U.S. Air Fresheners Market Size and Trends

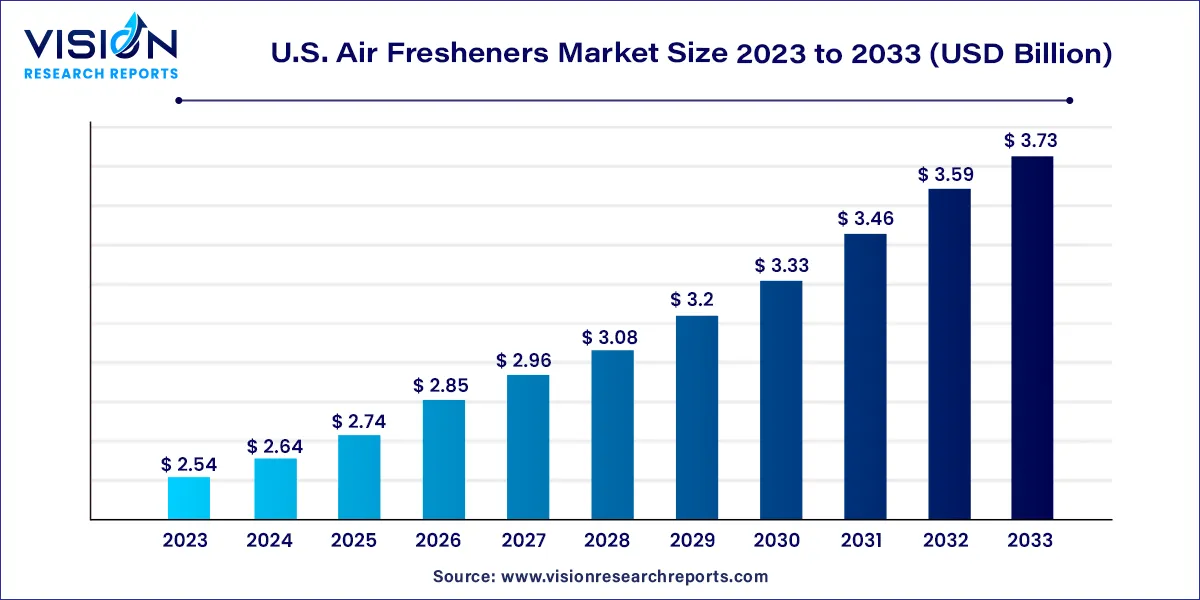

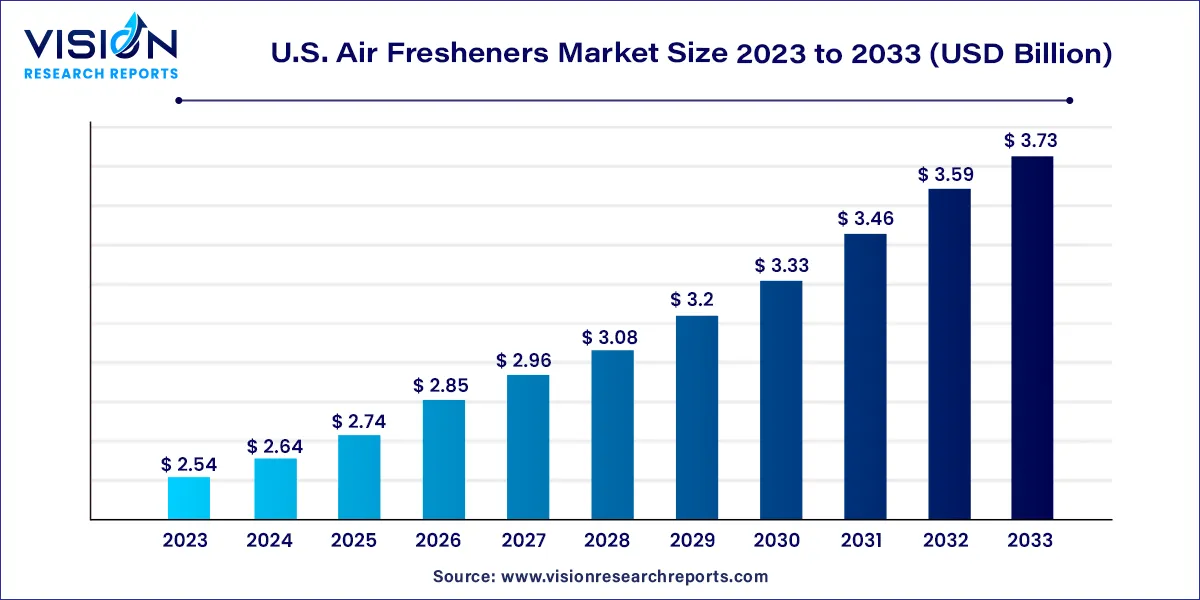

The U.S. air fresheners market size was estimated at around USD 2.54 billion in 2023 and it is projected to hit around USD 3.73 billion by 2033, growing at a CAGR of 3.93% from 2024 to 2033. The U.S. air fresheners market has seen substantial growth in recent years, driven by increasing consumer demand for home and car fragrance products that enhance living spaces and provide a sense of well-being. The market encompasses a wide variety of products, including sprays, gels, plug-ins, candles, and automated dispensers, catering to both residential and commercial applications.

Key Pointers

- By Product, the sprays/aerosol segment registered the maximum market share of 54% in 2023.

- By Product, the electric air fresheners segment is anticipated to witness significant growth during the forecast period.

- By Application, the residential segment captured the maximum market share in 2023.

- By Application, the automotive segment is expected to experience significant growth during the forecast period.

What are the Growth Factors of U.S. Air Fresheners Market?

The growth of the U.S. air fresheners market is primarily driven by an increasing consumer awareness of indoor air quality and the desire for a pleasant living environment have significantly boosted demand. As people spend more time at home, especially in urban areas with smaller living spaces, the need for effective odor management solutions has grown. Secondly, rising disposable incomes allow consumers to invest in premium and innovative air freshening products, such as those with natural ingredients and smart technology integration. Additionally, the trend toward sustainability has led to the development of eco-friendly and refillable products, which are gaining traction among environmentally conscious consumers.

What are the Trends in U.S. Air Fresheners Market?

- Rise in Natural and Organic Products: Consumers are increasingly opting for air fresheners made from natural ingredients, such as essential oils, as concerns over synthetic chemicals and their potential health impacts grow.

- Sustainable and Eco-Friendly Packaging: The demand for sustainable products is driving the adoption of eco-friendly packaging solutions, including biodegradable materials and refillable options, reducing the environmental footprint.

- Smart Air Fresheners: Technological advancements have led to the emergence of smart air fresheners that can be controlled remotely via smartphones or integrated into home automation systems, offering convenience and customization.

- Customization and Personalized Scents: There is a growing trend toward personalized air freshening experiences, where consumers can create custom scent blends or adjust the intensity and timing of fragrance release.

- Health-Focused Products: Products that go beyond just masking odors—by neutralizing allergens, bacteria, and other airborne pollutants—are gaining popularity, aligning with the increasing focus on indoor air quality and health.

What are the Key Challenges Faced by U.S. Air Fresheners Market?

- Health Concerns: Growing awareness about the potential health risks associated with certain chemicals in air fresheners, such as phthalates and volatile organic compounds (VOCs), has led to increased scrutiny and demand for safer alternatives, which poses a challenge for manufacturers relying on traditional formulations.

- Environmental Impact: The environmental footprint of air fresheners, particularly the use of non-recyclable plastic packaging and aerosol propellants, is becoming a significant concern. Consumers and regulators are pushing for more sustainable options, creating pressure on companies to innovate and reduce their ecological impact.

- Intense Competition: The U.S. air fresheners market is highly competitive, with numerous established brands and new entrants vying for market share. This intense competition can lead to price wars and challenges in maintaining brand loyalty.

- Regulatory Compliance: Air fresheners are subject to various regulations regarding their chemical composition, labeling, and environmental impact. Keeping up with evolving regulatory requirements can be complex and costly for manufacturers, especially when entering new markets or launching innovative products

Product Insights

In 2023, the sprays/aerosol segment led the market with a 54% revenue share. This dominance is attributed to the growing popularity of water-based air freshener sprays, which are eco-friendly, chemical-free, and provide long-lasting fragrance. The availability of a wide range of affordable products within this category has further fueled its demand. Additionally, the strong odor-neutralizing capabilities of the propellants used in aerosols make these products a preferred choice among consumers.

The electric air fresheners segment is anticipated to witness significant growth during the forecast period. This growth is largely driven by technological advancements in the industry. Factors such as increasing concerns about indoor air quality in urban areas, rising disposable incomes, and a growing preference for automatic or touch-free air freshening solutions are contributing to the expansion of this segment.

Application Insights

The residential segment dominated the market in 2023. The demand in this segment has been driven by the growing adoption of electronic air fresheners, easy access to products through offline retail channels, increasing popularity of scented candles for their aesthetic appeal, and rising spending on home care and decor. Furthermore, companies in the industry are frequently launching new collections of fresheners with unique fragrances and formulations, further boosting demand. For example, in January 2024, Febreze, a brand under P&G, introduced a new scent and product line called Romance & Desire.

The automotive segment is expected to experience significant growth during the forecast period. This growth is primarily fueled by technological advancements leading to innovative product offerings, easy accessibility—especially through highway stores—a wide variety of products from different companies, and ongoing innovation within the segment.

Who are the Top Manufactures in U.S. Air Fresheners Market?

- Procter & Gamble

- Reckitt Benckiser Group PLC

- Henkel AG & Co. KGaA

- S. C. Johnson& Son, Inc.

- Air-Scent International

- Renegade Products USA.

- Good & Well Supply Co.

- The Yankee Candle Company, Inc.

- Bath & Body Works Direct, Inc.

- ILLUME Candles

Recent Development

- In November 2023, Procter & Gamble unveiled a new intelligent fragrance dispenser for household use under its Febreze brand. Named Febreze Airia, this innovative device offers a consistent fragrance experience by utilizing patented SmartJet technology, which is adapted from thermal ink-jet printer cartridges.

U.S. Air Fresheners Market Segmentation:

By Product

- Sprays/Aerosols

- Electric Air Fresheners

- Gels

- Scented Candles

- Others

By Application

- Residential

- Commercial

- Automotive

- Others

Frequently Asked Questions

The U.S. air fresheners market size was reached at USD 2.54 billion in 2023 and it is projected to hit around USD 3.73 billion by 2033.

The U.S. air fresheners market is growing at a compound annual growth rate (CAGR) of 3.93% from 2024 to 2033.

The driving factors of the U.S. air fresheners market include rising consumer awareness of indoor air quality, increasing disposable incomes, and a growing preference for natural, sustainable, and technologically advanced products.

The leading companies operating in the U.S. air fresheners market are Procter & Gamble; Reckitt Benckiser Group PLC; Henkel AG & Co. KGaA; S. C. Johnson& Son, Inc.; Air-Scent International; Renegade Products USA.; Good & Well Supply Co.; The Yankee Candle Company, Inc.; Bath & Body Works Direct, Inc. and ILLUME Candles.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others