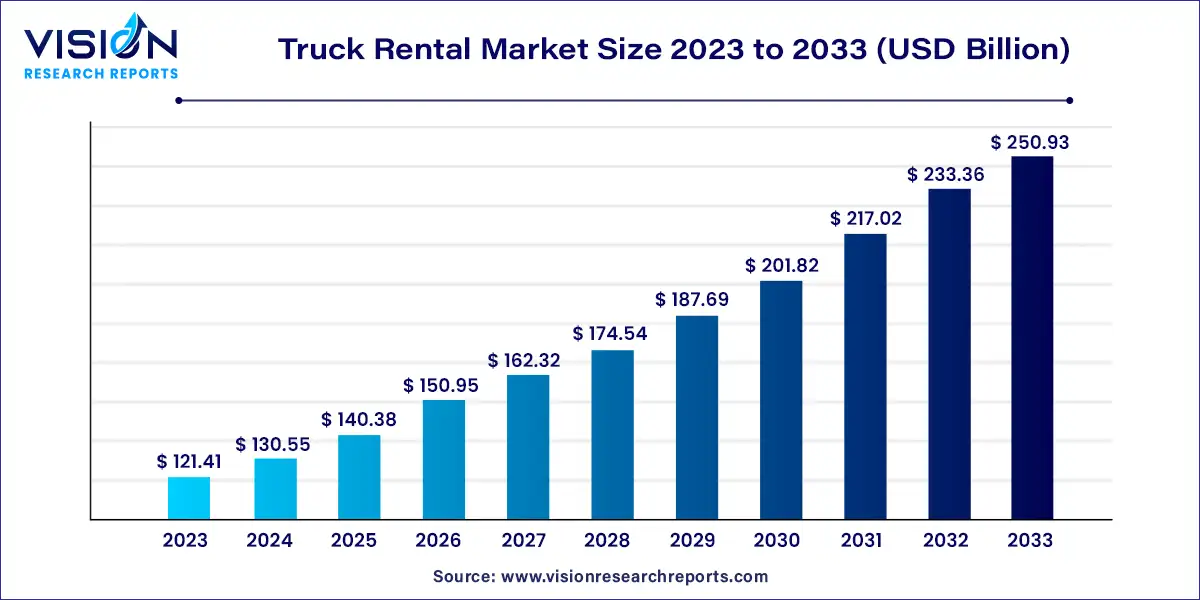

The global truck rental market size was estimated at around USD 121.41 billion in 2023 and it is projected to hit around USD 250.93 billion by 2033, growing at a CAGR of 7.53% from 2024 to 2033. The truck rental market plays a crucial role in logistics and transportation, providing businesses and individuals with the flexibility to rent trucks for a wide range of applications. From short-term hauling to long-term transportation projects, truck rentals offer a cost-effective and efficient solution. This market has seen substantial growth due to increasing demand from various sectors, including e-commerce, construction, and commercial transportation.

The growth of the truck rental market is driven by the primary drivers is the booming e-commerce industry, which has significantly increased the need for reliable last-mile delivery solutions. Retailers and logistics companies prefer truck rentals to quickly scale their delivery operations without the financial burden of purchasing and maintaining a fleet. Another crucial factor is the growth of the construction industry, which often requires specialized trucks for transporting heavy materials and equipment to different job sites. Truck rentals provide a flexible and cost-effective option for construction companies to meet their varying transportation needs. Additionally, the overall cost-efficiency of renting versus owning, which includes savings on maintenance, insurance, and depreciation, attracts businesses, especially small and medium-sized enterprises (SMEs), to opt for rental services.

The Asia-Pacific truck rental market held the largest share, accounting for 40% of the global market in 2023. The region's rapidly growing e-commerce sector is a significant driver of this growth. As online shopping continues to expand, there is an increasing need for efficient and reliable last-mile delivery solutions. Truck rentals allow e-commerce businesses to scale their delivery operations based on demand, particularly during peak periods such as holidays and promotional events.

| Attribute | Asia-Pacific |

| Market Value | USD 48.56 Billion |

| Growth Rate | 7.55% CAGR |

| Projected Value | USD 100.37 Billion |

The North American truck rental market also held a significant share of the global market in 2023. The rising need for urban delivery services, spurred by the growth of online shopping and on-demand services, is a key contributor to this trend. Urban areas in North America face challenges related to congestion and regulatory restrictions on commercial vehicles. Truck rentals enable businesses to utilize specialized vehicles for urban deliveries, such as smaller or electric trucks, which are well-suited for navigating city environments and complying with regulatory requirements.

The truck rental market in Europe is expected to witness substantial growth from 2024 to 2033. The implementation of stricter environmental regulations and policies across European countries is a significant factor influencing this growth. To combat air pollution and promote sustainability, European nations are enforcing stringent emission standards. Truck rental companies are responding to these regulations by offering newer, cleaner vehicles that meet environmental standards, thereby aligning with the growing demand for eco-friendly transportation solutions.

In 2023, the light-duty truck segment led the market, accounting for 70% of global revenue. The growth of this segment is primarily driven by the increasing demand for efficient transportation solutions among small-scale and local businesses. Light-duty trucks are particularly beneficial for companies such as local delivery services, food vendors, and tradespeople who require a dependable vehicle that is easy to drive and suitable for transporting goods or equipment within a localized area. The affordability and accessibility of light-duty trucks through rental services enable these businesses to operate efficiently without the financial strain of purchasing a vehicle outright.

Looking ahead, the heavy-duty truck segment is expected to experience significant growth from 2024 to 2033. This growth is fueled by the expansion of the logistics and supply chain sectors, which drive demand for heavy-duty trucks in the rental market. As global trade continues to increase and supply chains become more intricate, there is a growing need for reliable transportation solutions capable of hauling large volumes of cargo over long distances. Companies within the logistics sector often opt to rent heavy-duty trucks to handle peak periods, seasonal surges, or specific contractual obligations, thereby contributing to the segment's growth in the truck rental market.

The short-term rental segment dominated the market in 2023. The proliferation of the gig economy and the rising number of independent contractors within the logistics and transportation sectors are key drivers of this trend. Freelance drivers, moving services, and on-demand delivery providers often prefer short-term rentals to meet specific job requirements. The emphasis on flexibility and on-demand services within the gig economy aligns well with the short-term rental model, fostering its growth in the truck rental market.

Conversely, the long-term rental segment is projected to grow significantly from 2024 to 2033, largely due to its ability to mitigate depreciation risks. Vehicle depreciation is a substantial concern for companies that own their fleets, as trucks and other commercial vehicles lose value over time, which can negatively impact a company's financial standing. Long-term rentals alleviate this concern by transferring the depreciation burden to the rental company. This arrangement allows businesses to utilize the vehicles as needed without worrying about resale values, enabling them to focus on core operations while maintaining a suitable fleet.

In 2023, the internal combustion engine (ICE) segment led the market, driven by the presence of established infrastructure and support systems. The extensive network of refueling stations and maintenance facilities for ICE trucks offers convenience and reliability, making them a preferred choice for many businesses. The familiarity and accessibility of these support services contribute to the continued dominance of ICE trucks in the rental market.

However, the electric truck segment is anticipated to grow considerably from 2024 to 2033, driven by increasing urbanization and the implementation of low-emission zones in many cities. These zones restrict access to areas with high pollution levels, making electric trucks an ideal choice for urban operations. Truck rental companies can cater to businesses operating in these urban environments by offering electric trucks that comply with local environmental regulations, thereby boosting demand for electric truck rentals.

The rental and leasing companies segment was the market leader in 2023, attributed to enhanced service offerings and customer support. Many rental companies provide value-added services, such as 24/7 roadside assistance, comprehensive maintenance packages, and customized leasing options tailored to specific business needs. These improvements in service quality make rental and leasing options increasingly attractive to businesses seeking reliable and hassle-free transportation solutions.

The OEM captives segment is forecasted to experience significant growth from 2024 to 2033, driven by customized financing options that are often more appealing than those provided by traditional lenders. OEM captives offer favorable terms, including lower interest rates, flexible payment schedules, and tailored lease agreements that cater to the unique needs of different industries. These flexible financing solutions help businesses manage their cash flow more effectively, reducing the financial burden associated with acquiring new trucks and supporting fleet optimization.

By Truck

By Duration

By Propulsion

By Service Provider

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others