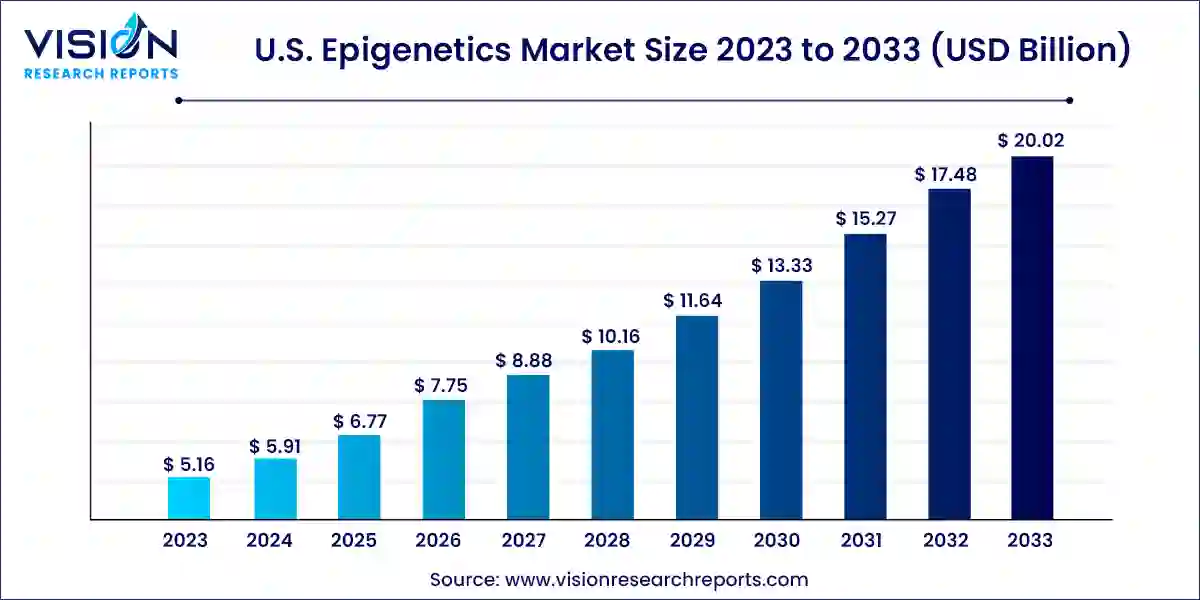

The U.S. epigenetics market size was estimated at around USD 5.16 billion in 2023 and it is projected to hit around USD 20.02 billion by 2033, growing at a CAGR of 14.52% from 2024 to 2033.

The U.S. epigenetics market is experiencing significant growth driven by advancements in research and the increasing prevalence of chronic diseases such as cancer and cardiovascular conditions. Epigenetics, which studies changes in gene expression without altering the DNA sequence, has become a critical area of focus for developing targeted therapies and personalized medicine. The market is fueled by substantial investments in biotechnology, rising demand for innovative diagnostic tools, and expanding applications in drug discovery and development.

The growth of the U.S. epigenetics market is propelled by an advances in technology have enhanced the ability to study epigenetic modifications, leading to breakthroughs in understanding complex diseases. The rising incidence of cancer and other chronic conditions has increased the demand for innovative diagnostic and therapeutic solutions, driving market expansion. Additionally, significant investment from both public and private sectors is boosting research and development activities in the field. Government initiatives supporting precision medicine and collaborations between research institutions and biotech companies are further accelerating the growth of the epigenetics market. These factors collectively create a fertile ground for the development and commercialization of epigenetic-based products and therapies.

In 2023, the reagents segment led the market with a 33% share. Epigenetic reagents are vital for studying and manipulating epigenetic mechanisms, which involve changes in gene expression without altering the DNA sequence. These reagents are crucial for understanding epigenetic regulation and are used in both research and potential therapeutic applications. Numerous companies specialize in providing reagents tailored for epigenetics research. For example, Promega Corporation offers a variety of kits and reagents for DNA methylation, histone modification, and RNA transcription analysis, supporting epigenetic research. The availability of diverse reagents from leading companies is expected to significantly drive the growth of this segment.

The services segment is projected to grow at the fastest CAGR from 2024 to 2033. Epigenetic services include sequencing, analysis, and consultation, involving sophisticated techniques like ChIP-seq, bisulfite sequencing, and DNA methylation profiling. Researchers and institutions often rely on specialized services to conduct these complex analyses accurately and efficiently, which is anticipated to drive the growth of this segment over the forecast period.

The DNA methylation segment captured the largest revenue share of 45% in 2023. DNA methylation is increasingly utilized to enhance sequencing techniques. Methods such as methylated DNA immunoprecipitation sequencing and methylated DNA binding domain sequencing highlight methylated regions for sequencing. Growing research activities in biological and pharmaceutical fields are boosting the demand for DNA methylation, which significantly influences gene expression by modifying interactions between DNA, chromatin proteins, and specific transcription factors. These factors are expected to drive the growth of this segment.

The histone acetylation segment is expected to witness the fastest CAGR during the forecast period, driven by the development of innovative methods improving its efficacy. Studies suggest that histone acetylation may offer therapeutic benefits for conditions such as solid tumors, inflammation, leukemia, and viral infections. Key drivers for histone acetylation include its role in gene activation, activity of histone acetyltransferases and deacetylases, chromatin remodeling, epigenetic memory, cellular development, environmental stimuli, interactions with other modifications, disease associations, cellular memory, and drug development.

The oncology segment held the largest revenue share in 2023. Cancer remains the primary focus for epigenetics research. With the increasing incidence of cancer, the market for cancer-related epigenetic diagnostics is expected to grow. According to the American Cancer Society, there were an estimated 1.9 million new cancer cases in the U.S. in 2022, with approximately 609,360 related deaths. Epigenetics research in oncology is driven by the significant role of epigenetic alterations in cancer development and progression. Collaborative initiatives like The Cancer Genome Atlas (TCGA) unite researchers, clinicians, and bioinformaticians to analyze large-scale cancer genomics and epigenomics datasets, accelerating discoveries in cancer epigenetics.

The non-oncology segment is anticipated to experience the fastest CAGR during the forecast period. Growth in this segment is driven by a diverse range of factors across various medical fields. Understanding epigenetic mechanisms in areas such as neurological and cardiovascular diseases, metabolic and autoimmune disorders, aging, mental health, drug development, and precision medicine significantly contributes to the expansion of the market beyond cancer applications.

In 2023, academic research dominated the end-use segment with a 38% market share. Epigenetics has become a major focus area in academic research due to its implications for understanding gene expression regulation beyond DNA sequence changes. As technologies advance, enabling more precise mapping and manipulation of epigenetic marks, the demand for skilled researchers and innovative methodologies is expected to rise. These factors contribute to the growing demand for epigenetics in the U.S.

Clinical research is projected to grow at the fastest CAGR of 15.58% from 2024 to 2033. The increasing demand for epigenetics in clinical research reflects a transformative shift in drug discovery and development. Epigenetics, with its intricate exploration of gene expression beyond DNA sequencing, offers vast opportunities for understanding disease mechanisms at a fundamental level.

By Product

By Technology

By Application

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Epigenetics Market

5.1. COVID-19 Landscape: U.S. Epigenetics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global U.S. Epigenetics Market, By Product

8.1. U.S. Epigenetics Market, by Product, 2024-2033

8.1.1. Reagents

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Kits

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Instruments

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Enzymes

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Services

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global U.S. Epigenetics Market, By Technology

9.1. U.S. Epigenetics Market, by Technology, 2024-2033

9.1.1. DNA Methylation

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Histone Methylation

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Histone Acetylation

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Large Non - coding RNA

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. MicroRNA Modification

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Chromatin Structures

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global U.S. Epigenetics Market, By Application

10.1. U.S. Epigenetics Market, by Application, 2024-2033

10.1.1. Oncology

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Non - oncology

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Epigenetics Market, By End-use

11.1. U.S. Epigenetics Market, by End-use, 2024-2033

11.1.1. Academic Research

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Clinical Research

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Hospitals & Clinics

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Pharmaceutical & Biotechnology Companies

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Others

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. U.S. Epigenetics Market, Regional Estimates and Trend Forecast

12.1. U.S.

12.1.1. Market Revenue and Forecast, by Product (2021-2033)

12.1.2. Market Revenue and Forecast, by Technology (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Roche Diagnostics

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Thermo Fisher Scientific, Inc

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Danaher

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Eisai Co. Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Novartis AG

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Element Biosciences, Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Dovetail Genomics LLC.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Illumina, Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Promega Corporation.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Abcam plc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others