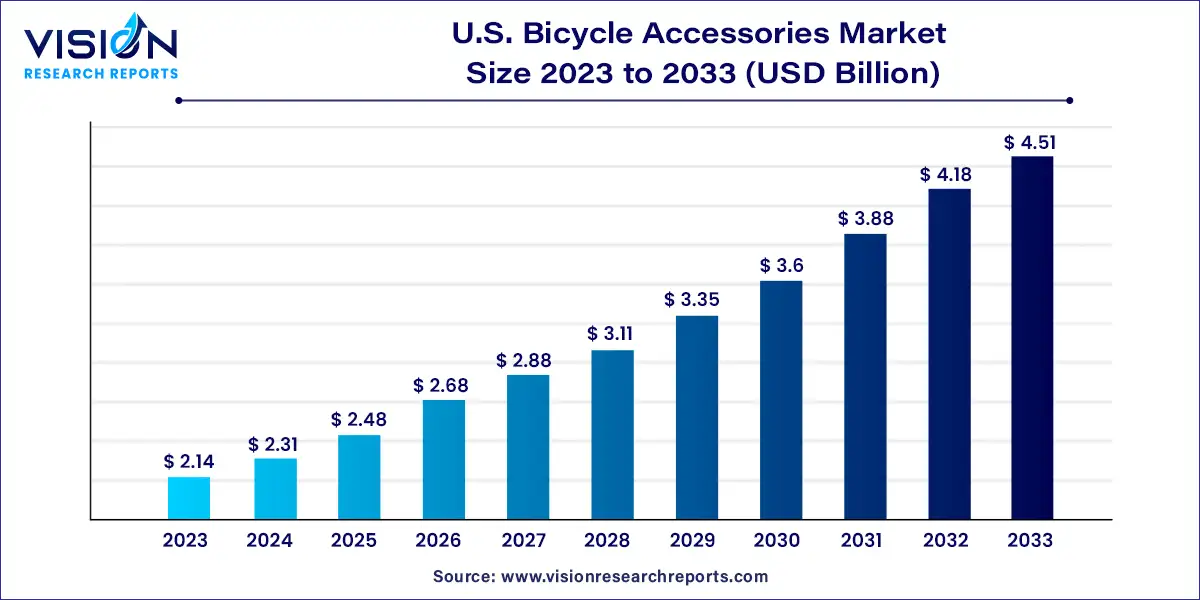

The U.S. bicycle accessories market size was estimated at around USD 2.14 billion in 2023 and it is projected to hit around USD 4.51 billion by 2033, growing at a CAGR of 7.73% from 2024 to 2033.

The U.S. bicycle accessories market is a dynamic sector that plays a crucial role in supporting the thriving cycling industry. With a growing emphasis on health and wellness, coupled with increasing interest in sustainable transportation alternatives, the demand for bicycle accessories continues to rise.

The growth of the U.S. bicycle accessories market is driven by the rising emphasis on health and wellness, with more individuals opting for cycling as a form of exercise and recreation. This trend has bolstered the demand for accessories that enhance the safety, comfort, and performance of cyclists. Additionally, increasing awareness about environmental sustainability has led to a greater adoption of cycling as a sustainable mode of transportation, driving the demand for accessories such as lights, locks, and racks. Moreover, advancements in technology have fueled innovation in the bicycle accessories sector, with the integration of smart features and connectivity enhancing the functionality and appeal of products. Furthermore, government initiatives promoting cycling infrastructure and safety have contributed to market growth by creating a conducive environment for cycling enthusiasts.

The market is categorized into two main segments: apparel (including cycling gloves, clothes, shoes, protective gear, among others) and components (comprising saddles, pedals, lighting systems, mirrors, water bottle cages, locks, bar ends/grips, kickstands, fenders & mud flaps, air pumps & tire pressure gauges, and others). In 2023, the component segment led the market with a revenue share of 62%, driven by the growing popularity of cycling in transportation and fitness sectors. Within components, pedals stood out, commanding a revenue share of 14.37% in 2023. Due to their frequent wear and tear, pedals are often the most replaced accessory in bicycles.

The apparel segment is expected to exhibit the fastest CAGR of 7.93% during the forecast period. This growth is fueled by advancements in fabric technology and design, resulting in high-performance materials that offer breathability, UV protection, and moisture-wicking properties. Consequently, cyclists can now enjoy functional and comfortable apparel without compromising on style. Within the apparel segment, protective gear accounted for the largest market share of 29.2% in 2023. This significant share underscores the importance of protective gear in preventing injuries and minimizing their severity during accidents.

The market is segmented by bicycle type into mountain bikes, hybrid bikes, road bikes, cargo bikes, and others. In 2023, the road bicycle segment led with the largest revenue share of 41%, and it is expected to maintain its dominance throughout the forecast period. Basic bicycles, like road bikes, are preferred by a majority of the population due to their simplicity in modification compared to racing, mountain, or specialized bicycles. Additionally, the rising trend of customizing road bikes for specific purposes is projected to drive market growth in the coming years.

Moreover, the cargo bikes segment is poised to demonstrate the fastest CAGR during the forecast period. Cargo bikes serve as sustainable and eco-friendly alternatives to traditional vehicles for transporting goods, thus contributing to their increasing popularity. Consequently, there is a growing demand for accessories that enhance the functionality and carrying capacity of cargo bikes, such as racks, bags, and baskets. Furthermore, the mountain bicycle segment is expected to witness significant growth over the forecast period as consumers increasingly embrace mountain biking for adventure and leisure activities.

In 2023, the OEM (original equipment manufacturer) segment emerged as the market leader, boasting the largest revenue share of 58%. This dominance is primarily attributed to the fact that OEM accessories are meticulously designed to seamlessly integrate with specific bicycle models, ensuring impeccable fit, quality, and durability. Unlike aftermarket accessories, OEM counterparts undergo rigorous testing to guarantee compatibility, thereby mitigating potential issues. Moreover, OEM accessories come with the added assurance of being covered under the bicycle manufacturer's warranty, instilling confidence in customers regarding product quality, compatibility, negligible shipping costs, and access to authenticated manuals for troubleshooting. Furthermore, OEM accessories are tailored to enhance bicycle aesthetics, offering cohesive color schemes and finishes that appeal to discerning customers seeking a unified look for their bicycles.

Conversely, the aftermarket segment is poised to witness the fastest CAGR of 8.03% over the forecast period. This growth trajectory is driven by the broader range of options available with aftermarket accessories compared to their OEM counterparts, which are limited to specific bicycle models. With a plethora of color, design, and functionality choices, aftermarket accessories empower customers to personalize their bicycles according to their preferences. Additionally, aftermarket accessories often come at a lower price point than OEM alternatives, making them more accessible and affordable to customers, particularly those seeking bicycle upgrades without significant expenditure. The burgeoning popularity of e-commerce platforms and online marketplaces further facilitates access to and purchase of aftermarket accessories, amplifying their appeal among consumers.

In 2023, the offline sales channel segment commanded the largest share of 54%. This dominance is primarily driven by a substantial portion of consumers preferring to make purchases from physical stores, as the in-person shopping experience allows them to test accessories before buying. Physical stores also offer customization options, enabling consumers to select their preferred designs and colors for bicycle accessories with the convenience of instant availability. Furthermore, the ability to physically examine products in-store provides customers with a better understanding of their quality and suitability for their needs. The presence of branded bicycle accessories in local supermarkets and other retail outlets further contributes to driving demand for this segment.

The online sales channel segment is poised to be the fastest-growing segment, with a projected CAGR of 8.05% over the forecast period. Increased consumer engagement in online shopping is expected, particularly in emerging economies such as Brazil, China, India, and Mexico, propelled by the widespread penetration of smartphones and the internet. Moreover, the expanding internet accessibility encourages vendors to tap into previously untapped markets through popular online platforms such as Ali Express, Amazon, and Flipkart. Additionally, online channels entice consumers with attractive discounts, incentivizing them to make purchases online and thereby fostering the growth of the online market.

By Product

By Bicycle Type

By Type

By Sales Channel

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Bicycle Accessories Market

5.1. COVID-19 Landscape: U.S. Bicycle Accessories Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Bicycle Accessories Market, By Product

8.1. U.S. Bicycle Accessories Market, by Product, 2024-2033

8.1.1. Apparels

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Components

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Bicycle Accessories Market, By Bicycle Type

9.1. U.S. Bicycle Accessories Market, by Bicycle Type, 2024-2033

9.1.1. Mountain Bikes

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Hybrid Bikes

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Road Bikes

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cargo Bikes

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Bicycle Accessories Market, By Type

10.1. U.S. Bicycle Accessories Market, by Type, 2024-2033

10.1.1. OEM

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Aftermarket

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Bicycle Accessories Market, By Sales Channel

11.1. U.S. Bicycle Accessories Market, by Sales Channel, 2024-2033

11.1.1. Offline

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Online

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Bicycle Accessories Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Bicycle Type (2021-2033)

12.1.3. Market Revenue and Forecast, by Type (2021-2033)

12.1.4. Market Revenue and Forecast, by Sales Channel (2021-2033)

Chapter 13. Company Profiles

13.1. Cycling Sports Group, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Giant Bicycle, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Lezyne USA, Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Marin Bikes

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. SelleRoyalGroup.com

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Shimano, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Specialized Bicycle Components, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. SRAM LLC

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Surly Bikes

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Trek Bicycle Corporation

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others