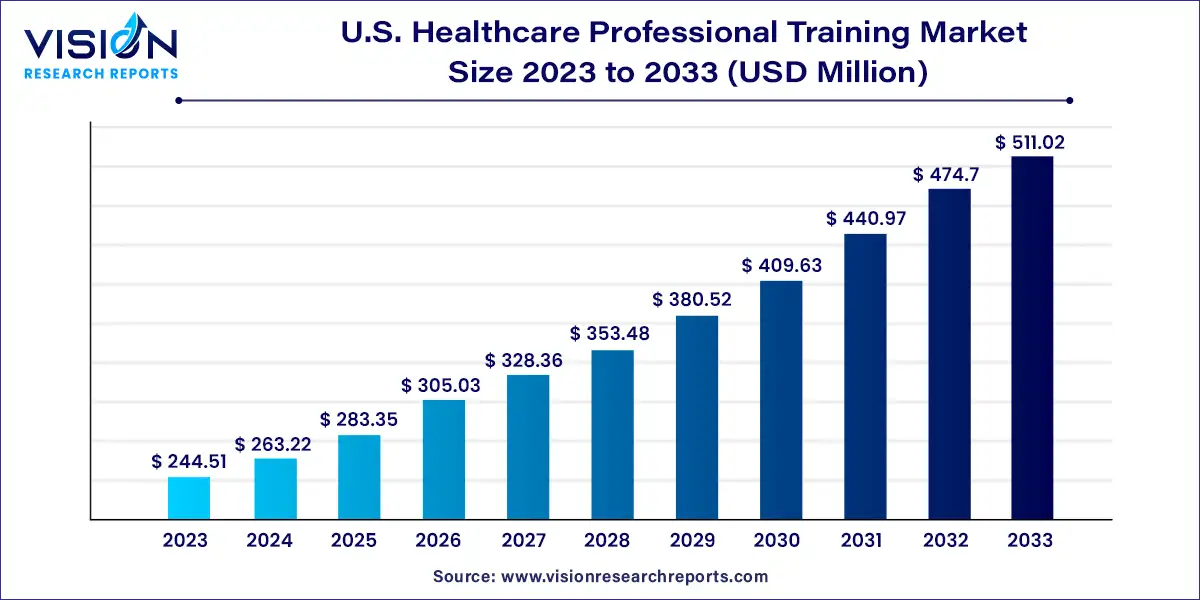

The U.S. healthcare professional training market size was estimated at around USD 244.51 million in 2023 and it is projected to hit around USD 511.02 million by 2033, growing at a CAGR of 7.65% from 2024 to 2033. The U.S. healthcare professional training market is a dynamic sector that plays a crucial role in ensuring the competency and efficiency of healthcare professionals across the country. This market encompasses a broad range of training programs, including continuing education, certification courses, and specialized training designed to enhance the skills and knowledge of healthcare practitioners.

The U.S. healthcare professional training market is propelled by the technological advancements in medical equipment and procedures drive the need for continuous education and skill enhancement among healthcare professionals. As new technologies and treatment methodologies emerge, there is a constant demand for training programs that can help practitioners stay abreast of these developments. Additionally, stringent regulatory requirements and accreditation standards mandate ongoing education and certification, ensuring that healthcare professionals meet the highest standards of practice. The growing and aging population in the U.S. further intensifies the demand for healthcare services, necessitating a larger and more skilled workforce. Moreover, the increasing focus on patient safety and quality of care highlights the importance of comprehensive training programs designed to reduce errors and improve patient outcomes.

| Report Coverage | Details |

| Market Size in 2023 | USD 244.51 million |

| Revenue Forecast by 2033 | USD 511.02 million |

| Growth rate from 2024 to 2033 | CAGR of 7.65% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The offline segment led the market with a revenue share of 72% in 2023. The offline segment refers to in-person or traditional classroom-based training, which has traditionally been a prominent and essential component of healthcare education. Many healthcare professional training programs require students to gain hands-on experience through clinical practice and experiential learning. This involves working directly with patients, healthcare teams, and mentors in healthcare settings. These practical experiences are typically conducted offline to provide students with real-world exposure and skill development.

The online segment is projected to grow at the highest CAGR of 12.54% during the forecast period. Online learning is less expensive than traditional schooling since it eliminates the need for travel and infrastructure. Universities and colleges are rapidly updating their curricula to accommodate online education system protocols, which is expected to boost the online segment throughout the projection period. In recent years, there has been a gradual shift toward online and hybrid models of healthcare professional training. Online learning platforms and technologies have been increasingly integrated into educational programs, offering flexibility, accessibility, and the opportunity for self-paced learning. This shift has been further accelerated by the COVID-19 pandemic, which necessitated remote learning and social distancing measures.

In 2023, training institute was the dominating segment, with a revenue share of 40%. The factors attributed to the segment growth include advancements in medical technology, an aging population, and increased demand for specialized healthcare services. Training institutes play a crucial role in preparing individuals for careers in the healthcare industry by providing them with the necessary skills and knowledge. Moreover, training institutes introduce innovative medical programs and platforms in both conventional and online formats to increase student engagement and enrollment in the medical profession in response to the growing need to provide experience in quality care management and upskilling of medical knowledge of nurses, physical therapists, and others.

Hospitals in the U.S. are expanding their residency programs to meet the growing demand for healthcare professionals. This includes increasing the number of residency positions and developing new programs in various specialties. The expansion aims to train and retain a skilled workforce to address healthcare needs across different regions. For instance, in January 2019, The University of California, San Francisco (UCSF) Medical Center expanded its residency programs in primary care and specialty fields to address the shortage of physicians in underserved areas. They have increased the number of residency slots and established new training sites in rural communities.

The individual user criteria segment led the market with a revenue share of 56% in 2023. The U.S. healthcare professional training serves diverse end-users, including individuals with different backgrounds, qualifications, and career goals. There has been an increasing trend of individuals from non-healthcare backgrounds seeking training and education to transition into healthcare professions.

The organization end-user segment is anticipated to hold the highest revenue share of the U.S. healthcare professional training industry in 2033. Moreover, it is also estimated to dominate the market throughout the forecast period. This is due to the surge in government initiatives to enhance the country's health training quality and professionalism. These organizations include groups of doctors, hospitals, and other healthcare providers with strong networks in collaboration with other health associations, which helps them raise funds for their program.

By Mode of Education

By Organization Type

By End-user

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Mode of Education Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on U.S. Healthcare Professional Training Market

5.1. COVID-19 Landscape: U.S. Healthcare Professional Training Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. U.S. Healthcare Professional Training Market, By Mode of Education

8.1. U.S. Healthcare Professional Training Market, by Mode of Education, 2024-2033

8.1.1 Offline

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Online

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. U.S. Healthcare Professional Training Market, By Organization Type

9.1. U.S. Healthcare Professional Training Market, by Organization Type, 2024-2033

9.1.1. School of Medicine

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Public Sector Organizations

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Hospitals/Clinics

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Training Institutes

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. U.S. Healthcare Professional Training Market, By End-user

10.1. U.S. Healthcare Professional Training Market, by End-user, 2024-2033

10.1.1. Individual User Criteria

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Organizations

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. U.S. Healthcare Professional Training Market, Regional Estimates and Trend Forecast

11.1. U.S.

11.1.1. Market Revenue and Forecast, by Mode of Education (2021-2033)

11.1.2. Market Revenue and Forecast, by Organization Type (2021-2033)

11.1.3. Market Revenue and Forecast, by End-user (2021-2033)

Chapter 12. Company Profiles

12.1. Nuance Communications

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. K Health

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ava

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Lyssn.io

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Healthily

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Deep6.ai

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Cass

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Suki AI, Inc.

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. AiCure

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. KANINI Software Solutions

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others