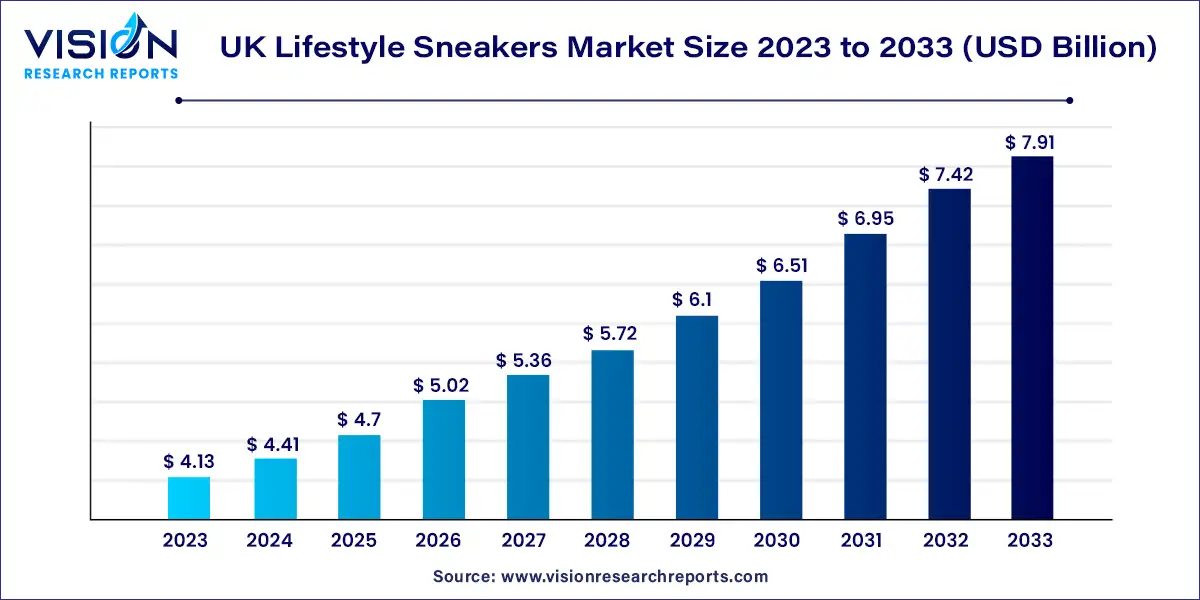

The UK lifestyle sneakers market size was valued at USD 4.13 billion in 2023 and it is predicted to hit around USD 7.91 billion by 2033 with a CAGR of 6.72% from 2024 to 2033. The UK lifestyle sneakers market has witnessed significant growth and transformation in recent years. This sector, encompassing casual and fashion-oriented footwear, reflects broader trends in consumer behavior, fashion, and technological advancements. Lifestyle sneakers, which blend comfort with style, cater to a wide range of consumers, from fashion enthusiasts to athletes and casual wearers.

UK lifestyle sneakers market growth is driven by an integration of advanced technologies and materials in sneaker design has significantly enhanced comfort and performance, appealing to a broader consumer base. Innovations such as improved cushioning systems, breathable fabrics, and ergonomic designs are attracting consumers seeking both functionality and style. Secondly, the rise of fashion-forward streetwear culture and influencer marketing has elevated the status of lifestyle sneakers, making them a desirable fashion statement. Collaborations between sneaker brands and high-profile designers or celebrities further amplify their appeal. Additionally, the surge in online shopping has made it easier for consumers to access a wide variety of sneaker options, contributing to market expansion. Finally, an increasing emphasis on sustainability is shaping consumer preferences, with many opting for brands that prioritize eco-friendly materials and ethical production practices. These factors collectively drive the vibrant growth of the lifestyle sneakers market in the UK.

| Report Coverage | Details |

| Market Size in 2023 | USD 4.13 billion |

| Revenue Forecast by 2033 | USD 7.91 billion |

| Growth rate from 2024 to 2033 | CAGR of 6.72% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The low-top sneakers segment dominated the market and held the largest share of over 62% in 2023 and is expected to continue leading over the forecast period. Low-top sneakers are a popular footwear style characterized by their low-cut design that sits below the ankle. They offer a casual and versatile option that can be paired with a variety of outfits. Low-top sneakers come in numerous designs, materials, and colors, catering to different tastes and preferences. Low-top lifestyle sneakers are a popular category of casual footwear that blends style, comfort, and versatility. Some of the brands catering to low-top sneakers are Nike, Puma, Tommy Hilfiger, and Sketchers, among others. Chunky soles in low-top sneakers are one of the most popular styles in the product.

The mid-top sneakers segment is expected to grow at a CAGR of 7.05% from 2024 to 2033. Mid-top sneakers are a footwear style that falls between low-top sneakers and high-top sneakers in terms of height. They typically cover the ankle partially, providing a bit more support and coverage compared to low tops while still maintaining a casual and versatile look. Mid-tops are suitable for various occasions and outfits. They can be paired with jeans, chinos, or even shorts for a stylish and casual look. Some of the popular mid-top lifestyle sneaker brands are Converse, Fila, Adidas, and ASICS, among others. Hybrid mid-top sneakers that combine elements of different sneaker styles are in trend. Brands are experimenting with blending athletic, lifestyle, and even hiking or outdoor influences, resulting in unique and versatile designs that cater to a wide range of tastes.

The sneaker segment priced less than £50 (USD ~60) dominated the market and held a share of over 39% in 2023 and is projected to remain the leading segment over the forecast period. In the UK, the category of lifestyle sneakers priced below £50 offers affordable options for budget-conscious consumers. Brands like Primark, F&F, and George at Asda provide stylish and inexpensive sneakers in this price range. These sneakers often feature basic designs with simple colorways and minimal branding, catering to individuals who prioritize affordability and practicality.

The sneaker segment priced between £50 to £100 (~60 to USD ~125) is expected to grow with a CAGR of 7.27% from 2024 to 2033. Lifestyle sneakers available in the £50 to £100 category in the UK offer a balance between affordability and quality. Brands like Adidas, Nike, New Balance, and Vans present a wide range of options within this category. Sneakers in this price range often feature more recognizable brand names, popular models, and diverse designs. These sneakers incorporate advanced technology and cushioning systems to enhance comfort and performance. Retailers like JD Sports, Foot Locker, and Schuh regularly feature sales and discounts on sneakers within this price range, allowing customers to find stylish options at more affordable prices.

The men sneaker segment dominated the market and held a share of over 57% in 2023. It is expected to remain the leading segment over the forecast period. Men in the UK purchase lifestyle sneakers because they combine style and comfort. A large number of brands offer lifestyle sneakers for men, including Adidas, New Balance, Puma, and Vans. These shoes come in high-top, mid-top, and low-top options and in classic designs, sporty influences, and streetwear aesthetics. Men tend to prefer versatile, neutral-tone sneakers that can be paired with different outfits and for various occasions.

The women sneakers segment is expected to grow at a CAGR of 7.04% over the forecast period. Women's lifestyle sneakers in the UK reflect diverse fashion preferences and styles. Brands such as Converse, Reebok, Sketchers, and Adidas offer an extensive selection of sneakers tailored to women's tastes. These shoes tend to embrace a mix of casual chic, athleisure, and fashion-forward designs. Popular styles include sleek and minimalistic sneakers, platform sneakers, and retro-inspired models. Women also tend to gravitate toward sneakers that range from neutral tones to vibrant and pastel shades.

The offline distribution channel dominated the market and held a share of over 77% in 2023. Offline distribution channels, including brick-and-mortar stores and specialty sneaker retailers, continue to play a crucial role in the UK lifestyle sneaker industry. Physical stores offer customers the opportunity to try on sneakers, receive personalized assistance from the sales staff, and experience the tactile aspects of shoe shopping. Offline stores often have dedicated sections for men, women, and kids, providing a comprehensive selection. In-store shopping allows customers to access the latest sneaker releases, explore exclusive collaborations, and participate in in-store events or raffles.

The online distribution channel is expected to grow at a CAGR of 8.46% from 2024 to 2033. Online distribution channels play a significant role in the availability and accessibility of lifestyle sneakers in the UK. Online shopping provides convenience, a vast selection, and the ability to compare prices and styles easily. Customers can explore a multitude of brands, including Nike, Adidas, Puma, Reebok, and New Balance. In September 2023, Puma became the first sneaker brand to collaborate with the online marketplace Secret Sales to sell its sneakers in the UK market. This partnership was beneficial for both brands as it brought new customers to the website and ensured promising profits for Puma.

By Product Type

By Price Band

By End-user

By Distribution Channel

UK Lifestyle Sneakers Market

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on UK Lifestyle Sneakers Market

5.1. COVID-19 Landscape: UK Lifestyle Sneakers Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. UK Lifestyle Sneakers Market, By Product Type

8.1. UK Lifestyle Sneakers Market, by Product Type, 2024-2033

8.1.1. Low-Top

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Mid-Top

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. High-Top

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. UK Lifestyle Sneakers Market, By Price Band

9.1. UK Lifestyle Sneakers Market, by Price Band, 2024-2033

9.1.1. Online Less than £50 (USD ~60)

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. £50 to £100 (~60 to USD ~125)

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. £100 to £150 (USD ~125 to USD ~200)

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. £150 to £250 (USD ~200 to USD ~300)

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Above £250 (USD ~300)

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. UK Lifestyle Sneakers Market, By End-user

10.1. UK Lifestyle Sneakers Market, by End-user, 2024-2033

10.1.1. Men

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Women

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Kids

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. UK Lifestyle Sneakers Market, By Distribution Channel

11.1. UK Lifestyle Sneakers Market, by Distribution Channel, 2024-2033

11.1.1. Online

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Offline

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. UK Lifestyle Sneakers Market, Regional Estimates and Trend Forecast

12.1. UK

12.1.1. Market Revenue and Forecast, by Product Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Price Band (2021-2033)

12.1.3. Market Revenue and Forecast, by End-user (2021-2033)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Nike, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Adidas AG

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. New Balance

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Puma SE

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Vans

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Converse

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. FILA

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. C. & J. Clark International Limited

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Grenson Shoes

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Gola (D Jacobson & Sons Ltd)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others