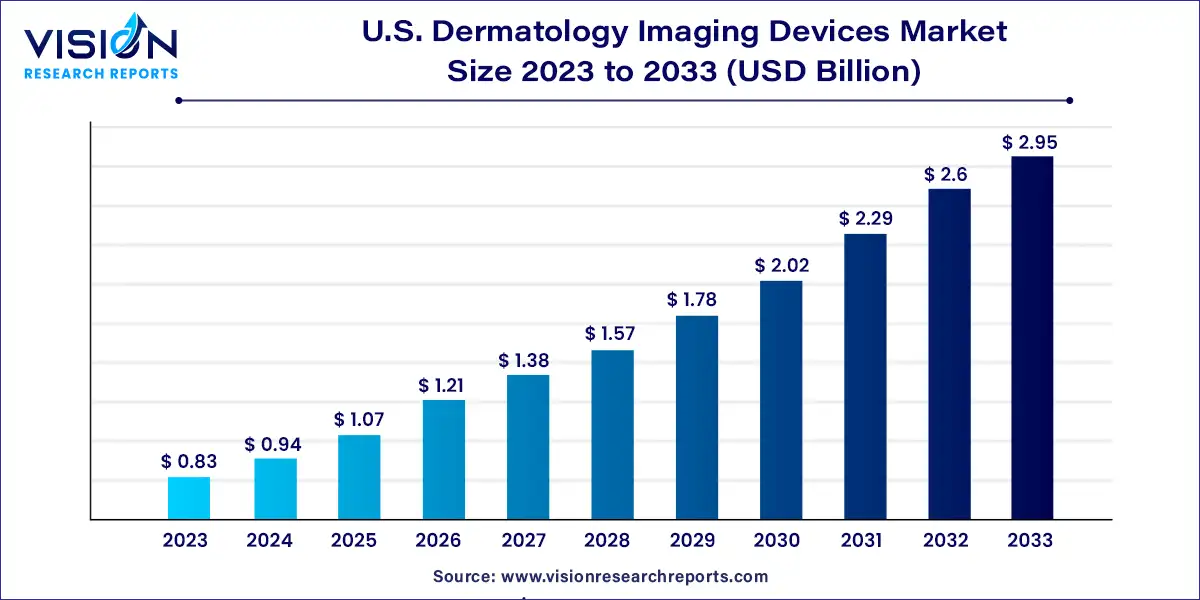

The U.S. dermatology imaging devices market size was estimated at around USD 0.83 billion in 2023 and it is projected to hit around USD 2.95 billion by 2033, growing at a CAGR of 13.53% from 2024 to 2033. The U.S. dermatology imaging devices market is a rapidly growing sector within the medical imaging industry. These devices are used for the diagnosis, monitoring, and treatment of various skin conditions, including melanoma, psoriasis, and eczema. The rising prevalence of skin disorders, coupled with advancements in imaging technology, is driving the growth of this market.

The U.S. dermatology imaging devices market is experiencing significant growth driven by the rising incidence of skin cancer, particularly melanoma, is driving the demand for advanced imaging solutions that facilitate early detection and improved treatment outcomes. Technological advancements in imaging devices, such as high-resolution digital dermatoscopes and confocal microscopes, are enhancing diagnostic accuracy and efficiency, further propelling market growth. Additionally, increased awareness about skin health and the importance of regular screenings, supported by public health initiatives, is boosting the adoption of dermatology imaging devices. The aging population, which is more prone to skin conditions, is also contributing to the market expansion. Together, these factors are fostering a robust growth environment for dermatology imaging devices in the U.S.

The U.S. dermatology imaging devices market is witnessing several key trends that are shaping its evolution. One significant trend is the integration of artificial intelligence (AI) and machine learning (ML) technologies into imaging devices, enhancing diagnostic capabilities and enabling more precise and efficient analysis of skin conditions. The market is also seeing a shift towards portable and user-friendly devices, making advanced dermatological imaging more accessible to a wider range of healthcare providers, including smaller clinics and dermatology practices.

Additionally, there is a growing emphasis on teledermatology, where imaging devices are used to facilitate remote consultations and diagnostics, a trend accelerated by the COVID-19 pandemic. Furthermore, increasing investment in research and development by key market players is leading to continuous innovation and the introduction of next-generation imaging solutions. These trends are collectively driving the advancement and adoption of dermatology imaging devices across the U.S.

The dermatoscope segment led the market with the largest revenue share of 42% in 2023. Dermatoscopes provide dermatologists with a magnified and illuminated view of skin lesions, enabling them to identify characteristic patterns and structures not visible to the naked eye. This enhanced visualization improves diagnostic accuracy, particularly in differentiating benign from malignant skin lesions, thus reducing the need for unnecessary biopsies. Continuous improvements in dermatoscope technology, such as higher resolution, better illumination, and integration with digital imaging, have further enhanced their diagnostic capabilities.

The digital photographic imaging market is growing at the fastest CAGR over the forecast period. This growth is attributed to the ease of availability of smartphones, which allow for capturing high-quality images of skin lesions, and handheld cameras that can produce high-resolution images documenting the patient's condition. The rise in skin cancer cases and the growing demand for non-invasive diagnostic procedures are also driving this segment's growth. Devices like MoleScope, FotoFinder, and Canfield VISIA, which provide high-resolution skin images, are widely used in the U.S. market, allowing dermatologists to identify and track changes in the skin over time.

The skin cancer segment led the market with the largest revenue share of 49% in 2023, driven by the higher prevalence and increased awareness of skin cancers. According to the American Cancer Society, skin cancers, primarily basal and squamous cell types, are the most prevalent forms of cancer in the U.S., with around 5.4 million cases diagnosed annually. The increasing incidence of skin cancer is expected to drive demand for dermatology imaging devices. Technological advancements, such as optical coherence tomography (OCT) and confocal microscopy, are transforming the diagnosis of skin disorders by providing high-resolution images of skin layers in a non-invasive manner.

The plastic and reconstructive surgery segment is anticipated to grow at a significant CAGR over the forecast period, driven by the rising demand for minimally invasive procedures and technological innovations in the field. As cosmetic surgeries continue to increase, there is a growing need for accurate imaging technologies to achieve optimal results. According to the American Society of Plastic Surgeons, the number of cosmetic and reconstructive procedures performed in the U.S. increased significantly in 2022, with a total of 26.2 million procedures, representing a 19% increase since 2019.

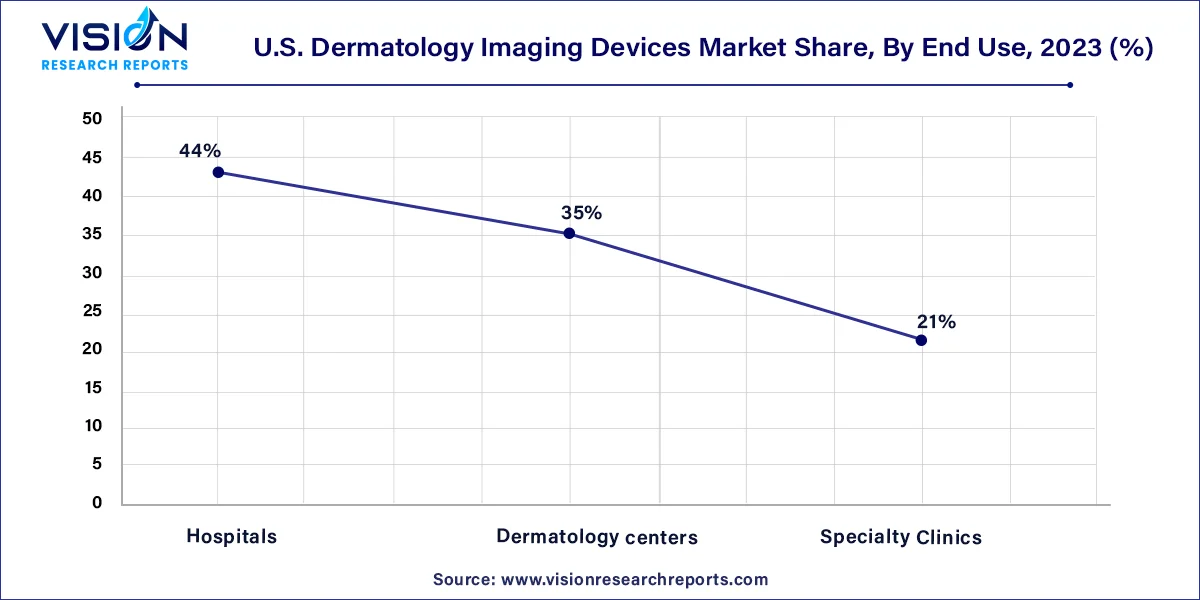

The hospital segment accounted for the largest revenue share of 44% in 2023. This is due to the widespread adoption of advanced dermatology imaging devices in hospitals, enabling dermatologists to accurately diagnose and effectively treat various skin conditions, including skin cancer. Hospitals employ highly trained and experienced dermatologists and imaging technicians, ensuring optimal utilization of these advanced technologies. They have the necessary infrastructure, resources, and expertise to provide comprehensive diagnosis, treatment, and follow-up care. For instance, the renewed collaboration between GE HealthCare and Hartford HealthCare in March 2024 is expected to strengthen the hospital segment, ensuring access to GE HealthCare's advanced dermatology imaging technologies and enhancing the quality of care provided to patients.

The dermatology centers segment is expected to experience significant growth during the forecast period. This growth can be attributed to the increasing popularity of dermatology centers among patients seeking specialized care for skin-related issues. These centers offer expertise and advanced imaging technologies, such as dermatoscopes and digital photographic imaging systems, which may not always be available in hospitals. These devices provide high-resolution images of the skin, enabling dermatologists to identify characteristic patterns and structures that are not visible to the naked eye.

By Modality

By Application

By End Use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Modality Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Dermatology Imaging Devices Market

5.1. COVID-19 Landscape: U.S. Dermatology Imaging Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Dermatology Imaging Devices Market, By Modality

8.1. U.S. Dermatology Imaging Devices Market, by Modality, 2024-2033

8.1.1 Digital Photographic Imaging

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Optical Coherence Tomography (OCT)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Dermatoscope

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. High Frequency Ultrasound

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Dermatology Imaging Devices Market, By Application

9.1. U.S. Dermatology Imaging Devices Market, by Application, 2024-2033

9.1.1. Skin Cancers

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Inflammatory Dermatoses

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Plastic & Reconstructive Surgery

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Dermatology Imaging Devices Market, By End Use

10.1. U.S. Dermatology Imaging Devices Market, by End Use, 2024-2033

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Dermatology centers

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Specialty Clinics

10.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Dermatology Imaging Devices Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Modality (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End Use (2021-2033)

Chapter 12. Company Profiles

12.1. Caliber Imaging and Diagnosis.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Canfield Scientific, Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Clarius.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Cortex Technology.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Courage+Khazaka electronic GmbH.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Comp6

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. DermLite.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. DRAMIŃSKI S. A.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. e-con Systems Inc.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. FotoFinder Systems GmbH

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others