U.S. Exosomes Market Size and Trends

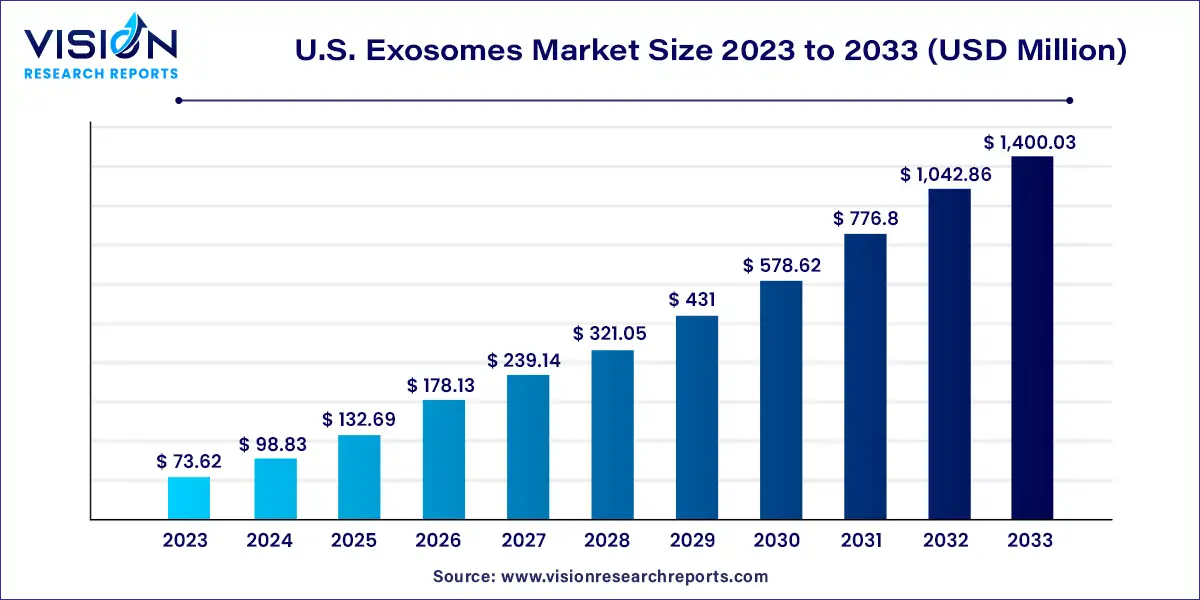

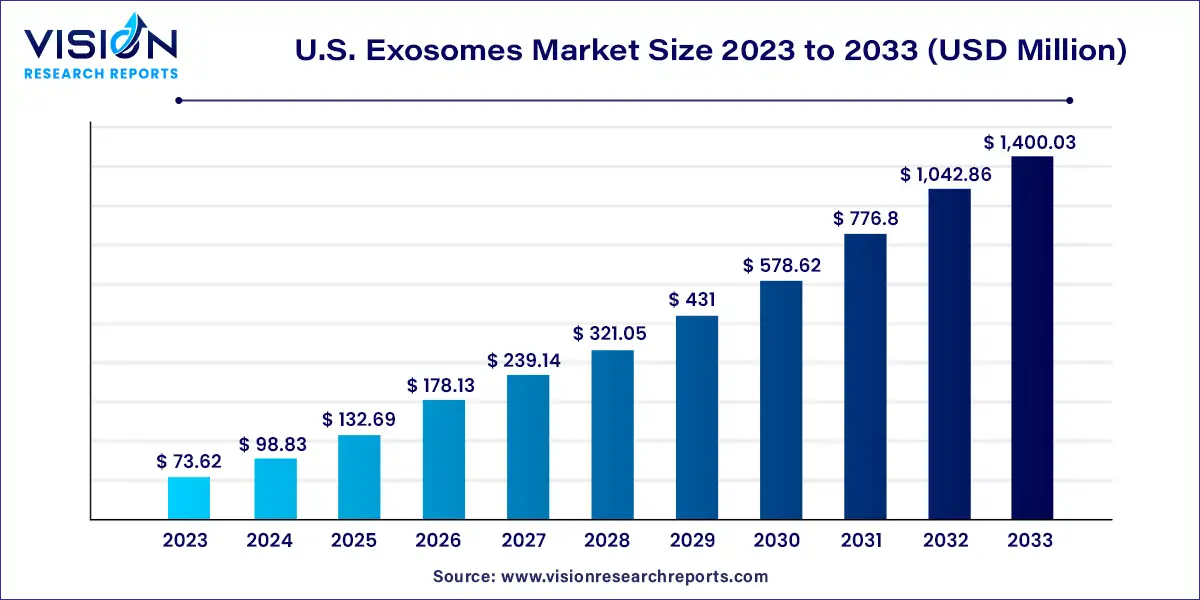

The U.S. exosomes market size was estimated at USD 73.62 million in 2023 and it is expected to surpass around USD 1,400.03 million by 2033, poised to grow at a CAGR of 34.25% from 2024 to 2033.

Key Pointers

- By Product, the kits and reagents segment contributed the largest market share of 46% in 2023.

- By Product, the services segment is projected to grow at a CAGR of 33.03% from 2024 to 2033.

- By Workflow, the downstream analysis held the largest revenue share in 2023.

- By Workflow, the isolation methods segment is anticipated to expand at a significant CAGR from 2024 to 2033.

- By Applications, the cancer application segment contributed the largest market share of 33% in 2023.

- By Applications, the infectious diseases segment is anticipated to grow at 35.04% CAGR from 2024 to 2033.

- By End-use, the academic and research institutes segment is predicted to grow at the remarkable CAGR from 2024 to 2033.

U.S. Exosomes Market Overview

The U.S. exosomes market is experiencing significant growth driven by advancements in research and development, increasing applications across various therapeutic areas, and growing investments in biotechnology and pharmaceutical sectors.

U.S. Exosomes Market Growth Factors

The growth of the U.S. exosomes market is propelled by an advancements in research and development have significantly expanded our understanding of exosomes and their potential applications in various therapeutic areas. This increased knowledge has led to a surge in investment in biotechnology and pharmaceutical sectors, driving innovation and commercialization efforts. Additionally, the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions has created a strong demand for novel therapeutic approaches, with exosomes emerging as promising candidates due to their unique properties. Furthermore, favorable regulatory policies and initiatives aimed at streamlining the development and approval processes for exosome-based products have facilitated their translation from bench to bedside, fostering market growth.

U.S. Exosomes Market Trends:

- Rapid Expansion of Research and Development: Continuous advancements in research and development are driving innovation in the field of exosomes, leading to the exploration of new applications and therapeutic avenues.

- Diversification of Therapeutic Applications: Exosomes are being investigated for their therapeutic potential across a wide range of medical fields, including regenerative medicine, oncology, neurology, and cardiovascular diseases, among others, indicating a diverse and expanding market landscape.

- Increasing Focus on Diagnostic Applications: Beyond therapeutics, there's a growing emphasis on leveraging exosomes for diagnostic purposes, particularly in cancer diagnostics where exosomes serve as valuable sources of biomarkers for early detection and disease monitoring.

- Technological Advancements in Isolation and Characterization: Ongoing advancements in exosome isolation and characterization techniques are enhancing the efficiency, scalability, and purity of exosome-based products, facilitating their translation into clinical applications.

- Rising Investment in Biotechnology Startups: The U.S. exosomes market is witnessing a surge in investment activities, particularly in biotechnology startups focused on exosome-based therapeutics, diagnostics, and drug delivery systems, indicating a promising future for the industry.

- Increased Awareness and Education: There's a growing awareness among healthcare professionals, researchers, and patients about the potential of exosomes in revolutionizing healthcare delivery and treatment modalities, driving further interest and investment in the market.

U.S. Exosomes Market Restraints:

- Challenges in Standardization and Quality Control: Ensuring consistency, reproducibility, and quality control of exosome-based products remains a significant challenge due to variations in isolation methods, heterogeneity of exosome populations, and lack of standardized protocols, which can hinder widespread adoption and commercialization.

- Scalability and Manufacturing Constraints: Scaling up exosome production to meet commercial demand while maintaining product consistency and quality poses challenges such as scalability issues, cost-effectiveness concerns, and complexities associated with large-scale manufacturing processes, potentially limiting market growth and accessibility.

- Regulatory Uncertainty and Compliance: Despite regulatory support, navigating the evolving regulatory landscape for exosome-based products can be complex and time-consuming, with uncertainties surrounding classification, approval pathways, and compliance requirements, which may impede market entry and commercialization efforts.

- Limited Clinical Evidence and Validation: While preclinical studies demonstrate promising therapeutic potential, the lack of robust clinical evidence and validation studies evaluating the safety, efficacy, and long-term outcomes of exosome-based interventions in human populations remains a barrier to widespread adoption and acceptance by healthcare providers and regulators.

- High Development Costs and Investment Risks: Developing exosome-based therapeutics and diagnostics entails substantial research and development costs, along with inherent investment risks associated with early-stage technologies, lengthy development timelines, and uncertain market acceptance, which may deter investment and slow market growth.

Product Insights

The kits and reagents segment held the largest revenue share of 46% in 2023, and is expected to witness the fastest CAGR over the forecast period. Exosome kits play a crucial role in facilitating simple and reliable extraction, while reagents aid in analyzing exosome content, particularly in research related to conditions like cancer and regenerative medicine. The increasing emphasis on exosome-based clinical trial research will expand significantly in the upcoming forecast period.

The services segment is projected to grow at a CAGR of 33.03% over the forecast period owing to the growing outsourcing of exosome services. Companies offer various services for extracting and analyzing exosomes to facilitate efficient research and therapeutic development. For instance, AMSBIO provides services including exosome isolation and quantification, exosome miRNA isolation and sequencing, exosome surface marker analysis, and proteomics. This diverse array of services provided by different companies is anticipated to stimulate growth in this segment.

Workflow Insights

Downstream analysis accounted for the largest share in 2023. Technological advancements in exosome analysis have enhanced downstream workflows, encompassing detection, quantification, labeling, and modification of exosomes. These processes may involve complex sample preparation, data interpretation, and applying analytical methods like RNA sequencing and mass spectrometry for proteomic analysis. The improved efficiency and effectiveness of advanced downstream analysis methods drive growth in this segment.

The isolation methods segment is anticipated to expand at a significant CAGR from 2024 to 2033, with techniques like ultracentrifugation, immunocapture on beads, precipitation, and filtration driving this expansion. Companies are introducing advanced isolation platforms to streamline workflows, reduce processing time, increase yield, and maintain exosome integrity, leading to the growth of this segment.

Applications Insights

The cancer application segment dominated this market with 33% share in 2023. The growing prevalence of severe and chronic illnesses fuels the use of exosomes for developing advanced diagnostics and therapies to address diseases. Government support, an aging population, and improved healthcare infrastructure further contribute to market growth. Increased engagement in conferences and seminars is also raising awareness and driving market expansion.

The infectious diseases segment is anticipated to grow at 35.04% CAGR from 2024 to 2033. Exosomes offer clinical benefits such as cell-free treatments for various diseases and tissue repair, delivering therapeutic components effectively without immune rejection or cellular harm. Due to their diverse applications, these features are expected to boost exosome market revenue.

End-use Insights

Academic researchers actively study exosome biology, isolation techniques, and their roles in health and disease. They focus on using exosomes as biomarkers for diseases like cancer, neurodegenerative disorders, infectious diseases, and cardiovascular conditions. Researchers aim to develop noninvasive diagnostic methods by identifying disease-specific exosome profiles. Exosomes are also explored for their potential in tissue repair and regeneration, with efforts to engineer them for delivering therapeutic substances.

The academic and research institutes segment is expected to experience substantial growth during the forecast period. This growth is driven by the rising emphasis of numerous research institutions on utilizing exosomes for innovative therapeutic discoveries. Carnegie Mellon University researchers are currently studying exosome-based cell communication to deliver growth factors for regenerative medicine. This research is expected to contribute to the growth of this field in the future.

U.S. Exosomes Market Key Companies

- Danaher

- Thermo Fisher Scientific, Inc.

- Hologic Inc.

- Bio-Techne

- RoosterBio, Inc

- Aragen Bioscience

- Capricor Therapeutics

- Coya Therapeutics

- Aegle Therapeutics Corporation

- Aethlon Medical

Recent Developments

- In January 2024, Capricor Therapeutics announced a collaboration with the National Institutes of Health to conduct a clinical trial focusing on a novel exosome-based multivalent vaccine for SARS-CoV-2. Capricor's exclusive StealthX™ exosome-based multivalent vaccine has been selected to participate in Project NextGen, demonstrating a significant step forward in the fight against the COVID-19 pandemic.

- In January 2023, Sartorius forged a strategic partnership with RoosterBio with the objective of refining downstream purification techniques for exosome manufacturing. This collaboration aims to bolster the efficiency and effectiveness of an hMSC-based exosome production platform, ensuring optimal yield, purity, and potency of exosome-based products.

U.S. Exosomes Market Segmentation:

By Product

- Kits & reagents

- Instruments

- Services

By Workflow

- Isolation Methods

- Ultracentrifugation

- Immunocapture on beads

- Precipitation

- Filtration

- Others

- Downstream Analysis

- Cell surface marker analysis using flow cytometry

- Protein Analysis using blotting & ELISA

- RNA analysis with NGS & PCR

- Proteomic analysis using mass spectroscopy

- Others

By Application

- Cancer

- Neurodegenerative Diseases

- Cardiovascular Diseases

- Infectious Diseases

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Hospitals & Diagnostics Centers

- Academic & Research Institutes

Frequently Asked Questions

The U.S. exosomes market size was reached at USD 73.62 million in 2023 and it is projected to hit around USD 1,400.03 million by 2033.

The U.S. exosomes market is growing at a compound annual growth rate (CAGR) of 34.25% from 2024 to 2033.

Key factors that are driving the U.S. exosomes market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others