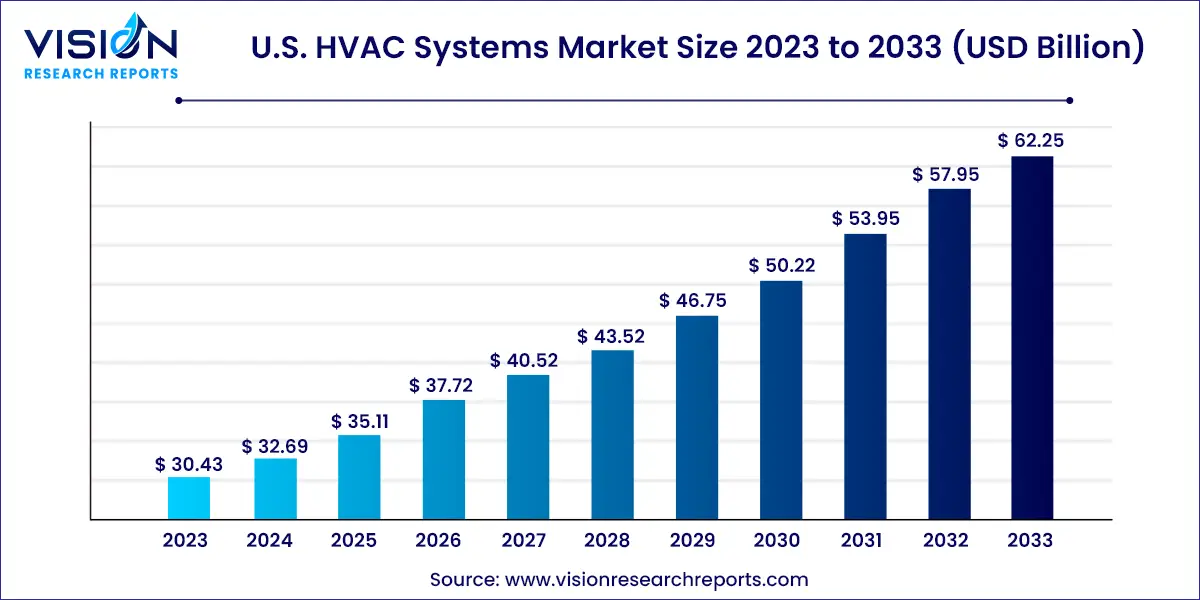

The U.S. HVAC systems market size was valued at around USD 30.43 billion in 2023 and is projected to hit around USD 62.25 billion by 2033, growing at a CAGR of 7.42% from 2024 to 2033. The U.S. HVAC (Heating, Ventilation, and Air Conditioning) systems market is a critical segment of the broader building and construction industry, providing essential climate control solutions across residential, commercial, and industrial sectors.

The U.S. HVAC systems market is experiencing significant growth driven by the primary drivers is the increasing focus on energy efficiency and sustainability, as both consumers and businesses seek to reduce energy consumption and lower their carbon footprints. This has led to the adoption of advanced HVAC technologies that offer greater efficiency and integration with renewable energy sources. Additionally, the growing trend of smart homes and buildings is fueling demand for HVAC systems that can be seamlessly integrated with smart devices, offering enhanced control, monitoring, and energy management. The expansion of the construction sector, particularly in urban areas, is also contributing to market growth, as new residential, commercial, and industrial developments require state-of-the-art HVAC systems to meet modern standards for comfort and air quality.

| Report Coverage | Details |

| Market Size in 2023 | USD 30.43 billion |

| Revenue Forecast by 2033 | USD 62.25 billion |

| Growth rate from 2024 to 2033 | CAGR of 7.42% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The heat pump segment led the market, capturing 48% of total revenue in 2023. Supportive government policies aimed at promoting energy efficiency and reducing carbon footprints are projected to drive further market growth. Many governments offer subsidies, incentives, and tax credits for heat pump installations, which are expected to enhance demand for energy-efficient systems and fuel the growth of the heat pump industry.

Increasing pollution levels and the prevalence of airborne illnesses have heightened the global need for air purifiers. The U.S. Environmental Protection Agency (EPA) reports that the average American spends around 90% of their time indoors. Over recent decades, indoor pollutant concentrations have risen due to factors such as energy-efficient construction practices and the use of synthetic materials. Additional indoor pollutants include asbestos, formaldehyde, radon, and biological contaminants from paints, carpets, and damp environments. Air purifiers, especially those equipped with high-efficiency particulate air (HEPA) filters, can remove over 99.97% of airborne particles, according to the EPA.

The market is segmented into residential, commercial, and industrial end-uses. The commercial sector is expected to experience the highest compound annual growth rate (CAGR) from 2024 to 2033, driven by the booming real estate market in the U.S. Commercial spaces such as malls, hotels, airports, and offices are contributing to this growth.

HVAC systems are also crucial in the industrial sector, particularly for manufacturing facilities and cold chain storage. Maintaining optimal temperatures in these environments is essential for product quality, thus driving demand for industrial HVAC systems, including furnaces, boilers, thermostats, and chillers. However, the industrial sector may see a slightly slower CAGR due to less frequent upgrades or replacements.

In 2023, the Western region held a 25% revenue share. The West has the highest population in the U.S., as reported by the U.S. Census Bureau in 2023, which has boosted the residential HVAC market. Additionally, higher median incomes in many Western states contribute to elevated consumer purchasing power. The diverse weather conditions across the region further drive the need for HVAC systems to maintain comfortable indoor environments.

The Midwest also represented a significant market share in 2023, a trend expected to persist. States like Illinois, Michigan, and Ohio have numerous manufacturing facilities, increasing the demand for industrial HVAC systems.

By Equipment

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others