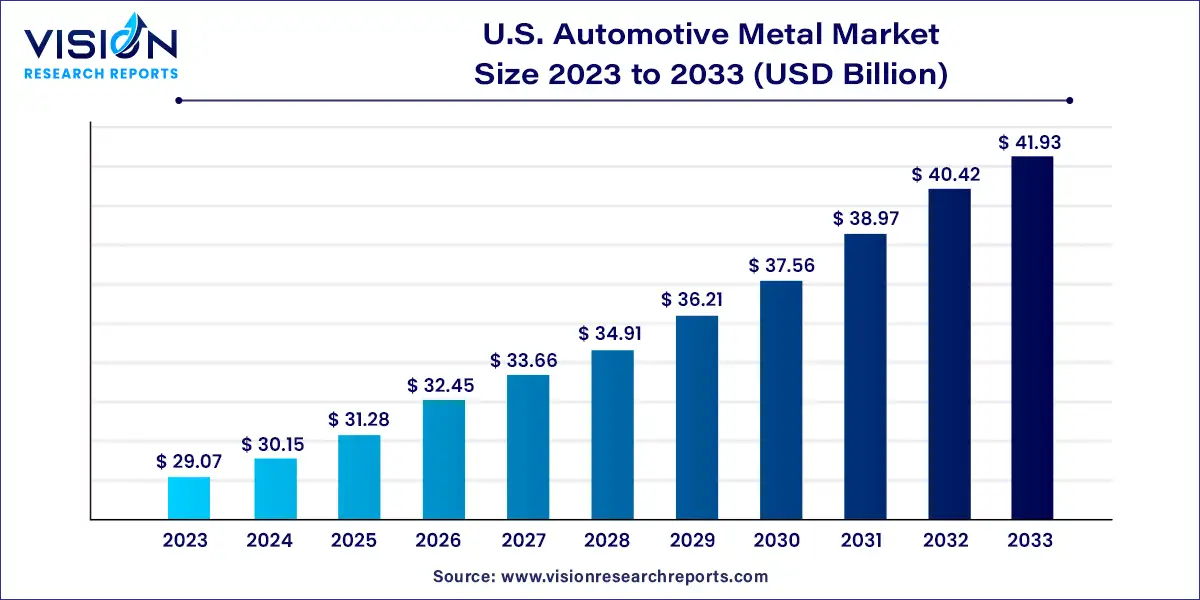

The U.S. automotive metal market size was valued at USD 29.07 billion in 2023 and is anticipated to reach around USD 41.93 billion by 2033, growing at a CAGR of 3.73% from 2024 to 2033. The U.S. automotive metal market stands as a cornerstone of the nation's industrial landscape, providing crucial materials for the production of vehicles that drive the economy forward.

The growth of the U.S. automotive metal market is propelled by the technological advancements in metal manufacturing processes have led to increased efficiency, cost-effectiveness, and product quality, driving demand within the industry. Additionally, the rising consumer preference for lightweight vehicles, driven by fuel efficiency and environmental concerns, has spurred the adoption of advanced metal alloys and composites in automotive design. Moreover, stringent regulatory standards aimed at enhancing vehicle safety and reducing emissions have necessitated the use of high-performance metals with superior strength-to-weight ratios. Furthermore, the ongoing trend towards vehicle electrification has created new opportunities for metal suppliers, as electric vehicles require specialized components and materials for their construction.

Steel dominates the U.S. automotive metal industry with a revenue share of 60% in 2023 on account of its wide application in the manufacturing of parts such as vehicle body structure, panels, doors, closures, engine blocks, gears, wheels, steering parts, braking systems, and more. It accounts for about 900 kg of an average vehicle weight. The high strength and cost-effectiveness of steel is likely to increase its utilization in the automotive sector over the coming years. The market has been witnessing increased utilization of lightweight steels, including Advanced High-Strength Steels (AHSS). This product reduces the weight of the vehicle structure, enhances safety, and improves the fuel efficiency of the vehicles.

Magnesium segment is expected to witness the fastest CAGR of 10.83% during the forecast period. The light weight of the material facilitated its utilization in racing cars to add a competitive advantage for the racers. Commercial vehicles, including Volkswagen Beetle, contained about 20kg of magnesium. It is being used in gearbox, steering column, air bag housing, steering wheels, seat frames, and fuel tank covers. Increasing focus onenvironmental issues coupled with increased fuel efficiency, performance, and sustainability is expected to propel the utilization of the product over the forecast years.

The passenger cars segment held a revenue share of over 55% in the market in 2023. High demand for passenger cars in the U.S. is anticipated to increase at a rapid pace on account of growing consumer disposable income and changing consumer lifestyles. Consumers are increasingly willing to pay for all vehicles in order to obtain better quality and durability on the market. Consequently, manufacturers are working on the development of new innovative products with premium features at a low cost. The demand for metal in passenger vehicles is likely to be stimulated by these factors.

The light commercial vehicle segment is expected to grow at the fastest CAGR of 4.03% during the forecast period. Low operation and maintenance costs facilitate an increase in the use of these vehicles for commercial purposes. Increasing demand for commercial transportation services, including taxis are expected to propel the demand for light commercial vehicles over the forecast period, thereby resulting in increased demand for automotive metals.

The body structure segment dominated the market with a revenue share of over 38% in 2023in 2023. One of the main factors boosting the demand for metals in vehicle body structures is the ease of maintenance and repair along with the high recyclability compared to plastics and composites.The body structure includes frames, panels, doors, bonnets, and trunk closures. These are usually produced from steel for gaining robustness and providing crash energy absorption to the structure. The casted aluminium products and hot-stamped steel products provide a high level of safety for the body structure compared to plastic materials. This is likely to augment the utilization of lightweight metals in the body structure over the coming years.

The suspension segment is expected to witness the fastest growth during the forecast period. Numerous manufacturers are shifting towards lightweight metals such as aluminium and magnesium in order to reduce vehicle weight. In addition, specialized applications like military vehicles are also utilizing titanium alloys for manufacturing of suspension for armoured vehicles. Low rigidity and strength of plastics as compared to metals is likely to augment the market growth in suspension application over the coming years.

By Product

By Vehicle-type

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others