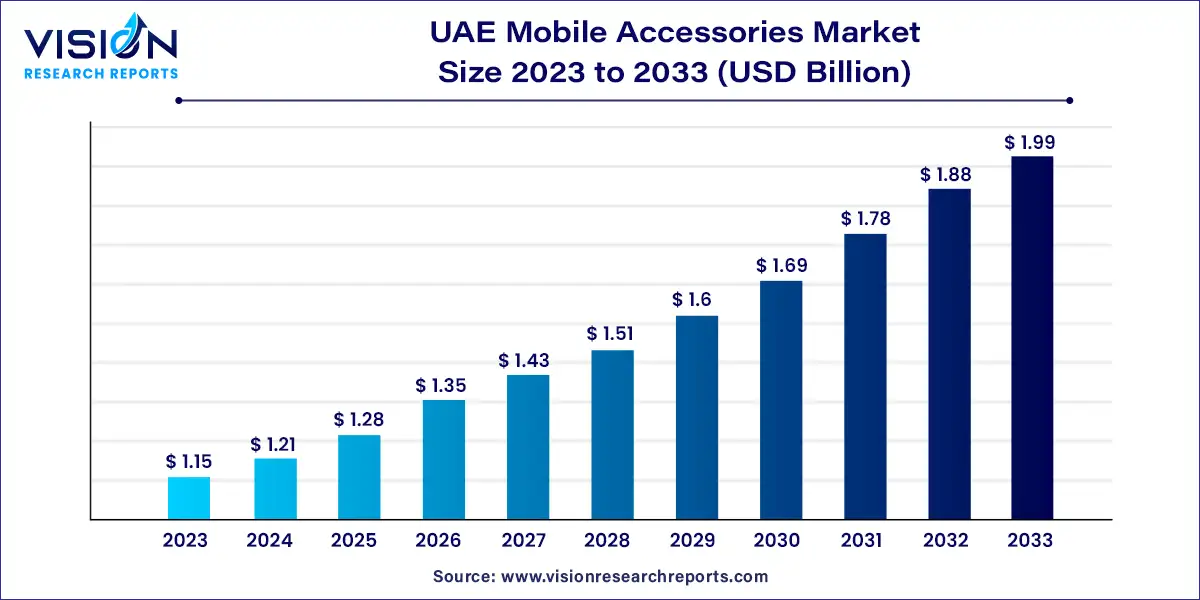

The UAE mobile accessories market size was estimated at around USD 1.15 billion in 2023 and it is projected to hit around USD 1.99 billion by 2033, growing at a CAGR of 5.62% from 2024 to 2033. The UAE mobile accessories market is a dynamic sector reflecting the country's robust technological advancements and growing consumer base. With the UAE being a technology-forward nation and a key player in the Middle East, the demand for mobile accessories continues to rise, driven by both the expanding smartphone user base and an increasing inclination towards enhanced mobile experiences.

The growth of the UAE mobile accessories market is driven by the rapid technological advancements in mobile devices, including the widespread adoption of 5G technology and enhanced smartphone features, have significantly increased the demand for compatible accessories. As smartphones evolve with faster processors, better cameras, and new functionalities, consumers seek accessories that can complement and enhance these features. Additionally, the rising smartphone penetration rate in the UAE has created a larger consumer base for mobile accessories. With more individuals using smartphones, the need for protective cases, charging devices, and other related products has surged. Furthermore, increased disposable incomes and a growing inclination towards premium and innovative accessories have also spurred market growth. Consumers are willing to invest in high-quality and branded accessories that offer enhanced performance and aesthetics. These factors collectively contribute to the robust expansion of the mobile accessories market in the UAE.

In 2023, tablets captured a 29% share of the revenue in the UAE market. The growth of tablet accessories in the region reflects its status as a hub for technological innovation and the increasing demand for advanced tech solutions. The UAE’s reputation for embracing cutting-edge devices has driven a strong market for high-quality accessories. Major brands like Apple and Samsung, known for their premium devices, continue to have a significant presence. For example, in May 2024, Apple launched a new iPad Pro featuring an advanced display, M4 chip, and the Apple Pencil Pro. The new Apple Pencil Pro, designed to enhance precision and functionality, complements the iPad Pro with improved responsiveness and performance compared to earlier models.

Headphones are projected to grow at a CAGR of 8.13% from 2024 to 2033. The rise of streaming platforms such as Spotify, Apple Music, and Netflix has increased consumer consumption of audio and video content on mobile devices, leading to higher demand for quality headphones. Market players are focusing on delivering high-fidelity audio and noise-canceling features to cater to both audiophiles and casual listeners. In May 2024, Sonos entered the personal listening market with its first headphones, the Sonos Ace. These high-end Bluetooth over-ear headphones feature advanced audio technologies, including lossless and spatial audio, aware mode, and Active Noise Cancellation (ANC). Notably, the TrueCinema technology creates a lifelike surround sound experience by adapting to the listener’s environment. The Sonos Ace became available in the UAE in June 2024.

In 2023, offline channels accounted for 31% of the UAE mobile accessories market revenue. Offline stores like Jumbo Electronics and Sharaf DG play a crucial role in this segment by providing expert customer support and advice on product compatibility and functionality. Their knowledgeable staff assist with product selection, installation, and troubleshooting, which builds trust and enhances customer satisfaction. This personalized service makes offline stores a preferred choice for many consumers seeking technical assistance.

From 2024 to 2033, sales through offline channels are expected to grow at a CAGR of 8.43%. Meanwhile, online distribution of mobile accessories is also expanding rapidly due to advanced logistics and efficient delivery systems. Platforms such as Amazon, Noon, and Souq.com have developed strong delivery networks that ensure fast and reliable shipping, often offering same-day or next-day delivery. The convenience of easy returns and exchanges further enhances the online shopping experience, making it an attractive option for consumers. This shift has prompted brands to strengthen their online presence, with products from major accessory makers like Anker and JBL widely available on these platforms, enriching the UAE’s online market for mobile accessories.

By Product

By Distribution Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others