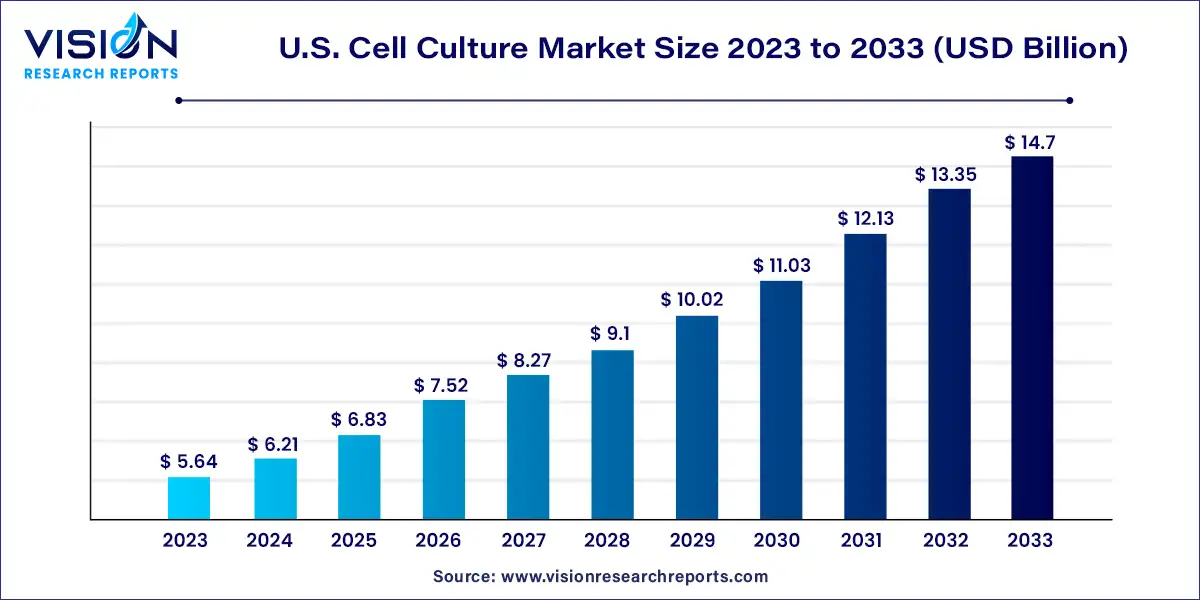

The U.S. cell culture market size was estimated at around USD 5.64 billion in 2023 and it is projected to hit around USD 14.7 billion by 2033, growing at a CAGR of 10.05% from 2024 to 2033.

The United States cell culture market is experiencing a notable surge in growth, driven by advancements in biotechnology, pharmaceuticals, and research sectors. Cell culture, a vital technique in modern biological research, involves the cultivation of cells outside their natural environment under controlled conditions

The growth of the U.S. cell culture market is propelled by the continuous technological advancements, such as the development of 3D cell culture techniques and automation, are enhancing efficiency and scalability in cell-based research and manufacturing processes. Secondly, increased investments in research and development across pharmaceutical, biotechnology, and academic sectors are driving demand for cell culture products and services. Thirdly, the growing biopharmaceutical industry, characterized by the rising demand for monoclonal antibodies, vaccines, and cell therapies, is fueling adoption of cell culture technologies for large-scale production.

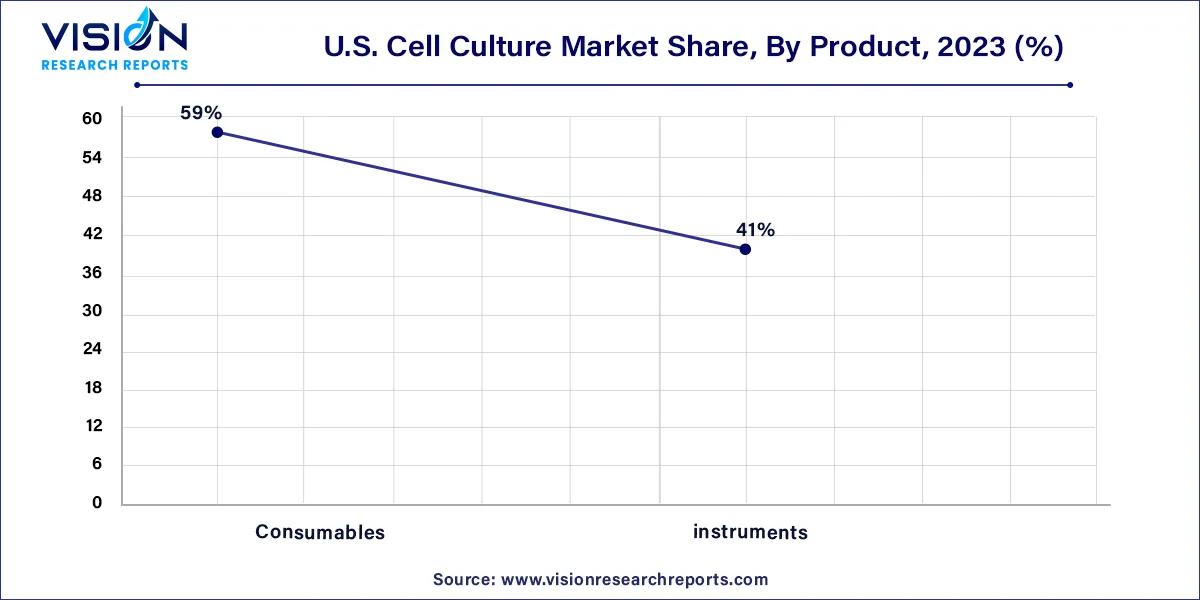

The market comprises two main segments: consumables and instruments. Consumables accounted for the largest revenue share, holding 59% in 2023. This dominance is attributed to the consistent demand for consumables and the ongoing R&D investments by biotechnology and biopharmaceutical companies, particularly in the development of advanced biologics like monoclonal antibodies and vaccines. The demand for consumables is projected to remain robust throughout the forecast period, with reagents, media, and sera being the primary subcategories. Among these, media holds the largest market share within the consumables segment.

On the other hand, the instruments segment is expected to witness significant growth at a promising CAGR during the forecast period. These instruments find applications in diverse areas such as vaccination, cancer research, drug screening and development, recombinant products, toxicity testing, stem cell technology, regenerative therapies, and other sectors served by end-users including industrial, biotechnology, and agriculture. Notably, FUJIFILM Corporation made a substantial investment of USD 1.6 billion in June 2022 to expand and enhance its cell culture manufacturing services, signaling further potential for growth in this segment. This investment is poised to bolster FUJIFILM's facilities in Denmark and Texas, underlining the company's commitment to meeting the evolving needs of the market.

The market is divided by application into several segments, including biopharmaceutical production, drug development, diagnostics, tissue culture and engineering, cell and gene therapy, toxicity testing, and other applications. In 2023, the biopharmaceutical production segment dominated the market with a 32% revenue share and is projected to experience the fastest growth rate throughout the forecast period. Mammalian cell cultures are predominantly utilized in biopharmaceutical production, driven by the escalating demand for genetically enhanced drugs and unconventional therapeutic options. Consequently, there's a surge in the demand for various cell culture consumables, particularly media.

The diagnostics segment is poised for significant growth with a notable CAGR over the forecast period. Cell cultures find application in metabolomics for identifying biomarkers associated with pathological conditions. Moreover, they enable the identification of metabolic pathways leading to the production of such biomarkers, aiding in the diagnosis of underlying metabolic disorders. Additionally, metabolites play a pivotal role in cancer diagnosis and recurrence detection, expanding the application spectrum for cell culture products and driving market growth.

By Product

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others