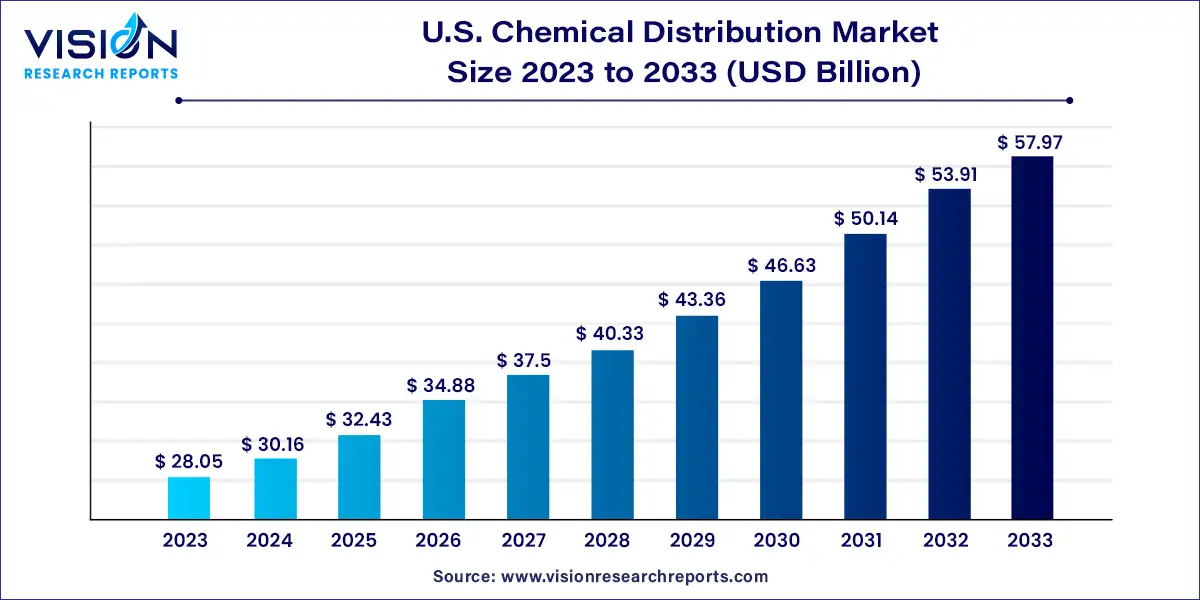

The U.S. chemical distribution market size was estimated at around USD 28.05 billion in 2023 and it is projected to hit around USD 57.97 billion by 2033, growing at a CAGR of 7.53% from 2024 to 2033.

The U.S. chemical distribution market plays a crucial role in the supply chain of various industries, providing essential raw materials and chemicals needed for production processes. This market encompasses a wide range of chemicals, including specialty chemicals, bulk chemicals, and raw materials, distributed to industries such as agriculture, pharmaceuticals, food and beverages, and manufacturing. The chemical distribution sector ensures the timely and efficient delivery of these products, enabling businesses to maintain uninterrupted operations.

The growth of the U.S. chemical distribution market is primarily driven by an increasing demand from various end-user industries, including agriculture, pharmaceuticals, and manufacturing. These industries rely heavily on a consistent supply of specialty and bulk chemicals for their production processes. Additionally, advancements in distribution logistics, such as the implementation of automation and real-time tracking systems, have enhanced the efficiency and reliability of chemical delivery. Stringent regulatory requirements also necessitate specialized distribution services that ensure safe handling and compliance, further boosting market demand. As a result, chemical distributors that can navigate these regulatory landscapes and adopt cutting-edge technologies are well-positioned to capitalize on the growing market opportunities.

In 2023, the commodity segment led the market, holding the largest share at 70%. The growing use of chemicals in plastics, polymers, and petrochemical industries has fueled the expansion of the commodity chemicals market. Commodity chemicals, also known as bulk chemicals, are essential for large-scale manufacturing of other chemicals. They are broadly categorized into organic and inorganic chemicals. Inorganic chemicals include soda ash, chlorine, caustic soda, carbon black, and calcium carbonate. Organic chemicals include methanol, acetic acid, and formaldehyde, among others.

Within the commodity chemical market, petrochemicals held the largest share due to their extensive use in producing downstream derivatives like plastic resins, man-made fibers, dyes and pigments, synthetic rubber, and surfactants. Petrol serves as the primary fuel and feedstock for petrochemicals.

Specialty chemicals also held a significant market share in 2023, attributed to their ability to enhance manufacturing processes and product performance. These chemicals are tailored to meet specific services and consumer needs. However, their availability can be limited by patents, with only a few manufacturers producing them.

The CASE segment (Coatings, Adhesives, Sealants, and Elastomers) had the highest revenue share within the specialty chemicals market in 2023. This is due to its role in improving the performance and durability of building materials like concrete and steel in commercial and industrial applications. The rising demand for specialty adhesives, coatings, and other materials in high-performance sectors such as construction, automotive, and paints is expected to drive the CASE segment and, consequently, the specialty chemicals market.

In the commodity chemical segment, the downstream category held the largest market share at 38% in 2023. This growth is driven by the use of downstream chemicals in producing petrochemical products like petrol, kerosene, jet fuel, diesel oils, lubricants, waxes, and asphalt, which are directly utilized in various heavy manufacturing industries such as automotive, aviation, steel, and shipping. The demand for petrochemicals is anticipated to rise due to the significant growth in these end-user industries, thereby boosting the downstream chemicals market.

Additionally, the automotive and transportation segment within the commodity chemicals market also held a notable share in 2023. In this industry, commodity chemicals are essential raw materials for manufacturing automobile parts, such as HVAC systems and basic building blocks, contributing to the segment's growth.

Conversely, within the specialty chemicals market, the construction segment accounted for the largest share at 32% in 2023. Specialty chemicals are used to enhance the aesthetic appeal of buildings, and the demand for these chemicals is directly linked to the global growth of construction activities.

Furthermore, the industrial manufacturing segment within specialty chemicals also held a significant market share in 2023. The favorable physicochemical properties of specialty chemicals have increased their demand in lubricants and oil additives, which are crucial for various industries, including rubber processing, metalworking, oil fields, and pulp and paper.

By Product

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Chemical Distribution Market

5.1. COVID-19 Landscape: U.S. Chemical Distribution Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Chemical Distribution Market, By Product

8.1. U.S. Chemical Distribution Market, by Product, 2024-2033

8.1.1. Specialty Chemicals

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Commodity Chemicals

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Chemical Distribution Market, By End-use

9.1. U.S. Chemical Distribution Market, by End-use, 2024-2033

9.1.1. Specialty Chemicals

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Commodity Chemicals

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Chemical Distribution Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Univar Solutions Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Helm AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Brenntag AG

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Barentz

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Azelis

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Safic Alan

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Ashland

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Biesterfeld AG

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. ICC Industries, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others