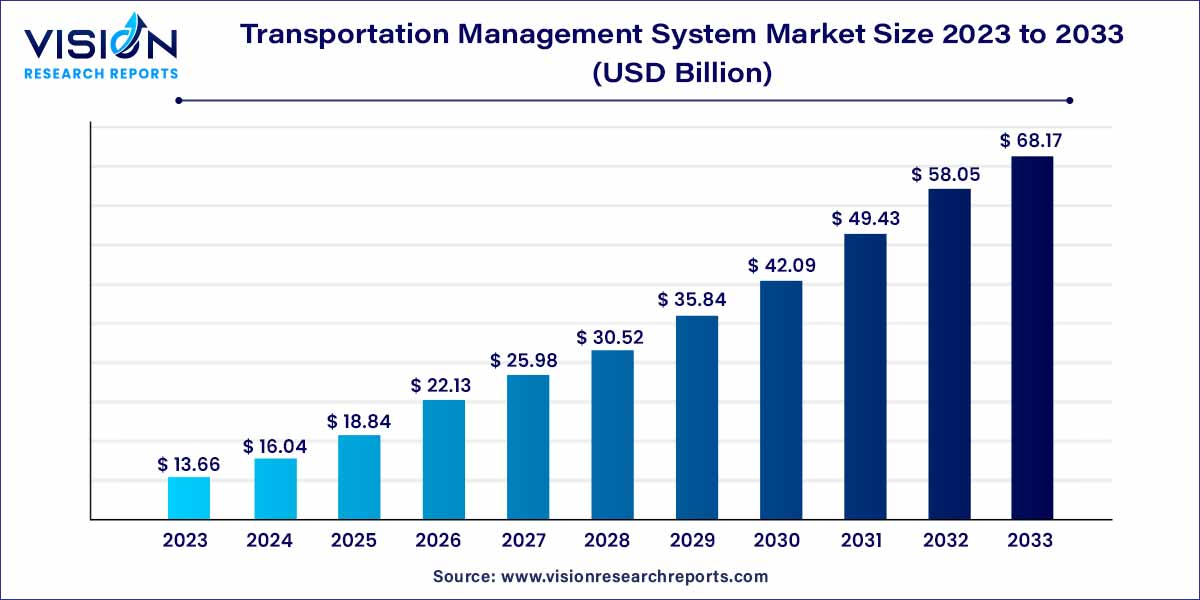

The global transportation management system market was estimated at USD 13.66 billion in 2023 and it is expected to surpass around USD 68.17 billion by 2033, poised to grow at a CAGR of 17.44% from 2024 to 2033.

The Transportation Management System (TMS) market has witnessed significant growth in recent years, driven by the increasing complexity of supply chain operations and the growing need for efficient transportation solutions. This overview delves into key aspects of the TMS market, providing insights into its current landscape, trends, and future prospects.

The growth of the Transportation Management System (TMS) market can be attributed to several key factors. Firstly, the increasing globalization of supply chains has led to greater complexity in transportation networks, driving the demand for efficient TMS solutions. Additionally, technological advancements, including real-time tracking, artificial intelligence, and machine learning, have significantly enhanced the capabilities of TMS, offering predictive analytics and automation features. The booming e-commerce sector has further fueled market expansion, as TMS facilitates order fulfillment, warehouse management, and last-mile delivery optimization. The trend towards cloud-based solutions has provided scalability and flexibility, contributing to the market's upward trajectory. Integration with emerging technologies like IoT and blockchain is also a growth factor, providing enhanced visibility and security across supply chains. Moreover, the industry's increasing focus on sustainability has led TMS solutions to incorporate features supporting eco-friendly practices, such as route optimization to minimize fuel consumption. As businesses continue to seek sophisticated and integrated solutions for their transportation needs, the Transportation Management System market is expected to experience sustained growth in the foreseeable future.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.44% |

| Market Revenue by 2033 | USD 68.17 billion |

| Revenue Share of North America in 2023 | 33% |

| CAGR of Asia Pacific from 2024 to 2033 | 19.98% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The freight & order management segment accounted for the largest market share of 26% in 2023. The growing customer-centric offerings require more intelligent solutions to engage customers and provide the right product through the right channel with significant speed and convenience based on customer requirements. Organizations are looking for advanced transportation management, logistics, and supply chain solutions that can manage the freight and order management processes, helping businesses to adapt and scale faster by ensuring a seamless customer experience from onboarding to delivery and support. Fright & order management allows businesses to estimate orders, inventory availability, real-time delivery status, and fulfillment, allowing them to gain a competitive advantage and deliver enhanced customer experience are the key factors expected to drive the market growth.

The reporting & analytics segment is expected to grow at a CAGR of 19.38% during the forecast period. Report & analytics TMS enables businesses to collect and integrate relevant data across various operational areas to gain business-related and specific insights, which are crucial for strategic and operational decision-making. It offers end-to-end visibility and custom reports, including fuel charges, freight and transportation expenses, and taxes, among others, allowing companies to boost service performance, drive informed decision-making, and trim additional expenses. Thus, these are the key factors aimed at driving the segment's growth in the market.

The on-premise segment held the largest revenue share of 57% in 2023. Various manufacturing and distribution enterprises largely rely on the on-premise deployment mode for transportation management system solutions owing to the safety requirements, ease of access to the server, and greater control over customization. However, with the awareness of the benefits of the cloud's low cost of implementation as compared to the on-premise deployment, end users are expected to adopt advanced cloud-based transportation management.

The cloud-based segment is anticipated to grow at a CAGR of 18.47% during the forecast period. Cloud-based transportation management systems have gained increased popularity in recent years owing to the quick and easy setup, low initial cost, and reduced dependency on hardware requirements. It offers significant planning and optimizing advantages to vendors, shippers, and logistics providers. With the rising amount of data being generated, companies are actively looking for cloud-based TMS solutions as they offer a cost-effective alternative as compared to premise deployment, primarily reducing the licensing, data storage, and technical labor costs, thereby minimizing the overall operational costs.

The roadways segment contributed the largest market share of42% in 2023. Roadways are among the most common transportation modes and are relatively cheaper compared to other modes. Moreover, it is flexible and makes loading and unloading possible at any destination. However, there are certain limitations to road transportation, such as limited carrying capacity, multipoint police checks, poor road conditions, traffic, and others. However, continuous government initiatives in emerging economies to improve the transportation infrastructure are expected to flourish the demand for logistics through roadways, hence influencing the demand for the market for the roadways segment.

The railways segment is expected to grow at a CAGR of 18.18% during the forecast period. The rising government initiatives for the upgradation of railways through the Public Private Partnership (PPP) are expected to drive the growth of TMS in the following segment. Railways play a significant role in cargo handling by the transportation of goods and consignment in large volumes of cargo via special wagons to carry cargo in a lesser in-transit time than roadways.

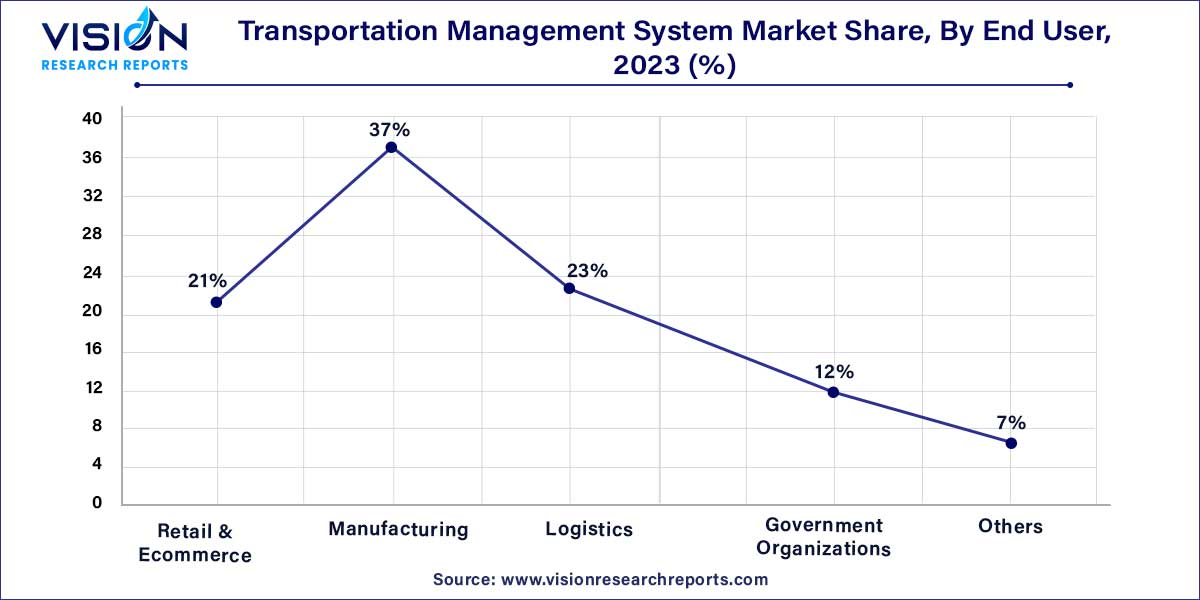

The manufacturing segment accounted for the largest market share of over 37% in 2023. The growing number of manufacturing units in countries such as Mexico and India has led to an increase in the outsourcing of raw materials, inventories, and other materials required for manufacturing activities. Furthermore, increasing imports and exports and trade relations between countries are expected to boost the demand for shipping services, which would ultimately drive market growth. For instance, the Indian government’s ‘Make in India’ initiative has put a strong emphasis on the domestic manufacturing sector, which has triggered the local market growth.

The retail & e-commerce segment is expected to grow at a CAGR of 18.87% during the forecast period. Retailers use the transportation management system for a wide range of purposes, including managing, storing, and analyzing data in real-time. A retailer's success depends on extending its reach to customers through multiple stores and managing its supply chains efficiently to provide a unique customer experience. Furthermore, growing demand for online retail and rising competition in the industry to provide seamless customer experience enable retailers to adopt advanced technologies such as multi-cloud management that simplify workflows, improve customer experience, and reduce IT operating costs.

North America dominated the market with a revenue share of over 33% in 2023. The North American region is known for its fast-paced adoption of roadways as the key mode of transportation for moving freight and delivering goods. The rising spending by local municipalities on connected infrastructure is aimed at creating a favorable and smooth transit environment. It is among the key factors driving the growth of the North America TMS market. Moreover, the presence of various leading TMS vendors, including IBM Corporation, JDA Software Group Inc., Manhattan Associates, and MercuryGate International Inc., among others, providing numerous solutions to the consumers is also expected to strengthen the regional market growth.

The Asia Pacific segment is expected to grow at a CAGR of 19.98% during the forecast period. The rising retail and e-commerce industries in China, India, Singapore, and Indonesia are aimed at driving the Asia Pacific region’s market growth during the forecast period. Further, the launch of the ASEAN Economic Community (AEC) is expected to play a major role in regional economic integration and the implementation of regulations encouraging the growth and development of trade across the region.

By Solution

By Deployment

By Mode of Transportation

By End User

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Transportation Management System Market

5.1. COVID-19 Landscape: Transportation Management System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Transportation Management System Market, By Solution

8.1. Transportation Management System Market, by Solution, 2024-2033

8.1.1. Operational Planning

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Fright & Order Management

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Payment & Claims Management

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Monitoring & Tracking

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Reporting & Analytics

8.1.5.1. Market Revenue and Forecast (2021-2033)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Transportation Management System Market, By Deployment

9.1. Transportation Management System Market, by Deployment, 2024-2033

9.1.1. On-premise

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Transportation Management System Market, By Mode of Transportation

10.1. Transportation Management System Market, by Mode of Transportation, 2024-2033

10.1.1. Roadways

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Railways

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Waterways

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Airways

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Transportation Management System Market, By End User

11.1. Transportation Management System Market, by End User, 2024-2033

11.1.1. Retail & Ecommerce

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Manufacturing

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Logistics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Government Organizations

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Transportation Management System Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.1.4. Market Revenue and Forecast, by End User (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End User (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.2.4. Market Revenue and Forecast, by End User (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End User (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End User (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End User (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.3.4. Market Revenue and Forecast, by End User (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End User (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End User (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End User (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.4.4. Market Revenue and Forecast, by End User (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End User (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End User (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Solution (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End User (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End User (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Solution (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Mode of Transportation (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End User (2021-2033)

Chapter 13. Company Profiles

13.1. BluJay Solutions Ltd.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Cargobase

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Cerasis, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. GoComet

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. 3GTMS

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Infor Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. IBM Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. JDA Software Group, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Manhattan Associates

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. MercuryGate International, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others