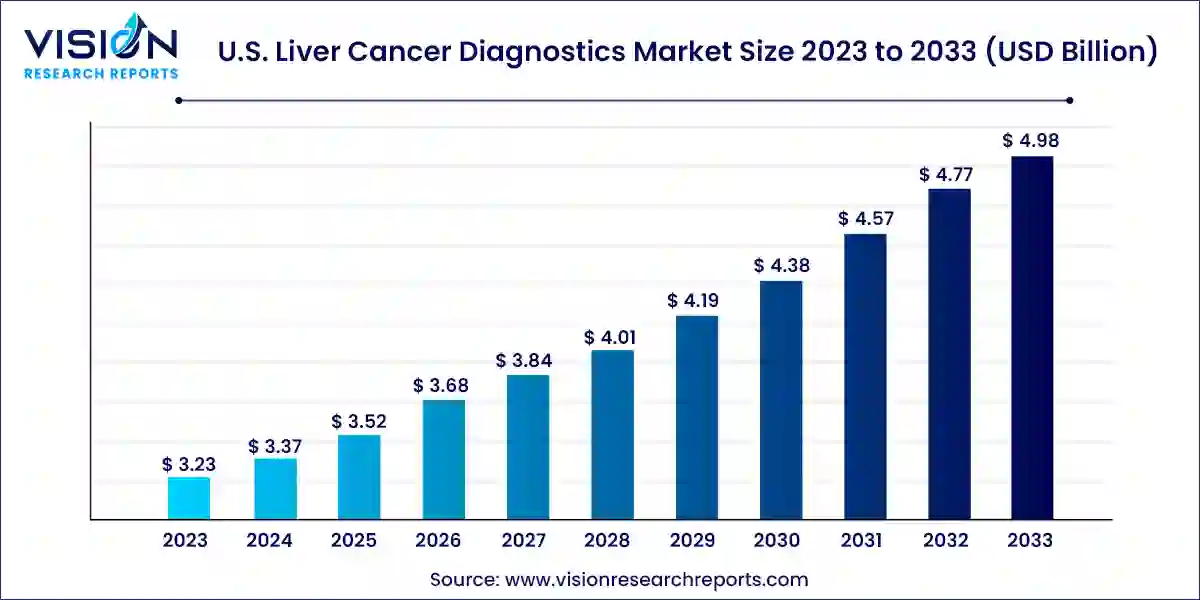

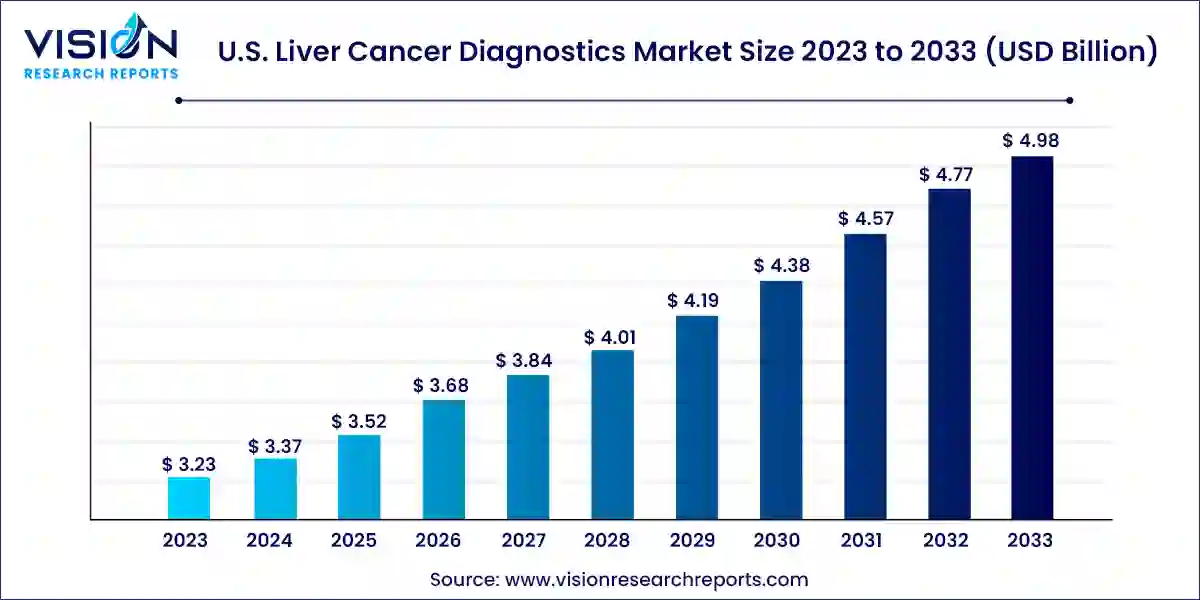

U.S. Liver Cancer Diagnostics Market Size and growth

The U.S. liver cancer diagnostics market size was valued at USD 3.23 billion in 2023 and is predicted to surpass around USD 4.98 billion by 2033 with a CAGR of 4.43% from 2024 to 2033.

Key Pointers

- By Test Type, the laboratory tests category contributed the largest market share of 41% in 2023.

- By End-use, the hospitals and diagnostic laboratories generated the maximum market share of 51% in 2023.

- By End-use, the pharmaceutical and Contract Research Organization (CRO) laboratories estimated to expand the fastest CAGR from 2024 to 2033.

U.S. Liver Cancer Diagnostics Market Overview

Liver cancer remains a significant healthcare challenge in the United States, necessitating a robust diagnostic infrastructure to enable timely detection and intervention. The U.S. liver cancer diagnostics market encompasses a range of modalities and technologies aimed at accurate disease identification, staging, and monitoring.

U.S. Liver Cancer Diagnostics Market Growth Factors

The growth of the U.S. liver cancer diagnostics market is propelled by an escalating incidence of liver cancer, driven by factors such as chronic hepatitis C infection and non-alcoholic fatty liver disease, underscores the critical need for advanced diagnostic solutions. Secondly, advancements in imaging technologies, including computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound, have significantly enhanced the accuracy and efficiency of liver cancer detection, contributing to market expansion. Additionally, the integration of biomarkers and liquid biopsy techniques into diagnostic workflows offers non-invasive means of early detection and monitoring, further driving market growth. Furthermore, the growing emphasis on early detection and personalized medicine, coupled with investments in healthcare infrastructure development, fosters a conducive environment for market expansion.

U.S. Liver Cancer Diagnostics Market Trends:

- Rising Incidence: The U.S. is witnessing a steady increase in liver cancer incidence, attributed to factors like chronic hepatitis C infection and non-alcoholic fatty liver disease (NAFLD). This trend necessitates advanced diagnostic solutions to facilitate early detection and intervention.

- Advancements in Imaging Technologies: Innovations in imaging modalities such as computed tomography (CT), magnetic resonance imaging (MRI), and ultrasound are enhancing the accuracy and efficiency of liver cancer diagnosis. Techniques like contrast-enhanced ultrasound and multiparametric MRI offer promising avenues for improved disease characterization.

- Integration of Biomarkers: Biomarker-based assays, including alpha-fetoprotein (AFP) and circulating tumor DNA (ctDNA) analysis, are complementing imaging diagnostics by providing molecular insights into liver cancer pathology. These biomarkers enhance early detection, prognostication, and treatment monitoring.

- Adoption of Liquid Biopsy: Liquid biopsy techniques, particularly ctDNA analysis, are revolutionizing liver cancer diagnostics by enabling minimally invasive, real-time monitoring of tumor dynamics. This non-invasive approach facilitates early detection of actionable mutations and enhances treatment decision-making.

- Personalized Medicine: The paradigm shift towards personalized medicine is driving the demand for tailored diagnostic approaches in liver cancer management. Integration of genetic profiling and molecular imaging techniques allows for precise patient stratification and targeted therapy selection.

U.S. Liver Cancer Diagnostics Market Restraints:

- Limited Sensitivity of Biomarkers: While biomarkers like alpha-fetoprotein (AFP) and des-gamma-carboxy prothrombin (DCP) are used in liver cancer diagnostics, they lack sufficient sensitivity and specificity, particularly in early-stage disease. This limits their utility as standalone diagnostic tools.

- Cost and Accessibility: The high cost associated with advanced imaging modalities and biomarker assays poses a barrier to access for some patients. Limited insurance coverage or reimbursement for diagnostic tests further exacerbates disparities in access to timely and accurate liver cancer diagnosis.

- Inadequate Screening Programs: Despite the rising incidence of liver cancer, there is a lack of widespread screening programs for high-risk populations, such as individuals with chronic hepatitis B or C infection. This results in missed opportunities for early detection and intervention.

- Resource Constraints: Limited availability of specialized healthcare facilities, expertise, and infrastructure in certain regions can impede timely diagnosis and management of liver cancer. Rural and underserved areas face particular challenges in accessing advanced diagnostic services.

Test Type Insights

In 2023, the laboratory tests category emerged as the frontrunner, capturing the largest revenue share at approximately 41%. Within laboratory testing, biomarker assessments and blood tests are key components. These tests are pivotal in the detection and monitoring of liver cancer, analyzing specific molecules in the blood to signal the presence of the disease or offer insights into its progression. Commonly utilized biomarkers for liver cancer include alpha-fetoprotein (AFP), des-gamma-carboxy prothrombin (DCP), and glypican-3.

Various imaging modalities and blood tests are accessible for liver cancer screening, encompassing ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and serum alpha-fetoprotein (AFP) assessments. Early detection of hepatocellular carcinoma (HCC) is paramount for initiating potentially curative interventions during the disease's initial stages. Promisingly, imaging ligands targeting glypican-3 receptor expression, such as peptides, antibodies, and aptamers, demonstrate potential for precise diagnosis, staging, and prognosis of HCC.

End-use Insights

Hospitals and diagnostic laboratories claimed dominance in the market, seizing a revenue share of about 51% in 2023. Hospitals serve as primary diagnostic hubs, extending care, managing diseases, and administering treatment for various conditions like Hepatocellular Carcinoma (HCC) and cholangiocarcinoma. They offer resources for long-term disease management and treatment, proving indispensable for patients necessitating continuous medical attention. Moreover, hospitals and diagnostic laboratories provide economically viable screening options, enabling timely detection and intervention. Their equipped facilities, proficient healthcare personnel, advanced diagnostic capabilities, specimen collection proficiency, and robust data sensitivity contribute to expedited turnaround times for diagnosis and treatment.

The pharmaceutical and Contract Research Organization (CRO) laboratories segment anticipates notable growth over the forecast period, marked by a significant Compound Annual Growth Rate (CAGR). This growth stems from their pivotal role in advancing cancer research, facilitating drug development, and contributing to the approval process for new oncology treatments.

U.S. Liver Cancer Diagnostics Market Key Companies

- Abbott Laboratories

- Guardant Health

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Qiagen N.V.

- Siemens Healthineers

- Becton, Dickinson & Company

- Epigenomics AG

- Koninklijke Philips N.V.

- FUJIFILM Healthcare Americas Corporation

Recent Developments

- In October 2023, Qiagen forged a collaboration with Myriad Genetics to jointly develop and commercialize laboratory-developed cancer test kits tailored for the U.S. market.

- In December 2022, Integrated DNA Technologies (IDT) acquired ArcherDX's Next Generation Sequencing (NGS) research assays from Invitae Corporation, marking a significant stride in the genomics and molecular biology sector. This acquisition broadened IDT's portfolio to encompass ArcherDX's cutting-edge NGS technologies.

- In November 2019, Exact Sciences, a prominent player in cancer screening tests, completed the acquisition of Genomic Health. This strategic move aimed to enrich Exact Sciences' offerings in comprehensive genomic profiling and enhance its foothold in the oncology market.

U.S. Liver Cancer Diagnostics Market Segmentation:

By Test Type

- Laboratory Tests

- Biomarkers

- Oncofetal and Glycoprotein Antigens

- Enzymes and Isoenzymes

- Growth Factors and Receptors

- Molecular Markers

- Pathological Biomarkers

- Blood Tests

- Imaging

- Endoscopy

- Biopsy

- Others

By End-use

- Hospitals & Diagnostic Laboratories

- Academic & Research Institutes

- Pharmaceutical & CRO Laboratories

By Region

- West

- Midwest

- Northeast

- Southwest

- Southeast

Frequently Asked Questions

The U.S. liver cancer diagnostics market size was reached at USD 3.23 billion in 2023 and it is projected to hit around USD 4.98 billion by 2033.

The U.S. liver cancer diagnostics market is growing at a compound annual growth rate (CAGR) of 4.43% from 2024 to 2033.

Key factors that are driving the U.S. liver cancer diagnostics market growth include rising need for solutions to reduce healthcare costs, increasing focus on patient-centric care, and strong government support.

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others