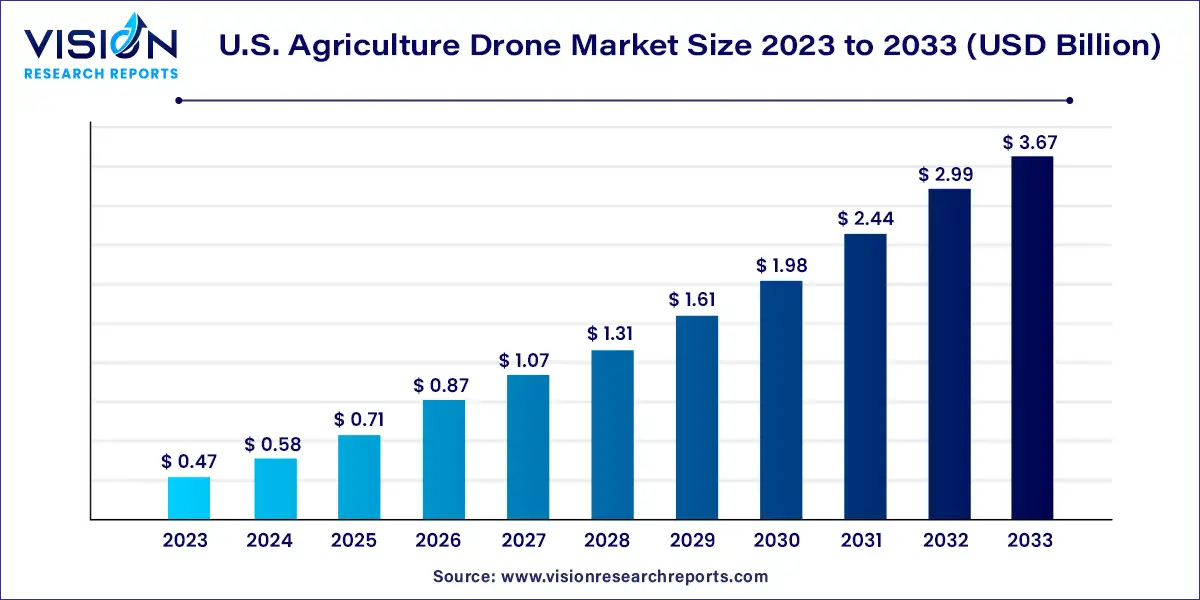

The U.S. agriculture drone market size was estimated at around USD 0.47 billion in 2023 and it is projected to hit around USD 3.67 billion by 2033, growing at a CAGR of 22.83% from 2024 to 2033.

The growth of the U.S. agriculture drone market is driven by an including advancements in drone technology and data analytics, which enhance precision agriculture practices. The increasing demand for efficient crop monitoring and management solutions to boost yields and reduce costs is propelling market expansion. Additionally, supportive government initiatives and subsidies aimed at promoting the adoption of innovative agricultural technologies are contributing to market growth. The rising awareness of sustainable farming practices and the need for real-time data collection for informed decision-making are further fueling the adoption of drones in agriculture.

Based on type, the market is divided into fixed-wing and rotary-wing. The rotary wing segment dominated the overall market, gaining a revenue share of 64% in 2023. It is expected to grow at a CAGR of 22.03% throughout the forecast period. The unique features of rotary wing drones such as their ability to hover, climb, descend, and maneuver in any direction, have increased their market share. Unlike fixed-wing drones, which require a forward motion for lift, rotary-blade drones may move quickly and precisely by altering the speed and rotation of their propellers. Because of their maneuverability, they are well-suited for activities that require close control and agility.

The fixed-wing segment is anticipated to grow at the fastest CAGR of 24.06% throughout the forecast period. Because of their aerodynamic shape, fixed-wing drones can fly for longer durations and cover larger areas in a single flight. This flight efficiency allows them to preserve power and stay in the air for longer, resulting in enhanced output and cost-effectiveness.

Based on component, the market is divided into hardware, software, and services. The hardware segment dominated the U.S. agriculture drone market in 2023, with a revenue share of 52%. It is expected to grow at a CAGR of 22.24% throughout the forecast period Hardware for the agriculture drone industry includes frames, flight control systems, navigation systems, propulsion systems, cameras, sensors, and others.

The functionality of agriculture drones and their performance capabilities are directly influenced by their hardware components, including the airframe design, propulsion system, and payload capacity. These components ensure a stable flight, maneuverability, and efficient data collection, ultimately enhancing the drone's effectiveness in crop health monitoring and early pest or disease identification.

The services segment is expected to grow at the fastest CAGR of 23.85% during the forecast period. This is due to the increased need for data analysis and interpretation, improved mapping and surveying services, and crop monitoring and management services. These specialized services assist farmers in making informed decisions, increasing productivity, and optimizing resource utilization, boosting market growth in the services segment.

Based on farming environment, the market is classified into indoor farming and outdoor farming. The outdoor farming segment dominated the overall market with a revenue share of 84% in 2023. It is expected to grow at the fastest CAGR of 22.64% throughout the forecast period. Agriculture UAVs with high-resolution cameras and remote sensing technologies provide valuable monitoring capabilities for large farmland areas in outdoor farming practices.

They enable early detection of crop stress, disease outbreaks, and nutrient deficiencies, empowering farmers to take proactive measures and optimize crop health. Additionally, UAVs with spraying mechanisms offer a more efficient and accurate alternative to traditional pesticide and fertilizer application methods, enhancing worker safety and improving pest and disease control.

The indoor farming segment is expected to grow at a significant CAGR of 23.84% during the forecast period. Agricultural drones play a significant role in inventory management for indoor farming operations by scanning and tracking plant growth, providing accurate counts, and generating reports on crop yields. This enables farmers to make informed decisions about space utilization, optimize resource allocation, and plan for future crop rotations, ultimately maximizing productivity and profitability in indoor farming.

Based on application, the market is divided into crop management, field mapping, crop spraying, livestock monitoring, variable rate application (VRA), and others. The crop management segment held the maximum share of 26% in 2023. Crop management holds the highest market share due to its ability to optimize crop production by using agriculture UAVs. By utilizing advanced drone technology, farmers can monitor crop health, detect issues early on, and implement targeted management strategies, resulting in improved yields, reduced waste, and increased productivity.

The field mapping segment is anticipated to grow at the fastest CAGR of 24.18% throughout the forecast period. Providing farmers with detailed and accurate information about their fields enables them to make informed decisions regarding crop management, resource allocation, and overall field planning. The use of aerial imaging techniques, such as high-resolution aerial photographs and remote sensing technologies, allows farmers to obtain valuable insights into crop health, identify areas of concern, and develop targeted strategies for addressing challenges.

By Type

By Component

By Environment

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Agriculture Drone Market

5.1. COVID-19 Landscape: U.S. Agriculture Drone Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Agriculture Drone Market, By Type

8.1. U.S. Agriculture Drone Market, by Type, 2024-2033

8.1.1. Fixed Wing

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Rotary Wing

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Agriculture Drone Market, By Component

9.1. U.S. Agriculture Drone Market, by Component, 2024-2033

9.1.1. Hardware

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Frames

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Flight Control Systems

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Navigation Systems

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Propulsion Systems

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Cameras

9.1.6.1. Market Revenue and Forecast (2021-2033)

9.1.7. Sensors

9.1.7.1. Market Revenue and Forecast (2021-2033)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2021-2033)

9.1.9. Software

9.1.9.1. Market Revenue and Forecast (2021-2033)

9.1.10. Services

9.1.10.1. Market Revenue and Forecast (2021-2033)

9.1.11. Professional Services

9.1.12.1. Market Revenue and Forecast (2021-2033)

9.1.13. Managed Services

9.1.13.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Agriculture Drone Market, By Environment

10.1. U.S. Agriculture Drone Market, by Environment, 2024-2033

10.1.1. Indoor Farming

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Outdoor Farming

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Agriculture Drone Market, By Application

11.1. U.S. Agriculture Drone Market, by Application, 2024-2033

11.1.1. Crop Management

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Field Mapping

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Crop Spraying

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Livestock Monitoring

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Variable Rate Application (VRA)

11.1.5.1. Market Revenue and Forecast (2021-2033)

11.1.6. Others

11.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Agriculture Drone Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Type (2021-2033)

12.1.2. Market Revenue and Forecast, by Component (2021-2033)

12.1.3. Market Revenue and Forecast, by Environment (2021-2033)

12.1.4. Market Revenue and Forecast, by Application (2021-2033)

Chapter 13. Company Profiles

13.1. AeroVironment, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. AgEagle Aerial Systems Inc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. DJI (SZ DJI Technology Co., Ltd)

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Parrot Drone SAS

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. PrecisionHawk

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Trimble Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. DroneDeploy

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Sentera

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Sky Drones Technologies LTD

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Draganfly Inc

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others