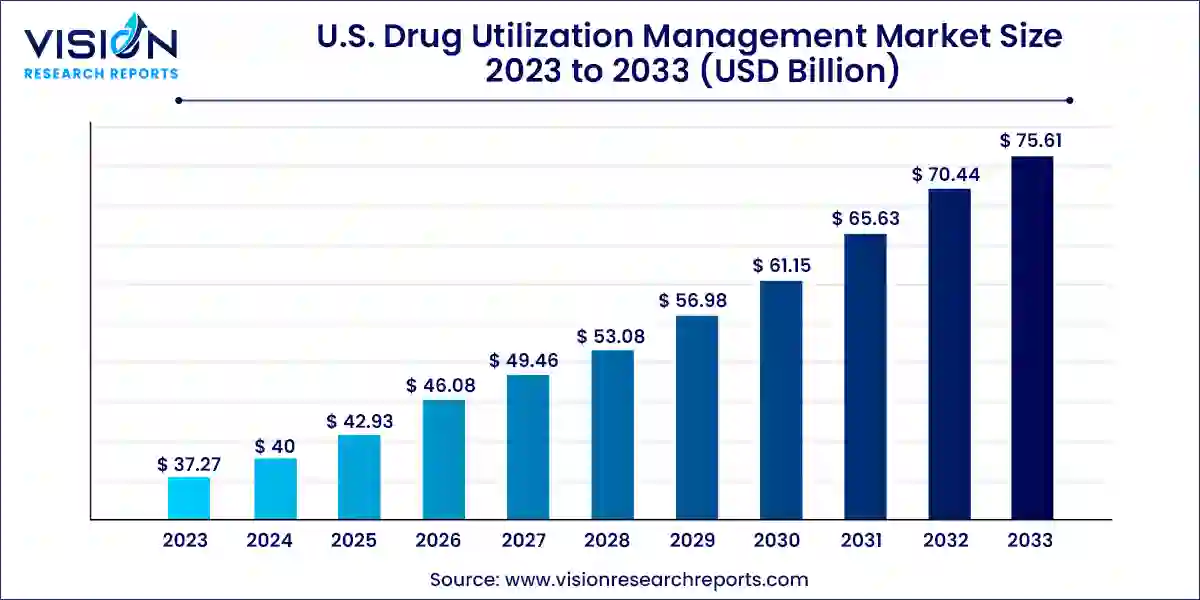

The U.S. drug utilization management market size was valued at USD 37.27 billion in 2023 and it is predicted to surpass around USD 75.61 billion by 2033 with a CAGR of 7.33% from 2024 to 2033.

The U.S. drug utilization management (DUM) market plays a crucial role in optimizing healthcare outcomes and controlling costs through systematic strategies. DUM encompasses various techniques aimed at ensuring appropriate medication use, enhancing patient safety, and managing healthcare expenditures.

The growth of the U.S. drug utilization management (DUM) market is driven by an increasing healthcare costs have spurred the need for strategies that optimize medication use and control expenditures. DUM techniques such as utilization review, prior authorization, and step therapy help healthcare organizations manage drug utilization efficiently, thereby reducing unnecessary spending. Secondly, advancements in healthcare technology have enabled more sophisticated approaches to DUM, including the use of data analytics and electronic health records to monitor and improve prescribing patterns. Thirdly, regulatory initiatives aimed at improving patient safety and quality of care have encouraged the adoption of DUM practices among healthcare providers and insurers. Lastly, the shift towards value-based care models has incentivized stakeholders to implement DUM strategies that enhance patient outcomes and satisfaction while containing costs. These factors collectively contribute to the expansion and evolution of the U.S. Drug Utilization Management market.

In 2023, the in-house segment emerged as the dominant force in the market, capturing the largest revenue share of 66%. This segment's leadership is attributed to its ability to deliver cost savings, efficient utilization management, and streamlined administrative processes for health plans and employers. This trend reflects the healthcare industry's shift towards vertical integration. Pharmacy Benefit Managers (PBMs) within in-house programs implement key utilization management strategies such as prior authorization and step therapy to ensure appropriate medication use.

Furthermore, the high utilization of prescription drugs in the U.S. underscores the importance of robust in-house programs capable of managing the volume of prescriptions filled by retail pharmacies. Notable providers of in-house drug and pharmacy utilization management include Ultimate Health Plans, Security Health Plan of Wisconsin, Inc., and Blue Cross Blue Shield Association.

Conversely, the outsourced segment is anticipated to experience rapid growth throughout the forecast period. The increasing demand for outsourced programs in the U.S. market is primarily driven by healthcare providers' focus on delivering high-quality care alongside efficient utilization management services. This approach aims to optimize patient care while effectively managing healthcare costs, thereby fueling the growth of this segment in the coming years.

In 2023, the PBMs segment dominated the market with a substantial share of 38% and is projected to exhibit the highest growth rate during the forecast period. PBMs play a pivotal role in negotiating discounted drug prices and securing refunds from pharmaceutical manufacturers. Through effective management of drug formularies and utilization, PBMs help mitigate medication costs for health insurance plans and employers. They also streamline operations by overseeing administrative tasks such as pharmacy network management, claims processing, and benefit plan design, which alleviates the workload for insurers, employers, and pharmacies alike.

Meanwhile, the health plan provider/payors segment is expected to witness significant growth in the forecast period. With healthcare spending in the U.S. continuing to rise, stakeholders are increasingly focused on addressing factors contributing to high costs. This includes the overutilization of healthcare services, which not only impacts patient well-being but also escalates healthcare expenses. Health plan providers leverage drug utilization management strategies to curtail unnecessary services and ensure patients receive appropriate, high-quality, and cost-effective care. This strategic approach is anticipated to drive growth within this segment throughout the forecast period.

Third Party Providers:

In-House Providers:

By Program Type

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Drug Utilization Management Market

5.1. COVID-19 Landscape: U.S. Drug Utilization Management Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Drug Utilization Management Market, By Program Type

8.1. U.S. Drug Utilization Management Market, by Program Type, 2024-2033

8.1.1. In-house

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Outsourced

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Drug Utilization Management Market, By End-use

9.1. U.S. Drug Utilization Management Market, by End-use, 2024-2033

9.1.1. PBMs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Health Plan Provider/Payors

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Pharmacies

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Drug Utilization Management Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Program Type (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. Prime Therapeutics LLC

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. MedicusRx

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. EmblemHealth

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Optum, Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Point32Health, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. AssureCare LLC

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. MindRx Group

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Agadia Systems, Inc

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Elevance Health (CarelonRx)

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ExlService Holdings, Inc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others