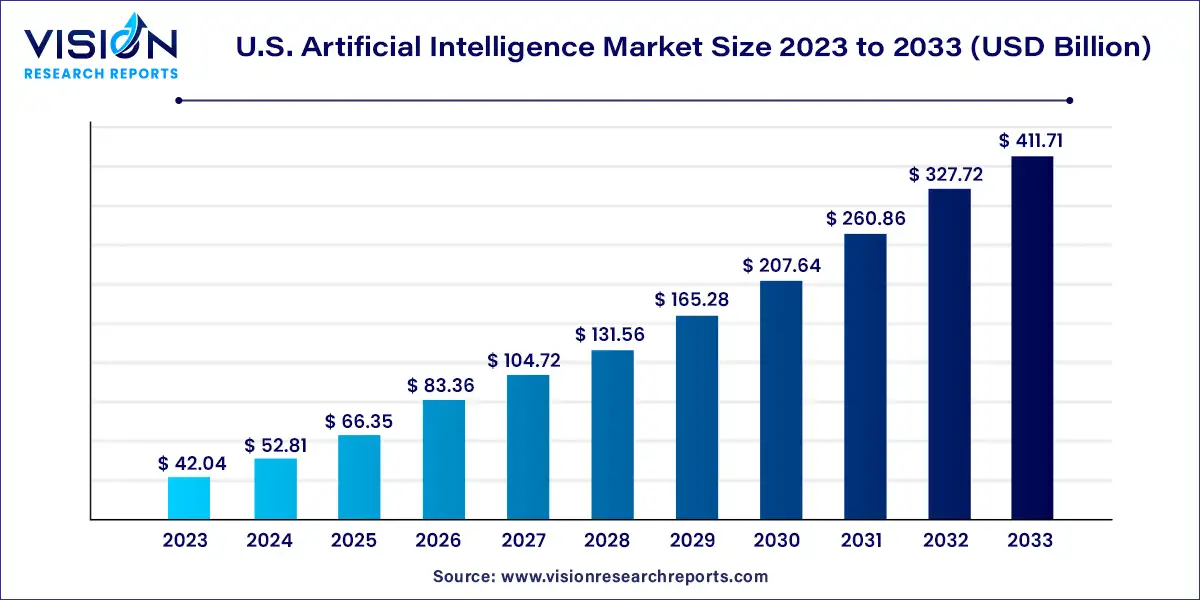

The U.S. artificial intelligence market was estimated at USD 42.04 billion in 2023 and it is expected to surpass around USD 411.71 billion by 2033, poised to grow at a CAGR of 25.63% from 2024 to 2033.

The growth of the U.S. artificial intelligence (AI) market is propelled by the technological advancements in machine learning, natural language processing, and computer vision are expanding the capabilities of AI systems, enabling them to solve complex problems and deliver unprecedented value. Moreover, increasing industry adoption across sectors such as healthcare, finance, retail, manufacturing, and automotive is driving demand for AI-driven solutions to enhance efficiency, productivity, and decision-making processes. Government initiatives aimed at promoting AI research, development, and deployment further contribute to the market's expansion by fostering an environment conducive to innovation and investment. Additionally, the influx of venture capital funding and corporate investments in AI startups and initiatives fuel innovation and drive market growth. These combined factors underscore the robust momentum of the U.S. AI market, positioning it for continued advancement and success in the future.

In 2023, the software segment took the lead in the U.S. market, commanding a revenue share of 36%. This growth is attributed in part to its inherent capability to deliver real-time insights, extract data, and aid in decision-making processes. For example, AI software is now highly sought after for executing a significant portion of trading activities on Wall Street. Furthermore, software plays a pivotal role in the development of intelligent applications and the advancement of deep learning and machine learning technologies.

On the other hand, the hardware segment is anticipated to witness substantial demand across various end-use applications. Notably, the increasing adoption of virtual assistants managing facial recognition systems and smart homes will drive the uptake of AI hardware. Additionally, semiconductor companies are expected to experience heightened demand due to the growing importance of hardware in AI applications. The proliferation of chipsets, including Graphics Processing Units (GPUs), application-specific integrated circuits (ASICs), central processing units (CPUs), and field-programmable gate arrays (FPGAs), is poised to support market growth.

In 2023, the deep learning segment held the largest share of revenue and is expected to maintain its dominance, driven by a surge in demand for automation enhancements. The growing preference for performing both physical and analytical tasks without human intervention is fueling the demand for this technology. Specifically, the need for credit card fraud detection, voice-activated TV remotes, and digital assistants has spurred investment in deep learning solutions. Stakeholders foresee generative AI and autonomous vehicles further stimulating the regional market.

Meanwhile, the Natural Language Processing (NLP) segment is poised for robust growth, reshaping business operations. This technology has gained traction for its ability to save time, money, and human effort. Additionally, it facilitates the structuring of company data and the analysis of large volumes of text. For instance, OpenAI’s GPT-3 utilizes statistics and AI to predict the next word in a sentence based on language models. Language models are proving instrumental in enhancing customer satisfaction by managing complex customer service interactions.

The advertising and media segment is poised to make a significant contribution to the U.S. AI market, driven primarily by the demand for technology in data analysis, enhancing return on investment, content generation and creation, automated decision-making, and personalization. Particularly, the advertising and media industry relies on AI to analyze customer behavior for creating personalized and targeted campaigns. For example, platforms like Netflix and Amazon Prime use AI algorithms to recommend content to users based on their purchasing and viewing history.

In 2023, the healthcare segment also captured a notable share of revenue, and it is expected to further expand during the assessment period. This positive outlook is attributed to the wide-ranging applications of AI in various healthcare areas, including diversifying clinical trials, facilitating drug discovery, early disease detection, and improving patient treatment. Specifically, AI and machine learning (ML) technologies enable rapid assessment of lab results, electronic medical records, CT scans, and MRIs. The adoption of AI and ML is particularly prominent in identifying new targets and predicting drug interactions, fostering growth opportunities for companies in the U.S. market.

By Solution

By Technology

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others