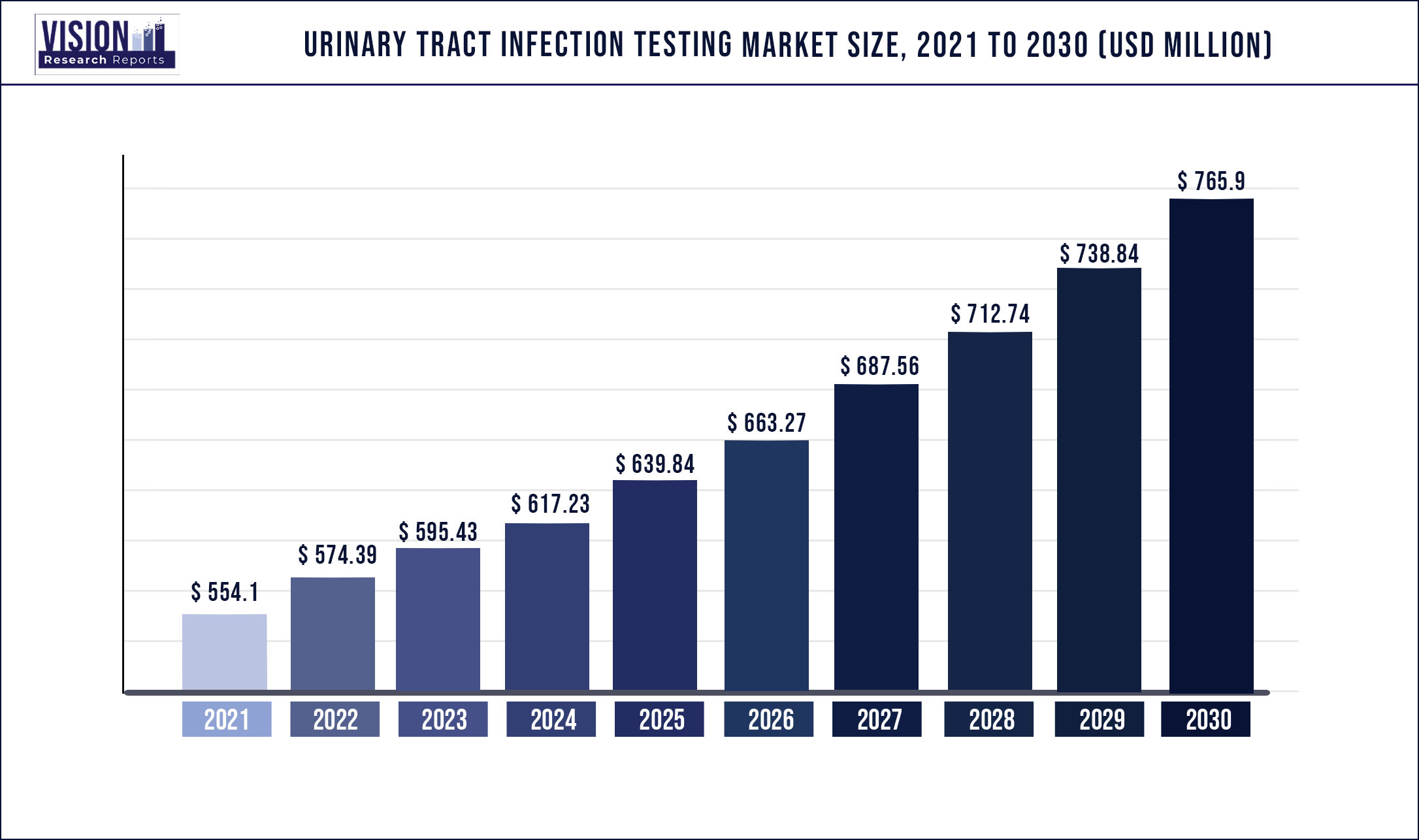

The global urinary tract infection testing market was surpassed at USD 554.1 million in 2021 and is expected to hit around USD 765.9 million by 2030, growing at a CAGR of 3.66% from 2022 to 2030.

Report Highlights

Urinary tract infection is becoming a common global concern. According to research studies, UTI occurs in one in five adult women at some point in their life. In the U.S., about 25%-40% of women aged 20-40 have suffered a UTI. In the U.S., about 250,000 cases of pyelonephritis are reported every year. In women aged 18-19, its incidence is about 28/10,000, out of which 7% of cases require hospital admission. Genetic and cultural factors may influence its prevalence; for instance, in South Korea, the incidence of pyelonephritis is around 59/10,000. Its recurrence is more common than other UTIs, with the recurrence rate being 5.7% in men and 9% in women.

Patients with diabetes are at increased risk of developing urinary tract infections such as acute cystitis, and therefore, the increasing global prevalence of diabetes is likely to contribute to cystitis growth. According to an NCBI article, type 2 diabetes raises UTI risk and patients with type 2 diabetes experience frequent & severe UTIs. According to the International Diabetes Federation (IDF) data from 2021, approximately 643 million individuals will have diabetes by 2030 and 783 million by 2045. Moreover, the estimated prevalence of asymptomatic bacteriuria in diabetic females is 26%, compared to 6% in nondiabetic females. Such factors are expected to boost the prevalence of cystitis globally.

However, due to the rise in awareness about such diseases, the demand for specialist treatment has increased in recent years. According to the U.S. Department of Health and Human Services, in the U.S., the number of practicing urologists in 2020 was 4.07 per 100,000 populations. The report further stated that due to the rise in demand, a shortage of urologists was observed, which is likely to exceed nearly 3,600 physicians by 2025. This can impede market growth in the coming years. Moreover, COVID-19 has had a detrimental impact on the industry. Individuals with UTIs have experienced substantial disruptions in testing and emergency care.

Key players are introducing novel products to strengthen their portfolios. For instance, in September 2021, OpGen, Inc. announced initiating clinical trials of the Unyvero Urinary Tract Infection Panel. The panel can analyze a broad range of pathogens and antimicrobial resistance markers directly from a urine sample. Successful clinical trials and the launch of such technologically advanced & efficient products are anticipated to drive market growth over the coming years. Similarly, in July 2020, Uqora, Inc. (Pharmavite, LLC), a urinary health biotechnology company, launched a UTI diagnostic and management kit. The kit includes a rapid UTI diagnostic device, Clarify, compatible with a PoC and homecare setting.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 554.1 million |

| Revenue Forecast by 2030 | USD 765.9 million |

| Growth rate from 2022 to 2030 | CAGR of 3.66% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, End-use, region |

| Companies Covered | QIAGEN; Accelerate Diagnostics, Inc.; Bio-Rad Laboratories, Inc.; F. Hoffmann-La Roche Ltd.; Danaher Corporation; Siemens Healthcare GmbH; Randox Laboratories Ltd.; Thermo Fisher Scientific, Inc.; bioMérieux SA; T2 Biosystems, Inc. |

By Type Insights

The cystitis segment dominated the market in 2021. This can be attributed to the high incidence & recurrence rate of cystitis, increased number of product approvals, and the high number of diabetes patients who are more prone to cystitis. According to NCBI’s epidemiology report, globally, acute cystitis occurs in about 10 out of 100 women every year. In addition, its recurrence rate is also high in women; half of the women affected by cystitis have it again within a year.

In addition, pyelonephritis is anticipated to be the fastest-growing segment in the coming years and is expected to grow at a CAGR of 4.2%. due to its growing prevalence.According to NCBI statistics, in the U.S., more than 250,000 cases of pyelonephritis are diagnosed every year. The study further suggested that across the globe, in women aged 18 years to 49 years, there are around 28 pyelonephritis cases per 10,000 individuals.

By End-Use Insights

The general practitioner segment held a share of 13.33% in 2021. This can be attributed to the fact that it is the primary point of contact for most patients with urinary tract infection, and in most cases, uncomplicated UTIs is diagnosed and treated by a general practitioner.According to an American Urological Association article, in the U.S., every year, UTIs contribute to more than 8 to 10 million doctor visits.

The reference laboratories segment is expected to grow at a CAGR of 3.8% due to ongoing efforts to improve patient outcomes by providing diagnostic facilities. In addition, reference labs can handle large volumes of diagnostic tests at an expedited rate and provide better results at comparatively lower prices, which is anticipated to offer economies of scale to service providers.

Regional Insights

In 2021, North America dominated the overall UTI testing market in terms of value, accounting for a share of nearly 34.25%. This can be attributed tothe high disease burden, availability of infrastructure, increased healthcare expenditure, rapid technological advancements, proactive government initiatives, rise in patient awareness, and presence of major players.

In addition, the Asia Pacific region is expected to witness the highest CAGR during the forecast period. The high growth rate can be attributed to the rising disease incidence rate and the high geriatric population. Increasing demand for cost-effective diagnostics and a growing population are among the factors significantly contributing to market growth. Asia Pacific markets such as Australia and South Korea already have a healthcare reimbursement system that provides coverage for UTI diagnostic tests.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Urinary Tract Infection Testing Market

5.1. COVID-19 Landscape: Urinary Tract Infection Testing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Urinary Tract Infection Testing Market, By Type Scope

8.1. Urinary Tract Infection Testing Market, by Type Scope, 2022-2030

8.1.1. Urethritis

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Cystitis

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Pyelonephritis

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Urinary Tract Infection Testing Market, By End-use

9.1. Urinary Tract Infection Testing Market, by End-use, 2022-2030

9.1.1. General practitioners (GPs)

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Urologists

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. Urogynecologists

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Hospital Laboratories

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Reference Laboratories

9.1.5.1. Market Revenue and Forecast (2017-2030)

9.1.6. Hospital Emergency Departments

9.1.6.1. Market Revenue and Forecast (2017-2030)

9.1.7. Urgent Care

9.1.7.1. Market Revenue and Forecast (2017-2030)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Urinary Tract Infection Testing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.1.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.2.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.5.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Type Scope (2017-2030)

10.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 11. Company Profiles

11.1. QIAGEN

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Accelerate Diagnostics, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Bio-Rad Laboratories, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. F. Hoffmann-La Roche Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Danaher Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Siemens Healthcare GmbH

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Randox Laboratories Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Thermo Fisher Scientific, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. bioMérieux SA

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. T2 Biosystems, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others