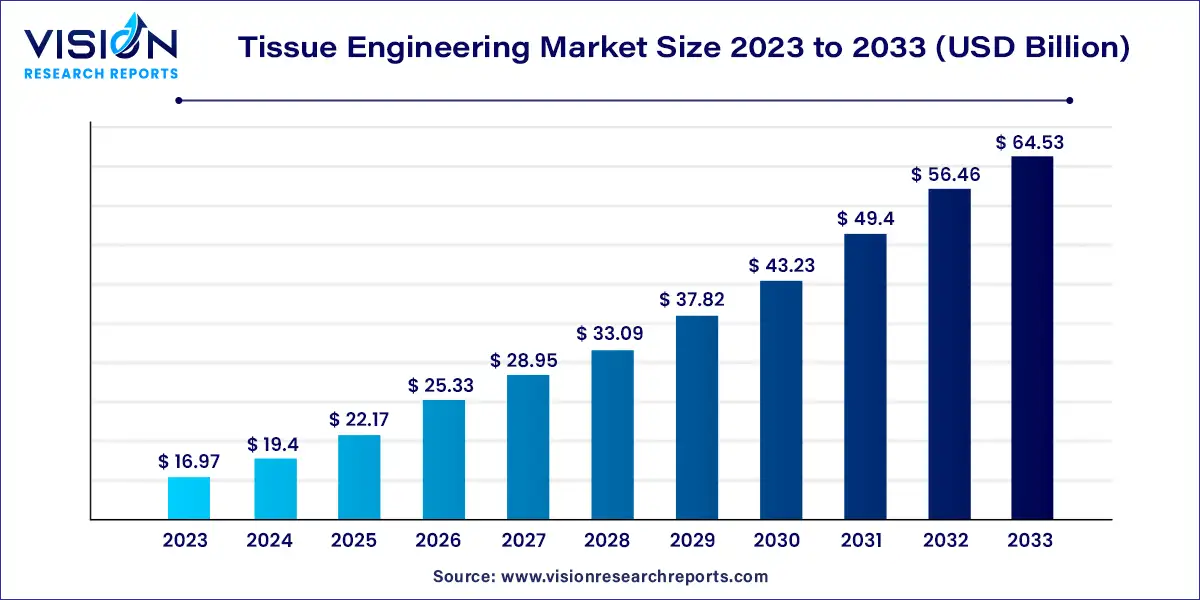

The global tissue engineering market size was estimated at around USD 16.97 billion in 2023 and it is projected to hit around USD 64.53 billion by 2033, growing at a CAGR of 14.29% from 2024 to 2033.

The tissue engineering market is poised for substantial growth driven by advancements in regenerative medicine and biomaterials. Tissue engineering involves the development of biological substitutes to restore, maintain, or improve tissue function. This innovative field combines biology, engineering principles, and medical sciences to create solutions that mimic natural tissue structure and function.

The tissue engineering market is experiencing significant growth driven by an advancements in regenerative medicine and biomaterials. This field combines biology, engineering principles, and medical sciences to develop biological substitutes that mimic natural tissue. Key growth factors include technological advancements in biomaterials and 3D bioprinting, rising incidence of chronic diseases like cardiovascular disorders, and an aging global population requiring effective tissue regeneration solutions. Additionally, supportive regulatory frameworks and increasing investments in healthcare infrastructure are further propelling market expansion. Despite challenges such as scaling up production and high development costs, the market outlook remains promising due to ongoing research and collaborations driving innovation in tissue engineering therapies.

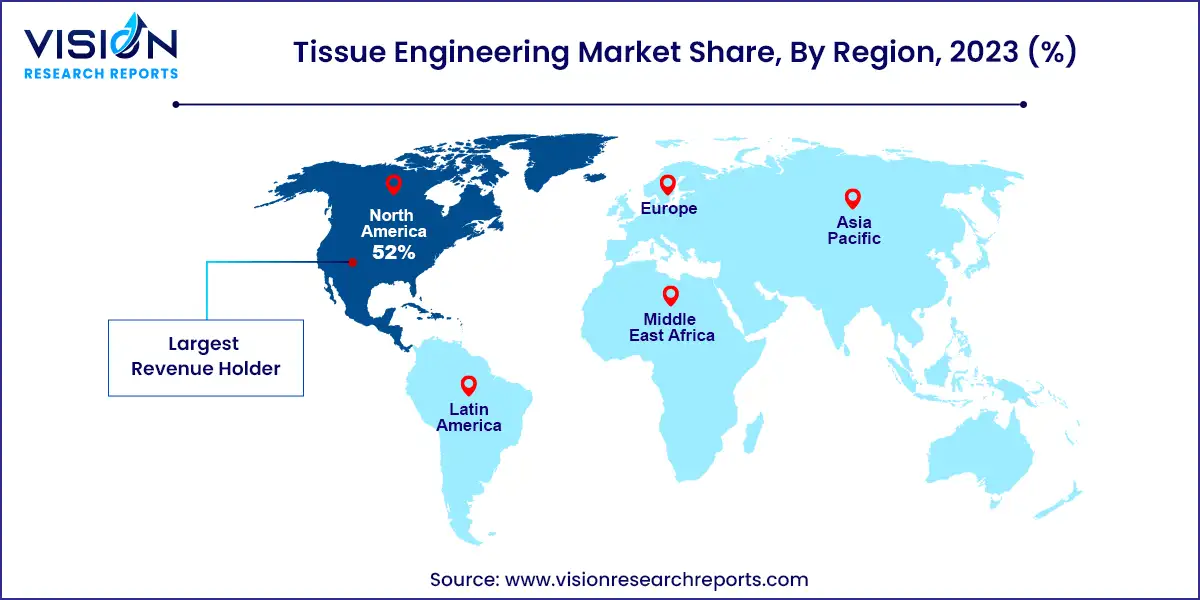

North America emerged as the dominant region in 2023, capturing a significant revenue share of 52%. Factors contributing to its leadership include heightened awareness of stem cell therapies, a burgeoning elderly population, and an uptick in chronic disease incidences. The region benefits from advanced healthcare technology, robust private and public funding, and substantial healthcare expenditures.

| Attribute | North America |

| Market Value | USD 8.82 Billion |

| Growth Rate | 3.85% CAGR |

| Projected Value | USD 33.55 Billion |

Advancements in 3D tissue engineering technology and the presence of key market players drive growth through continuous product innovation. For instance, Organogenesis showcased pioneering wound care solutions such as PuraPly AM, Affinity, Apligraf, and Organogenesis Physician Solutions at the 2023 Symposium on Advanced Wound Care Conference in Phoenix, Arizona, held in April 2023.

The Asia Pacific region is poised to witness the fastest CAGR of 15.88% during the forecast period. Japan leads technological advancements in tissue engineering, bolstered by a rise in clinical disorders like cancer and advancements in 3D bioprinting. Additionally, medical tourism contributes to market growth across the region.

Regarding application, the orthopedics, musculoskeletal, and spine segment dominated with a substantial revenue share of 60% in 2023, driven by the rising incidence of musculoskeletal disorders. Tissue engineering has become pivotal for orthopedic surgeons, addressing various conditions from meniscal injuries in athletes to osteochondral defects in joints like the glenohumeral. According to the World Health Organization (WHO), rheumatoid arthritis affects over 23 million people globally. Recent studies underscore the prevalence, with 460 cases per 100,000 individuals worldwide from 1980 to 2019.

Market players' adoption of diverse growth strategies and product innovations is set to propel segment expansion. Notably, LifeNet Health showcased cutting-edge allograft biologics for fusion, including ViviGen MIS, designed specifically for minimally invasive surgery, at the North American Spine Society (NASS) 2023 Annual Meeting in Chicago, held in October 2023.

The cardiology & vascular segment is projected to achieve the highest compound annual growth rate (CAGR) of 25.93% during the forecast period, driven by the increasing prevalence of cardiovascular diseases. Industry leaders are actively developing stem cell therapies aimed at repairing and regenerating damaged heart tissues, alongside research into gene therapy and advanced biologics to stimulate heart cell regeneration.

By Application

By Region

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Tissue Engineering Market

5.1. COVID-19 Landscape: Tissue Engineering Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Tissue Engineering Market, By Application

8.1.Tissue Engineering Market, by Application Type, 2024-2033

8.1.1. Cord blood & Cell Banking

8.1.1.1.Market Revenue and Forecast (2021-2033)

8.1.2. Cancer

8.1.2.1.Market Revenue and Forecast (2021-2033)

8.1.3. GI, Gynecology

8.1.3.1.Market Revenue and Forecast (2021-2033)

8.1.4. Dental

8.1.4.1.Market Revenue and Forecast (2021-2033)

8.1.5. Skin & Integumentary

8.1.5.1.Market Revenue and Forecast (2021-2033)

8.1.6. Urology

8.1.6.1.Market Revenue and Forecast (2021-2033)

8.1.7. Orthopedics, Musculoskeletal, & Spine

8.1.7.1.Market Revenue and Forecast (2021-2033)

8.1.8. Neurology

8.1.8.1.Market Revenue and Forecast (2021-2033)

8.1.9. Cardiology & Vascular

8.1.9.1.Market Revenue and Forecast (2021-2033)

8.1.10. Others

8.1.10.1.Market Revenue and Forecast (2021-2033)

Chapter 9. Global Tissue Engineering Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2021-2033)

Chapter 10.Company Profiles

10.1. Medtronic plc

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Zimmer Biomet Holdings, Inc

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Allergan plc

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Athersys, Inc

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. ACell, Inc.

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. Organogenesis Holdings Inc

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. Tissue Regenix Group plc

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Stryker Corporation

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. RTI Surgical, Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10. Integra LifeSciences Corporation

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others