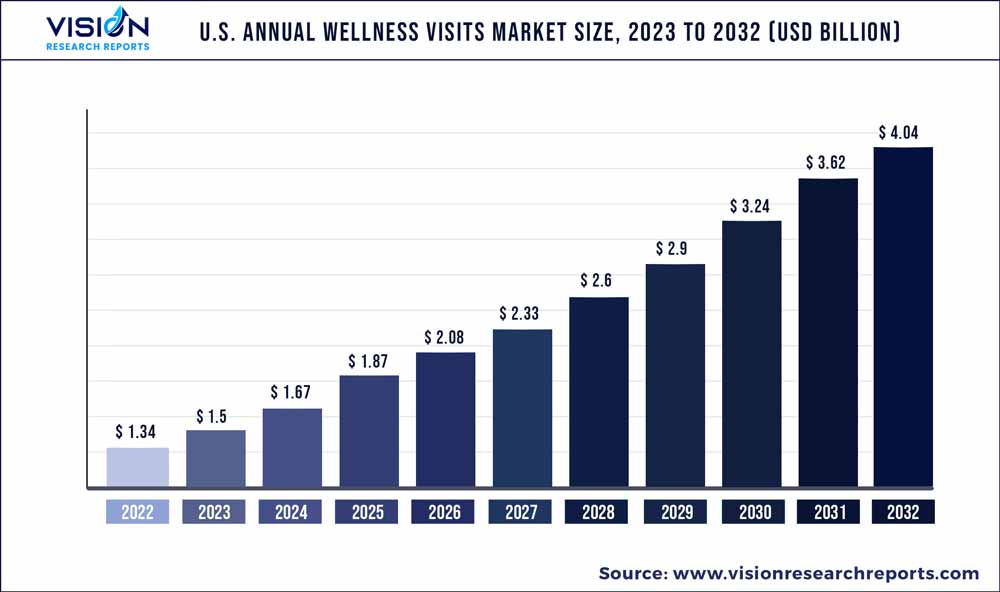

The U.S. annual wellness visits market was valued at USD 1.34 billion in 2022 and it is predicted to surpass around USD 4.04 billion by 2032 with a CAGR of 11.67% from 2023 to 2032.

Key Pointers

Report Scope of the U.S. Annual Wellness Visits Market

| Report Coverage | Details |

| Market Size in 2022 | USD 1.34 billion |

| Revenue Forecast by 2032 | USD 4.04 billion |

| Growth rate from 2023 to 2032 | CAGR of 11.67% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Morris Hospital & Healthcare Centers; Sparta Community Hospital District; Medical Center Clinic; St. Luke Community Healthcare; Mason Health; UC San Diego; HealthCare Partners, MSO.; Mercy; RUSH Copley Medical Center; Carson Tahoe Health; Overlake Hospital Medical Center; Northwestern Medicine; The General Hospital Corporation; Hamilton Health Care System; UCLA Health |

The growth is attributed to the factors such as rising awareness about the benefits of preventive healthcare, increasing healthcare expenditure, the aging population, and rising government initiatives.Medicare, the federal health insurance program for the older population, covers annual wellness visits(AWV)s as a preventive care service for eligible beneficiaries. The Centers for Medicare and Medicaid introduced the annual wellness visit for elderly people who are enrolled under Medicare. AWV is an opportunity for older people and their providers to focus on disease prevention and the early recognition of disease. In the AWV, primary-care practitioners identify health risks and encourage and promote healthy behaviors, enable proper disease screening, and prevent and manage syndromes of aging.

AWV specifically includes assessments of psychosocial risks, cognition, depression, physical function, and behavioral risks, such as drinking, nutritional status, smoking, sedentary behavior, and obesity. Moreover, screening for pertinent diseases, such as diabetes, cardiovascular disease, and cancer is also included in the AWV.

The increasing demand for early detection of diseases has boosted the demand for annual wellness visits. For instance, in September 2022 , Alzheimer’s Association published an article that stated that early detection of Alzheimer's disease and associated dementias allows patients and clinicians to identify treatment options and prepare for future needs.Furthermore, significant cost-saving and a decrease in the number of emergency hospitalization are driving the market growth.

The COVID-19 pandemic had a significant impact on the U.S. AWV market. During the pandemic, many healthcare providers suspended routine in-person visits, including wellness visits, to reduce the risk of COVID-19 transmission. Owing to this there was a significant decline in the number of wellness visits in 2020 compared to previous years.

However, the pandemic has highlighted the importance of preventive healthcare and the need for regular checkups and screenings to maintain overall health and detect potential health conditions at an early stage. This has increased awareness of the benefits of wellness visits and may lead to increased demand for these services in the coming years.

Key Companies & Market Share Insights

Market players are offering various services to their customers which is making the market highly competitive. The providers are incorporating telehealth to enhance their services. Furthermore, partnerships and collaborations are major strategies undertaken by key players to gain a competitive edge. Some prominent players in the U.S. annual wellness visits market include:

U.S. Annual Wellness Visits Market Segmentations:

| By Type | By Services | By Provider Type | By Specialty |

|

Initial Annual Wellness Visit Subsequent Annual Wellness Visit |

Health Risk Assessment Physical Exam Laboratory Tests Immunizations Cancer Screening Mental Health Screening Health Education And Guidance |

Clinics Hospitals Physician’s Office |

Primary Care Cardiology Infectious Disease Nephrology Endocrinology |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Annual Wellness Visits Market

5.1. COVID-19 Landscape: U.S. Annual Wellness Visits Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Annual Wellness Visits Market, By Type

8.1. U.S. Annual Wellness Visits Market, by Type, 2023-2032

8.1.1. Initial Annual Wellness Visit

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Subsequent Annual Wellness Visit

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. U.S. Annual Wellness Visits Market, By Services

9.1. U.S. Annual Wellness Visits Market, by Services, 2023-2032

9.1.1. Health Risk Assessment

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Physical Exam

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Laboratory Tests

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Immunizations

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Cancer Screening

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Mental Health Screening

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Health Education And Guidance

9.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 10. U.S. Annual Wellness Visits Market, By Provider Type

10.1. U.S. Annual Wellness Visits Market, by Provider Type, 2023-2032

10.1.1. Clinics

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Hospitals

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Physician’s Office

10.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 11. U.S. Annual Wellness Visits Market, By Specialty

11.1. U.S. Annual Wellness Visits Market, by Specialty, 2023-2032

11.1.1. Primary Care

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Cardiology

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Infectious Disease

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Nephrology

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Endocrinology

11.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 12. U.S. Annual Wellness Visits Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Type (2020-2032)

12.1.2. Market Revenue and Forecast, by Services (2020-2032)

12.1.3. Market Revenue and Forecast, by Provider Type (2020-2032)

12.1.4. Market Revenue and Forecast, by Specialty (2020-2032)

Chapter 13. Company Profiles

13.1. Morris Hospital & Healthcare Centers

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Sparta Community Hospital District

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Medical Center Clinic

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. St. Luke Community Healthcare

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Mason Health

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. UC San Diego

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. HealthCare Partners

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. MSO.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Mercy

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. RUSH Copley Medical Center

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others