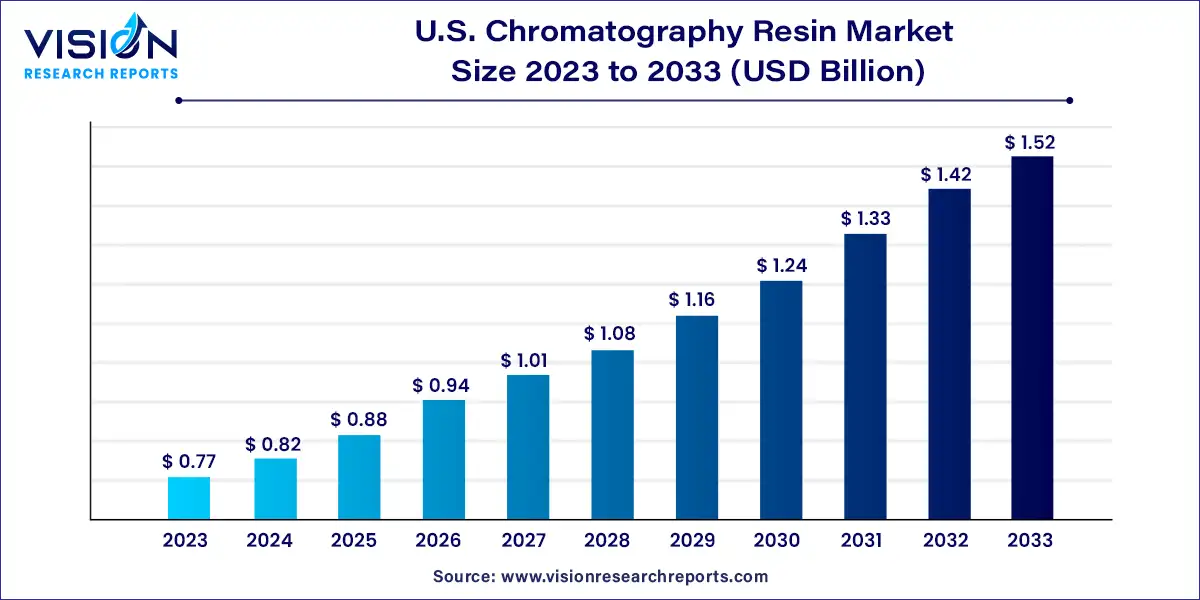

The U.S. chromatography resin market was valued at USD 0.77 billion in 2023 and it is predicted to surpass around USD 1.52 billion by 2033 with a CAGR of 7.03% from 2024 to 2033.

The U.S. chromatography resin market is experiencing robust growth driven by advancements in biopharmaceutical research and increasing demand for high-quality chromatography resins. Chromatography resins play a crucial role in separating and purifying biomolecules and are extensively used in pharmaceutical, biotechnology, food and beverage, and research sectors.

The growth of the U.S. chromatography resin market is driven by an advancements in biopharmaceutical research have increased the demand for efficient purification methods, where chromatography resins play a vital role in achieving high purity and yield. Technological innovations in resin chemistry and matrices further enhance the efficiency and scalability of chromatography processes. Additionally, rising applications in therapeutic protein production and monoclonal antibodies contribute significantly to market expansion. Moreover, stringent regulatory standards governing drug purity and safety propel the adoption of chromatography resins that ensure compliance. The market's future growth is anticipated through continued R&D investments aimed at developing advanced resin technologies to meet evolving industry needs.

In 2023, the natural type dominated the market, holding a significant revenue share of 53%. This growth is driven by its extensive application in size exclusion chromatography and paper chromatography across various industries. Increased spending in healthcare and rising demand from the food and beverage sector are key factors propelling the natural resin market. Moreover, government investments in research and development to enhance chromatography resin efficiency are expected to further boost demand for natural resin across diverse applications.

The synthetic segment also captured a substantial market share in 2023, largely due to its widespread adoption as a substitute for natural resin to enhance production levels. Recent advancements in synthetic resin manufacturing are anticipated to significantly increase the market share of the synthetic resin segment in the coming years.

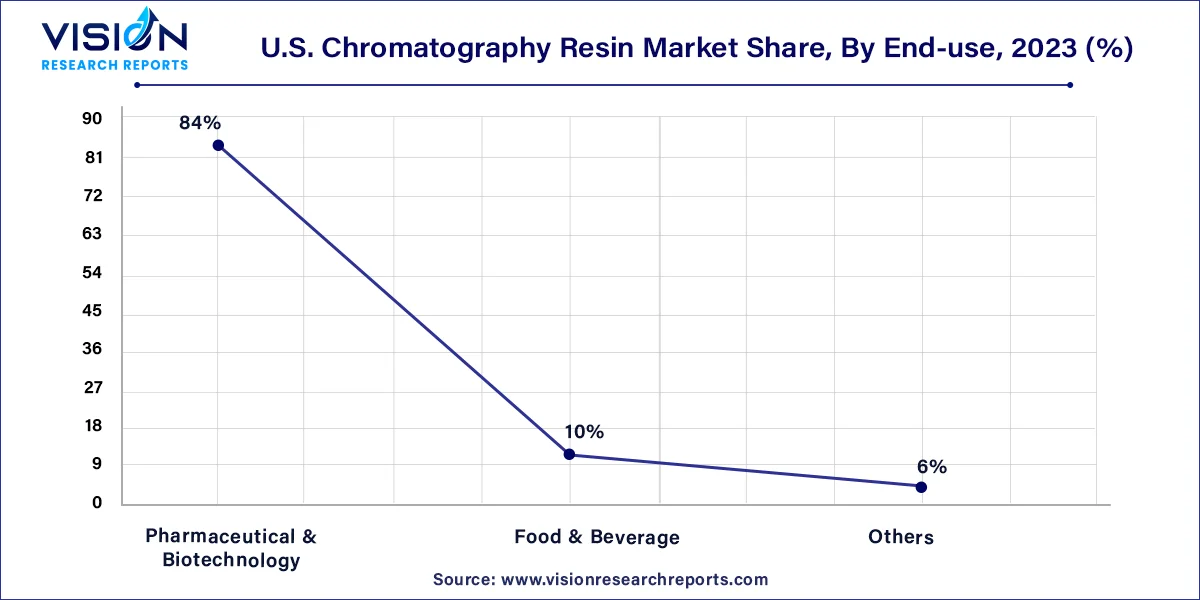

The pharmaceutical & biotechnology sector dominated the market in 2023, accounting for 84% of the revenue share. This growth is driven by the extensive use of chromatography resin in pharmaceutical processes for producing highly pure materials in bulk and inspecting purified substances for impurities. Additionally, the increasing application of monoclonal antibodies in critical therapeutic areas such as cancer and autoimmune disorders is expected to drive demand for chromatography resin.

The food and beverage sector also experienced notable growth in 2023, driven by increasing consumer awareness about food product quality and safety regulations. This trend is prompting food producers to adhere strictly to guidelines set by regulatory bodies, thereby propelling market growth in this segment.

In 2023, the Ion exchange technique dominated the market with a revenue share of 43%. The growth in Contract Research Organizations (CRO) and Contract Manufacturing Organizations (CMO) is expected to drive demand for ion exchange chromatography resin. Furthermore, the increasing use of monoclonal antibodies is a significant factor contributing to market expansion.

The affinity segment also held a considerable market share in 2023, driven by high demand for protein and nucleic acid purification processes. Affinity resin is predominantly used in the biotechnology industry to meet the growing demand for chromatography resin, particularly in therapeutic applications involving monoclonal antibodies.

Additionally, the size exclusion segment witnessed significant growth in 2023, driven by its expanding applications in biochemical processes and polymer synthesis. Size exclusion chromatography (SEC) resin, utilized in pharmaceuticals for purifying and analyzing biological and synthetic polymers like polysaccharides and nucleic acids, contributed to this growth.

By Type

By End-use

By Technique

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Chromatography Resin Market

5.1. COVID-19 Landscape: U.S. Chromatography Resin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Chromatography Resin Market, By Type

8.1. U.S. Chromatography Resin Market, by Type, 2024-2033

8.1.1 Natural

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Inorganic Media

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Chromatography Resin Market, By End-use

9.1. U.S. Chromatography Resin Market, by End-use, 2024-2033

9.1.1. Pharmaceutical & Biotechnology

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food & Beverage

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Chromatography Resin Market, By Technique

10.1. U.S. Chromatography Resin Market, by Technique, 2024-2033

10.1.1. Ion Exchange

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Affinity

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Hydrophobic Interaction

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Size Exclusion

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Others

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Chromatography Resin Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Type (2021-2033)

11.1.2. Market Revenue and Forecast, by End-use (2021-2033)

11.1.3. Market Revenue and Forecast, by Technique (2021-2033)

Chapter 12. Company Profiles

12.1. Bio-Rad Laboratories, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. GE Healthcare.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. W. R. Grace & Co.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Danaher Corporation.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. THERMO FISHER SCIENTIFIC INC.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Purolite Corporation

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. PerkinElmer Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Agilent Technologies

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Pall Corporation.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others