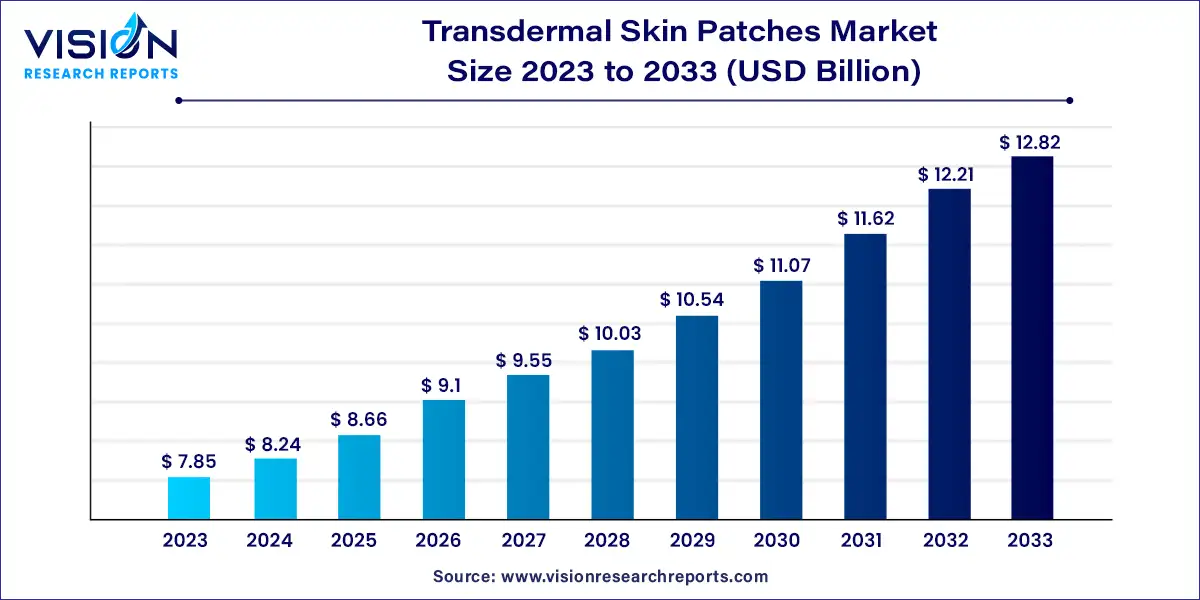

The global transdermal skin patches market size was valued at USD 7.85 billion in 2023 and is anticipated to reach around USD 12.82 billion by 2033, growing at a CAGR of 5.03% from 2024 to 2033. The transdermal skin patches market has been experiencing notable growth due to its non-invasive delivery method and ease of use. These patches offer a convenient way to administer medications and treatments, ensuring a steady release of active ingredients into the bloodstream through the skin.

The growth of the transdermal skin patches market is driven by the rising prevalence of chronic diseases such as diabetes, cardiovascular conditions, and hormonal disorders significantly boosts demand for effective, long-term treatment solutions. Transdermal patches offer a convenient and non-invasive method of drug delivery, which enhances patient adherence to prescribed therapies and improves overall treatment outcomes. Additionally, advancements in patch technology, including the development of more sophisticated drug delivery systems and innovative materials, have expanded the range of medications that can be effectively administered through the skin. The increasing focus on personalized medicine also contributes to market growth, as transdermal patches can be tailored to meet individual patient needs.

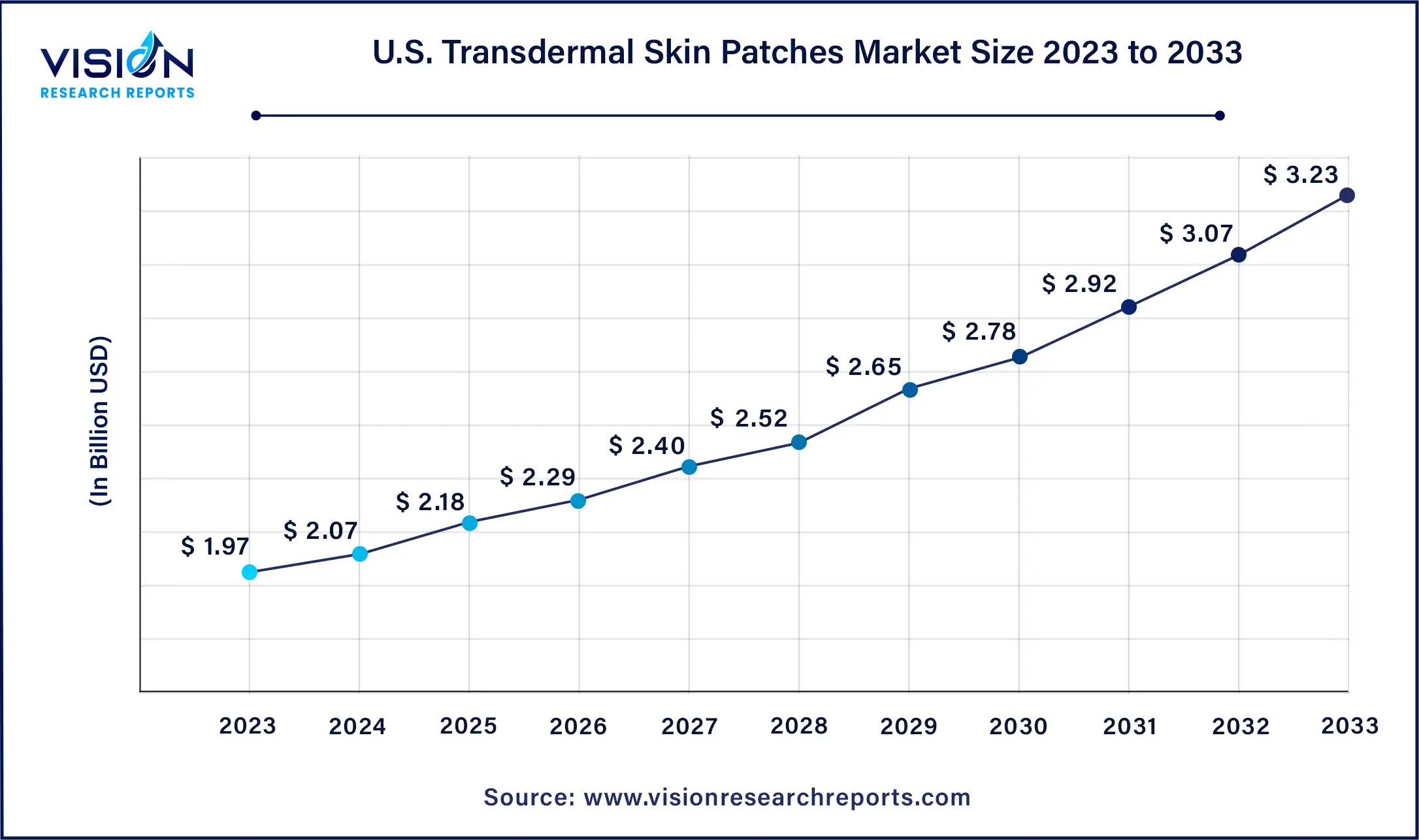

North America led the market with a revenue share of 36% in 2023, supported by advanced healthcare infrastructure and regulatory frameworks that facilitate the development and approval of innovative transdermal patch technologies. The high prevalence of chronic diseases such as diabetes, cardiovascular disorders, and chronic pain conditions further fuels demand for effective treatment options. According to the CDC, cigarette smoking is the leading cause of preventable disease in the U.S., resulting in over 480,000 deaths annually. In 2021, 11.5% of U.S. adults smoked, contributing to 28.3 million adults and over 16 million Americans living with smoking-related illnesses.

| Attribute | North America |

| Market Value | USD 2.82 Billion |

| Growth Rate | 5.06% CAGR |

| Projected Value | USD 3.23 Billion |

The U.S. transdermal skin patches market size was estimated at around USD 1.97 billion in 2023 and it is projected to hit around USD 3.23 billion by 2033, growing at a CAGR of 5.06% from 2024 to 2033.

Europe is characterized by stringent regulations, high disease prevalence, and a focus on innovation. Regulatory bodies like the European Medicines Agency (EMA) ensure the approval and monitoring of transdermal products, fostering consumer trust and market growth. Countries like Germany, the UK, and France are leading the way in developing new formulations and delivery mechanisms to enhance therapeutic outcomes.

Asia Pacific is expected to see significant growth due to its large, rapidly growing population, rising disposable incomes, and increasing healthcare spending. The awareness of chronic diseases such as diabetes and cardiovascular disorders is driving demand for advanced drug delivery systems like transdermal patches. In China, the elderly population faces major public health issues due to chronic diseases, with 75% of those over 60 suffering from at least one chronic condition. Chronic diseases account for 86.6% of deaths in China, highlighting the growing need for effective treatment solutions.

In 2023, multi-layer drug-in-adhesive transdermal patches captured the largest market share of 37%, owing to their superior drug delivery efficiency and broad applicability. These advanced patches feature multiple adhesive layers, each infused with the active pharmaceutical ingredient (API), enabling controlled and sustained drug release over an extended period. This design minimizes the risk of dose dumping and ensures a steady therapeutic effect. For example, the Fentanyl transdermal patch, used for chronic pain management, utilizes a multi-layer structure to provide continuous relief for up to 72 hours, offering greater patient comfort and adherence compared to oral painkillers that require frequent dosing. Similarly, the Clonidine transdermal patch for hypertension provides a weekly dosing schedule, improving patient compliance and blood pressure management over daily oral tablets.

Matrix patches are projected to grow at the fastest CAGR of 5.53% during the forecast period. Their growth is driven by their flexible formulation and cost-effective manufacturing advantages. In matrix patches, the API is dispersed within a polymer matrix, ensuring uniform distribution and consistent drug release. This design allows for versatile formulation of various APIs, facilitating the development of patches for diverse therapeutic uses. For instance, the Nicotine transdermal patch, used for smoking cessation, employs a matrix design to deliver a steady dose of nicotine throughout the day, helping reduce withdrawal symptoms and cravings, thus improving the success of smoking cessation efforts.

The pain relief segment dominated the market with a share of 24% in 2023, driven by the high prevalence of chronic pain conditions. Conditions such as arthritis, fibromyalgia, and lower back pain affect millions worldwide, increasing the demand for effective pain management solutions. According to a report by the Institute for Health Metrics and Evaluation, by 2050, 1 billion people will suffer from osteoarthritis, with 15% of those aged 30 and older currently affected. Transdermal patches offer continuous and controlled release of analgesics, providing sustained pain relief without the peaks and troughs of oral medications.

The smoking cessation segment is expected to grow at the highest CAGR, driven by increasing awareness of smoking-related health risks. The WHO estimates that smoking causes over 8 million deaths annually. Heightened public awareness and stringent tobacco regulations have increased the demand for smoking cessation aids. Nicotine transdermal patches offer a proven, non-invasive solution by providing a controlled nicotine dose to alleviate withdrawal symptoms and reduce cravings. For instance, Rusan Pharma's campaign in April 2023 promoted their '2baconil' 24-hour nicotine transdermal patch to support smoking cessation efforts.

In 2023, hospital pharmacies held the largest market share of 40%, benefiting from high patient traffic and trust in hospital settings. Hospitals serve a large number of patients daily, creating a steady demand for medications, including transdermal patches. Patients frequently rely on hospital pharmacies for their prescriptions, ensuring a consistent distribution channel. Hospital pharmacists also play a critical role in educating patients about the proper use, benefits, and potential side effects of transdermal patches, which is crucial for first-time users or those undergoing complex treatments like hormone replacement therapy or pain management.

Online pharmacies are anticipated to grow at the fastest CAGR of 5.43% during the forecast period. The rise of e-commerce and online shopping has expanded the accessibility of healthcare products, including transdermal patches. Platforms such as Amazon and Walgreens provide a wide range of transdermal patches, enhancing convenience for patients managing chronic conditions. The COVID-19 pandemic accelerated the shift towards online shopping, driven by the preference for contactless transactions and home shopping. As these habits persist, the online pharmacies segment is expected to continue its robust growth.

By Type

By Application

By Distribution Channel

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others