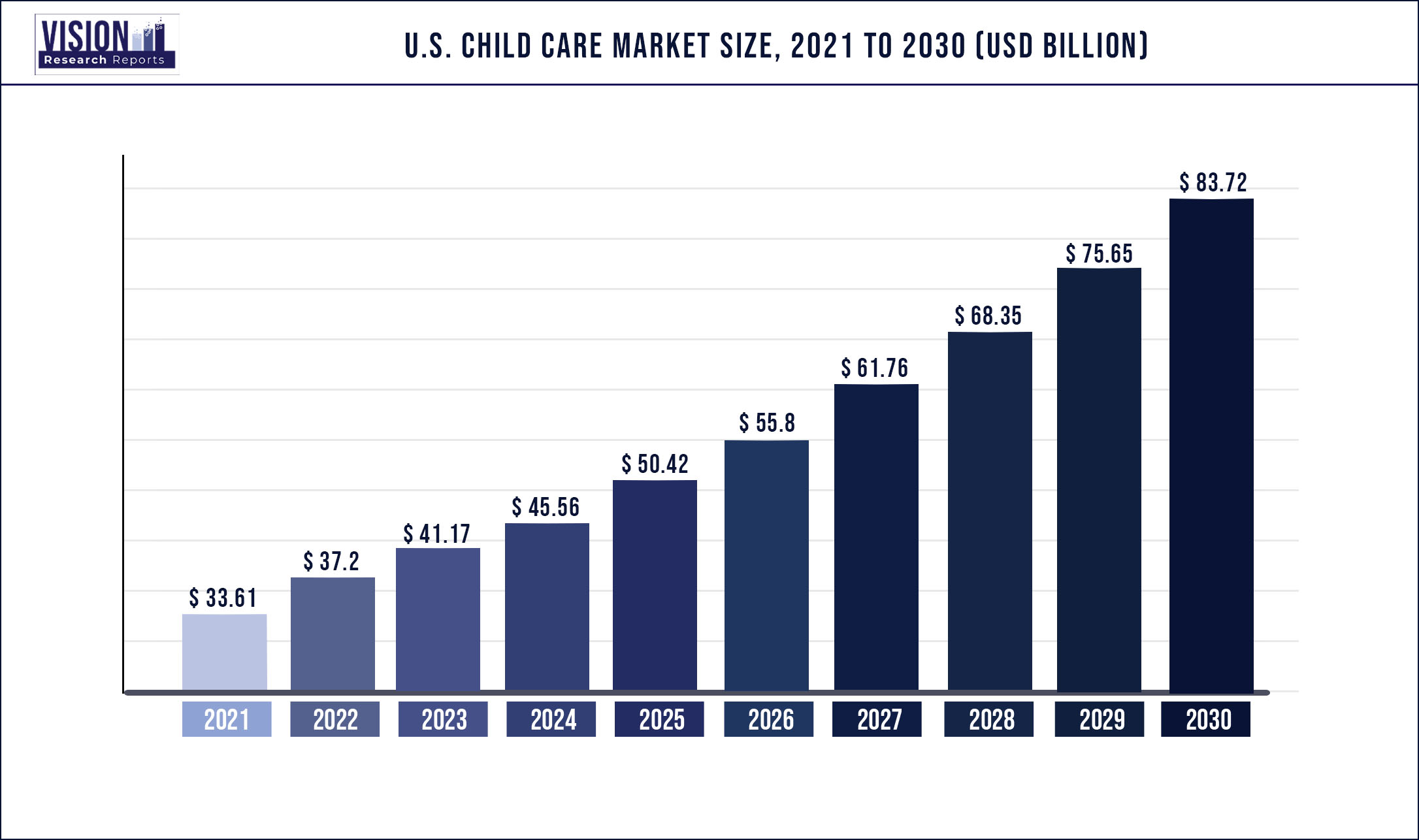

The U.S. child care market size was estimated at around USD 33.61 billion in 2021 and it is projected to hit around USD 83.72 billion by 2030, growing at a CAGR of 10.67% from 2022 to 2030.

The key factors driving the growth include an increase in awareness regarding early education, high demand for early education centers, and an increase in the number of working parents. In addition, the advancement in learning technologies for children is resulting in further growth opportunities.

Public awareness campaigns and government programs have increased awareness about child education & development in the U.S. The National Center for Healthy Safe Children is spreading awareness regarding the development of the child & need for developing skills at an early age. Factors such as the growing disposable income in the U.S. and the interest of parents to give top-quality care & early education to their children are also resulting in higher demand for early education centers.

However, the affordability of early education services in the U.S. is a huge concern. 63% of full-time working parents are finding it difficult to afford the services. 1 in 3 American families is struggling to pay for early attention and education services. Hence the high cost of services is negatively impacting the market. The quality of services is another challenge According to the National Institute of child health and human development, only 10% of the child care services available are of high quality.

The COVID-19 pandemic resulted in the closure of facilities temporarily due to restrictions by the government. The services resumed shortly, despite the risk of infection involved. This resulted in higher operating costs for the service providers. A 47% increase in operations cost was observed as per the report by the Center for American Progress. The cost of home-based services witnessed a 70% rise since the pandemic. The high cost of service has negatively impacted the market, worsening the affordability issues.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 33.61 billion |

| Revenue Forecast by 2030 | USD 83.72 billion |

| Growth rate from 2022 to 2030 | CAGR of 10.67% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, delivery type |

| Companies Covered |

Bright Horizons Family Solutions, Inc.; KinderCare Education; Primrose Schools; Learning Care Group, Inc.; Spring Education Group; Cadence Education; The Learning Experience; Childcare Network; Kids ‘R’ Learning Academies; Goddard Systems |

Type Insights

The early education & daycare segment dominated the market in 2021, attributed to the development of advanced learning techniques for children. Starfall is one of the top learning tools for children. The tool is based on the latest technology enabling the children to learn languages, art, and math among others through activities and games. The new learning software are transforming the segment. In addition, the government is supporting to children to have access to proper learning tools & daycare services. For Instance, the department of early education and care, Massachusetts provide grants for center-based early education service.

The backup care segment is expected to witness lucrative growth over the forecast period. Backup care is usually a benefit given to employers in applicable situations wherein a regular child attention service plan is disrupted. There are two types of backup services, in-home & in-center services. There increasing no of working single parents is driving growth for the segment.

The COVID-19 pandemic resulted in employers providing more benefits to employees. In some of the states in the U.S., the state government has laws requiring employers to provide backup service benefits. For Instance, in March 2021, the California state government proposed a new bill making it mandatory for employers to facilitate subsidized backup care service benefits to their employees, thus boosting the growth opportunities for the segment in the region.

The early care segment is expected to have lucrative growth during the forecast period. There are 19.7 billion children below age 4 in the U.S. These children require extreme attention; hence daycare centers are in high demand for these children. The federal government is focusing on enhancing infant daycare services in the U.S. The child care and development Fund (CCDF) provides subsidies to assist low-income families.

Furthermore, the cost of early care service is influencing the opportunities for the segment. The Southern States in the U.S. have lower costs of infant daycare services. South Carolina has the lowest cost of USD 584 per month. The affordable cost and high single-parent population in the Southern States are boosting the segment’s growth opportunities. However, the Northern States have a high cost of early care services. Massachusetts has the highest early care services costs, wherein the cost of the service is USD 1,666.67 per month, nearly double compared to southern states. The high cost & scarcity of service providers in the northern region restrict growth opportunities.

Delivery Type Insights

The organized care facilities segment accounted for the highest revenue share of the U.S. child care market in 2021. The segment is expected to witness the highest growth rate during the forecast period. The rising number of working parents, technological advancements, and growing funding for supporting quality early education are some of the key factors expected to drive the growth of the segment.

Organized childcare services include the larger, center-based licensed daycare services. Organized settings have better facilities, learning equipment, and caregivers. These settings are managed professionally and offer programs tailor-made for the child, thus resulting in parents preferring the services over home-based daycare. Governments across the states are supporting organized child care.

In South Carolina, the state government facilitates a voucher program, to make the services affordable for families. Over 1500 child care providers accept the vouchers. The organizations facilitating daycare are collaborating to enable large-scale organized daycare. For Instance, The First Steps 4K, an organization facilitating early education for 4-year-old children collaborated with 200 non-profit daycare centers for facilitating high-quality early education as per the requirements of the child.

The home-based settings are expected to have lucrative growth during the forecast period. According to the U.S. department of health & human services, billions of families in the U.S. rely on home-based daycare (HBCC). Home-based caregivers supervise a small group of children per day, which may vary depending on state & local regulations and the caregiver's personal preferences.

For instance, In Georgia, the state government has limited the no of children in a home-based setting to 12 children under 13, each 35 sq ft. The small private residential home daycare can facilitate care for only 3-6 children at a time. Home care services are beneficial as they enable better management of child routine & care by having a smaller group of children at a time. Home-based service providers allow the optimization of motor skills development in the child. These benefits are boosting demand for child care in the segment.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Child Care Market

5.1. COVID-19 Landscape: U.S. Child Care Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Child Care Market, By Type

8.1. U.S. Child Care Market, by Type, 2022-2030

8.1.1. Early Care

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Early Education & Daycare

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Backup Care

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. U.S. Child Care Market, By Delivery Type

9.1. U.S. Child Care Market, by Delivery Type, 2022-2030

9.1.1. Organized Care Facilities

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Home-based Settings

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. U.S. Child Care Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Type (2017-2030)

10.1.2. Market Revenue and Forecast, by Delivery Type (2017-2030)

Chapter 11. Company Profiles

11.1. Bright Horizons Family Solutions, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. KinderCare Education

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Primrose Schools

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Learning Care Group, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Spring Education Group.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Cadence Education

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. The Learning Experience

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Childcare Network

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Kids ‘R’ Learning Academies

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Goddard Systems

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others