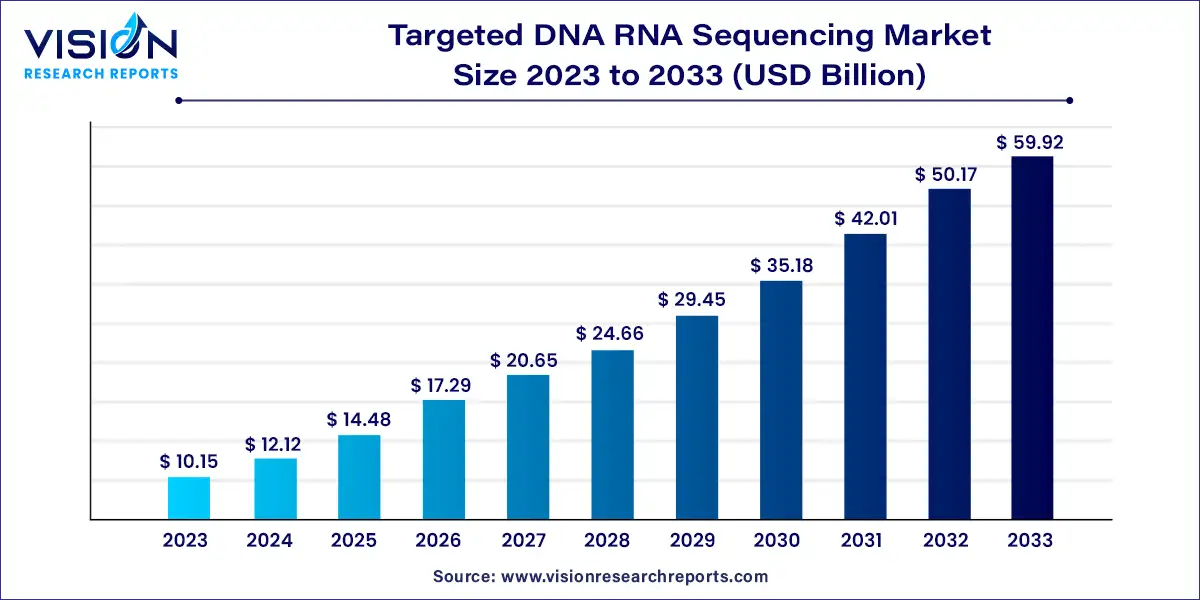

The global targeted DNA RNA sequencing market size was estimated at around USD 10.15 billion in 2023 and it is projected to hit around USD 59.92 billion by 2033, growing at a CAGR of 19.43% from 2024 to 2033. Targeted DNA and RNA sequencing represents a pivotal technology in genomics, allowing researchers to focus on specific regions of interest within the genome or transcriptome. This approach enhances the efficiency of genetic analysis by concentrating on particular genes or pathways rather than sequencing the entire genome or transcriptome. This market has been rapidly evolving, driven by advancements in sequencing technologies and a growing demand for precision medicine.

The growth of the targeted DNA and RNA sequencing market is significantly driven by an escalating prevalence of genetic disorders and chronic diseases necessitates precise diagnostic tools and targeted therapies, which targeted sequencing effectively provides. Advancements in sequencing technologies have also played a crucial role by enhancing accuracy, reducing costs, and improving overall efficiency, making these techniques more accessible to a broader range of researchers and clinicians. The shift towards personalized medicine further propels market growth, as targeted sequencing offers insights that enable tailored treatment strategies based on individual genetic profiles. Additionally, substantial investments in research and development within the genomics field are fueling innovations and expanding the applications of targeted sequencing, from oncology to rare disease research.

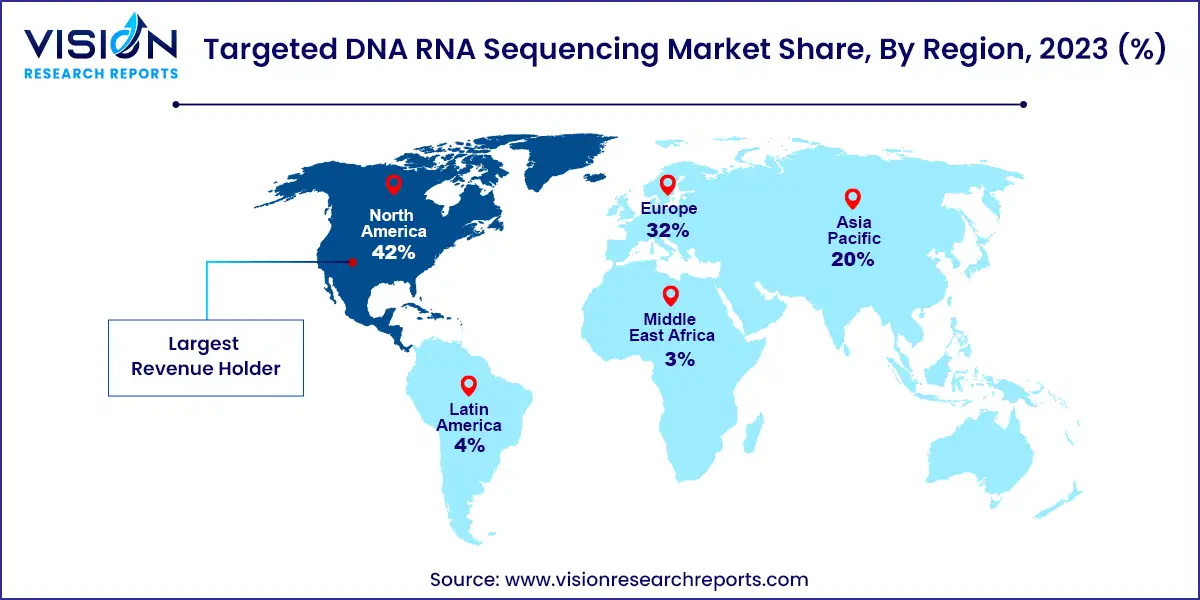

In 2023, North America led the DNA/RNA sequencing market with a 42% revenue share. The region's dominance is attributed to its well-established research organizations and pharmaceutical companies, which have shown strong interest in leveraging sequencing technology for drug discovery and development. Additionally, North America's supportive legal framework and high disposable incomes contribute to the broad application of sequencing in diagnostics and personalized healthcare.

In 2023, Europe emerged as a promising market for targeted DNA/RNA sequencing, driven by government support for genomics research and a focus on personalized medicine. These factors create a favorable environment for market players and researchers to increase the adoption of sequencing technologies.

The Asia Pacific region is anticipated to see significant growth in the targeted DNA/RNA sequencing market. This growth is fueled by rising disposable incomes and increased government investment in genomics. These developments are generating higher demand for sequencing technologies in healthcare and opening new opportunities for diagnostics and personalized medicine in the region.

In 2023, the next-generation sequencing (NGS) segment led the market due to its numerous advantages over traditional methods. NGS technology allows for the simultaneous sequencing of a larger number of targets at a significantly reduced cost, making it the preferred choice for researchers and healthcare providers in targeted sequencing.

The "Others" segment is expected to experience substantial growth during the forecast period. This segment encompasses various fields beyond drug discovery, human health, and plant and animal studies. Emerging research areas such as pharmacogenomics—studying the impact of genes on drug efficacy—and metagenomics—analyzing microbial genomes in various environments—are opening new opportunities for targeted sequencing tools and driving this segment's growth.

The sequencing segment was the market leader in 2023, primarily due to its crucial role in defining the nucleotide order in targeted DNA or RNA. This foundational step supports all subsequent analyses and contributes significantly to market expansion.

The pre-sequencing segment is projected to grow significantly over the forecast period. Advances in pre-sequencing processes, such as library preparation and target enrichment, have enhanced efficiency and specificity. Additionally, the increasing demand for high-throughput sequencing necessitates more robust pre-sequencing processes for handling larger sample volumes.

In 2023, drug discovery dominated the market, holding a 43% share. Pharmaceutical companies utilize targeted sequencing to identify genetic factors associated with specific diseases, accelerating drug development and improving the efficacy and safety of new medications. With the rising emphasis on personalized medicine, targeted sequencing has become an essential tool in developing drugs tailored to individual patient needs, further driving its growth.

Plant and animal sciences are expected to grow at a CAGR of 19.93% during the forecast period. In agriculture, targeted sequencing helps identify genes linked to desirable traits in plants and animals. In animal breeding, it aids in selecting animals with superior traits, enhancing livestock quality and productivity. Additionally, veterinary medicine benefits from targeted sequencing in diagnosing diseases and developing tailored treatment plans for animals.

The DNA-based targeted sequencing segment led the market in 2023. DNA analysis offers greater stability compared to RNA, which degrades more quickly, facilitating easier sample handling, storage, and analysis. Targeted DNA sequencing also provides precise drug compatibility by focusing on specific genes related to diseases, enabling the development of personalized therapies. Moreover, DNA sequencing technologies are generally more advanced, offering faster and more cost-effective workflows compared to RNA sequencing.

The RNA-based targeted sequencing segment is expected to grow considerably during the forecast period. New methods to stabilize RNA are addressing the challenges of RNA instability, making it a more viable option for targeting. RNA sequencing provides dynamic insights into gene expression and cellular mechanisms involved in disease development, contributing to its market growth.

The academic research segment led in 2023 due to its crucial role in advancing scientific knowledge. Custom research capabilities allow for targeted gene analysis, facilitating in-depth exploration of specific research questions and uncovering new disease mechanisms. Efficient genetic variant identification through targeted sequencing provides valuable insights into disease development and progression, paving the way for future breakthroughs.

The pharmaceutical and biotech sectors are projected to grow at a CAGR of 20.13% over the forecast period. Targeted sequencing aids in identifying disease-related components with high precision, streamlining drug development by avoiding irrelevant pathways and accelerating the availability of new drugs to patients.

By Product

By Workflow

By Application

By Type

By End Use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others