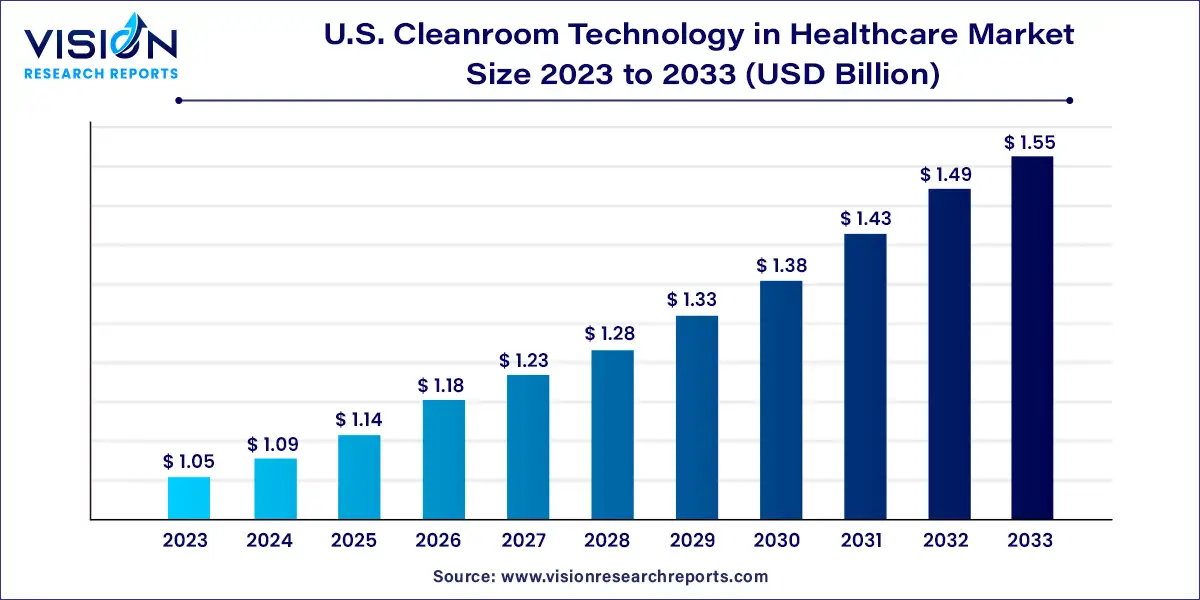

The U.S. cleanroom technology in healthcare market size was estimated at USD 1.05 billion in 2023 and it is expected to surpass around USD 1.55 billion by 2033, poised to grow at a CAGR of 3.98% from 2024 to 2033.

The U.S. cleanroom technology market in healthcare is experiencing significant growth driven by increasing demand for contamination-free environments in pharmaceutical production, biotechnology research, and medical device manufacturing. This expansion is fueled by stringent regulatory standards, the rise in chronic diseases necessitating advanced healthcare solutions, and the burgeoning biopharmaceutical sector. Innovations in cleanroom technology, such as improved air filtration systems, modular cleanrooms, and automation, are enhancing operational efficiency and safety.

The growth of the U.S. cleanroom technology market in healthcare is driven by the stringent regulatory requirements for maintaining sterile environments in pharmaceutical manufacturing and medical device production propel the adoption of advanced cleanroom technologies. Secondly, the increasing prevalence of chronic diseases necessitates precise and contamination-free environments for research, development, and production of biopharmaceuticals and medical equipment. Thirdly, advancements in cleanroom technology, including enhanced air filtration systems, modular cleanroom designs, and automation, are improving operational efficiencies and reducing the risk of contamination. Lastly, growing investments in healthcare infrastructure and rising awareness among healthcare providers about the importance of infection control and quality assurance further support market growth.

Consumables dominated the market, accounting for over 51% of revenue in 2023. This significant share is driven by the frequent usage of items like gloves, wipes, disinfectants, and other cleaning products, which are sold in large volumes. Cleanroom technology mandates the use of consumables to minimize contamination and infections, thereby boosting demand for such products. For instance, Berry Global Inc. introduced a new line of sustainable professional wipe materials in July 2023, including Spunlace, SMS, Scrubby, and Spunbound varieties.

The equipment sector is expected to exhibit the highest CAGR from 2024 to 2033, fueled by increasing regulatory requirements, research and development activities, demand for sterile products, and technological advancements. In October 2023, Sensata Technologies, Inc. launched a new UL-certified leak detection sensor capable of detecting multiple A2L refrigerant gases used in HVAC equipment.

The pharmaceutical industry held the largest revenue share in 2023, driven by stringent regulations and advancements in pharmaceutical research and development. Technological innovations in cleanroom equipment, such as modular cleanrooms, isolators, and automated monitoring systems, have facilitated efficient maintenance of controlled environments. For instance, Alpha Teknova, Inc. inaugurated a new modular manufacturing facility in Hollister, California, in August 2023. This facility features ISO-certified cleanrooms compliant with GMP standards, tripling manufacturing capacity for life sciences reagents.

The biotechnology sector is poised to achieve the highest CAGR from 2024 to 2033, supported by heightened focus on contamination control, process efficiency, increased R&D initiatives, and technological advancements. Stringent regulatory frameworks from agencies like the FDA and EPA mandate cleanroom compliance to uphold Good Manufacturing Practices (GMP) and ensure the safety and quality of biotechnological products.

By Product

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Cleanroom Technology in Healthcare Market

5.1. COVID-19 Landscape: U.S. Cleanroom Technology in Healthcare Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Cleanroom Technology in Healthcare Market, By Product

8.1. U.S. Cleanroom Technology in Healthcare Market, by Product, 2024-2033

8.1.1. Equipment

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Consumables

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Cleanroom Technology in Healthcare Market, By End-use

9.1. U.S. Cleanroom Technology in Healthcare Market, by End-use, 2024-2033

9.1.1. Pharmaceutical industry

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Medical device industry

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Biotechnology industry

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Hospitals and diagnostic centers

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Cleanroom Technology in Healthcare Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Terra Universal. Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Clean Air Technology, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kimberley-Clark Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DuPont

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Labconco

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Clean Room Depot

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ICLEAN Technologies

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Abtech

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Berkshire Corporation

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Texwipe

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others