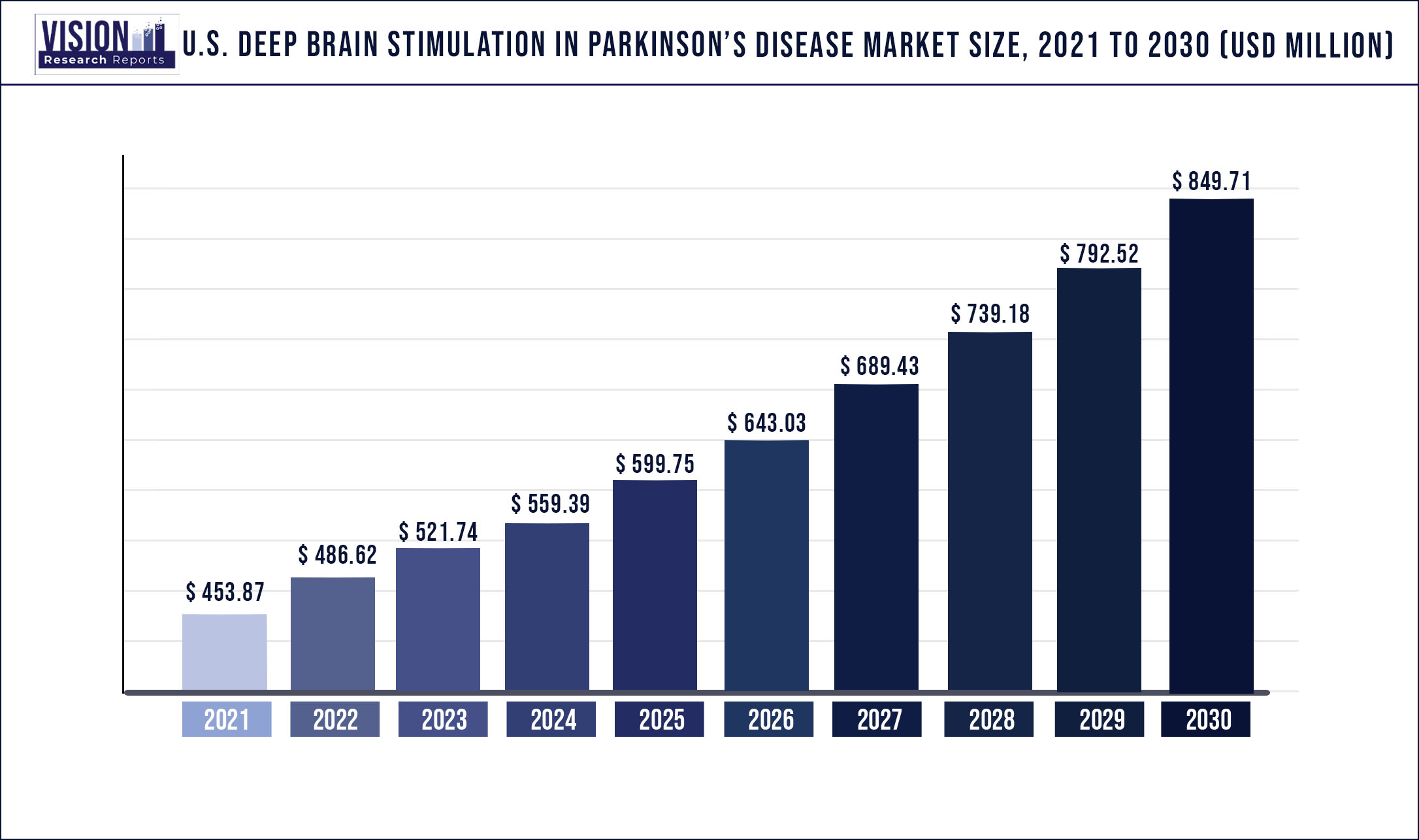

The U.S. deep brain stimulation in Parkinson’s disease market was estimated at USD 453.87 million in 2021 and it is expected to surpass around USD 849.71 million by 2030, poised to grow at a CAGR of 7.22% from 2022 to 2030.

Report Highlights

The rising prevalence of neurological conditions, such as Parkinson’s Disease (PD), increasing awareness, positive research outcomes, and growing investments in the development of transcranial stimulators are among the major factors driving the overall U.S DBS devices market.

DBS devices have been observed to be greatly effective in controlling the tremors associated with PD. They provide electrical stimulation to the basal ganglia, which results in suppressed neuronal activity that is generally spontaneous in patients suffering from PD. Low dopamine levels and other genetic factors are the main causes of PD. According to the Parkinson’s Foundation, about 1 million people are expected to be living with PD in the U.S. by 2020. Men are more susceptible to this disease than women.

Increasing investments for conducting R&D on PD have helped in raising awareness and boosting the development of new and innovative products and therapies for the treatment of this disease. For instance, the National Parkinson Foundation (NPF) provides funds to researchers and scientists with an aim to make advancements in this field. Extensive research activities for the inclusion and approval of deep brain stimulators in new application areas, such as full-body MRI scans and depression, are anticipated to boost the market growth over the forecast period. The DBS procedure price in the U.S. is around USD 96,000. It is expensive as compared with the cost of DBS procedures in countries such as the U.K. and Japan.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 453.87 million |

| Revenue Forecast by 2030 | USD 849.71 million |

| Growth rate from 2022 to 2030 | CAGR of 7.22% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product |

| Companies Covered | Boston Scientific Corporation; Abbott; Medtronic; Functional Neuromodulation; Nuvectra Corporation; Aleva Neurotherapeutics SA |

Product Insights

The dual-channel led the market and accounted for more than 55.0% share in 2021. High-frequency DBS has become a widely utilized procedure for the management of severe momentum disorders when the symptoms can no longer be improved by medical treatment. The procedure is safe, bilateral, and reversible. It can be performed by bilateral implantation of leads into the target areas. Growing adoption of double-channel DBS for the treatment of numerous neurological disorders, such as Parkinson’s disease, dystonia, Alzheimer’s disease, and epilepsy, is a key factor fueling segment growth.

Moreover, technological advancements and new product launches are further impelling segment growth. For instance, in January 2020, Abbott’s Infinity DBS system secured FDA approval for the treatment of Parkinson's disease from the U.S. FDA. This system will allow targeting of a specific area of the brain called internal Globus Pallidus (GPi), which is associated with Parkinson's disease symptoms. In addition, Vercise, Vercise PC, & Vercise Gevia DBS systems by Boston Scientific; Activa PC & Activa RC by Medtronic; and Infinity by Abbott are some of the key offerings under the segment.

The single-channel segment is anticipated to witness the fastest growth over the forecast period. A Deep Brain Stimulator (DBS) device is also known as brain pacemaker and has been clinically used over the past 25 years for the treatment of Parkinson's disease. The single-channel DBS systems are used for patients who have only one lead implanted. Healthcare professionals consider that a single channel offers the neurologist more programming options and provides better motor results, which led to the increased preference for single-channel DBS.

A rise in the geriatric population, which is more prone to developing Parkinson’s disease, and growing awareness about neurological movement disorders among patients are anticipated to impel the growth of the segment. For instance, as per the World Ageing 2019 report, it is estimated that globally, there were about 703 million people aged 65 years in 2019. Furthermore, in March 2018, the Brain & Spine Foundation (BSF) and Neurological Alliance launched “Brain Awareness Week,” a global campaign to increase awareness about progress in diagnosis, treatment, and prevention of neurological conditions. One of the key products offered under this segment is Activa SC, which is a single-channel DBS offered by Medtronic. Activa SC controls one-DBS electrode, which has been approved for the treatment of Parkinson’s disease.

Key Players

Market Segmentation

Product Outlook

Chapter 1.Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on U.S. Deep Brain Stimulation In Parkinson’s Disease Market

5.1.COVID-19 Landscape: U.S. Deep Brain Stimulation In Parkinson’s Disease Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global U.S. Deep Brain Stimulation In Parkinson’s Disease Market, By Product

8.1.U.S. Deep Brain Stimulation In Parkinson’s Disease Market, by Product Type, 2020-2027

8.1.1.Single-channel

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2.Dual-channel

8.1.2.1.Market Revenue and Forecast (2016-2027)

Chapter 9.Global U.S. Deep Brain Stimulation In Parkinson’s Disease Market, Regional Estimates and Trend Forecast

9.1.U.S.

9.1.1.Market Revenue and Forecast, by Product (2016-2027)

Chapter 10.Company Profiles

10.1.Boston Scientific Corporation

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Abbott

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Medtronic

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Functional Neuromodulation

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Nuvectra Corporation

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Aleva Neurotherapeutics SA

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others