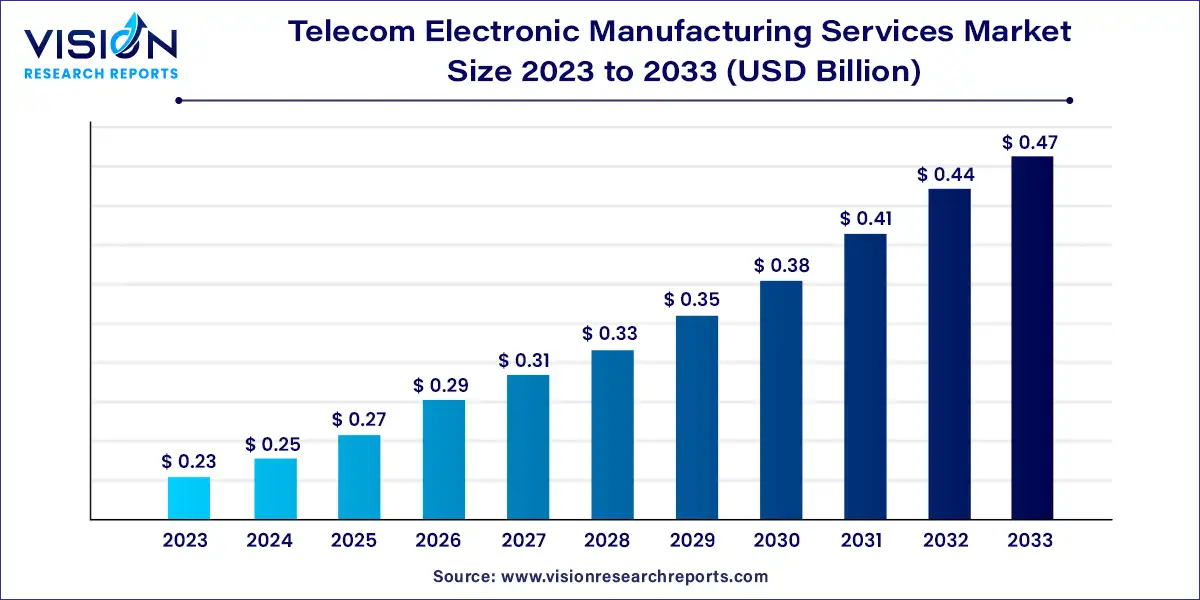

The global telecom electronic manufacturing services market size was valued at USD 0.23 billion in 2023 and is anticipated to reach around USD 0.47 billion by 2033, growing at a CAGR of 7.44% from 2024 to 2033.

The growth of the telecom electronic manufacturing services (EMS) market is driven by an increasing demand for advanced telecommunications infrastructure globally, coupled with rapid technological advancements, fuels the need for efficient EMS solutions. Secondly, outsourcing manufacturing to specialized EMS providers enables telecom companies to focus on core competencies, enhancing operational efficiency and reducing time-to-market for new products. Thirdly, the rise in consumer demand for high-speed internet, mobile connectivity, and IoT applications necessitates agile and scalable manufacturing solutions provided by EMS firms. These factors collectively contribute to the robust expansion of the Telecom EMS market, positioning it as a critical enabler of innovation and competitiveness within the telecom industry.

In 2023, the electronic manufacturing segment claimed the largest revenue share at 45%. Original Equipment Manufacturers (OEMs) are increasingly outsourcing product design and development to subcontractors to achieve two primary benefits: shifting from fixed to variable costs and reducing overall expenses. Many telecommunications electronic contract manufacturers are expanding their service offerings with higher profit margins, a move expected to drive segment growth in the coming years.

The electronic design and engineering segment is projected to grow at a rapid CAGR of 9.33% during the forecast period. Advancements in wireless communication sensor technologies and big data capabilities are facilitating the transformation of IoT, influencing product engineering and design processes to meet escalating consumer expectations and requirements. This trend is anticipated to significantly contribute to the segment's expansion.

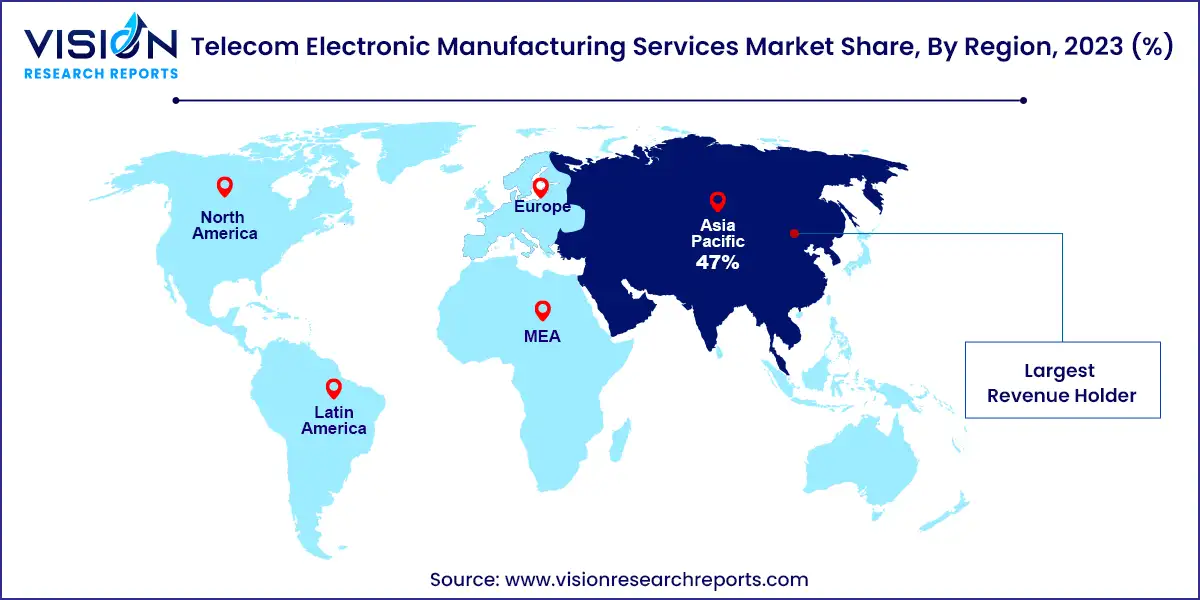

Asia Pacific led the market, capturing the largest revenue share of 47% in 2023, and is forecasted to grow at the fastest CAGR of 7.9% over the forecast period. OEMs in the region are increasingly outsourcing product design processes, allowing them to concentrate on core competencies. Asia Pacific has maintained its position as a vital electronic production hub for nearly a decade due to low labor costs, significantly bolstering its dominance in recent years.

However, rising labor costs in countries like China and other Southeast Asian nations have prompted efforts to position themselves as manufacturers of complex products. For example, Vietnam is emerging as a key hub for electronics component production, supported by investments from major players such as Samsung Electronics and LG Electronics. These developments are expected to further enhance the region's market.

North America is expected to experience substantial growth during the forecast period, driven by the proliferation of smart devices and increasing demand for environmentally friendly component manufacturing. Additionally, the thriving telecom industry in the region is poised to bolster market growth significantly.

By Service

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Telecom Electronic Manufacturing Services Market

5.1. COVID-19 Landscape: Telecom Electronic Manufacturing Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Telecom Electronic Manufacturing Services Market, By Service

8.1. Telecom Electronic Manufacturing Services Market, by Service Type, 2024-2033

8.1.1. Electronic Design & Engineering

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Electronics Assembly

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Electronic Manufacturing

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Supply Chain Management

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Telecom Electronic Manufacturing Services Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Service (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Service (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Service (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Service (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Service (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Service (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Service (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Service (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Service (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Service (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Service (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Service (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Service (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Service (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Service (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Service (2021-2033)

Chapter 10. Company Profiles

10.1. FLEX LTD.

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Jabil Inc.

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Plexus Corp.

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Benchmark Electronics, Inc.

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Celestica Inc.

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. COMPAL Inc.

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Creation Technologies LP

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Fabrinet

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3. Financial Performance

10.8.4. Recent Initiatives

10.9. Foxconn Technology

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Sanmina Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others