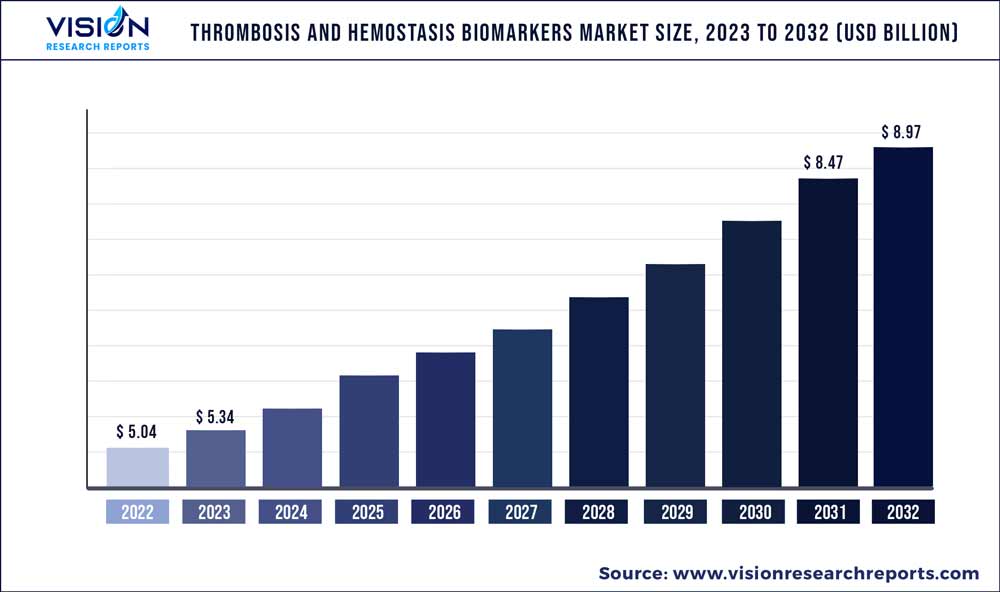

The global thrombosis and hemostasis biomarkers market was valued at USD 5.04 billion in 2022 and it is predicted to surpass around USD 8.97 billion by 2032 with a CAGR of 5.94% from 2023 to 2032. The thrombosis and hemostasis biomarkers market in the United States was accounted for USD 1.57 billion in 2022.

Key Pointers

Report Scope of the Thrombosis And Hemostasis Biomarkers Market

| Report Coverage | Details |

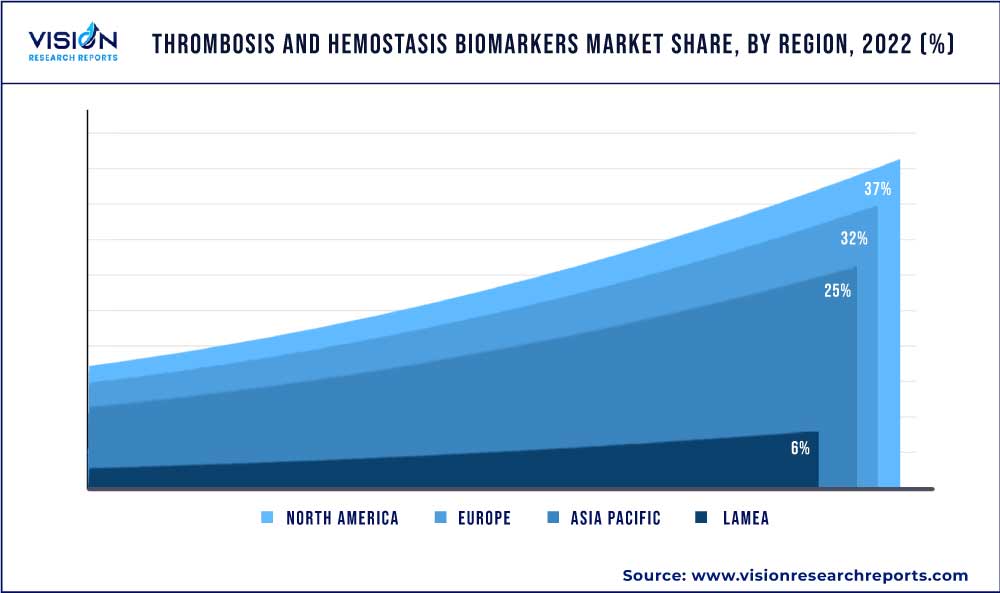

| Revenue Share of North America in 2022 | 37% |

| Revenue Forecast by 2032 | USD 8.97 billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche Ltd.; Siemens Healthineers; Abbott; bioMérieux SA; Werfen; HORIBA Ltd; Quidel Corporation; Diazyme Laboratories, Inc.; Biomedica Diagnostics. |

The market growth is attributable to the increasing prevalence of chronic diseases such as pancreatic cancer, expanding base of the geriatric population, the growing demand for personalized medicines, and overall advancements in technology. The market was also positively impacted by the spread of COVID-19. As per the National Library of Medicine, in September 2020, thrombotic complications were frequent in COVID-19 patients and contributed to high mortality and morbidity. The increased awareness created by the pandemic also created significant new opportunities for market players.

Biomarker test results for thrombosis help in articulating treatment for high-risk patient pools. For instance, according to the American Heart Association, in August 2020, laboratory biomarker testing suggested a 30% prevalence of thrombotic events in hospitalized COVID-19 patients. Furthermore, D-Dimer biomarker tests allowed to screen for thrombosis risk in COVID-19 patients, thereby, positively impacting the market.

The increasing prevalence of chronic diseases such as pancreatic cancer, deep vein thrombosis (DVT), and pulmonary embolism (PE) have become major contributors to the growth of the thrombosis and hemostasis biomarkers market. As per the World Cancer Research Fund International in 2020, pancreatic cancer was termed the 12th most common form of cancer globally. Nearly 495,000 new cases of pancreatic cancer were reported in 2020, with an ASR of 4.9 per 100,000 people. Thrombosis and hemostasis biomarkers are readily used to diagnose and assess the risk of thrombotic events in patients with pancreatic cancer, as various chemotherapy agents used in treating cancer increase the risk of thrombotic events.

The increasing demand for personalized medicines is projected to drive the thrombosis and hemostasis biomarkers market. The biomarkers allow healthcare providers to develop personalized treatment plans which are more effective and safer for every individual. Personalized medicines work on the principle of curating personalized medical treatment for individuals with unique genetic makeup and medical history; thereby, thrombosis and hemostasis biomarkers help identify patients at an increased risk of blood clots. According to researchers from the Tohoku University of Japan, complications related to blood clots for people with IBD or inflammatory bowel disease can be prevented using a newly found combination of genetic markers. This ailment affects as many as 2,10,000 people in Japan today.

Based on the promise of biomarkers and personalized medicine, the British Heart Foundation has funded research into the arena to transform heart treatments. According to its publication, new funding in personalized medicine can transform heart treatment in 4 key ways. These include creating digital hearts to predict treatment success, designing personalized pacemakers, preventing heart attacks & strokes with personalized medicine, and predicting the impact of chemotherapy on the heart.

Novel technologies are being built to curate more sensitive and specific biomarkers that can detect small changes in the clotting and hemostasis systems. For example, mass spectrometry and other high-throughput proteomics technologies have evolved, allowing to identify new, previously undetectable biomarkers.

New technologies are enabling the development of more sensitive and specific biomarkers that can detect small changes in the clotting & hemostasis systems. For example, the use of mass spectrometry and other high-throughput proteomics technologies has led to the identification of new biomarkers that were previously undetectable, providing more comprehensive information about a patient's clotting and hemostasis status.

Additionally, new product developments with advanced technologies are anticipated to have a positive impact on the market. For instance, in May 2022, Precision BioLogic made its CRYOcheck Chromogenic Factor IX test available in Canada, which indicates its availability in Canada along with the EU, New Zealand, & Australia. CRYOcheck chromogenic assay is the only FIX assay approved by Health Canada and used for the diagnosis of Hemophilia A.

Product Insights

The reagents & consumables segment held the largest market share of 66% in 2022 in the hemostasis and thrombosis biomarkers market and is estimated to become the fastest-growing segment over the forecast period. The dominant segment share can be attributed to the growing prevalence of bleeding and coagulation disorders, high demand for diagnostic tools, and new product launches. For example, in March 2019, HORIBA UK Ltd announced a product launch of a specific D-dimer parameter, which will be applicable in the instrument range of Yumizen G. The parameter will be known as GDDi 2 (D-Dimer), which also includes compact coagulation analyzer called Yumizen G200.

The analyzer segment is expected to grow at a significant CAGR over the forecast period. The segment’s growth can be attributed to the increasing prevalence of bleeding disorders and coagulation disorders and technological advancements in diagnostic tools. Advancements in this area continue to make way in the industry. For instance, in December 2022, Hemo-Sonics announced the FDA approval of its blood analyzer system for the determination of blood clotting during liver transplantation and trauma procedures.

Test Location Insights

The clinical laboratory test segment held the largest share of 63% in the thrombosis & hemostasis biomarkers market in 2022. Clinical laboratory tests help identify abnormalities within the blood clotting process, determine the severity of the condition, and guide treatment decisions. Moreover, the increasing investment in healthcare infrastructure, particularly in emerging economies, is also driving the growth of the clinical laboratory tests segment. For instance, as per Niti Aayog’s National Health Accounts (NHA) 2022, India’s government health expenditure represents 1.28% of its total GDP, an increase from 1.15% in 2013-14. As healthcare systems become more sophisticated and accessible, more people can access diagnostic tests, including clinical laboratory tests, leading to an increased demand for thrombosis and hemostasis biomarkers tests.

Point-of-care tests (POCT) are estimated to grow at the fastest rate over the forecast period. Point-of-care test segment growth can be attributed to the convenience it provides to healthcare providers, as POC tests can provide results within minutes. POCT allows diagnostic tests to be performed in settings outside traditional clinical laboratory settings, such as doctor's offices, emergency rooms, or even in patients' homes, thereby, driving the thrombosis and hemostasis biomarkers industry. Furthermore, geographic expansion by market players will help in curating demand for the POC tests. In November 2022, Entegrion, Inc., which has expertise in the management and clinical diagnosis of hemostasis, announced an expansion in Europe. The company launched Entegrion Italia for its European business.

Test Type Insights

Post-Thrombin (PT) test segment held the largest share of 18% in the thrombosis & hemostasis biomarkers market in 2022. The test allows to monitor the effectiveness of anticoagulant medications, such as warfarin, used to prevent blood clots. It is also utilized as a diagnostic tool to identify bleeding disorders or liver diseases. Blood plasma typically takes approximately 11 to 13.5 seconds to clot for individuals not taking blood thinning medications. PT tests are often presented as an International Normalized Ratio (INR) that typically ranges from 0.9 to 1.1. For people with warfarin, the target INR range is usually between 2 and 3.5, which is higher than the normal range.

Fibrin/ fibrinogen is estimated to be the fastest-growing segment of the thrombosis & hemostasis biomarkers market over the forecast period. The test is performed to manage and assess medical conditions such as blood clot formation, which include DVT, PE, and other thrombotic disorders. Furthermore, it is also useful in detecting deficiencies in fibrinogen levels, caused by genetic or hereditary factors. Different types of fibrinogen deficiencies include Afibrinogenemia, Hyperfibrinogenemia, and Dysfibrinogenemia. Afibrinogenemia is a rare disease affecting only 1 in every 1 million people and refers to a complete absence of fibrinogen in the blood.

Application Insights

Deep Vein Thrombosis (DVT) held the largest share of 41% in 2022 for the thrombosis and hemostasis biomarkers market. Deep vein thrombosis is a serious and underdiagnosed disease that develops a blood clot in a deep vein most commonly in the pelvis, lower leg, thigh, and arm. DVT cases are estimated at 1-2 cases per 1,000 people annually. It affects people from all ethnicities, gender, and age, but certain people remain at higher risk. This includes factors such as people with a history of blood clots, family history, obesity, cancer, and other chronic diseases.

Pulmonary embolism (PE) is expected to grow at a significant CAGR over the forecast period. Pulmonary embolism is a disease caused by blood clots in the blood vessels in the lungs, which can also occur in other body parts such as arms or legs. PE is one of the most common heart diseases, ranking only behind stroke and heart attack. For instance, as per American Lung Association in January 2023, PE affects nearly 900,00 people in the U.S. annually. Pulmonary embolism can be diagnosed via a D-dimer test, computed tomography angiogram, ultrasound, and V/Q scan.

End-use Insights

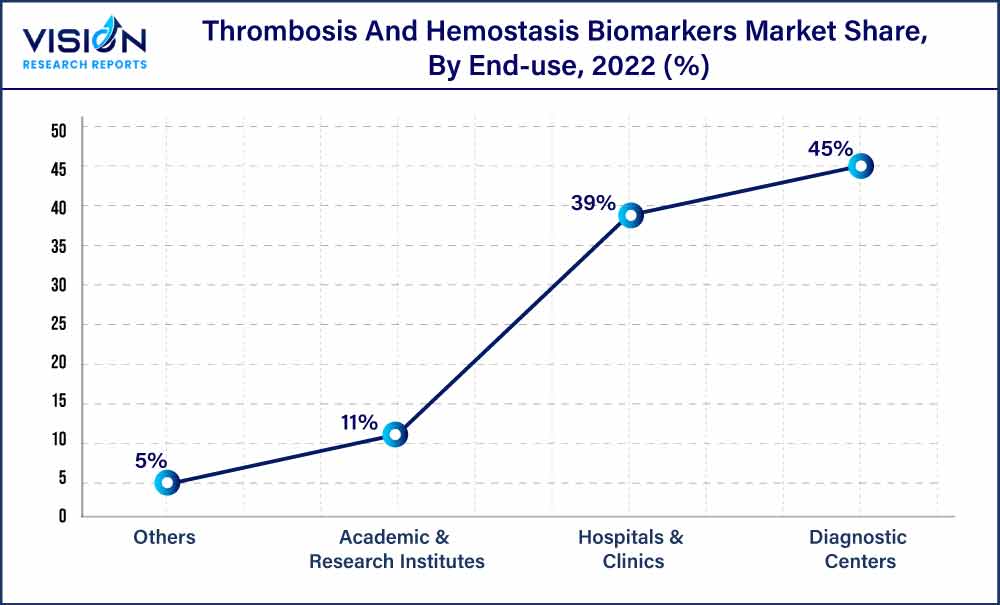

Diagnostic centers held the largest market share of 45% in 2022 in the thrombosis and hemostasis biomarkers market. The share can be attributed to an improved reliance of hospitals on diagnostic laboratories for testing & evaluation, which further leads to accelerated growth of the segment. Another major factor expected to drive segment growth is the increase in government initiatives to provide various facilities, such as compensation for diagnostic tests. Moreover, several healthcare institutions are working with laboratories to incorporate different clinical tests, such as thrombosis & hemostasis biomarkers testing. For instance, in May 2023, Labcorp entered into a strategic agreement with Jefferson Health, through which the former will acquire the latter’s outreach for laboratory services. Additionally, with this strategic move, Jefferson will be able to expand its specialty lab testing.

Hospitals and clinics are expected to grow at a lucrative growth in the thrombosis & hemostasis biomarkers market. Constant changes in the healthcare industry have led to a rise in the need for hospitals with improved diagnostic services. The increase in healthcare spending globally has significantly contributed to the segment growth. As hospitals collect and maintain data on disease frequency, regulatory bodies often collaborate with hospitals for disease surveillance. The need for hospitals with advanced facilities has increased with ongoing changes in the healthcare industry. The rise in the number of hospitals and diagnostic laboratories has also led to high growth in the segment.

Regional Insights

North America held the largest share of 37% in the thrombosis and hemostasis biomarkers market in 2022. It can be attributed to an increasing prevalence of thrombosis and hemostasis disorders, advancements in technology, and consistent R&D efforts in thrombosis and hemostasis biomarkers are key factors driving the market in the region. For instance, the estimated annual incidence of Venous Thromboembolism (VTE) in the region ranges from 104 to 183 cases per 100,000 population per year. Furthermore, within the U.S., 10% to 30% of patients in the ICU develop disseminated intravascular coagulation. Lastly, growing demand for personalized medicines and favorable government initiatives propel the hemostasis & thrombosis industry in the region.

Asia-Pacific is estimated to register the fastest growth in the thrombosis & hemostasis biomarker market over the forecast period attributed to the local presence of leading companies and increased R&D investment. Furthermore, the growing geriatric population susceptible to diseases and rising prevalence of cardiovascular diseases and blood clotting disorders, are anticipated to propel the Asia Pacific regionalmarket. For instance, according to research published in Science Direct, there were 18.6 million CVD deaths globally in 2019, of which, 58% occurred in Asia Pacific. Favorable reimbursement policies in the Asia Pacific for thrombosis & hemostasis biomarker testing are influencing the market in the region.

Thrombosis And Hemostasis Biomarkers Market Segmentations:

By Product

By Test Location

By Test Type

By Application

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Thrombosis And Hemostasis Biomarkers Market

5.1. COVID-19 Landscape: Thrombosis And Hemostasis Biomarkers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Thrombosis And Hemostasis Biomarkers Market, By Product

8.1. Thrombosis And Hemostasis Biomarkers Market, by Product, 2023-2032

8.1.1. Analyzers

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Reagents & Consumables

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Thrombosis And Hemostasis Biomarkers Market, By Test Location

9.1. Thrombosis And Hemostasis Biomarkers Market, by Test Location, 2023-2032

9.1.1. Clinical Laboratory Tests

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Point-of-Care Tests

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Thrombosis And Hemostasis Biomarkers Market, By Test Type

10.1. Thrombosis And Hemostasis Biomarkers Market, by Test Type, 2023-2032

10.1.1. D-Dimer

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Anti-Thrombin III

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Plasminogen

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Soluble Fibrin

10.1.4.1. Market Revenue and Forecast (2020-2032)

10.1.5. Selectins

10.1.5.1. Market Revenue and Forecast (2020-2032)

10.1.6. Factor VIII

10.1.6.1. Market Revenue and Forecast (2020-2032)

10.1.7. PT

10.1.7.1. Market Revenue and Forecast (2020-2032)

10.1.8. APTT

10.1.8.1. Market Revenue and Forecast (2020-2032)

10.1.9. Fibrinogen

10.1.9.1. Market Revenue and Forecast (2020-2032)

10.1.10. Others

10.1.10.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Thrombosis And Hemostasis Biomarkers Market, By Application

11.1. Thrombosis And Hemostasis Biomarkers Market, by Application, 2023-2032

11.1.1. Deep Vein Thrombosis (DVT)

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Pulmonary Embolism (PE)

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Disseminated Intravascular Coagulation (DIC)

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Thrombosis And Hemostasis Biomarkers Market, By End-use

12.1. Thrombosis And Hemostasis Biomarkers Market, by End-use, 2023-2032

12.1.1. Hospitals & Clinics

12.1.1.1. Market Revenue and Forecast (2020-2032)

12.1.2. Academic & Research Institutes

12.1.2.1. Market Revenue and Forecast (2020-2032)

12.1.3. Diagnostic Centers

12.1.3.1. Market Revenue and Forecast (2020-2032)

12.1.4. Others

12.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 13. Global Thrombosis And Hemostasis Biomarkers Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.1.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.5. Market Revenue and Forecast, by End-use (2020-2032)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.6.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.1.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.7. Market Revenue and Forecast, by End-use (2020-2032)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.1.8.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.1.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.1.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.1.8.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.2.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.5. Market Revenue and Forecast, by End-use (2020-2032)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.6.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.2.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.7. Market Revenue and Forecast, by Application (2020-2032)

13.2.8. Market Revenue and Forecast, by End-use (2020-2032)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.9.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.2.9.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.10. Market Revenue and Forecast, by Application (2020-2032)

13.2.11. Market Revenue and Forecast, by End-use (2020-2032)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.12.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.2.12.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.12.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.13. Market Revenue and Forecast, by End-use (2020-2032)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Product (2020-2032)

13.2.14.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.2.14.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.2.14.4. Market Revenue and Forecast, by Application (2020-2032)

13.2.15. Market Revenue and Forecast, by End-use (2020-2032)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.3.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.6.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.3.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.7. Market Revenue and Forecast, by End-use (2020-2032)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.8.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.3.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.9. Market Revenue and Forecast, by End-use (2020-2032)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.10.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.3.10.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Product (2020-2032)

13.3.11.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.3.11.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.3.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.3.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.4.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.6.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.4.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.7. Market Revenue and Forecast, by End-use (2020-2032)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.8.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.4.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.9. Market Revenue and Forecast, by End-use (2020-2032)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.10.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.4.10.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.10.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.10.5. Market Revenue and Forecast, by End-use (2020-2032)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Product (2020-2032)

13.4.11.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.4.11.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.4.11.4. Market Revenue and Forecast, by Application (2020-2032)

13.4.11.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.5.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.5. Market Revenue and Forecast, by End-use (2020-2032)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.6.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.5.6.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.6.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.7. Market Revenue and Forecast, by End-use (2020-2032)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Product (2020-2032)

13.5.8.2. Market Revenue and Forecast, by Test Location (2020-2032)

13.5.8.3. Market Revenue and Forecast, by Test Type (2020-2032)

13.5.8.4. Market Revenue and Forecast, by Application (2020-2032)

13.5.8.5. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 14. Company Profiles

14.1. Thermo Fisher Scientific, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. F. Hoffmann-La Roche Ltd.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Siemens Healthineers

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Abbott

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. bioMérieux SA

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Werfen

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. HORIBA Ltd

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Quidel Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Diazyme Laboratories, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Biomedica Diagnostics.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others