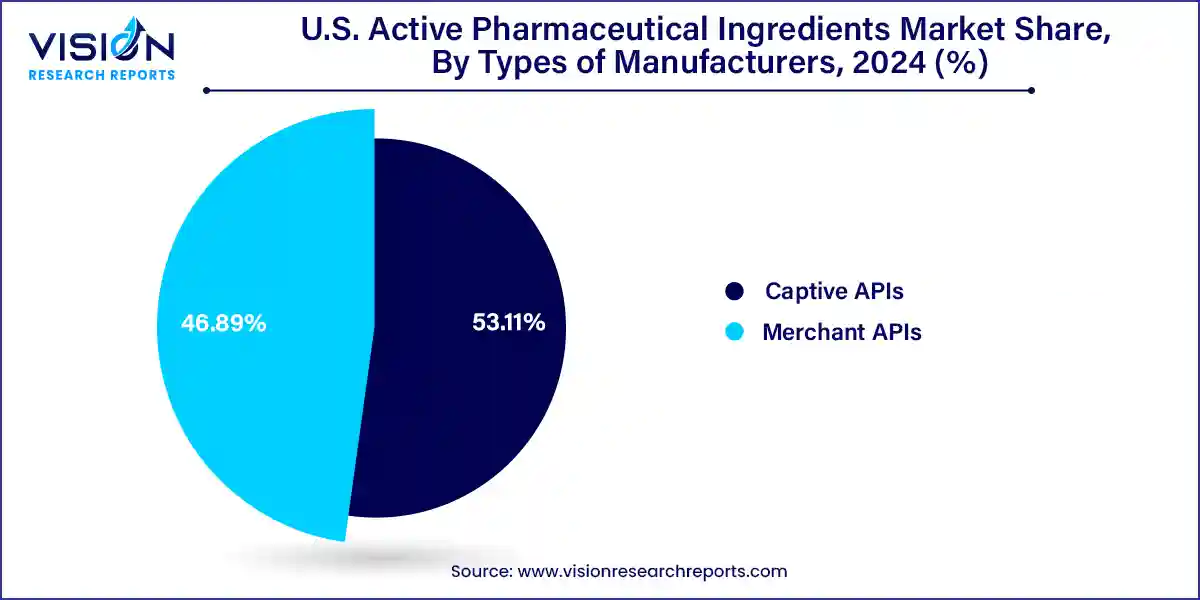

The captive API dominated the market and accounted for the largest revenue share of 53.11% in 2024. This growth is attributed to the increasing demand for high-quality APIs, the need for cost-effective and effective manufacturing procedures, and the increasing focus on research and development. Furthermore, the country has a well-established pharmaceutical industry with numerous businesses investing in API manufacturing facilities, further contributing to the growth of captive API.

Merchant API witnessed substantial growth in 2024 owing to the increasing need for affordable and efficient industrial developments and increasing focus on R&D. In addition, strategic collaborations among pharmaceutical businesses and research institutions further drive the growth of the segment.

Innovative APIs held a substantial market share in 2024, driven primarily by the surge in funding and favorable regulatory environments for research and development (R&D) facilities. This influx of resources has enabled the development of numerous new innovative products, which are expected to be launched in the near future.

The generic API market witnessed significant revenue share in 2023 and is estimated to experience swift growth over the forecast period. The primary driver of this growth is the termination of patents for numerous branded molecules, which creates a considerable opportunity for generic API manufacturers.

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2034. For this study, Vision Research Reports has segmented the U.S. active pharmaceutical ingredients market report based on types of synthesis, types of manufacturers, types, and applications:

By Types of Synthesis

By Types of Manufacturers

By Types

By Application

Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.1.1. Market Definitions

1.2. Objectives

1.2.1. Objective - 1

1.2.2. Objective - 2

1.2.3. Objective - 3

1.3. Research Methodology

1.4. Information Procurement

1.4.1. Purchased Database

1.4.2. Vision Research Reports Internal Database

1.4.3. Secondary Sources

1.4.4. Primary Research

1.5. Information Or Data Analysis

1.5.1. Data Analysis Models

1.6. Market Formulation & Validation

1.7. Model Details

1.7.1. Commodity Flow Analysis

1.8. List of Secondary Sources

1.9. List of Abbreviations

1.10. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segment Snapshot

2.3. Competitive Landscape Snapshot

Chapter 3. Active Pharmaceutical Ingredients Market: Market Variables, Trends, & Scope

3.1. Market Segmentation and Scope

3.2. Market Lineage Outlook

3.2.1. Parent Market Outlook

3.2.2. Related/Ancillary Market Outlook

3.3. Market Dynamics

3.4. Market Drivers

3.4.1. Increasing geriatric population

3.4.2. Rising prevalence of target diseases such as hospital-acquired infections, genetic, cardiovascular, and neurological diseases

3.4.3. Increasing preference for targeted therapy approach in cancer treatment

3.4.4. Increasing preference for outsourcing APIs

3.5. Market Restraint Analysis

3.5.1. High capital investments and production cost

3.5.2. Stringent Safety and handling regulations regarding APIs

3.6. Business Environment Analysis

3.6.1. SWOT Analysis; By Factor (Political & Legal, Economic And Technological)

3.6.2. Porter’s Five Forces Analysis

Chapter 4. Active Pharmaceutical Ingredients Market: Type of Synthesis Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Active Pharmaceutical Ingredients Market: Type of Synthesis Movement Analysis

4.3. Active Pharmaceutical Ingredients Market by Type of Synthesis Outlook (USD Million)

4.4. Market Size & Forecasts and Trend Analyses, 2019 - 2034 for the following

4.5. Biotic APIs

4.5.1. Biotic APIs Market, 2019 - 2034(USD Billion)

4.5.1.1. Biotech APIs Market, By Type

4.5.1.2. Generic APIs

4.5.1.2.1. Generic APIs Market, 2019 - 2034(USD Billion)

4.5.1.3. Innovative APIs

4.5.1.3.1. Innovative APIs Market, 2019 - 2034(USD Billion)

4.5.1.4. Biotech APIs Market, By Product

4.5.1.5. Monoclonal Antibodies

4.5.1.5.1. Monoclonal Antibodies Market, 2019 - 2034(USD Billion)

4.5.1.6. Hormones

4.5.1.6.1. Hormones Market, 2019 - 2034(USD Billion)

4.5.1.7. Cytokines

4.5.1.7.1. Cytokines Market, 2019 - 2034(USD Billion)

4.5.1.8. Recombinant Proteins

4.5.1.8.1. Recombinant Proteins Market, 2019 - 2034(USD Billion)

4.5.1.9. Therapeutic Enzymes

4.5.1.9.1. Therapeutic Enzymes Market, 2019 - 2034(USD Billion)

4.5.1.10. Vaccines

4.5.1.10.1. Vaccines Market, 2019 - 2034(USD Billion)

4.5.1.11. Blood Factors

4.5.1.11.1. Blood Factors Market, 2019 - 2034(USD Billion)

4.6. Synthetic APIs

4.6.1. Synthetic APIs Market, 2019 - 2034(USD Billion)

4.6.1.1. Synthetic APIs Market, By Type

4.6.1.2. Generic APIs

4.6.1.2.1. Generic APIs Market, 2019 - 2034(USD Billion)

4.6.1.3. Innovative APIs

4.6.1.3.1. Innovative APIs Market, 2019 - 2034(USD Billion)

Chapter 5. Active Pharmaceutical Ingredients Market: Type of Manufacturer Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Active Pharmaceutical Ingredients Market: Type Movement Analysis

5.3. Active Pharmaceutical Ingredients Market by Type Outlook (USD Million)

5.4. Market Size & Forecasts and Trend Analyses, 2019 - 2034 for the following

5.5. Captive APIs

5.5.1. Captive APIs Market, 2019 - 2034(USD Billion)

5.6. Merchant APIs

5.6.1. Merchant APIs Market, 2019 - 2034(USD Billion)

Chapter 6. Active Pharmaceutical Ingredients Market: Type Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Active Pharmaceutical Ingredients Market: Type Movement Analysis

6.3. Active Pharmaceutical Ingredients Market by Type Outlook (USD Million)

6.4. Market Size & Forecasts and Trend Analyses, 2019 - 2034 for the following

6.5. Generic APIs

6.5.1. Generic APIs Market, 2019 - 2034(USD Billion)

6.6. Innovative APIs

6.6.1. Innovative APIs Market, 2019 - 2034(USD Billion)

Chapter 7. Active Pharmaceutical Ingredients Market: Application Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Active Pharmaceutical Ingredients Market: Application Movement Analysis

7.3. Active Pharmaceutical Ingredients Market by Application Outlook (USD Million)

7.4. Market Size & Forecasts and Trend Analyses, 2019 - 2034 for the following

7.5. Cardiovascular Diseases

7.5.1. Cardiovascular Diseases Market, 2019 - 2034(USD Billion)

7.6. Oncology

7.6.1. Innovative APIs Oncology Market, 2019 - 2034(USD Billion)

7.7. CNS and Neurology

7.7.1. CNS and Neurology Market, 2019 - 2034(USD Billion)

7.8. Orthopedic

7.8.1. Orthopedic Market, 2019 - 2034(USD Billion)

7.9. Endocrinology

7.9.1. Endocrinology Market, 2019 - 2034(USD Billion)

7.10. Pulmonology

7.10.1. Pulmonology Market, 2019 - 2034(USD Billion)

7.11. Gastroenterology

7.11.1. Gastroenterology Market, 2019 - 2034(USD Billion)

7.12. Nephrology

7.12.1. Nephrology Market, 2019 - 2034(USD Billion)

7.13. Ophthalmology

7.13.1. Ophthalmology Market, 2019 - 2034(USD Billion)

7.14. Others

7.14.1. Others Market, 2019 - 2034(USD Billion)

Chapter 8. Active Pharmaceutical Ingredients Market: Type of Drug Estimates & Trend Analysis

8.1. Segment Dashboard

8.2. Active Pharmaceutical Ingredients Market: Type of Drug Movement Analysis

8.3. Active Pharmaceutical Ingredients Market by Type of Drug Outlook (USD Million)

8.4. Market Size & Forecasts and Trend Analyses, 2019 - 2034 for the following

8.5. Prescription

8.5.1. Prescription Market, 2019 - 2034(USD Billion)

8.6. OTC

8.6.1. OTC Market, 2019 - 2034(USD Billion)

Chapter 9. Active Pharmaceutical Ingredients Market: Regional Estimates & Trend Analysis

9.1. Regional Dashboard

9.2. Market Size & Forecasts Trend Analysis, 2019 - 2034:

9.3. North America

9.3.1. North America Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.3.2. U.S.

9.3.2.1. Key Country Dynamics

9.3.2.2. Target Disease Prevalence

9.3.2.3. Competitive Scenario

9.3.2.4. Regulatory Framework

9.3.2.5. Reimbursement Scenario

9.3.2.6. U.S. Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.3.3. Canada

9.3.3.1. Key Country Dynamics

9.3.3.2. Target Disease Prevalence

9.3.3.3. Competitive Scenario

9.3.3.4. Regulatory Framework

9.3.3.5. Reimbursement Scenario

9.3.3.6. Canada Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.3.4. Mexico

9.3.4.1. Key Country Dynamics

9.3.4.2. Target Disease Prevalence

9.3.4.3. Competitive Scenario

9.3.4.4. Regulatory Framework

9.3.4.5. Reimbursement Scenario

9.3.4.6. Mexico Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4. Europe

9.4.1. Europe Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.2. Germany

9.4.2.1. Key Country Dynamics

9.4.2.2. Target Disease Prevalence

9.4.2.3. Competitive Scenario

9.4.2.4. Regulatory Framework

9.4.2.5. Reimbursement Scenario

9.4.2.6. Germany Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.3. UK

9.4.3.1. Key Country Dynamics

9.4.3.2. Target Disease Prevalence

9.4.3.3. Competitive Scenario

9.4.3.4. Regulatory Framework

9.4.3.5. Reimbursement Scenario

9.4.3.6. UK Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.4. France

9.4.4.1. Key Country Dynamics

9.4.4.2. Target Disease Prevalence

9.4.4.3. Competitive Scenario

9.4.4.4. Regulatory Framework

9.4.4.5. Reimbursement Scenario

9.4.4.6. France Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.5. Italy

9.4.5.1. Key Country Dynamics

9.4.5.2. Target Disease Prevalence

9.4.5.3. Competitive Scenario

9.4.5.4. Regulatory Framework

9.4.5.5. Reimbursement Scenario

9.4.5.6. Italy Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.6. Spain

9.4.6.1. Key Country Dynamics

9.4.6.2. Target Disease Prevalence

9.4.6.3. Competitive Scenario

9.4.6.4. Regulatory Framework

9.4.6.5. Reimbursement Scenario

9.4.6.6. Spain Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.7. Denmark

9.4.7.1. Key Country Dynamics

9.4.7.2. Target Disease Prevalence

9.4.7.3. Competitive Scenario

9.4.7.4. Regulatory Framework

9.4.7.5. Reimbursement Scenario

9.4.7.6. Denmark Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.8. Sweden

9.4.8.1. Key Country Dynamics

9.4.8.2. Target Disease Prevalence

9.4.8.3. Competitive Scenario

9.4.8.4. Regulatory Framework

9.4.8.5. Reimbursement Scenario

9.4.8.6. Sweden Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.4.9. Norway

9.4.9.1. Key Country Dynamics

9.4.9.2. Target Disease Prevalence

9.4.9.3. Competitive Scenario

9.4.9.4. Regulatory Framework

9.4.9.5. Reimbursement Scenario

9.4.9.6. Norway Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5. Asia Pacific

9.5.1. Asia Pacific Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.2. Japan

9.5.2.1. Key Country Dynamics

9.5.2.2. Target Disease Prevalence

9.5.2.3. Competitive Scenario

9.5.2.4. Regulatory Framework

9.5.2.5. Reimbursement Scenario

9.5.2.6. Japan Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.3. China

9.5.3.1. Key Country Dynamics

9.5.3.2. Target Disease Prevalence

9.5.3.3. Competitive Scenario

9.5.3.4. Regulatory Framework

9.5.3.5. Reimbursement Scenario

9.5.3.6. China Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.4. India

9.5.4.1. Key Country Dynamics

9.5.4.2. Target Disease Prevalence

9.5.4.3. Competitive Scenario

9.5.4.4. Regulatory Framework

9.5.4.5. Reimbursement Scenario

9.5.4.6. India Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.5. South Korea

9.5.5.1. Key Country Dynamics

9.5.5.2. Target Disease Prevalence

9.5.5.3. Competitive Scenario

9.5.5.4. Regulatory Framework

9.5.5.5. Reimbursement Scenario

9.5.5.6. South Korea Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.6. Australia

9.5.6.1. Key Country Dynamics

9.5.6.2. Target Disease Prevalence

9.5.6.3. Competitive Scenario

9.5.6.4. Regulatory Framework

9.5.6.5. Reimbursement Scenario

9.5.6.6. Australia Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.5.7. Thailand

9.5.7.1. Key Country Dynamics

9.5.7.2. Target Disease Prevalence

9.5.7.3. Competitive Scenario

9.5.7.4. Regulatory Framework

9.5.7.5. Reimbursement Scenario

9.5.7.6. Thailand Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.6. Latin America

9.6.1. Latin America Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.6.2. Brazil

9.6.2.1. Key Country Dynamics

9.6.2.2. Target Disease Prevalence

9.6.2.3. Competitive Scenario

9.6.2.4. Regulatory Framework

9.6.2.5. Reimbursement Scenario

9.6.2.6. Brazil Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.6.3. Argentina

9.6.3.1. Key Country Dynamics

9.6.3.2. Target Disease Prevalence

9.6.3.3. Competitive Scenario

9.6.3.4. Regulatory Framework

9.6.3.5. Reimbursement Scenario

9.6.3.6. Argentina Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.7. MEA

9.7.1. MEA Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.7.2. South Africa

9.7.2.1. Key Country Dynamics

9.7.2.2. Target Disease Prevalence

9.7.2.3. Competitive Scenario

9.7.2.4. Regulatory Framework

9.7.2.5. Reimbursement Scenario

9.7.2.6. South Africa Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.7.3. Saudi Arabia

9.7.3.1. Key Country Dynamics

9.7.3.2. Target Disease Prevalence

9.7.3.3. Competitive Scenario

9.7.3.4. Regulatory Framework

9.7.3.5. Reimbursement Scenario

9.7.3.6. Saudi Arabia Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.7.4. UAE

9.7.4.1. Key Country Dynamics

9.7.4.2. Target Disease Prevalence

9.7.4.3. Competitive Scenario

9.7.4.4. Regulatory Framework

9.7.4.5. Reimbursement Scenario

9.7.4.6. UAE Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

9.7.5. Kuwait

9.7.5.1. Key Country Dynamics

9.7.5.2. Target Disease Prevalence

9.7.5.3. Competitive Scenario

9.7.5.4. Regulatory Framework

9.7.5.5. Reimbursement Scenario

9.7.5.6. Kuwait Active pharmaceutical ingredients market, 2019 - 2034(USD Billion)

Chapter 10. Competitive Landscape

10.1. Participant’s overview

10.2. Financial performance

10.3. Participant categorization

10.3.1. Market Leaders

10.3.2. Active Pharmaceutical Ingredients Market Share Analysis, 2024

10.3.3. Company Profiles

10.3.3.1. Dr. Reddy’s Laboratories Ltd.

10.3.3.1.1. Company Overview

10.3.3.1.2. Financial Performance

10.3.3.1.3. Product Benchmarking

10.3.3.1.4. Strategic Initiatives

10.3.3.2. Sun Pharmaceutical Industries Ltd.

10.3.3.2.1. Company Overview

10.3.3.2.2. Financial Performance

10.3.3.2.3. Product Benchmarking

10.3.3.2.4. Strategic Initiatives

10.3.3.3. Teva Pharmaceutical Industries Ltd.

10.3.3.3.1. Company Overview

10.3.3.3.2. Financial Performance

10.3.3.3.3. Product Benchmarking

10.3.3.3.4. Strategic Initiatives

10.3.3.4. Cipla Inc.

10.3.3.4.1. Company Overview

10.3.3.4.2. Financial Performance

10.3.3.4.3. Product Benchmarking

10.3.3.4.4. Strategic Initiatives

10.3.3.5. AbbVie Inc.

10.3.3.5.1. Company Overview

10.3.3.5.2. Financial Performance

10.3.3.5.3. Product Benchmarking

10.3.3.5.4. Strategic Initiatives

10.3.3.6. Aurobindo Pharma

10.3.3.6.1. Company Overview

10.3.3.6.2. Financial Performance

10.3.3.6.3. Product Benchmarking

10.3.3.6.4. Strategic Initiatives

10.3.3.7. Sandoz International GmbH (Novartis AG)

10.3.3.7.1. Company Overview

10.3.3.7.2. Financial Performance

10.3.3.7.3. Product Benchmarking

10.3.3.7.4. Strategic Initiatives

10.3.3.8. Viatris Inc.

10.3.3.8.1. Company Overview

10.3.3.8.2. Financial Performance

10.3.3.8.3. Product Benchmarking

10.3.3.8.4. Strategic Initiatives

10.3.3.9. Fresenius Kabi AG

10.3.3.9.1. Company Overview

10.3.3.9.2. Financial Performance

10.3.3.9.3. Product Benchmarking

10.3.3.9.4. Strategic Initiatives

10.3.3.10. STADA Arzneimittel AG

10.3.3.10.1. Company Overview

10.3.3.10.2. Financial Performance

10.3.3.10.3. Product Benchmarking

10.3.3.10.4. Strategic Initiatives

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others