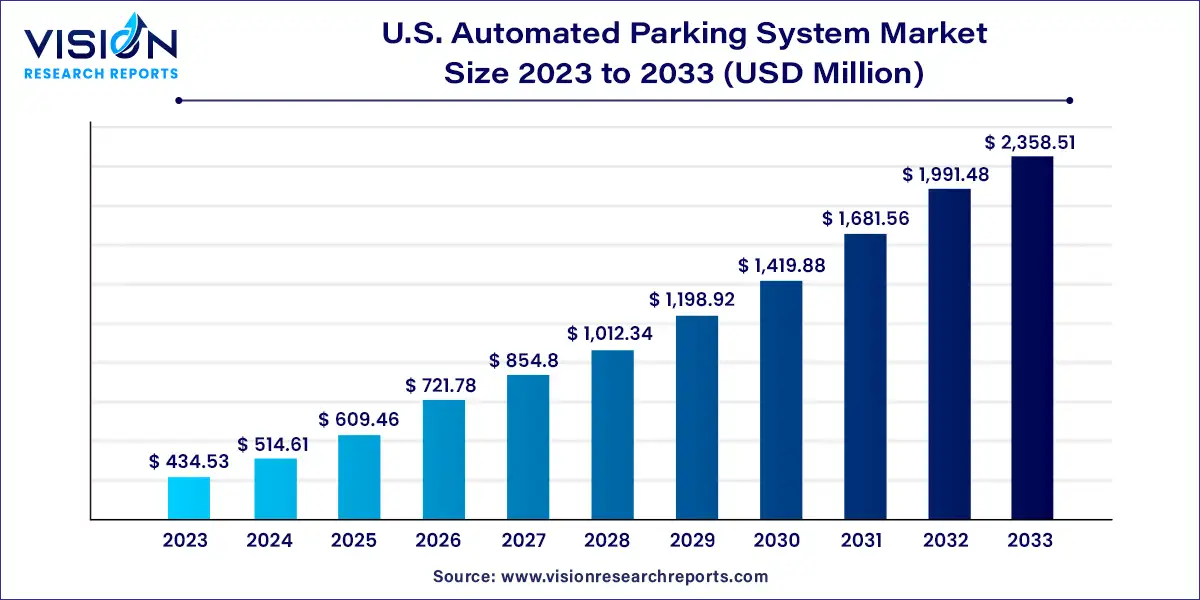

The U.S. automated parking system market size was estimated at around USD 434.53 million in 2023 and it is projected to hit around USD 2,358.51 million by 2033, growing at a CAGR of 18.43% from 2024 to 2033.

The U.S. automated parking system market has experienced significant growth driven by advancements in technology and urban infrastructure demands. Automated parking systems offer efficient utilization of space, reduced environmental impact, and enhanced user convenience compared to traditional parking methods. This market's expansion is further fueled by increasing urbanization, limited parking availability, and the rising adoption of smart city initiatives across major metropolitan areas. Key players in the market are continually innovating to improve system reliability, integration with smart technologies, and overall user experience.

The growth of the U.S. automated parking system market is driven by the technological advancements have significantly enhanced the efficiency and reliability of automated parking systems, making them increasingly attractive to urban developers and property owners seeking to maximize space utilization. The rise of smart city initiatives across major metropolitan areas has also spurred demand, as automated parking systems align with broader sustainability goals and the need for integrated, efficient urban infrastructure. Moreover, the growing urbanization trend and population density in cities have created a pressing need for innovative parking solutions that can accommodate more vehicles in limited spaces.

In 2023, hardware dominated the market with a significant share of 84%. Hardware encompasses physical components like sensors, gates, cameras, and robotics crucial for automated parking operations. These components are integral to the infrastructure required for automated parking, enabling efficient vehicle detection and navigation to parking spaces.

Software, expected to grow at the highest CAGR during the forecast period, includes algorithms, applications, and interfaces that facilitate user-system interaction. It provides intuitive interfaces for seamless access and efficient utilization. By effectively managing and coordinating hardware functionalities, software optimizes system performance, enhances reliability, and ensures a smooth parking experience.

The tower system held the largest market share in 2023, involving vertical stacking of vehicles in multi-level structures. This method maximizes space efficiency, enabling more vehicles to be parked in compact areas. In July 2023, Ultron introduced a cutting-edge slide system, featuring stationary conveyors for multidimensional vehicle movement, marking a significant advancement in automated parking technology.

The Puzzle System is projected to grow at the fastest CAGR, employing advanced software algorithms to strategically optimize vehicle placement. This approach enhances parking efficiency by solving complex spatial challenges.

In 2023, the palleted system dominated the market, utilizing pre-designed pallets for vehicle transport and storage. This system optimizes space and efficiency, catering to high demand in various applications such as luxury apartments with robotic parking garages, as reported by CNBC in November 2022. These systems offer amenities like electric vehicle charging and maximize parking space.

The non-palleted system is anticipated to grow rapidly, leveraging sensor and camera technology for accurate vehicle detection and flexible parking configurations without fixed platforms. This flexibility suits diverse layout and design needs.

Fully automated parking systems held the largest market share, characterized by minimal human interaction. Robotic systems autonomously park and retrieve vehicles, providing a swift and driverless parking experience appreciated for its efficiency.

Semi-automated parking systems require some human intervention, such as driver guidance during parking, offering improved precision and reduced driver effort compared to manual methods.

The commercial segment led the market, serving businesses like offices, hotels, shopping centers, and airports that require efficient parking solutions for high visitor volumes. Automated systems enhance customer satisfaction and revenue generation through streamlined parking operations.

The residential segment is poised for rapid growth, driven by urbanization and population density. Residential buildings seek efficient parking solutions to maximize limited space, supporting increased demand for automated parking systems.

By Component

By Structure Type

By Platform Type

By Automation Level

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Automated Parking System Market

5.1. COVID-19 Landscape: U.S. Automated Parking System Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Automated Parking System Market, By Component

8.1. U.S. Automated Parking System Market, by Component, 2024-2033

8.1.1. Hardware

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Automated Parking System Market, By Structure Type

9.1. U.S. Automated Parking System Market, by Structure Type, 2024-2033

9.1.1. AGV System

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Silo System

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Tower System

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Puzzle System

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Rotary System

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Automated Parking System Market, By Platform Type

10.1. U.S. Automated Parking System Market, by Platform Type, 2024-2033

10.1.1. Palleted

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Non-palleted

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Automated Parking System Market, By Automation Level

11.1. U.S. Automated Parking System Market, by Automation Level, 2024-2033

11.1.1. Fully Automated

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Semi-automated

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Automated Parking System Market, By End-use

12.1. U.S. Automated Parking System Market, by End-use, 2024-2033

12.1.1. Residential

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Commercial

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. Mixed-use

12.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 13. U.S. Automated Parking System Market, Regional Estimates and Trend Forecast

13.1. U.S.

13.1.1. Market Revenue and Forecast, by Component (2021-2033)

13.1.2. Market Revenue and Forecast, by Structure Type (2021-2033)

13.1.3. Market Revenue and Forecast, by Platform Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Automation Level (2021-2033)

13.1.5. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 14. Company Profiles

14.1. AutoMotion Parking Syatem

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. AUTOParkit

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. CityLift parking

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Harding Stee

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Hyundai Mobis

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Parkhub

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. ParkPlus

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. ParkWhiz

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Robotic Parking Systems Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Westfalia technologies Inc

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others