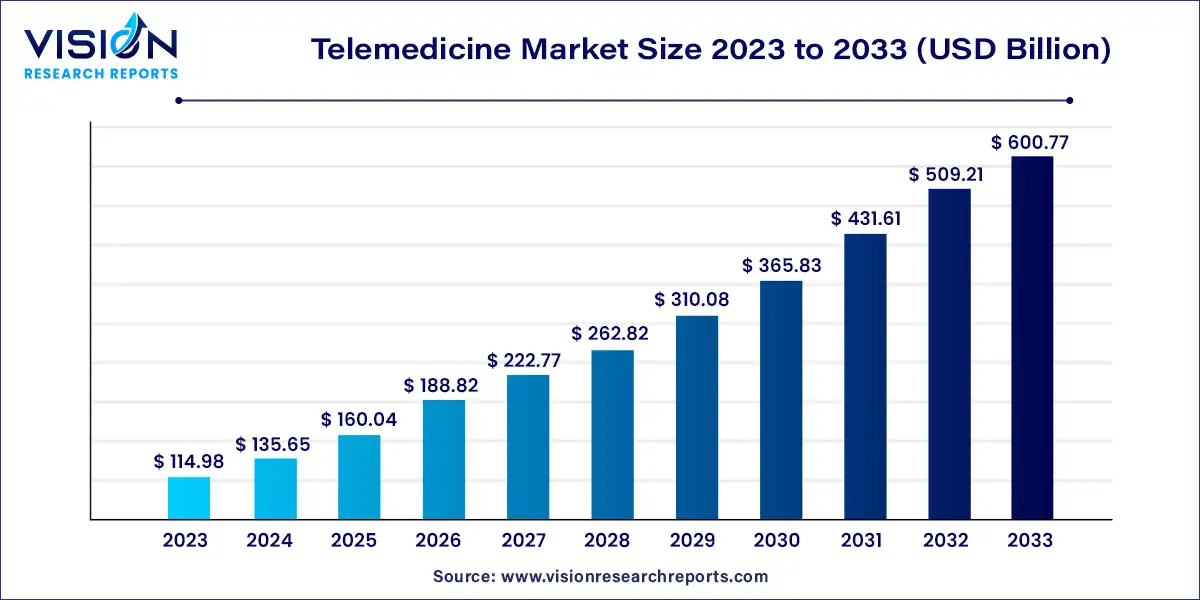

The global telemedicine market size was estimated at around USD 114.98 billion in 2023 and it is projected to hit around USD 600.77 billion by 2033, growing at a CAGR of 17.98% from 2024 to 2033. The telemedicine market has experienced significant growth driven by technological advancements, changing healthcare landscapes, and increasing demand for remote healthcare services

The growth of the telemedicine market growth is driven by the technological advancements have played a pivotal role, enabling seamless remote consultations and monitoring through sophisticated telemedicine platforms and mobile applications. Moreover, the rising healthcare costs have incentivized healthcare providers to embrace telemedicine as a cost-effective solution for delivering quality care while reducing overhead expenses. The aging population demographic has also contributed to the market's growth, as the demand for accessible and convenient healthcare services continues to rise.

The product segment dominated the market and is further categorized into software, hardware, and other components. In 2023, the product segment accounted for the largest market share, at 52%. This dominance can be attributed to the widespread adoption of various medical peripheral devices, audio equipment, microphones, display screens, and videoconferencing devices utilized to facilitate virtual visits. For instance, Teladoc Health, Inc. offers a range of devices such as Xpress & Xpress Cart, TV Pro & TV Pro+, Lite with Boom Camera, and Viewpoint Cart, aimed at facilitating clinical collaboration and point-of-care visits.

The service segment is projected to experience the fastest CAGR growth over the forecast period. This growth is primarily driven by the expanding field of remote patient monitoring and the widespread use of teleconsulting among patients and clinicians, as well as between physicians and surgeons, and between surgeons and students. For example, in December 2021, the Common Services Centre of the Ministry of Electronics and Information Technology in India launched the CSC Health Services Helpdesk, a chatbot-based helpline on WhatsApp.

The modality segment is categorized into real-time (synchronous), store and forward (asynchronous), and other technologies such as remote patient monitoring. In 2023, the real-time segment dominated the market in terms of revenue share. This growth can be attributed to the increasing demand for on-demand medical consultations, the adoption of mHealth, virtual video visits, and the availability of services from major market players.

Other segments, including patient monitoring from remote locations such as homes or hospitals, are expected to experience significant growth over the forecast period. For instance, in February 2022, Teladoc Health, Inc., a provider of whole-person virtual care, introduced Chronic Care Complete, a chronic condition management solution aimed at improving healthcare outcomes for patients with multiple chronic conditions. Moreover, in October 2020, Fitbit (now a subsidiary of Google) announced its intention to expand the premium health and fitness subscription service line by venturing into virtual care over the forecast period.

By application, the market is segmented into teleradiology, telepsychiatry, telepathology, teledermatology, telecardiology, and others. The teleradiology segment held the largest revenue share in 2023. As healthcare providers adopt teleradiology workflows and expand service offerings within radiology sub-segments, introduce new teleradiology services, and regulate teleradiology practices, this segment is expected to grow. For example, in November 2021, Agfa Healthcare introduced a true remote diagnostic imaging workflow. Key growth drivers for this segment include integrating Artificial Intelligence (AI) into teleradiology, implementing a Picture Archiving and Communication System (PACS), and increasing research and development (R&D) activities in eHealth.

Telepsychiatry is projected to grow at the fastest CAGR due to the increasing prevalence of mental and behavioral health disorders, growing awareness, and adoption of telepsychiatry services. For example, MD Live provides counseling and psychiatric sessions for a range of conditions such as anxiety, depression, trauma & PTSD, panic disorders, and more. Additionally, in December 2021, American Well launched Mind Your Mind, a mental health initiative designed to raise awareness about mental health issues.

By delivery mode, the market is segmented into web/mobile and call centers. The web/mobile segment accounted for the largest revenue share in 2023 and is predicted to grow at the fastest rate during the forecast period. This growth can be attributed to the increasing prevalence of smartphone usage, adoption of mHealth, and healthcare consumerism. The segment is further subdivided into audio/text-based and visualized access to care. Key players in this segment are tech companies that provide mobile and web-based solutions. Market growth is expected to be driven by the rising adoption of visualized care delivery solutions, various strategies implemented by market players, increasing user awareness, introduction of technologically advanced solutions, and penetration of cloud-based solutions.

The growth of the call centers segment is evidenced by the establishment of a COVID-19 telemedicine consultation call center by the Hyderabad Police in Telangana, India, in April 2021. The call center was launched to provide prompt responses to COVID-related queries from citizens.

By end use, the market is divided into patients, payers, providers, and others. In 2023, the patients segment held the largest market share. This can be attributed to patients utilizing telemedicine services for various health issues, ranging from mild to emergency situations. To address the diverse needs of patients, market players such as VSee offer a range of solutions, including telemedicine software, remote patient monitoring dashboards, and API & SDKs across various clinical specialties.

The provider segment is expected to grow at the fastest CAGR, driven by the ability of telemedicine solutions to improve the quality of healthcare services and provide healthcare providers with convenient access to patient records, enhanced decision support, workflows, and analytics. For instance, eHealth solutions offer healthcare professionals the convenience of patient scheduling and data management, which is expected to drive providers' adoption of telemedicine solutions over the forecast period.

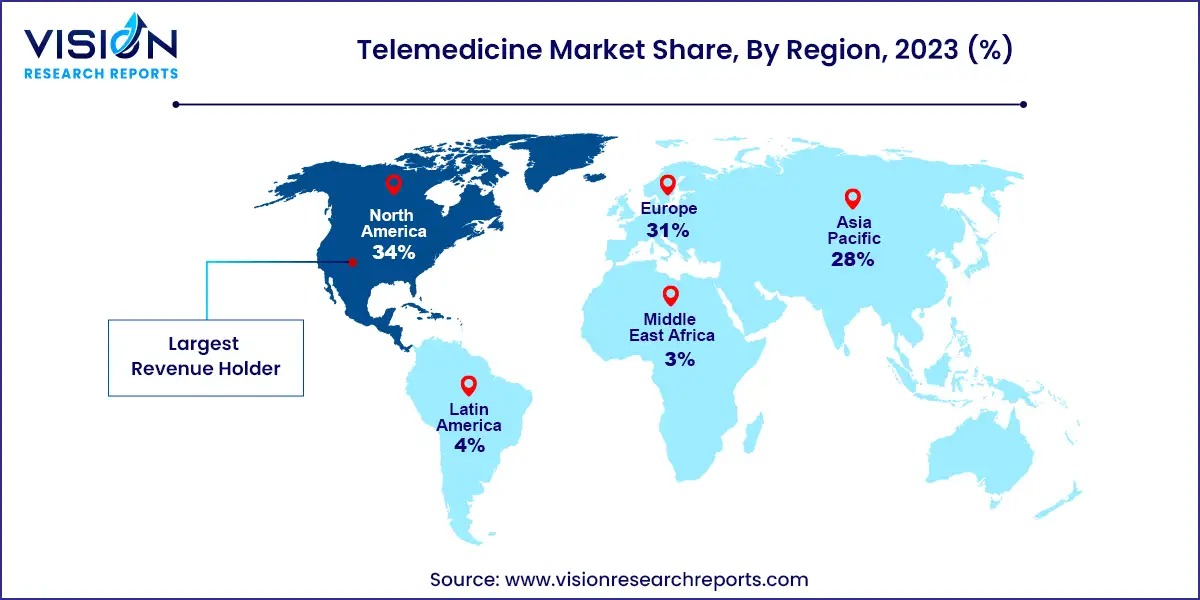

North America dominated the market with a revenue share of 34% in 2023. This can be attributed to the region's advanced healthcare facilities and a strong presence of key market players. Companies such as Teladoc Health, American Well Corporation, and Zoom Video Communications are based in the U.S. and are implementing strategic initiatives to increase their market share. The increasing adoption of home care by patients, growing demand for mobile technologies, and rising healthcare expenditure are expected to drive the market's growth over the forecast period.

Asia Pacific is expected to experience the fastest CAGR growth during the forecast period. This is due to the region's large patient population, growing internet usage, and high demand for healthcare assistance, particularly in rural areas. India and China are predicted to lead the regional growth, with India's telemedicine service, eSanjeevani, already completing around 3 billion consultations across the country, according to a report from the India Brand Equity Foundation in March 2021. The telemedicine market in India is growing significantly owing to improving internet coverage and increasing health-tech expenditure. Furthermore, telehealth and telemedicine services are expected to revolutionize medical tourism in India.

By Component

By Modality

By Application

By Delivery Mode

By Facility

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others