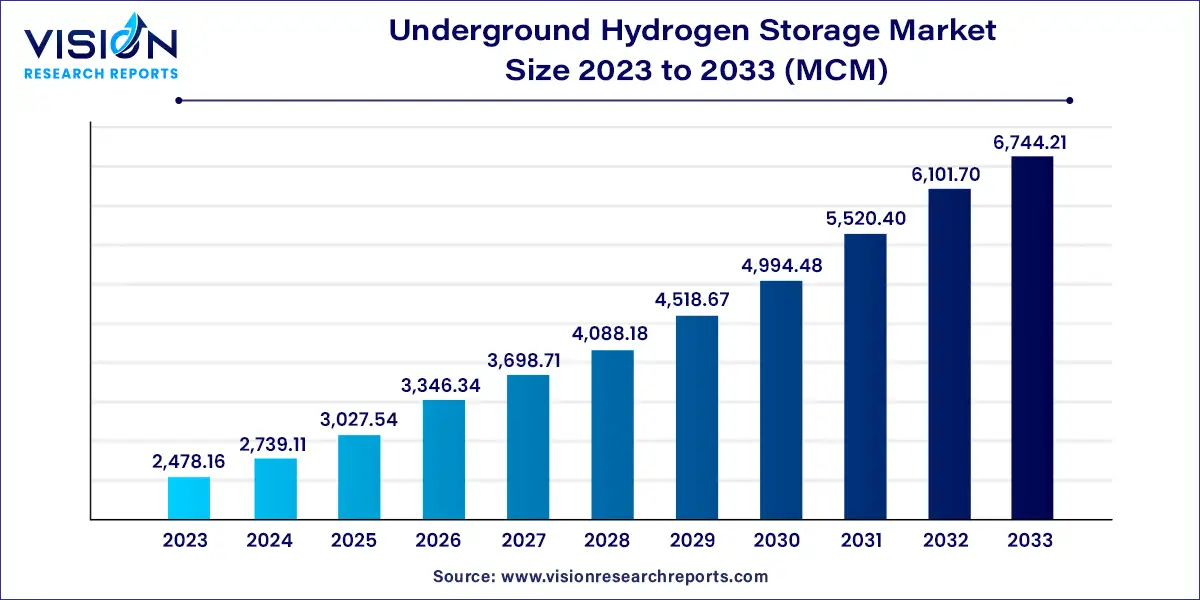

The global underground hydrogen storage market size was valued at 2,478.16 MCM in 2023 and it is predicted to surpass around USD 6,744.21 MCM by 2033 with a CAGR of 10.53% from 2024 to 2033. The underground hydrogen storage market is gaining momentum as a crucial component of the global energy transition. With the increasing demand for clean energy solutions and the growing focus on hydrogen as a viable energy carrier, underground storage methods are being explored for their potential to support large-scale hydrogen storage.

The growth of the underground hydrogen storage market is primarily driven by the global shift towards renewable energy and the urgent need for effective energy storage solutions. As nations intensify their efforts to decarbonize, hydrogen is emerging as a key player in the transition to clean energy, providing a flexible and efficient means to store excess energy generated from renewable sources. Additionally, the increasing adoption of hydrogen fuel cells across various sectors, including transportation and industrial processes, is creating a robust demand for reliable storage options. The ability of underground storage to offer large-scale capacity and ensure energy security further enhances its appeal. Moreover, advancements in technology and growing investments in infrastructure are facilitating the development of more efficient and safe underground storage systems, paving the way for broader acceptance and implementation in the energy landscape.

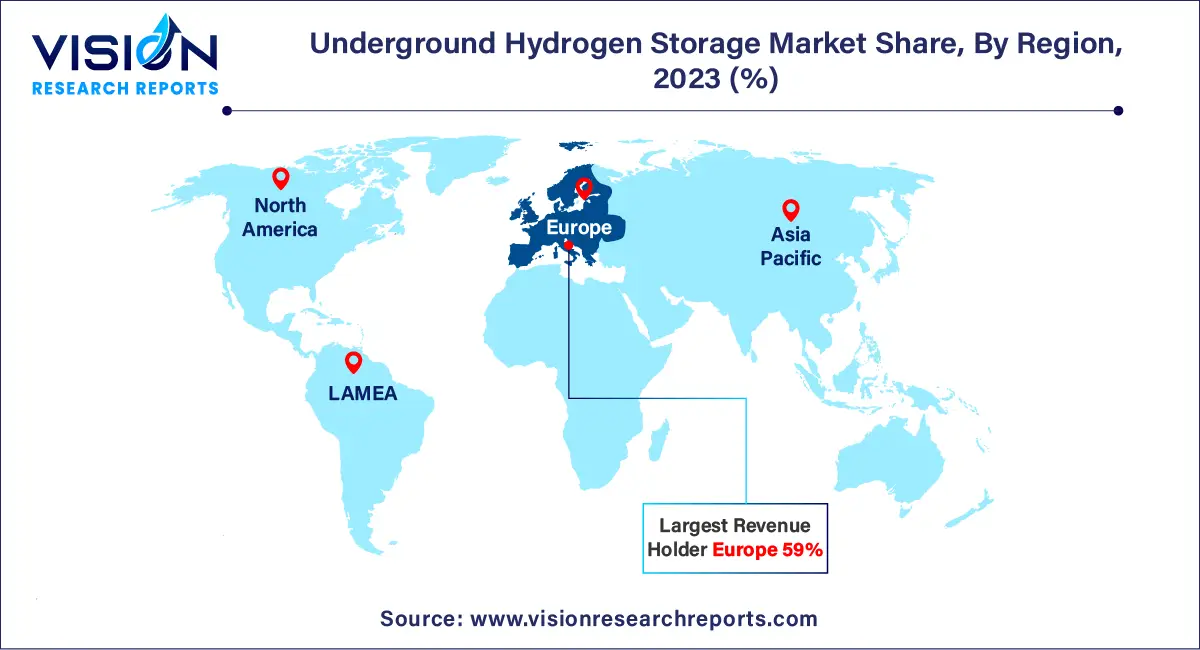

Europe held the largest volume share of 59% in 2023, driven by substantial investments in hydrogen energy as an alternative power source. European nations are pursuing energy independence by expanding their domestic underground hydrogen storage capabilities. The UK government, in particular, is investing heavily in developing its hydrogen generation and storage infrastructure, aiming to become a key player in the emerging hydrogen economy.

The North American underground hydrogen energy storage market is projected to grow significantly from 2024 to 2033. The hydrogen energy storage sector in North America has been expanding for several years, experiencing rapid growth across various applications and technologies.

The U.S. is a pioneer in adopting clean energy solutions across power generation, manufacturing, and transportation. Ongoing research and development in the country are expected to increase the demand for underground hydrogen storage. For example, in March 2023, the National Energy Technology Laboratory (NETL) released research on the potential for hydrogen storage in existing underground gas facilities, as part of the Department of Energy's Subsurface Hydrogen Assessment, Storage, and Technology Acceleration (SHASTA) initiative. This research evaluated the feasibility of storing hydrogen in current underground gas storage facilities and the possibility of blending hydrogen with methane present in the reservoirs.

The abundance of refineries in China and India is likely to enhance the adoption of underground hydrogen storage in the Asia Pacific region. Additionally, countries like Japan and Australia are exploring cleaner technologies for hydrogen generation, further increasing the demand for underground hydrogen facilities over the forecast period.

In 2023, the underground hydrogen storage market in Latin America accounted for a volume share of 0.23%. The region has relatively low demand for underground hydrogen storage compared to others, largely due to lower investments in green hydrogen technology and diminished demand from end-use industries. Demand is concentrated in industrialized nations such as Mexico, Brazil, and Argentina.

The underground hydrogen storage market in the Middle East and North Africa represented a volume share of 0.31% in 2023. Demand for these facilities in the region is anticipated to grow as countries invest in sustainable technologies and seek to diversify their energy mix away from traditional fossil fuels. Oil-rich nations like Saudi Arabia and the UAE have initiated hydrogen strategies to enhance production and export capabilities, contributing to the expected growth of the regional market.

In 2023, the salt caverns segment dominated the market, representing 98% of the total volume. Salt caverns, formed from salt domes and bedded salts, offer high deliverability with a rapid cycle time of 10 to 20 days. Although these caverns are the most expensive storage option due to the necessary infrastructure and solution mining processes, they require significantly less cushion gas injection (approximately 20%-30%) compared to depleted reservoirs. Increased investments in developing salt cavern-based underground hydrogen storage facilities are anticipated to drive the growth of this segment from 2022 to 2033.

Porous media storage ranked second in market share in 2023. This storage type includes limestone formations, shale, and conglomerates that provide high permeability and void fractions suitable for hydrogen storage. It encompasses gas fields, depleted reservoirs, and aquifers. Porous media storage is recognized as an effective and sustainable solution for underground hydrogen, helping to balance the supply of renewable energy with seasonal demand.

Engineered cavities, such as modified mine shafts, serve as underground gas storage facilities tailored for hydrogen. Currently, these facilities are in the research and development stage, with promising prospects for the near future. Several pilot projects have been conducted, and conceptual designs are being developed to assess their potential outcomes.

By Storage Type

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others