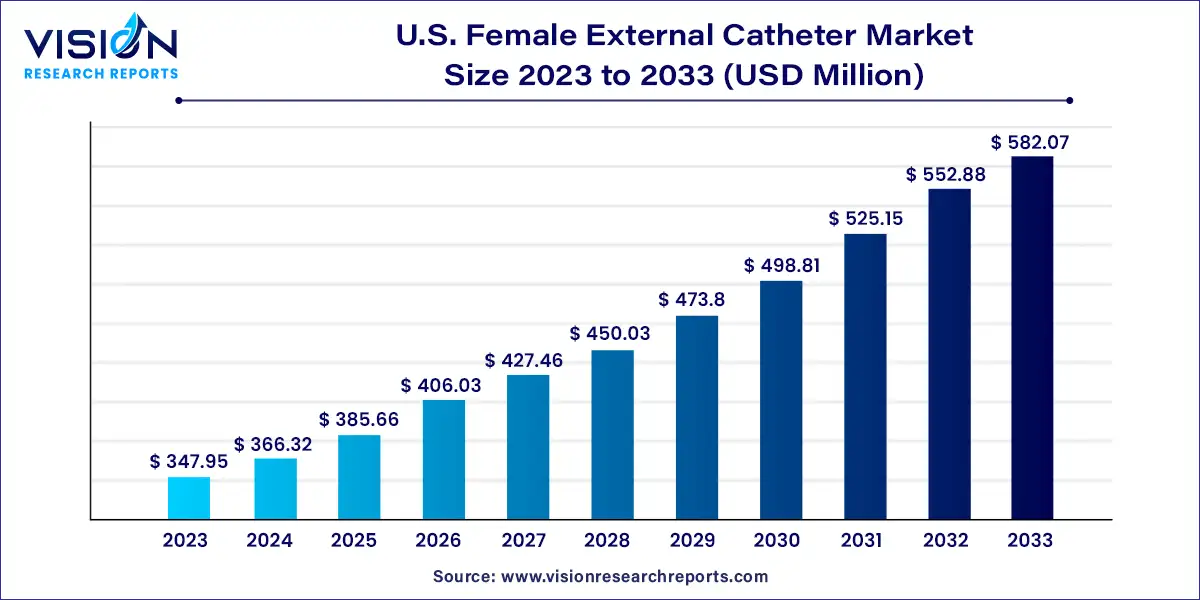

The U.S. female external catheter market size was estimated at USD 347.95 million in 2023 and it is expected to surpass around USD 582.07 million by 2033, poised to grow at a CAGR of 5.28% from 2024 to 2033.

The U.S. female external catheter market is experiencing significant growth due to increasing awareness of female health issues, advancements in medical technology, and the rising prevalence of urinary incontinence among women. Female external catheters are non-invasive devices designed to manage urinary incontinence, offering a comfortable and hygienic alternative to traditional methods such as adult diapers and internal catheters.

The growth of the U.S. female external catheter market is driven by the rising prevalence of urinary incontinence among women, particularly due to aging, pregnancy, childbirth, and menopause, significantly boosts demand. Technological advancements have also played a crucial role, with innovations leading to more comfortable, efficient, and user-friendly catheters. Increased awareness and acceptance of urinary incontinence solutions among women and healthcare providers further propel market growth. Additionally, the growing geriatric population in the U.S. amplifies the need for effective incontinence management products.

In 2023, the silicone segment led the market, primarily due to the exceptional comfort and durability offered by silicone-based catheters. The smooth, soft surface of silicone minimizes irritation and discomfort, while its robustness ensures a longer catheter lifespan and reduces the need for frequent replacements. The popularity of silicone-based female external catheters in the U.S. can be attributed to their superior performance and patient benefits. With increasing patient awareness regarding bladder health and catheter care, silicone-based catheters are expected to remain the top choice for those seeking comfort, durability, and ease of use.

Conversely, the latex segment is anticipated to experience the highest growth rate, with a CAGR of 5.61% during the forecast period. Although silicone-based catheters have traditionally dominated the market, some patients prefer latex-based options due to concerns about silicone allergies or sensitivities. Additionally, FDA regulations concerning latex-containing medical devices have contributed to the rising adoption of latex-based catheters as a safer alternative.

In 2023, the diabetes segment was the leading market driver due to the increasing prevalence of diabetes-related incontinence and advancements in related technology. To stay competitive, companies must focus on developing innovative products that address compliance and cost challenges while leveraging digital health solutions to enhance patient outcomes. Investments in research and development are also crucial to creating more comfortable, convenient, and effective catheters for patients with diabetes-related incontinence.

This segment is projected to achieve the highest CAGR of 5.98% during the forecast period, driven by the steady rise in diabetes prevalence. According to the Centers for Disease Control and Prevention (CDC), diabetes rates rose by 6% between 2021 and 2022, from 10.9% to 11.5% of adults, affecting nearly 31.9 million individuals.

In 2023, Stress Urinary Incontinence (SUI) was the dominant segment. This dominance is attributed to increased awareness of urinary incontinence and its effects on both mental and physical health. Contributing factors include the growing geriatric population, rising obesity rates, and sedentary lifestyles. Technological advancements have also led to the development of innovative products tailored to the needs of women suffering from SUI.

Data from a comprehensive analysis covering 2015-2018, published in the American Urogynecologic Society's official journal, reveals that 61.8% of adult women in the U.S. experience urinary incontinence (UI), translating to approximately 78.3 million women. Additionally, 32.4% of women reported UI symptoms at least once a month. Among those with UI, the distribution is as follows: 37.5% with stress urinary incontinence, 22.0% with urgency urinary incontinence, 31.3% with mixed symptoms, and 9.2% with unspecified incontinence.

Hospitals were the leading end-use segment in 2023, driven by high patient volumes, the growing prevalence of urinary incontinence, and government initiatives promoting evidence-based treatments. As the market evolves, companies must focus on innovation, digital health solutions, and patient engagement to maintain competitiveness and capitalize on growth opportunities.

The home care segment is expected to grow at the highest rate, with a CAGR of 7.43% during the forecast period, driven by increasing demand for convenience, comfort, and cost-effective solutions. To stay competitive, companies must emphasize innovation, digital health solutions, and patient education. Key players in the home care segment, such as BD and Consure Medical, are investing in research and development to stay ahead and capitalize on emerging market opportunities.

By Material

By Application

By Area of Incontinence

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others