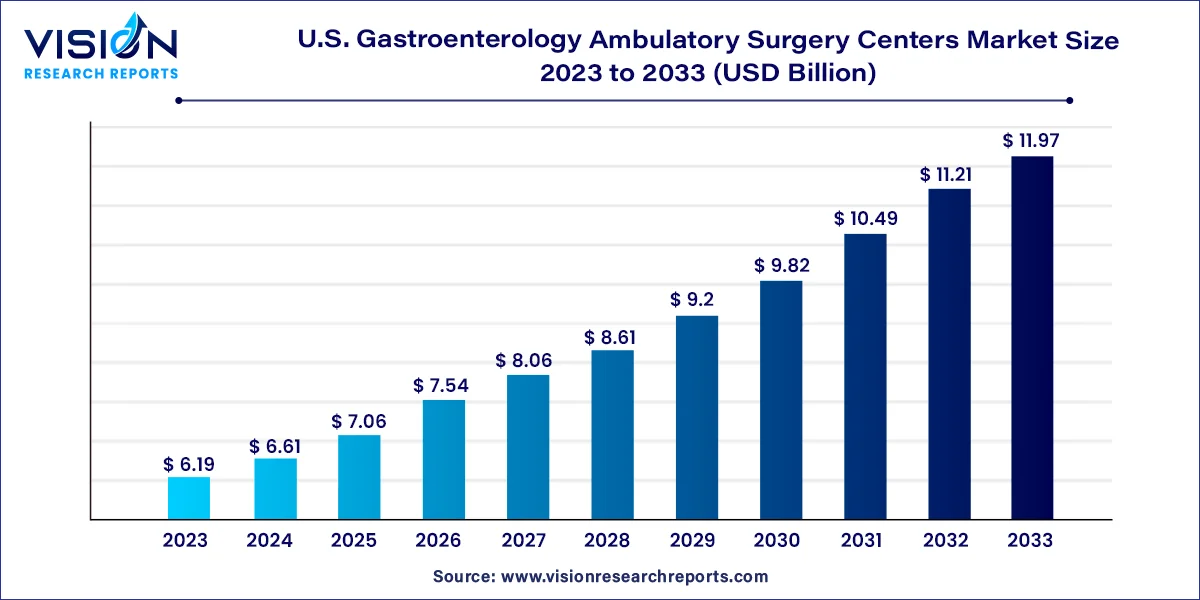

The U.S. gastroenterology ambulatory surgery centers market size was estimated at around USD 6.19 billion in 2023 and it is projected to hit around USD 11.97 billion by 2033, growing at a CAGR of 6.82% from 2024 to 2033. The U.S. Gastroenterology Ambulatory Surgery Centers (ASCs) market is a vital segment of the healthcare industry, offering specialized, outpatient surgical services for a range of gastrointestinal (GI) conditions. As healthcare moves toward cost-effective and patient-centered care, ASCs are becoming an increasingly preferred option over traditional hospital settings for certain procedures.

The growth of the U.S. gastroenterology ambulatory surgery centers (ASCs) market is primarily driven by the rising prevalence of gastrointestinal disorders such as colorectal cancer, inflammatory bowel disease (IBD), and gastroesophageal reflux disease (GERD). As the population ages, the demand for gastrointestinal procedures has increased, fueling the expansion of ASCs as cost-effective alternatives to hospitals. Additionally, advancements in minimally invasive surgical techniques and diagnostic tools have made outpatient surgeries more feasible, reducing patient recovery times and healthcare costs. Furthermore, the shift toward value-based care, coupled with favorable reimbursement policies from private and public payers, is encouraging more healthcare providers to adopt the ASC model, further bolstering the market's growth.

The freestanding ownership model dominates the market, accounting for the largest revenue share at 61%. This segment is largely comprised of physician-owned ambulatory surgery centers. The professional control over clinical operations and the quality of care provided by physicians significantly contributes to the market's growth. Freestanding centers allow physicians to focus on a select number of procedures in a dedicated setting. Furthermore, endoscopic ambulatory surgery centers, which are freestanding, offer gastrointestinal procedures at a lower cost compared to expensive hospital-based alternatives. These factors have driven the high demand for freestanding centers among patients and encouraged companies to adopt various strategies to capitalize on market growth.

Corporation-owned centers are projected to grow at a CAGR of 5.43% in the coming years. This growth is fueled by the increasing collaboration between corporations and physicians to establish joint ventures. Established companies in the healthcare sector bring expertise in financial management, operations, and recruitment of top talent, making these collaborations attractive. As more partnerships between corporations and physicians continue, this ownership model in the ambulatory surgery center market is expected to expand, with key players focusing on enhancing efficiency and outcomes.

The U.S. Gastroenterology Ambulatory Surgery Centers (ASC) Market is experiencing significant growth due to the increasing number of ASCs across the country. One of the main drivers is the high cost associated with traditional healthcare services, which often include unnecessary hospitalization expenses. ASCs offer a cost-effective alternative by providing surgeries with greater efficiency and at lower costs, which has made them a preferred option for many patients. This shift in patient preference has encouraged many hospitals to adopt the ASC model to streamline surgeries.

Many large hospitals and ASCs are expanding their presence in the U.S., further strengthening the market. The country boasts a well-established network of ambulatory surgery centers, which contributes to continuous market growth. Additionally, healthcare companies are innovating to meet the rising demand for specialized gastroenterology services in outpatient settings. This ongoing innovation and expansion ensure that the market for gastroenterology ASCs in the U.S. will continue to grow.

By Ownership

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Gastroenterology Ambulatory Surgery Centers Market

5.1. COVID-19 Landscape: U.S. Gastroenterology Ambulatory Surgery Centers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Gastroenterology Ambulatory Surgery Centers Market, By Ownership

8.1.U.S. Gastroenterology Ambulatory Surgery Centers Market, by Ownership Type, 2024-2033

8.1.1. Hospital-affiliated

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Freestanding

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Corporation-owned

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Gastroenterology Ambulatory Surgery Centers Market, Regional Estimates and Trend Forecast

9.1. U.S.

9.1.1. Market Revenue and Forecast, by Ownership (2021-2033)

Chapter 10. Company Profiles

10.1. Abbot

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Abbot

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Abbot

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Abbot

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Abbot

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Abbot

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Abbot

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Abbot

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Abbot

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. Abbot

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others