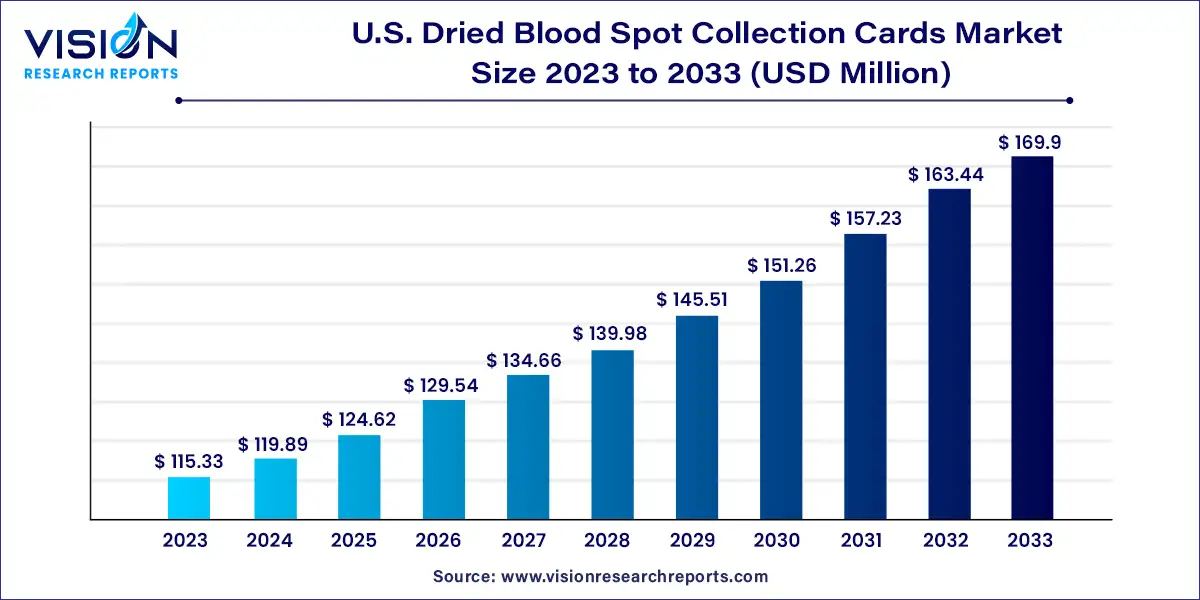

The U.S. dried blood spot collection cards market size was estimated at around USD 115.33 million in 2023 and it is projected to hit around USD 169.9 million by 2033, growing at a CAGR of 3.95% from 2024 to 2033.

In the United States, the market for dried blood spot collection cards is experiencing significant growth and evolution. These cards, used for collecting blood samples via a simple and minimally invasive process, are finding increasing applications across various sectors such as healthcare, pharmaceuticals, and research.

In the United States, the growth of the market for dried blood spot collection cards is driven by an increasing demand for point-of-care testing solutions is fueling the adoption of dried blood spot collection cards, which offer a convenient and minimally invasive method for collecting blood samples. Technological advancements in analytical techniques have also contributed to market growth by improving the accuracy and reliability of tests conducted using dried blood spot samples. Furthermore, the expansion of newborn screening programs across the country has boosted the usage of these cards in early disease detection. The cost-effectiveness and convenience of dried blood spot collection cards compared to traditional venous blood collection methods are driving their widespread adoption in clinical diagnostics and research applications. Lastly, the growing focus on personalized medicine has spurred the demand for dried blood spot collection cards, as they enable the collection of biological samples for genetic testing and biomarker analysis.

Newborn screening held the largest revenue share of 24% in 2023 and is expected to grow at a significant CAGR of 3.33% during the forecast period. This growth is attributed to the rising number of newborn screenings. According to the Network for Public Health Law, in 2023, each state health department in the U.S. had a newborn screening program. These programs enabled early detection of severe conditions in approximately 13,000 babies every year, proving to be a crucial public health initiative. Moreover, the state health department of U.S. manages a newborn screening program to assess newborns for specific genetic, endocrine, and metabolic disorders. These tests help safeguard the long-term health and survival of infants.

The forensics segment is estimated to witness the fastest growth of CAGR of 4.43% during the forecast period. This is attributed to the increasing applications of DBS collection cards in forensics and enhanced storage ability of DBS collection cards holding genetic information. For instance, according to the National Library of Medicine (NLM), in 2018, the Guthrie cards holding DBS samples could be economically transported via airmail across different continents. These cards could maintain the quality needed for gDNA extraction, enabling Sanger sequencing procedures to be carried out efficiently in overseas laboratories.

The Whatman 903 segment dominated the market with the largest share in 2023 and is expected to grow with the fastest CAGR throughout the forecast period due to its cost-effectiveness, ease of use, compatibility with various techniques such as ELISA, PCR, and spectrometry, and high binding capacity allowing efficient sample preparation. For instance, as of 2023, Tisch Scientific offered a Whatman 903 Protein Saver cards pack of 100 for around USD 200 on its online platform. The affordability of Whatman 903 cards is expected to impact its adoption rate positively. These cards also help preserve samples by preventing degradation and protecting them from environmental factors such as temperature and humidity, ensuring they remain stable during transportation and storage.

The FTA segment is expected to witness lucrative growth during the forecast period, due to its numerous benefits in various applications, such as stability, compatibility with multiple techniques involving DNA sequencing, low cost, RNA preservation, environmental friendliness, and sample elution capabilities. These features make FTA a valuable forensics, biology, and medical research tool.

The hospitals & clinics segment dominated the market and accounted for the largest revenue share in 2023, with a lucrative growth rate over the forecast period. DBS collection cards have gained significant importance in hospitals and clinics due to their convenience, cost-effectiveness, and versatility. These cards are primarily used for collecting, storing, and transporting small blood samples for various diagnostic tests and research purposes.

The others segment is estimated to witness the fastest growth during the forecast period. This is attributed to some benefits, such as affordability, ease of use, and ability to do sampling at home, which limits hospital-based sampling and increases patient compliance. In May 2022, according to the National Library of Medicine, blood sampling at home is expected to reduce hospital visits, reduce patient burden, increase compliance, and increase the quality of life of patients. This is one of the potential factors supporting the segment growth in the upcoming years. Furthermore, at-home DBS blood sampling is also expected to reduce healthcare costs.

By Application

By Card Type

By End-use

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others