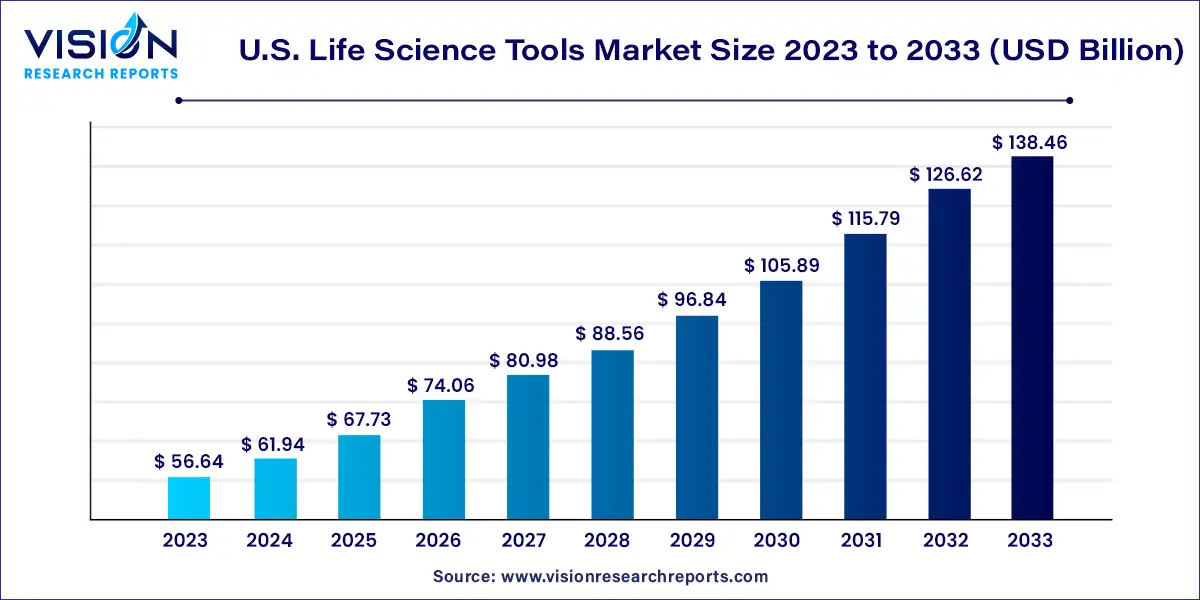

The U.S. life science tools market size was surpassed at USD 56.64 billion in 2023 and is expected to hit around USD 138.46 billion by 2033, growing at a CAGR of 9.35% from 2024 to 2033. The life science tools market in the United States is experiencing rapid growth, fueled by advancements in technology, increasing research and development activities, and rising demand for innovative solutions across various sectors.

The growth of the U.S. life science tools market is driven by the technological advancements, including high-throughput screening and next-generation sequencing, continuously push the boundaries of research capabilities, driving demand for advanced tools and equipment. Moreover, the increasing prevalence of chronic diseases and the rising need for personalized medicine fuel investments in life science research and diagnostics. Government funding initiatives aimed at supporting innovation further contribute to market expansion. Additionally, collaborations between academia, industry, and research institutions foster innovation and drive the development of novel solutions, propelling the growth of the U.S. life science tools market.

Cell biology technology dominated the market in 2023, capturing the largest share at 34%. The continuous advancements in cell analysis technologies, including microscopy, cytometry, and high content analysis, have significantly influenced growth across fields such as immunology, oncology research, stem cell research, and drug discovery. For example, a groundbreaking nanofluidic technology, initially developed with input from Amgen and pioneered by Berkeley Lights, utilizes light to manipulate cells. This innovative digital cell biology technology offers scientists resource-efficient and rapid methods to conduct standard biotech experiments. The introduction of novel technologies for utilizing and adopting stem cells, CAR T-cells, TCR T-cells, NK T-cells, and other cell therapies is driving revenue growth in this segment. Additionally, automation in the storage and processing of cord blood and adult stem cells is expected to further bolster segment growth.

Genomics technology is poised to achieve the fastest compound annual growth rate (CAGR) of 12.64% over the forecast period. Genomics, encompassing the evolutionary, comparative, and functional study of genomes, has witnessed a rapid expansion in its product range for conducting genomic analysis, thanks to various supportive technologies. Leading innovators such as Thermo Fisher Scientific, QIAGEN, Illumina, and Pacific Biosciences of California, Inc. are spearheading the development of instruments for diverse genomic applications. The growing awareness of genomics' role in managing human diseases and its potential in unconventional applications has spurred the utilization of genomic data. This heightened awareness has intensified competition among companies to introduce new products and technologies that leverage genetic information, thus tapping into the abundant opportunities present in the market.

In 2023, cell culture systems and 3D cell culture emerged as dominant players in the market, securing the largest share at 19%. Breakthroughs in cell biology research have played a pivotal role in driving revenue growth within this segment. A comprehensive understanding of cell biology has become integral to laboratory workflows, fueling market expansion. Moreover, the inclination of life science researchers towards incorporating new and advanced instruments is expected to further bolster this segment. This industry trend has prompted several major manufacturers, including Cytiva, BioTek Instruments, Horizon Discovery, and Seahorse Bioscience, to diversify their range of instruments, particularly in cell analysis, cell biology, and imaging.

Next-generation sequencing (NGS) is poised to achieve the fastest compound annual growth rate (CAGR) of 19.82% during the forecast period. NGS systems facilitate simultaneous sequencing of numerous genome samples, offering versatility in handling a wide array of sequencing reactions concurrently. The streamlining of the NGS process, coupled with ongoing reductions in equipment and reagent costs, is expected to drive broader adoption of this biotechnological method. Additionally, advancements in bioinformatics are anticipated to further enhance the utilization of NGS in both high-throughput and low-throughput research settings. For instance, in February 2022, Beckman Coulter Life Sciences collaborated with Illumina, Inc. for the development of the Biomek NGeniuS Next Generation Library Preparation System.

In 2023, the healthcare segment emerged as the dominant force in the market, capturing over 33% of the market share, and is poised to experience the fastest compound annual growth rate (CAGR) during the forecast period. The increasing adoption of proteomic and genomic workflows in hospitals for disease diagnosis and treatment is expected to drive this growth. Additionally, the rising utilization of tissue diagnostics and next-generation sequencing (NGS) services within hospital settings is projected to further fuel market expansion. Many hospitals and clinics are now offering sequencing services to patients and exploring the integration of advanced tools and technology into routine medical practice. Stanford Medicine, for instance, provides sequencing services to individuals with rare or undiagnosed genetic conditions, while Partners HealthCare in the U.S. is among the pioneers in offering public genomic sequencing, analysis, and interpretation services. The incorporation of genomic sequencing into hospital and clinical environments is anticipated to improve patient care while simultaneously reducing healthcare costs, thereby positioning the healthcare sector for significant growth in the foreseeable future.

Biopharmaceutical companies are also expected to witness lucrative growth over the forecast period. The surge in research and development (R&D) activities within the biopharmaceutical sector is driving the demand for life science tools. Companies such as Thermo Fisher Scientific and Merck KGaA have made substantial investments in bioprocessing capabilities and biopharmaceutical manufacturing units, respectively. The increasing demand for biologics has prompted investments in expanding manufacturing facilities, exemplified by initiatives like Alexion's investment in drug production facilities in Ireland and Upperton Pharma Solutions' expansion of R&D space and Good Manufacturing Practice (GMP) manufacturing capabilities. These strategic endeavors, aimed at enhancing the production of novel biologics, are expected to propel market growth within the biopharmaceutical sector.

By Technology

By Product

By End-use

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others