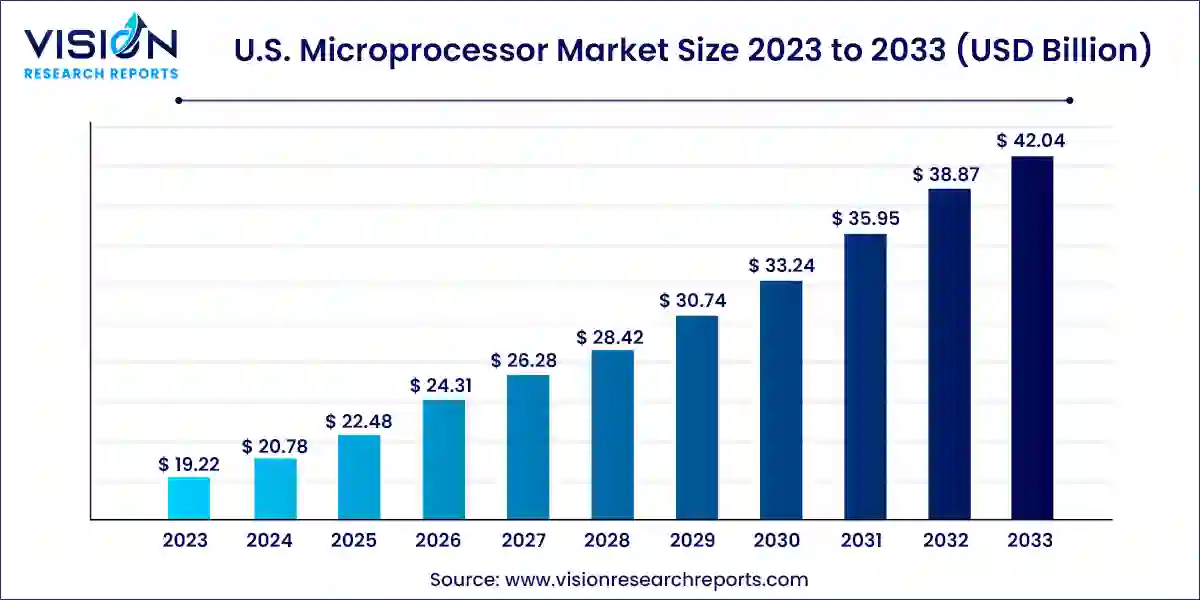

The U.S. microprocessor market size was estimated at around USD 19.22 billion in 2023 and is projected to hit around USD 42.04 billion by 2033, growing at a CAGR of 8.14% from 2024 to 2033.

The U.S. microprocessor market stands as a cornerstone of technological innovation and economic growth, driving advancements in various sectors ranging from consumer electronics to industrial applications. With a rich history of innovation and a competitive landscape, this market continues to evolve, fueled by factors such as technological advancements, increasing demand for high-performance computing, and the proliferation of IoT devices.

The growth of the U.S. microprocessor market is driven by the technological advancements in semiconductor design and manufacturing processes continually drive improvements in microprocessor performance, efficiency, and cost-effectiveness. Additionally, the increasing demand for high-performance computing across various industries, including data centers, automotive, and telecommunications, fuels market growth. Moreover, the proliferation of artificial intelligence (AI), machine learning (ML), and Internet of Things (IoT) applications necessitates the development of more powerful and energy-efficient microprocessors, further stimulating market expansion. Furthermore, the rapid adoption of cloud computing, edge computing, and 5G technology creates new opportunities for microprocessor manufacturers to cater to evolving computing needs.

In terms of architecture type, there are four types of architecture-based microprocessors, namely ARM MPU, x64 MPU, x86 MPU, and MIPS. The ARM MPU segment is anticipated to witness the fastest CAGR of 8.83% over the projected period of 2024 to 2033. The ARM segment dominated the market in 2023 with the largest market share of over 49%. The increased utilization of ARM processors in smartphones and personal computers is driving this trend. ARM architecture presents several benefits, including streamlined design, energy efficiency, and manageable operation. Its exceptional energy efficiency makes it particularly suitable for portable and low-power embedded devices like notebooks and smartphones. Furthermore, ongoing advancements in ARM architecture have empowered these processors to deliver superior computing performance when compared to x86 processors.

The dominance of the combined x86 and x64 segments in the processor market is from their extensive usage across PC and server environments. The x64 processor represents an advancement in the x86 architecture, both adhering to the Complex Instruction Set Computing (CISC) model. Within the x86 and x64 landscape, x64 processors lead the market due to their superior memory and processing capabilities compared to their x86 counterparts. In addition, x64 processors handle dual instructions better in contrast to the 32-bit architecture of x86 processors, resulting in enhanced efficiency. They are widely applied in mobile processing, video game consoles, supercomputers, and virtualization technology. On the other hand, x86 processors find their niche in personal computers, gaming consoles, laptops, and high-performance workstations.

Based on application, the microprocessor market has been segmented into smartphones, personal computers, servers, tablets, embedded devices, and others. The personal computer (PC) segment held the largest market share of more than 36% in 2023. This large share is attributed to microprocessors as they provide several benefits, such as enhanced storage, upgraded volatile memory, expanded logical functionalities, increased capability for operating system tasks, and reduced power consumption, which contribute to their widespread adoption in personal computer applications. Furthermore, major companies in the market are consistently introducing innovative products featuring advanced technologies to secure significant market share in the PC segment, which is resulting in propelling the growth of the segment.

The smartphone segment is anticipated to witness the fastest CAGR of 9.03% over the projected period. This growth can be attributed to microprocessors as every smartphone is equipped with a microprocessor, which enables a broad spectrum of functionalities such as placing calls, sending texts, browsing the web, and running diverse applications. The integration of microprocessors in smartphones has significantly enhanced their power and capabilities. As microprocessor technology advances, smartphones evolve into more potent devices capable of handling increasingly intricate tasks. With the current technological scenario, key companies are always launching new smartphones with better capabilities and superior power. Hence, the demand for microprocessors is on the rise with the increasing adoption of smartphones.

By Architecture Type

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others