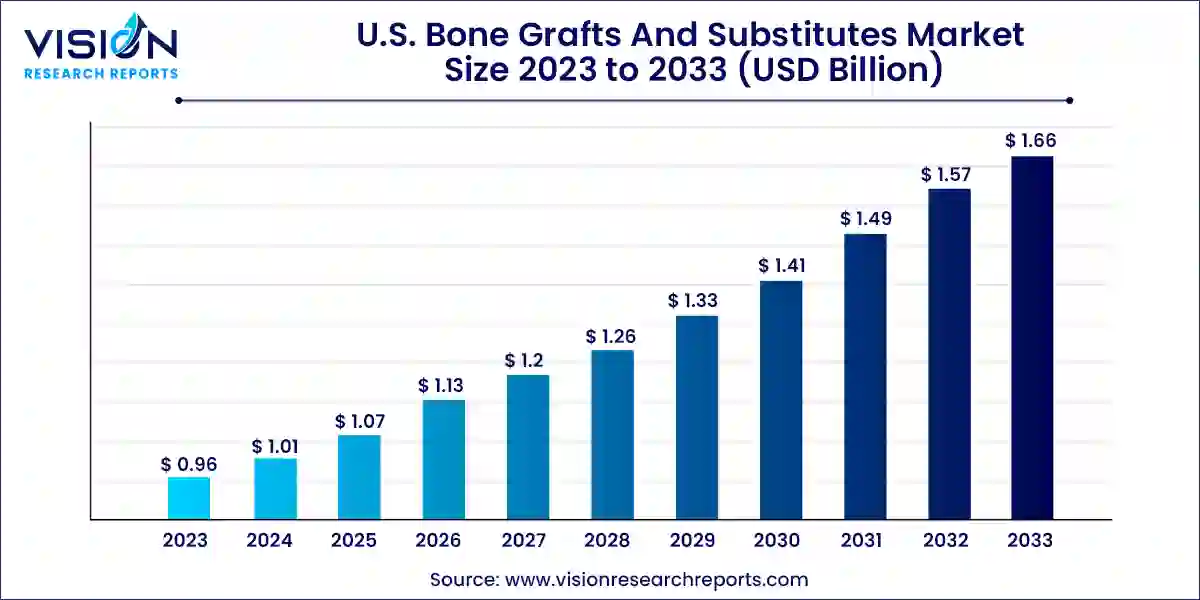

The U.S. bone grafts and substitutes market size was valued at USD 0.96 billion in 2023 and is anticipated to reach around USD 1.66 billion by 2033, growing at a CAGR of 5.63% from 2024 to 2033.

The U.S. bone grafts and substitutes market is a dynamic sector within the healthcare industry, characterized by innovation, technological advancements, and a growing demand for effective solutions in orthopedic and dental procedures. This market encompasses a wide range of products designed to facilitate bone healing, regeneration, and reconstruction, catering to diverse patient needs and clinical requirements.

The growth of the U.S. bone grafts and substitutes market is propelled by an increasing incidence of musculoskeletal disorders and traumatic injuries drives the demand for effective bone healing solutions. Additionally, the expanding aging population contributes to a higher prevalence of degenerative bone diseases, further fueling market growth. Moreover, advancements in medical technology, including biomaterials and tissue engineering, enable the development of innovative bone grafting products with enhanced efficacy and biocompatibility. Furthermore, the rising adoption of minimally invasive surgical techniques and the expanding applications of bone grafts across various medical specialties amplify market opportunities.

Allografts emerged as the dominant force in the market, commanding a substantial 62% share of revenue in 2023. This prominence can largely be attributed to the familiarity and inherent biocompatibility that allografts offer surgeons. Sourced from human tissues, allografts closely mirror the natural structure of bone, thereby facilitating osteoconductivity, where bone forms on the surface of the graft, potentially leading to quicker integration. Furthermore, the ample availability of allografts through tissue banks further solidifies their stronghold in the market.

On the other hand, the synthetic bone grafts segment is poised for the most rapid growth, with a projected compound annual growth rate (CAGR) of 7.43% from 2024 to 2033. This swift ascent is propelled by advancements in material science. Modern synthetic materials increasingly exhibit biocompatibility and osteoconductivity, mimicking the properties of natural bone. Additionally, synthetics offer distinct advantages over allografts, including a reduced risk of disease transmission and a virtually limitless supply regardless of donor availability. These factors are instrumental in propelling the robust growth trajectory of synthetic bone grafts within the U.S. market.

The spinal fusion segment emerged as the dominant force in the market, capturing a significant 61% share of revenue in 2023. This segment's prominence is fueled by the increasing prevalence of spinal conditions such as degenerative disc disease and spondylolisthesis. These conditions often necessitate spinal fusion surgeries to achieve stabilization and alleviate pain. With the aging population in the U.S. continuing to expand, the incidence rate of these spinal issues is anticipated to rise, further bolstering the demand for bone graft substitutes in spinal fusion procedures.

Conversely, dental applications are poised for substantial growth, with a projected compound annual growth rate (CAGR) of 8.73% between 2024 and 2033. This surge is attributed to the growing demand for dental implants and alveolar ridge augmentation procedures. Such procedures not only enhance the aesthetics but also improve the functionality of smiles, thereby driving the need for bone grafting materials in dentistry. The increasing emphasis on cosmetic dentistry and the rising disposable incomes among consumers are anticipated to propel the expansion of this segment even further.

By Material Type

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others