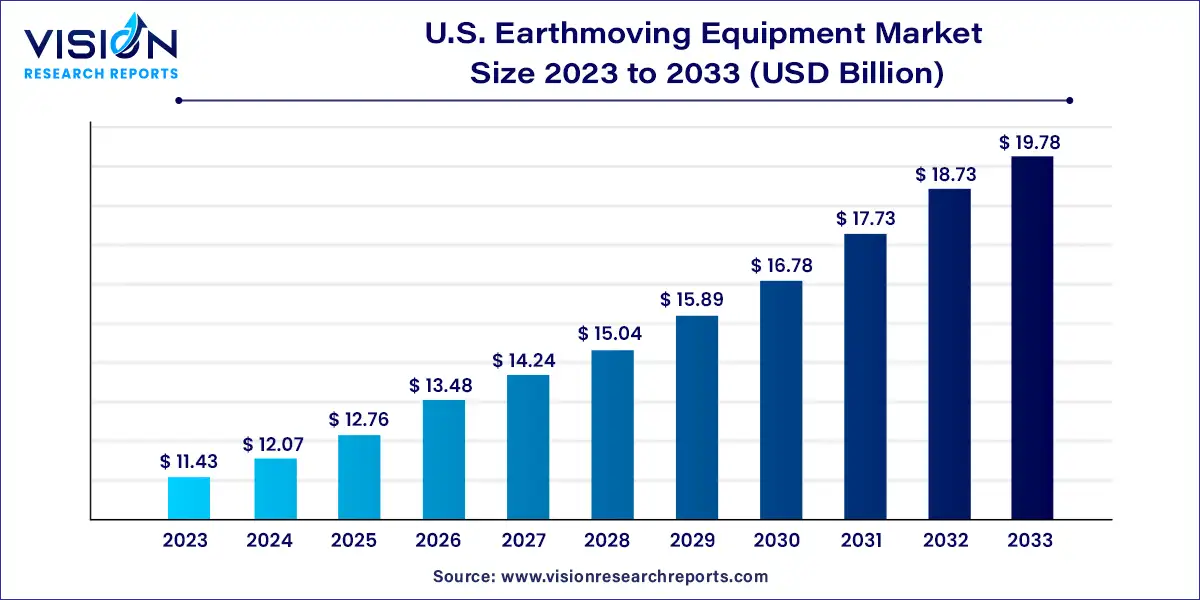

The U.S. earthmoving equipment market size was estimated at around USD 11.43 billion in 2023 and it is projected to hit around USD 19.78 billion by 2033, growing at a CAGR of 5.64% from 2024 to 2033.

The U.S. earthmoving equipment market is a pivotal sector within the construction industry, characterized by robust growth and technological advancements. Earthmoving equipment encompasses a variety of machinery designed for excavation, grading, and site preparation tasks, crucial for infrastructure development, residential construction, and mining operations.

The growth of the U.S. earthmoving equipment market is driven by an ongoing infrastructure development projects across the country, spurred by government investments in transportation, utilities, and residential sectors, are fueling demand for advanced earthmoving machinery. Secondly, technological advancements in equipment design, such as the integration of GPS tracking, telematics systems, and automated functionalities, are enhancing operational efficiency and productivity on construction sites. Moreover, increasing environmental awareness and stringent regulatory standards are pushing manufacturers to innovate towards more sustainable and fuel-efficient equipment solutions, meeting both customer demands and regulatory requirements.

The Up to 250 HP sub-segment asserted its dominance in 2023, capturing 46% of the market share and is poised for significant growth in the forecast period. Machines with engine capacities up to 250 HP are well-suited for medium-scale projects that require a blend of maneuverability and power. These machines are designed to be compact and versatile, facilitating smooth operation and transportability. These advantages associated with this engine capacity are expected to drive its expansion over the forecast period.

The 250-500 HP sub-segment is forecasted to exhibit the highest CAGR from 2024 to 2033. These machines excel in handling heavy loads and navigating challenging terrains, making them ideal for applications such as land clearing, timber handling, and road construction. The broad applicability across various construction sectors and increasing demand for materials like timber are anticipated to propel this sub-segment throughout the forecast period. For example, according to the Softwood Lumber Board (SLB), the anticipated rise in demand for softwood lumber by 600 million board feet is linked to the projected use of mass timber panels in hybrid construction.

In 2023, the ICE segment held the largest market share. ICE engines have seen significant improvements in fuel efficiency through technologies such as turbocharging, electronic control systems, and direct injection. The growth of the ICE sub-segment is primarily driven by the need to meet torque and power requirements while ensuring optimal performance. Moreover, end-users in various industries have a range of torque capacities and power outputs to choose from, aligning with their specific operational needs. These advantages associated with the ICE drive type are expected to drive its demand over the forecast period.

The electric segment is projected to grow at the fastest CAGR during the forecast period. Increasing focus on sustainability is a key driver for electric drive types. Regulations like the Environmental Protection Agency's (EPA) Tier 4 diesel engine standards and the broader Clean Air Act, combined with a growing emphasis on sustainable practices in the U.S., are expected to bolster the adoption of electric engines for earthmoving equipment. For instance, the Biden administration aims for electric engines to constitute 50% of all new vehicle sales by 2033, as stated on the White House website.

In 2023, the loader sub-segment accounted for the largest share of the market. Loaders are anticipated to grow at a substantial CAGR from 2024 to 2033, driven by the expansion of construction activities. According to Verdict Media Limited, construction spending in the U.S. is on the rise, with a projected year-on-year increase of 13.9% from $1.84 trillion USD in 2022 to $2.09 trillion USD in 2023.

The dump truck sub-segment is expected to witness the fastest CAGR during the forecast period. In the mining industry, dump trucks play a critical role in transporting materials from mining sites to processing facilities. The rising demand for gold is projected to contribute to the growth of this sub-segment. For example, the World Gold Council reported record-high gold demand in the U.S. in 2023, with expectations of further expansion as the Federal Reserve moves toward interest rate cuts.

By Engine Capacity

By Drive Type

By Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Engine Capacity Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Earthmoving Equipment Market

5.1. COVID-19 Landscape: U.S. Earthmoving Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Earthmoving Equipment Market, By Engine Capacity

8.1. U.S. Earthmoving Equipment Market, by Engine Capacity, 2024-2033

8.1.1 Up to 250 HP

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. 250-500 HP

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. More than 500 HP

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Earthmoving Equipment Market, By Drive Type

9.1. U.S. Earthmoving Equipment Market, by Drive Type, 2024-2033

9.1.1. Electric

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. ICE

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Earthmoving Equipment Market, By Product

10.1. U.S. Earthmoving Equipment Market, by Product, 2024-2033

10.1.1. Dozer

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Excavator

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Loader

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Motor Grader

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Dump Truck

10.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Earthmoving Equipment Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Engine Capacity (2021-2033)

11.1.2. Market Revenue and Forecast, by Drive Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Product (2021-2033)

Chapter 12. Company Profiles

12.1. Unicorn Construction Enterprises, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Caterpillar Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Deere & Company.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. The Manitowoc Company, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Oshkosh Corporation.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. HD Hyundai Construction Equipment Co., Ltd.

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Manitou group.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Tomahawk

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. AB Volvo.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. New Holland Construction (CNH Industrial N.V.)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others