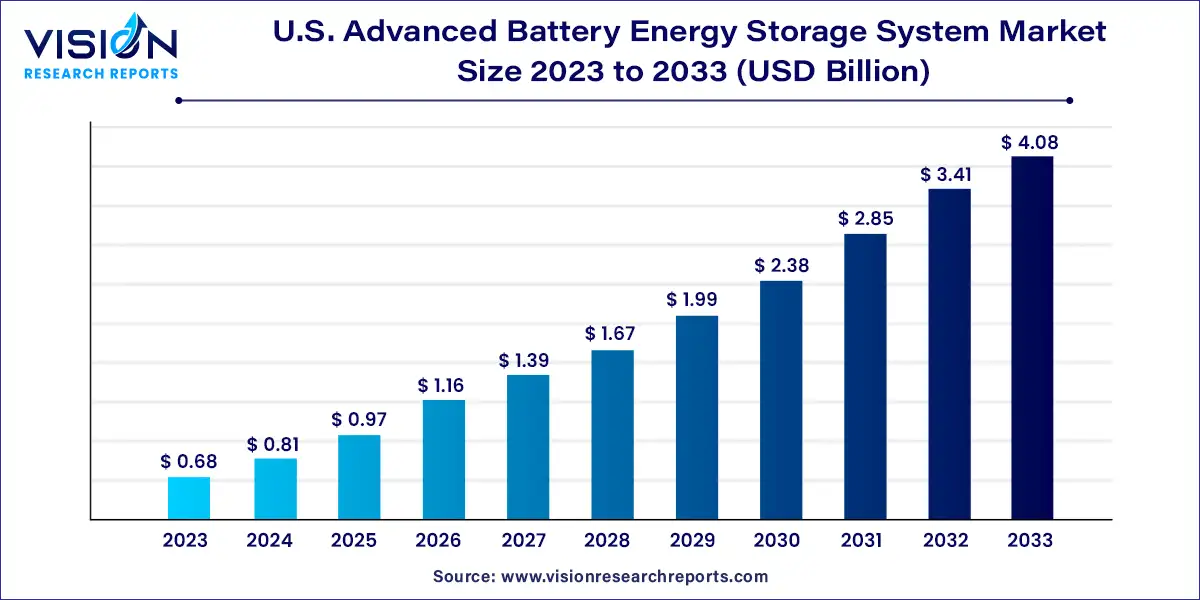

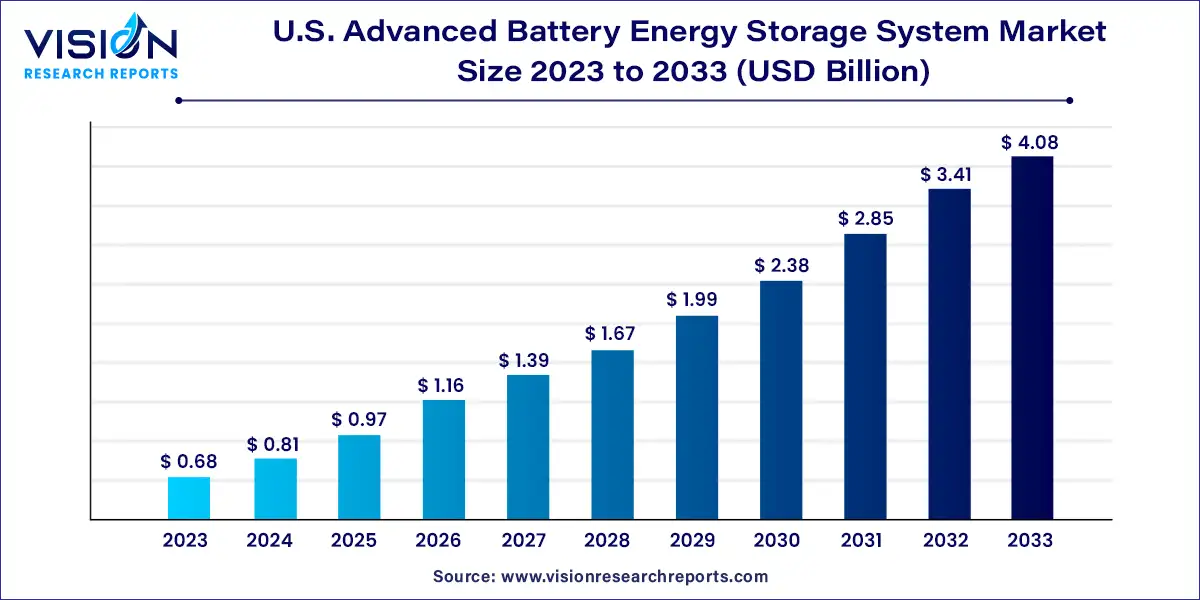

U.S. Advanced Battery Energy Storage System Market Size and Growth 2024 to 2033

The U.S. advanced battery energy storage system market size was estimated at around USD 0.68 billion in 2023 and it is projected to hit around USD 4.08 billion by 2033, growing at a CAGR of 19.63% from 2024 to 2033. The U.S. advanced battery energy storage market is experiencing rapid growth, fueled by increasing demand for efficient and reliable energy solutions. As the country intensifies its efforts towards decarbonization and the adoption of renewable energy sources, the need for advanced energy storage systems has become more pronounced. These systems are critical in balancing the intermittent nature of renewable energy sources such as solar and wind, ensuring a stable and reliable power supply.

Key Pointers

- By Product, the lithium-ion batteries (LIBs) captured the maximum market share of 79% in 2023.

- By Product, the sodium sulfur batteries is expected to grow at the fastest CAGR from 2024 to 2033.

- By Application, the grid storage segment generated the maximum market share in 2023.

What are the Growth Factors of U.S. Advanced Battery Energy Storage Market?

The U.S. advanced battery energy storage market is witnessing substantial growth primarily driven by anincreasing demand for renewable energy sources and the integration of these sources into the national power grid. With a strong push towards reducing carbon emissions and achieving energy sustainability, both federal and state governments are implementing favorable policies and incentives, encouraging the adoption of battery energy storage systems. Technological advancements in battery storage solutions, such as lithium-ion batteries, have significantly improved energy density, efficiency, and lifespan, making them more viable for large-scale deployment. Additionally, the declining costs of battery storage technologies are making these systems more affordable for utility-scale projects and residential use, further accelerating market expansion. The rising need for grid stability and reliability, especially with the increasing incidence of power outages due to extreme weather events, also fuels the demand for advanced battery storage solutions, ensuring uninterrupted power supply and enhancing grid resilience.

What are the Trends in U.S. Advanced Battery Energy Storage Market?

- Increasing Adoption of Renewable Energy Sources: As the U.S. shifts towards cleaner energy, the integration of renewable energy sources like wind and solar into the power grid is driving the demand for advanced battery energy storage systems. These systems are essential for storing excess energy generated during peak production times and ensuring a stable supply during periods of low production.

- Technological Innovations in Battery Storage: Significant advancements in battery technology, such as improvements in lithium-ion and the development of solid-state batteries, are enhancing the performance, efficiency, and safety of energy storage solutions. These innovations are making batteries more cost-effective and suitable for a broader range of applications, including utility-scale and residential energy storage.

- Supportive Government Policies and Incentives: Federal and state governments in the U.S. are introducing various policies and incentives to encourage the adoption of advanced battery energy storage. These include tax credits, subsidies, and grants that aim to reduce the initial costs associated with implementing these systems, thereby promoting widespread adoption.

- Growing Demand for Grid Stability and Reliability: With the increasing penetration of renewable energy sources, maintaining grid stability has become a priority. Advanced battery energy storage systems help in balancing supply and demand, providing backup power during outages, and enhancing the reliability of the power grid, which is crucial for both residential and industrial consumers.

What are the Key Challenges Faced by U.S. Advanced Battery Energy Storage Market?

- High Initial Costs: Despite declining prices, the initial investment required for advanced battery energy storage systems remains substantial. High capital costs for installation and maintenance can be a barrier, especially for smaller businesses and residential users. This can slow down the adoption rate, as some consumers might find the upfront expenses prohibitive.

- Limited Battery Life and Degradation: Over time, battery storage systems experience degradation, which leads to reduced efficiency and storage capacity. Lithium-ion batteries, for example, degrade with each charge and discharge cycle. This can result in higher long-term costs due to the need for battery replacements and may impact the reliability of these systems.

- Recycling and Disposal Issues: Managing the lifecycle of batteries, including recycling and disposal, poses a significant environmental and logistical challenge. Advanced battery technologies, such as lithium-ion, contain hazardous materials that require careful handling and disposal. Developing sustainable and efficient recycling methods is crucial but still lags behind the growth of battery deployment.

- Grid Integration and Compatibility: Integrating battery storage systems with the existing power grid infrastructure can be complex. Compatibility issues with current grid management systems, coupled with the need for advanced software and communication technologies to manage energy flow, present technical challenges. Ensuring seamless grid integration is essential for optimizing the benefits of battery storage.

Product Insights

In 2023, lithium-ion batteries (LIBs) led the market, capturing a significant 79% share. This dominance is largely due to lithium's exceptional properties. As the lightest metal with a high electrochemical potential, lithium enables these batteries to achieve superior energy densities compared to other technologies. Additionally, lithium-ion batteries are known for their low maintenance needs, a feature that sets them apart from other battery chemistries.

Sodium Sulfur Batteries is projected to experience the fastest compound annual growth rate (CAGR) during the forecast period, sodium sulfur batteries are gaining attention due to their ability to store energy over extended periods. They also provide enhanced grid stability, making them a favorable option for energy storage when compared to other renewable energy sources.

Application Insights

The grid storage segment was the market leader in 2023 and is anticipated to see continued growth. This trend is driven by the increasing adoption of renewable energy sources, governmental initiatives to upgrade grid infrastructure, and the rising use of electric vehicles. Moreover, there is a growing need for a reliable and uninterrupted power supply across various industries, which further fuels the demand for grid storage solutions.

Grid energy storage systems are vital for maintaining the balance between electricity supply and demand, incorporating variable renewable energy sources, and enhancing grid stability. These systems are essential for supporting the reliable integration of renewables and ensuring stable and continuous power supply.

Who are the Top Manufactures in U.S. Advanced Battery Energy Storage Market?

- Tesla

- Fluence Energy

- The AES Corporation

- LG Chem

- Samsung SDI

- Volta Grid

- NextEra Energy

- BYD Company

- Hitachi Ltd.

- Exide Technologies

- AES Technologies

- Samsung SDI

- EnerSys

U.S. Advanced Battery Energy Storage Market Segmentation:

By Product

- Lithium-Ion

- Lead Acid

- Sodium Sulfur

- Others

By Application

- Transportation

- Grid Storage

- UPS

- Telecom

- Others

Frequently Asked Questions

The U.S. advanced battery energy storage system market size was reached at USD 0.68 billion in 2023 and it is projected to hit around USD 4.08 billion by 2033.

The U.S. advanced battery energy storage system market is growing at a compound annual growth rate (CAGR) of 19.63% from 2024 to 2033.

The driving factors of the U.S. advanced battery energy storage system market include the increasing integration of renewable energy sources into the grid and supportive government policies and incentives that promote energy storage adoption.

The leading companies operating in the U.S. advanced battery energy storage system market are Tesla; Fluence Energy; The AES Corporation.; Sonnen; LG Chem; Samsung SDI; Volta Grid; NextEra Energy; BYD Company; Hitachi Ltd.; Exide Technologies; AES Technologies; Samsung SDI and EnerSys.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others