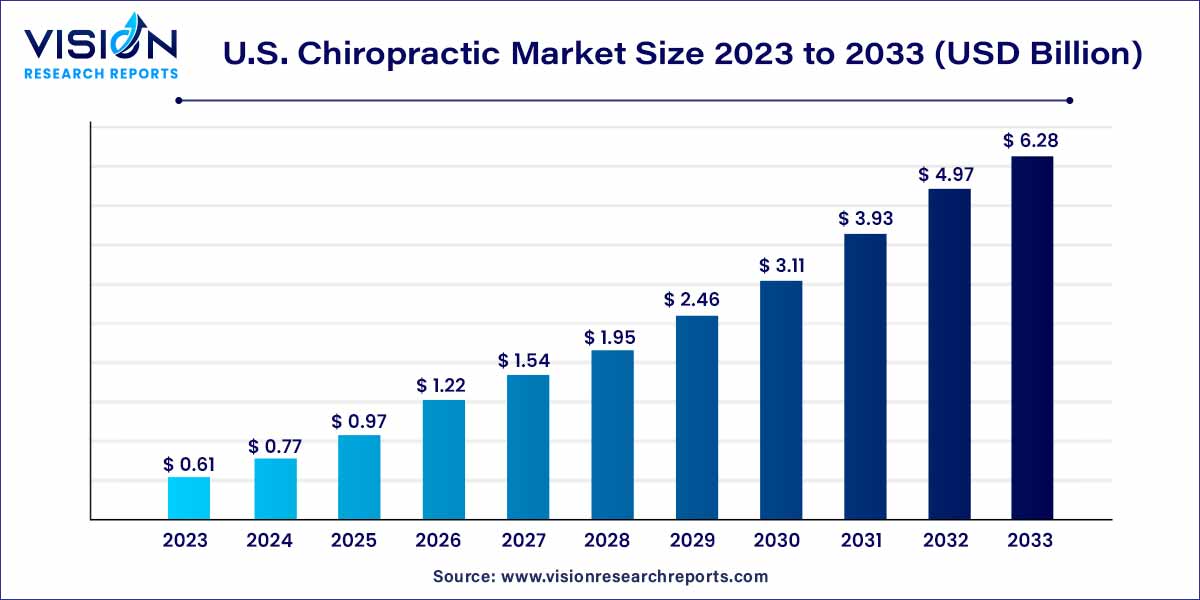

The U.S. chiropractic market size was estimated at around USD 0.61 billion in 2023 and it is projected to hit around USD 6.28 billion by 2033, growing at a CAGR of 26.33% from 2024 to 2033.

The growth of the U.S. chiropractic market can be attributed to a confluence of factors propelling its expansion. Firstly, an increasing awareness of the limitations and potential side effects of conventional medical treatments has spurred a demand for alternative, non-invasive healthcare solutions. Chiropractic care, with its focus on natural healing and wellness, aligns with this shifting consumer preference. Additionally, a rising aging population, coupled with a surge in musculoskeletal issues, has driven the need for holistic approaches to pain management, where chiropractic interventions excel. Furthermore, the mainstream integration of chiropractic services within broader healthcare models has expanded access, fostering a more inclusive patient demographic. As health consciousness grows, individuals are proactively seeking preventive measures, positioning chiropractic care as a proactive and personalized approach to well-being. These converging factors create a fertile ground for sustained growth in the U.S. chiropractic market, marking it as a pivotal player in the evolving healthcare landscape.

| Report Coverage | Details |

| Growth rate from 2024 to 2033 | CAGR of 26.33% |

| Market Size in 2023 | USD 0.61 billion |

| Revenue Forecast by 2033 | USD 6.28 billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The clinic segment accounted for the largest revenue share of around 46% in 2023. In comparison to wellness centers, chiropractic clinics have grown significantly. They provide specialized treatments for musculoskeletal diseases, especially those connected to spine-related diagnosis, treatment, and prevention. Patients are seeking out these clinics due to growing public knowledge of the advantages of chiropractic treatment. Additionally, the ease of direct access flexible scheduling, and the integration of chiropractic care with conventional healthcare systems, all contribute to their expansion.

However, wellness centers, which provide a wider range of holistic treatments, are not necessarily on the decline because chiropractic clinics are growing. In the U.S., there are approximately 95,438 licensed chiropractic businesses. Among the states, California and Florida have the highest number of chiropractor clinics, with each state having over 10,000 establishments offering chiropractic services. Chiropractic care is a popular form of complementary and alternative medicine, and these clinics cater to a diverse range of patients seeking relief from musculoskeletal issues and improve overall well-being.

The franchise segment is expected to expand at the fastest CAGR of 28.53% over the forecast period in the U.S. chiropractic market. The franchise segment offers a tested business structure that enables chiropractors to launch their practices with the backing of a well-known name. Franchises with a proven track record get more clients due to their credibility and reputation, accelerating segment growth.

Franchise systems support marketing and advertising, providing efficient service promotion both locally and nationally. The reputation of the clinics is improved through training programs that keep the level of services uniform across all franchise sites. Chiropractic professionals open new clinics at a faster pace due to the expansion strategies of franchise systems and financial aid availability.

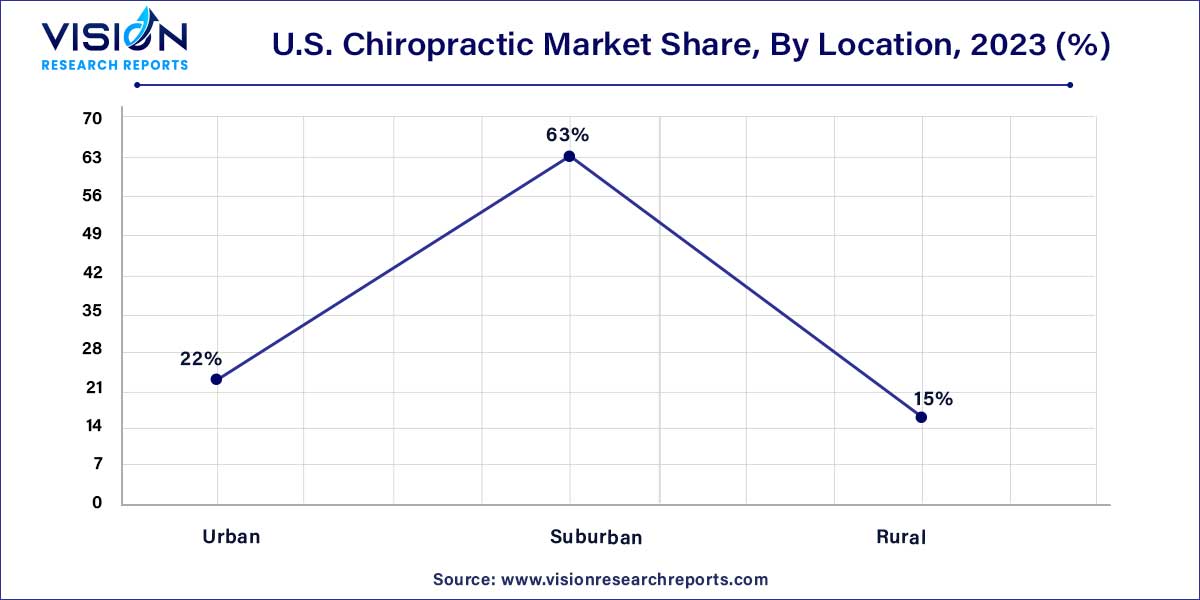

The suburban segment dominated the market with largest revenue share of around 63% in 2023. Chiropractic care has grown more rapidly in the U.S. suburbs than urban regions. The suburban population, frequently made up of families and people with established lives, show a larger propensity for holistic medical treatments.

In suburban locations, where space is more readily available, chiropractors can open larger clinics with plenty of parking, which might be difficult in highly populated metropolitan settings. In addition, the strong sense of community and close-knit relationships that may be found in suburban neighborhoods contribute significantly to the expansion of chiropractic clinics through word-of-mouth referrals and recommendations.

The rural segment is expected to grow at the fastest CAGR of 27.28% during the forecast period. The segment is projected to witness a significant increase in healthcare expenditure. The availability of limited healthcare facilities and the need for non-invasive treatments are the key factors driving market growth in this segment. In addition, chiropractic care is more affordable than other types of healthcare, which appeals to people with limited financial resources.

According to the U.S. Bureau of Labor Statistics, the average cost of a chiropractic visit in the U.S. is relatively affordable at USD 65, making it an attractive option for people seeking healthcare services. This lower cost compared to other medical procedures allows individuals to access chiropractic care more easily, leading to its popularity as a preferred choice for managing musculoskeletal issues and promoting overall health and wellness.

By Designation

By Location

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Chiropractic Market

5.1. COVID-19 Landscape: U.S. Chiropractic Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Chiropractic Market, By Designation

8.1. U.S. Chiropractic Market, by Designation, 2024-2033

8.1.1. Clinic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Wellness Center

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Rehab Center

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Franchise

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Chiropractic Market, By Location

9.1. U.S. Chiropractic Market, by Location, 2024-2033

9.1.1. Urban

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Suburban

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Rural

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Chiropractic Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Designation (2021-2033)

10.1.2. Market Revenue and Forecast, by Location (2021-2033)

Chapter 11. Company Profiles

11.1. Magen David Community Center, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. The Joint Corp.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Lbi Starbucks DC 3

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Allied Health of Wisconsin, S.C.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Sherman College of Chiropractic

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Chiropractic Strategies Group, Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Landmark Healthcare Services, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Parsons Gregory V Advanced Chiropractic Clinic

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Silverman Chiropractic Center, DC PCA

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Emergency Chiropractic

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others