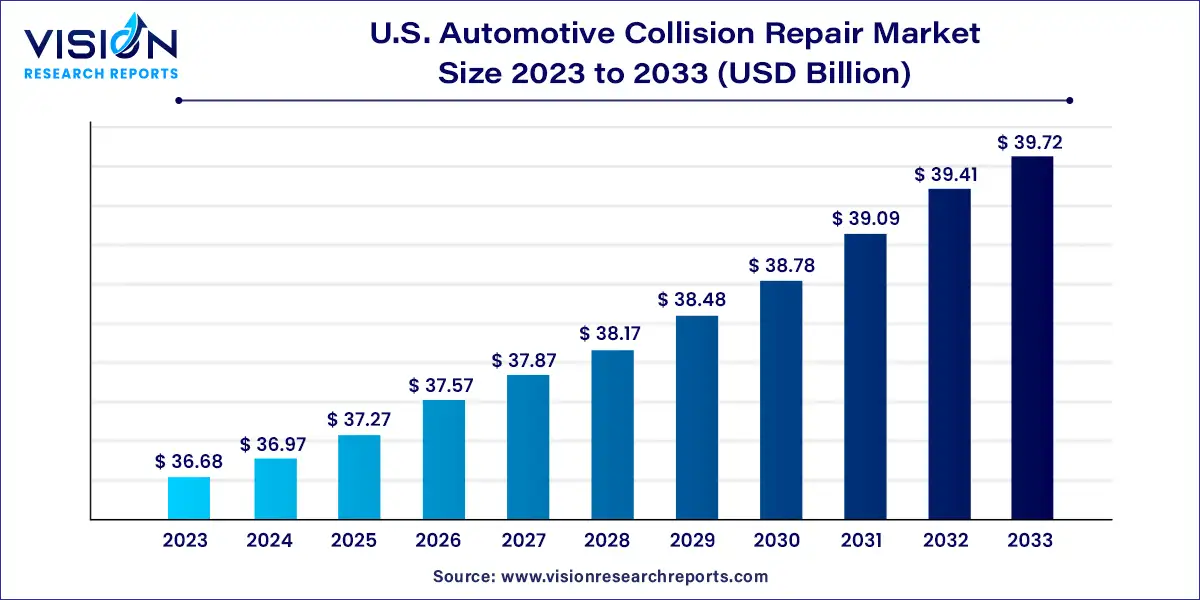

The U.S. automotive collision repair market size was surpassed at USD 36.68 billion in 2023 and is expected to hit around USD 39.72 billion by 2033, growing at a CAGR of 0.8% from 2024 to 2033. The U.S. automotive collision repair market plays a crucial role in the vehicle maintenance and repair industry. This market encompasses a wide range of services and products required to restore vehicles to their pre-accident condition. As the automotive industry evolves, so does the collision repair sector, driven by technological advancements, changing consumer preferences, and regulatory standards.

The growth of the U.S. automotive collision repair market is driven by an increasing average age of vehicles on the road amplifies the demand for collision repair services, as older vehicles are more susceptible to accidents and require more frequent maintenance. Technological advancements also play a crucial role, as innovations in repair equipment and diagnostic tools enhance repair accuracy and efficiency. The rising complexity of modern vehicles, which now feature advanced materials and intricate electronics, necessitates specialized repair skills and equipment, further fueling market growth. Additionally, the influence of the insurance industry, which often covers repair costs, drives consumer demand for professional collision repair services. Collectively, these factors contribute to a robust and expanding collision repair sector in the U.S. automotive market.

In 2023, the light-duty vehicle segment led the market, capturing a 57% revenue share. Light-duty vehicles, including cars, SUVs, and small trucks, are highly favored by consumers for both personal and professional use. There is a growing demand for affordable and fuel-efficient options, with electric SUVs gaining traction among eco-conscious buyers. This trend is expected to propel the growth of the light-duty vehicle segment.

Conversely, the heavy-duty vehicle segment is projected to experience substantial growth throughout the forecast period. This category encompasses commercial vehicles and multi-axle trucks and buses. The repair of heavy-duty vehicles involves extensive maintenance and troubleshooting, including sandblasting, painting, and addressing both minor and major collisions. These services are typically carried out in specialized workshops. Collision repair centers in the U.S. are adhering to new Clean Air Act (CAA) regulations aimed at reducing pollution around repair facilities.

The spare parts segment was the market leader in 2023. This segment includes a range of components such as repair materials, supplementary mechanical parts, and tools. The high frequency of road accidents that damage essential parts like grilles, bumpers, and fenders drives the demand for spare parts. Additionally, improved maintenance practices extend vehicle lifespans, contributing to the ongoing need for parts replacement and the segment's growth.

The paints and coatings segment is anticipated to grow at the fastest rate over the forecast period. Increasing demand for vehicle aesthetics, customization, and advanced paint technologies such as anti-scratch and self-healing paints is expected to drive this growth. Stricter environmental regulations requiring low-VOC paints, which fade faster than traditional coatings, will also contribute to the segment's expansion as these paints require more frequent application.

In 2023, the OE (Original Equipment) segment, managed by OEMs, was the dominant market force. Consumers prefer OEM parts to ensure vehicle integrity, safety, and warranty coverage. The high standards and quality associated with OEM parts reinforce their leading position in the U.S. collision repair market.

The DIFM (Do It For Me) segment is forecasted to grow at the fastest pace. With increasingly busy lifestyles and complex modern vehicles, many consumers are opting for professional repair services. The rise in leasing and subscription car models further drives the demand for authorized repair shops that adhere to manufacturer maintenance guidelines. Additionally, advancements such as online booking and repair tracking enhance convenience and transparency, further boosting the DIFM segment.

By Vehicle

By Product

By Service Channel

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others